Mehr Nachhaltigkeit: Dieser Trend ist – im Zuge der immer sichtbareren Folgen der Klimakrise – derzeit in aller Munde. Doch verhalten sich Konsumenten auch entsprechend? Für den Bereich Haushalts- und Elektrogeräte haben wir das in einer repräsentativen Studie untersucht, wobei ein besonderes Augenmerk in diesem Zusammenhang auf dem Thema Kreislaufwirtschaft lag.

65 Prozent der Deutschen halten den Umwelt- und Klimaschutz für ein sehr wichtiges Thema und 89 Prozent wünschen sich von Unternehmen mehr Nachhaltigkeit: Mit den sichtbarer werdenden Auswirkungen der Klimakrise rücken Umweltbewusstsein und Ressourcenschonung immer stärker in den Fokus der deutschen Bevölkerung. Ob sich dies auch im eigenen Handeln widerspiegelt, ist jedoch die Frage. Und die Antwort ist entscheidend für die zahlreichen Unternehmen, die sich den Herausforderungen, die nachhaltige Produktion und Produkte mit sich bringen, stellen wollen.

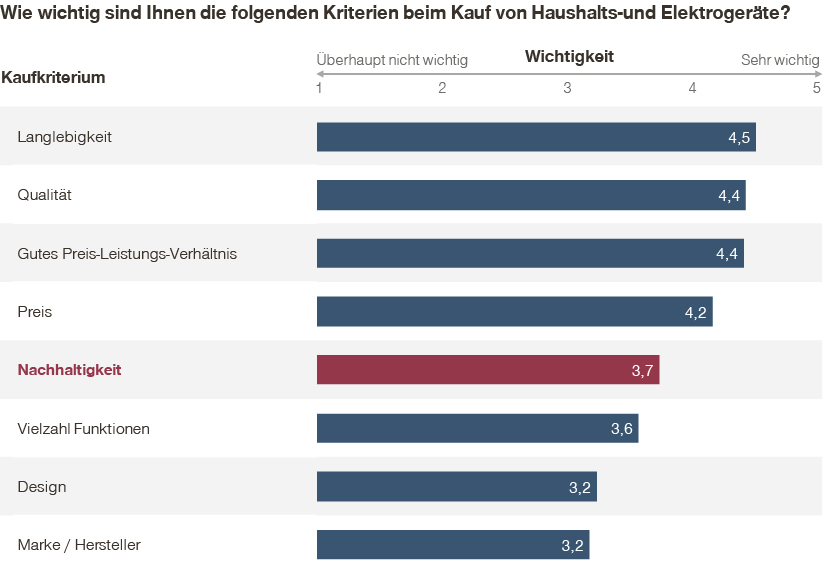

Um herauszufinden, wie relevant Nachhaltigkeit als Werttreiber beim Kauf von Haushalts- und Elektrogeräten ist, haben wir im Juni 2021 mehr als 1.000 Teilnehmer aus Deutschland zu ihren Vorlieben und Kaufverhalten online befragt. Hierbei fanden wir heraus, dass Nachhaltigkeit ein wichtiges Auswahlkriterium beim Erwerb eines solchen Gerätes ist, auch wenn es für viele Käufer nicht an erster Stelle steht.

Gemeinsam mit Kriterien wie Langlebigkeit und Qualität (die auch auf das Thema Nachhaltigkeit einzahlen, indem sie die nächste Neuerwerbung hinauszögern) sowie Preis und Preis-Leistungs-Verhältnis zählt Nachhaltigkeit somit zu den wichtigeren Entscheidungskriterien. Kriterien wie eine Vielzahl an Funktionen, Design und Marke sind nach Aussage der Studienteilnehmer somit weniger entscheidend – wobei dies noch keine eindeutigen und zuverlässigen Schlüsse auf das tatsächliche Kaufverhalten zulässt.

Interessant ist auch, dass Konsumenten Nachhaltigkeit bei Haushalts- und Elektrogeräten wesentlich wichtiger finden als bei anderen Produktgruppen oder Dienstleistungen. So gaben 60 Prozent an, dass ihnen Nachhaltigkeit bei Smartphone, Waschmaschine und Co. am wichtigsten sei. Bei Nahrungsmitteln und Getränken gaben dies nur 43 Prozent an, bei Mobilität sogar nur 34 Prozent. Elektronik hebt sich hier also deutlich ab, während die übrigen Dienstleistungs- und Produktgruppen nahe beieinander liegen. Konsumenten setzen also unterschiedliche Schwerpunkte.

Konsumenten verbinden Nachhaltigkeit mit Energieeffizienz

Doch was verstehen Verbraucher eigentlich unter dem Begriff „Nachhaltigkeit“? Dieser umfasst ja im allgemeinen Sprachgebrauch zahlreiche Bereiche. Laut unserer Studie assoziieren Konsumenten in Bezug auf Haushalts- und Elektrogeräte am stärksten eine hohe Energieeffizienz mit Nachhaltigkeit. Auch Langlebigkeit und ein Umweltsiegel spielen eine große Bedeutung in diesem Zusammenhang. Nur ca. ein Drittel der Befragten bringen erneuerte Geräte mit Nachhaltigkeit in Verbindung, was jedoch immer noch mehr ist als bei gebrauchten Geräten ohne Aufbereitung. Bei erneuerten Geräten (sogenannte refurbished / renewed Geräte) handelt es sich um gebrauchte Haushalts- und Elektrogeräte, die generalüberholt und so aufbereitet wurden, dass sie einen neuwertigen Zustand haben. Zudem sind sie oftmals mit einer Garantie versehen. Gerade erneuerte Geräte sind ein interessantes Geschäftsmodell für Hersteller und Händler von Haushalts- und Elektrogeräten. Doch sind solche Angebote bei Verbrauchern ausreichend bekannt?

Laut unserer Studie haben knapp 70 Prozent der Befragten bereits den Kauf eines erneuerten Haushalts- oder Elektrogerätes getätigt oder in Erwägung gezogen, somit ist das Konzept einem Großteil der Bevölkerung geläufig. Während durchschnittlich in allen Altersgruppen knapp 40 Prozent bereits gebrauchte, wiederaufbereitete Elektronik erworben haben, sind es in der Altersgruppe der 18- bis 34-Jährigen sogar 52 Prozent. Der Nachhaltigkeitsgedanke ist für die Interessenten und Käufer dieser Produkte zentral: Obwohl der Preis bei ca. einem Drittel der Befragten noch der alleinige Hauptgrund für den Kauf ist, steht bei ca. zwei Drittel der Befragten der Nachhaltigkeitsgedanke im Vordergrund oder ist zumindest genauso wichtig wie der Preis.

Aufbereitete gebrauchte Elektronik nur mit Preisabschlag und über etablierte Händler attraktiv

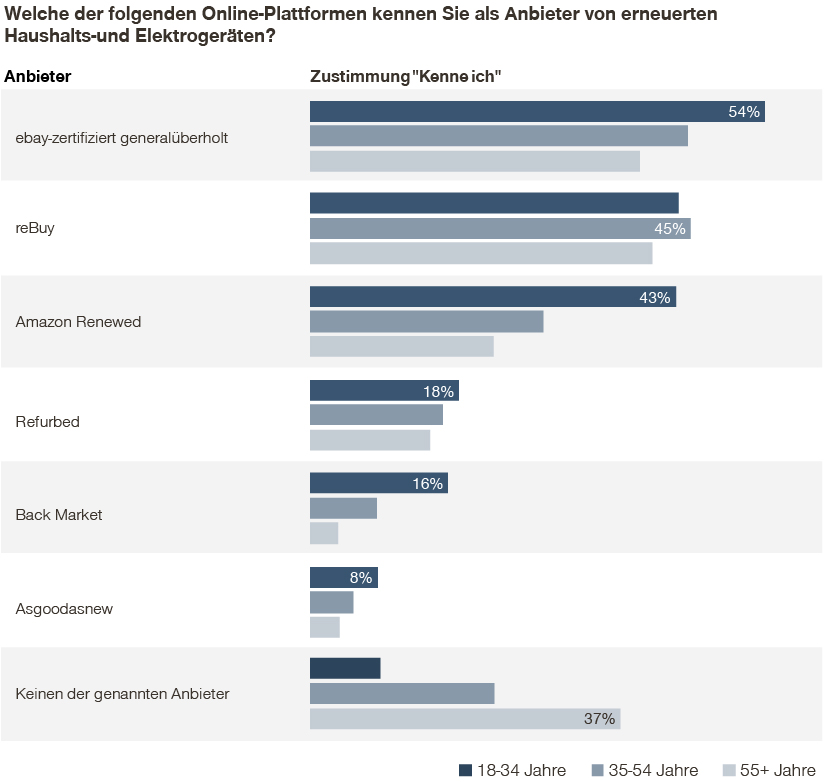

Welche Händler sind als Anbieter von erneuerten Geräten bekannt? Hier stehen besonders etablierte und dadurch vertrauenswürdige Anbieter hoch im Kurs. ebay (certified refurbished) und Amazon (renewed) sind neben dem deutschen Anbieter reBuy am bekanntesten – über 45 Prozent der Befragten können mit mindestens einem dieser Anbieter etwas anfangen. Dagegen sind junge, aber aufstrebende Unternehmen wie Refurbed und Back Market noch den wenigsten Konsumenten ein Begriff. Allerdings zeigen sich starke Unterschiede zwischen den verschiedenen Altersgruppen: Wenig überraschend kennen jüngere Verbraucher deutlich mehr Anbieter als ältere.

Um Konsumenten davon zu überzeugen, ein erneuertes Produkt zu erwerben, ist jedoch für viele neben einem seriösen und bekannten Anbieter auch ein signifikanter Preisabschlag im Verhältnis zu einem Neuprodukt die Voraussetzung. Damit die gebrauchten Geräte attraktiv sind, müssen sie nämlich nach Meinung der Befragten 30 bis 50 Prozent billiger sein als die entsprechende Neuware – ein deutlicher Preisnachlass, was Anbieter solcher refurbished Geräte bei ihren Monetarisierungsstrategien nicht außer Acht lassen dürfen.

Fazit: Anbieter brauchen klare Kommunikationsstrategie

Um erneuerte Geräte erfolgreich an den Konsumenten zu bringen, ist also ein attraktiver Preis Voraussetzung. Zusätzlich sollten Anbieter der Kreislaufwirtschaft jedoch den Nachhaltigkeitsaspekt stark in den Fokus stellen, um das Umweltschutzpotenzial solcher erneuerten Geräte für Verbraucher offensichtlicher zu machen. Mit einer klaren Kommunikationsstrategie, welche Wiederverwertung als wichtige Säule für mehr Nachhaltigkeit positioniert, können dann die zahlreichen Konsumenten wirksam überzeugt werden, die sich für das Thema interessieren.