This year’s rising interest rate cycle is unlike any other. The COVID-19 pandemic has transformed banking and the banking landscape. Retail bankers must challenge themselves to ensure margin expansion and growth. Experts David Chung, Rohan Shah, and Betty Cowell outline how to address the four pitfalls banks will need to overcome in 2022.

We are entering a rising interest rate cycle, a period which traditionally signals opportunities for margin expansion for banks. However, this is a rising rate environment unlike others. The Covid-19 pandemic has introduced a unique mix of macroeconomic conditions and market dynamics that will make retail banking particularly challenging over the next 24 months.

Inflation in the United States and Europe peaked early this year hitting 7.5 percent and about 4.8 percent respectively, driven by a set of unusual forces as a result of the pandemic. These include snarled global supply chains, erratic demand surges, and massive government spending. Central banks in the US and Europe have set the stage for rate hikes, but we are entering uncharted waters. In the US in particular, loan demand is sluggish, banks are still flushed with deposits, and economic growth is expected to decline.

Banks are entering a rising rate environment with market conditions that will test traditional responses. They will have to challenge themselves and find ways to act with precision, speed, and discipline to ensure margin expansion and growth.

Fierce and intense competition

Banks ended 2021 struggling to lend and flushed with deposits. According to our analysis, the average loan-to-deposit ratio for traditional banks in the US, stood at 65 percent in the fourth quarter of 2021. A loan-to-deposit ratio closer to 85 percent would have been more desirable.

With liquidity levels so high, when it comes to higher rates some banks might be tempted to keep their foot off the pedal to let excess deposits migrate away. However, this tactic is risky, as it has never been easier to open an online account. In a near frictionless world of digital transfers, switching banks can happen with just one click. There is also a growing list of non-traditional banks with fast and aggressive customer acquisition strategies. Capital One shelled out a hefty 1 billion US dollars on marketing in three months (from October to December 2021) to capitalize on, what it describes as, "windows of opportunity for growth."

Digital-only banks have also come of age in the past decade, becoming formidable players. For example, Ally Bank has tripled its deposits portfolio to 142 billion dollars in the past 10 years. The bank now has a bigger share of US deposits than Regions Bank, M&T, or Comerica. Nearly 70 percent of the 226,000 new customers Ally Bank added in 2021 are from younger generations, who, according to the bank are "still early in their financial journey and with a high propensity for digital engagement."

Banks that are not practicing customer-relationship optimization to identify and reward their most promising customers must begin to do so. Non-monetary factors like relationship pricing, waived account fees, and special perks will play critical roles in retention in the year ahead. Banks must also redouble efforts to analyze daily, and weekly fund movements to identify customers exhibiting attrition behaviors, taking pre-emptive action with the right offer to retain them.

Relying solely on rate

Another peril in the new rising rate environment is relying solely on rate increases to attract or retain customers.

Banking customers have spent the past two years depending on digital technology in all aspects of their lives. Consumers have elevated digital expectations, want higher levels of personalization, and contextualized digital interactions. Digital adoption has accelerated to the point where even older adults are using technology to stream movies, video chat, bank, and make payments.

To stay competitive, a bank's deposit portfolio strategy must include defining digital experiences. Nice-to-have features like seamless digital account opening, enhanced savings experiences, fast payments and transfers, and self-service capabilities have become table stakes to stay in the game.

Applying suboptimal pricing

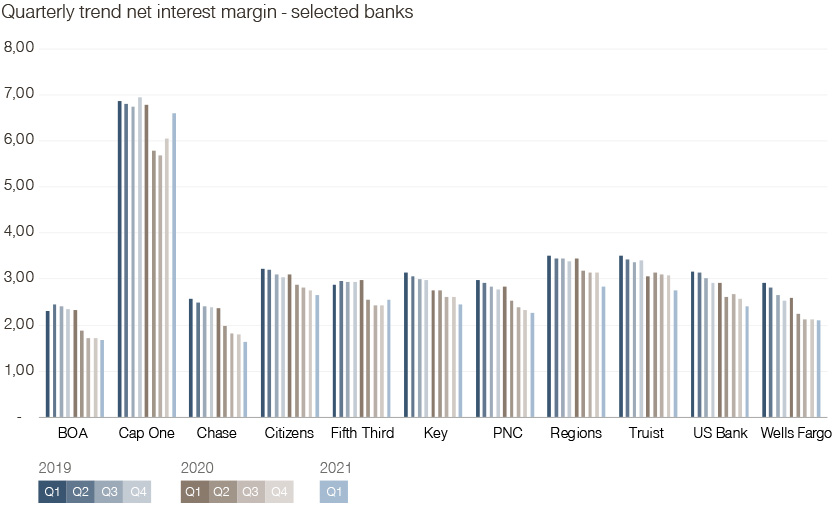

The pandemic has also left banks with shrinking margins. For many banks, net interest margins are at historic lows. Coupled with eminent changes to overdraft charges, not to mention the intense, competitive environment, the margin for error when it comes to pricing is dangerously thin.

The current economy is very different than the last time central banks hiked rates. Analysts are expecting anywhere from three to seven rate hikes in the US in 2022. Rising wages and runaway inflation could also push the Federal Reserve to make more aggressive moves like a 50-basis point rate hike.

When it comes to pricing, banks must come prepared to respond with agility and speed. Mastery over customer elasticities and precision pricing will determine the extent a bank can take aggressive, surgical actions to lower or increase rates accurately to meet portfolio goals, while optimizing profitability. Precision pricing based on an intelligent system that takes into account the various constraints the bank is operating within – including competition, volume, market share, branch presence, risk, and cost to serve – will determine to what extent banks can optimize outcomes and meet portfolio goals.

Failing to create personalized experiences

Consumers increasingly want and expect personalized experiences. According to a New Epsilon study, 80 percent of consumers are more likely to purchase from brands that offer personalization. Banks, with their treasure trove of data are well-positioned to orchestrate tailored messages, as well as marketing and product recommendations.

However, banks have traditionally operated along single product lines where knowledge, data, and expertise are housed in silos. Bank marketing campaigns can be fragmented and product-centric, neglecting to consider the customer's broader relationship with the bank. Personalization, where a bank can tailor next-best offers, messages, and nudges, is a powerful and effective way to deepen customer relationships and increase growth.

The transition from a marketing and pricing organization that executed blanket marketing campaigns to one capable of delivering the right message to the right customer at the right time, is a multistep and complex undertaking. Banks must begin to address the data, analytical, and organizational challenges to enable personalization if they want to safeguard their ability to stay competitive.

The months and year ahead will be full of unexpected twists and turns. A disciplined, thoughtful approach informed by data-driven intelligence will be key to success.