Companies across B2B industries are launching an increasing number of digital pricing transformations to create sustainable value. However, few manage to exploit these new capabilities.

With modernizing IT landscapes and widespread data opportunities, firms are starting to recognize digital pricing capabilities as a key lever to profit growth. When done correctly, digital pricing transformations can improve companies’ margins by between two and seven percentage points. However, when push comes to shove, many firms struggle to get digital pricing right. By running digital pricing initiatives through a digital lens, companies struggle to achieve these envisioned improvements – and trail behind the competition. The path to becoming a Pricing Star is all about getting the commercial and digital agendas in sync.

Pushing for growth in increasing complexity

The need for digital pricing transformations in B2B environments is driven by increasing commercial complexity. There are five trends underlying this case for change:

First, product assortment growth is resulting in an increasing number of products that need to be priced. Product bundles can also render additional value, and with every product added to the portfolio, the number of product combinations grows exponentially.

Second, enhanced customer data reveals diversified customer segments with unique value drivers. Willingness to pay can differ significantly based on the specific needs of those segments. For this reason, different pricing strategies and price levels are required to grow revenues from customers and segments.

Third, internationalization and geographic expansion are adding complexity. New markets may not only require different price levels but also different pricing approaches due to local competition or the strategic decision to first grow market share. This often differs from the conventional pricing approach taken in more mature markets, which is more focused on monetization.

The fourth complicating factor is consolidation. Non-organic growth has caused local pricing approaches to diversify. Centralization requires a harmonized and structured pricing approach that works for all local organizations.

Finally, increasing market transparency and rising online competition are forcing companies to improve their responsiveness, which is often only possible using digital pricing systems.

Due to these commercial challenges, digital pricing transformations are only effective when driven from a commercial perspective. In the current digital ecosystem, the amount of technical options can be daunting. By assessing their pricing maturity and needs first, companies can select the right type of technical solution prior to initiating their transformation. Companies will only be able to sustainably capture profit potential by taking a structured approach that plays right into these needs.

“The path to becoming a Pricing Star is all about getting the commercial and digital agendas in sync”

Understanding the digital pricing positioning

Wanting to achieve pricing excellence is the first step toward success. If companies do not understand their positioning, their chance of success remains limited, and the ideal destination will remain far out of sight.

Most companies don’t fully grasp the extent of the digital pricing playing field. They are often limited by their own view and industry, which prevents them from learning from other industries that are farther along on their digital journeys. However, before they can apply best practices from other sectors, it’s important for companies to have a clear understanding of their current digital pricing capabilities. These can be broken down into two factors: pricing maturity and digital maturity.

1. Pricing maturity

Pricing maturity represents an organization’s capabilities to achieve the prices it deserves. These include the pricing strategy, pricing logic, and value capture.

Pricing strategy

Most companies’ pricing strategies are oversimplified versions of their commercial strategies. Firms generally attempt to define their market position holistically, for instance defining themselves as a premium, niche, or low-cost player. This leads to oversimplified pricing targets with limited ability to steer and pinpoint performance. Companies with a well-defined pricing strategy have a good understanding of which product-market combinations can help them achieve growth, defend their position, and pinpoint where they can capitalize on their market position, both now and in the next one to three years.

Pricing structure

Most firms tend to accept prices as they are without clearly understanding why. Many companies apply general rules of thumb, such as offering a discount to higher volume buyers and lowering prices for tougher negotiations. However, rules of thumb are often too ambiguous and can differ within the same organization depending on who applies them. Mature companies have a clear pricing rationale that leads to harmonized pricing, including a strong understanding of delivered value. The pricing logic is translated into a structure, which guides pricing decisions and creates explainable price differences across regions, segments, and product groups. Ideally, deal-specific price differences are highly traceable and internally transparent.

Price levels

Particular in B2B environments, companies struggle to reduce the gap between the value they create and the value they capture. The main culprits are the lack of market transparency, where many companies fail to obtain quantitative insights into willingness to pay, and the tendency to accept legacy as a futureproof basis for pricing. Some companies manage to avoid these typical traps by combining three instrumental pricing perspectives: cost, competition, and value. The first ensures prices contain a cost-covering buffer. The second relates to competitive pricing insights. By understanding the differences in value and price level compared to peers, mature companies know what premium they can charge with respect to their competitors. The third signals the (quantified) value of the product to the customer, which is the most accurate depiction of willingness to pay. Companies can only bring a coherent value story to the market and successfully maximize value capture if they set consistent, value-based price levels across their entire portfolio.

2. Digital maturity

Digital maturity encompasses an organization’s capabilities to capture all relevant data, combine the data, and visualize the right data to make impactful decisions.

Data collection

The least mature companies collect data unsystematically. Data is either not stored, or it’s highly inaccessible (e.g., contracts in PDF form not saved in a database, data structures that are different across entities, regions, or product groups). The most mature companies have highly sophisticated data collection systems and storage that capture all important pricing and transactional elements (e.g., discount levels, negotiation information, deal-driver scoring).

Data integration

The least mature companies don’t have a centralized data lake and might run multiple data storage and information systems that aren’t compatible. This ultimately creates challenges when combining useful pieces of data up and across the chain. The most mature companies combine their data and store it in a centralized data lake that represents the single source of truth. The data in the lake is clean and immediately ready to use for analyses, and the data sources outside of the lake are well connected and integrated – and easy to link to enrich analyses.

Data analytics

The least mature companies don’t have any business intelligence (BI) tools, or they have BI software that doesn’t provide any analytical insight (e.g., shows no conclusive insights). This can result from investing in advanced software without having the necessary data components in place to support it. The most mature companies have advanced dashboard systems and sophisticated BI tools with clear ownership and actionable outcomes. The tools’ output is advanced but easily interpretable.

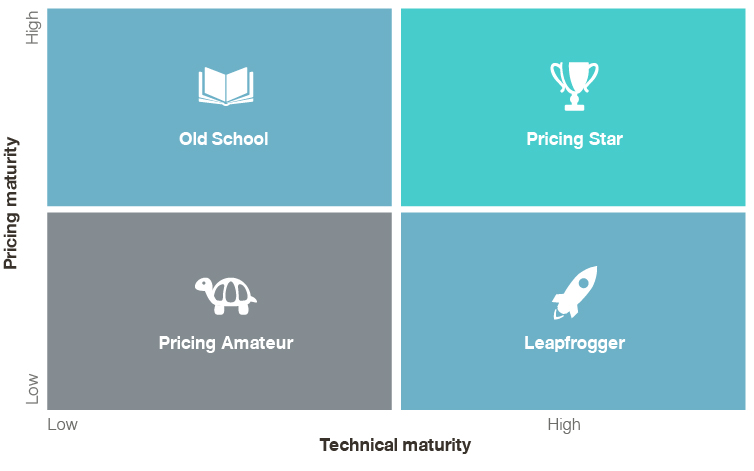

When combining these two capabilities, digital pricing companies can typically be sorted into four types:

- Pricing Amateur: These companies have a basic approach to digital pricing. Their prices are typically legacy based, and there is no comprehensive, harmonized logic between the different price levels between customers, across geographies and segments or across the product portfolio. These companies’ digital capabilities and data capturing methods are also limited, which leaves them unable to derive clear commercial conclusions.

- Old School: These companies have a good understanding of their pricing but have low technical advancements. These firms typically have a clear, defendable pricing structure. Their value markups across products, product groups, and geographies are well defined, and their discounts are logically structured and harmonized across the commercial organization. However, they lack digital systems and data.

- Leapfrogger: These are the companies that have built extensive IT infrastructures around commercial topics, such as pricing, but have not steered these activities from a commercial perspective. This typically happens with firms that drive large digital transformations to fix their outdated IT systems across the organizational infrastructure. In these cases, the pricing structure is not in place, but data systems and software are installed to embed pricing and commercial data.

- Pricing Star: Pricing Stars are the best of breed, as they combine high commercial excellence with high technical maturity to drive analytical pricing decisions. The few companies that achieve this status can quickly accelerate pricing performance through digital and commercial synergies and are able to translate data opportunities into concrete commercial response strategies.

Figure 1: The Digital Pricing Position

The profile of a Pricing Star will depend on the sub-industry’s commercial characteristics, e.g., whether deals are standardized or tailored, whether product bundling is simple or complex, whether transactions are low or high frequency. Commercial and digital maturity will also be different in practice. Therefore, it’s vital for companies to set a goal that fits with their particular industry prior to kicking off a transformation project.

The profile of a Pricing Star will depend on the sub-industry’s commercial characteristics, e.g., whether deals are standardized or tailored, whether product bundling is simple or complex, whether transactions are low or high frequency. Commercial and digital maturity will also be different in practice. Therefore, it’s vital for companies to set a goal that fits with their particular industry prior to kicking off a transformation project.

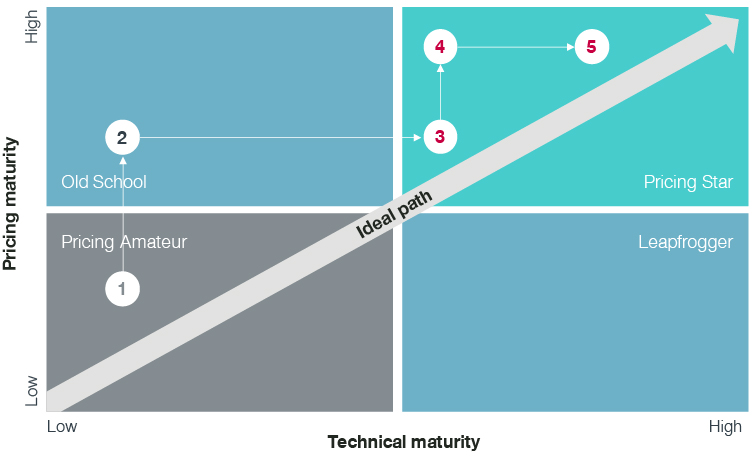

The path to becoming a pricing star

Understandably, decision makers who realize they aren’t in the top-right quadrant will want to become Pricing Stars as quickly as possible. However, it’s critical to understand that the road to success in digital pricing is almost never linear. The greatest risk to the transition is to push for digital maturity before having pricing maturity in place. This often leads to designing costly and complicated technical solutions that, from a commercial perspective, never truly take off. As a result, these digital solutions have to be adapted or, in the worst-case scenario, be completely rebuilt and replaced. Therefore, the path to success strongly depends on a company’s current position and requires continuous adaption based on the maturity trajectory.

- Pricing Amateur: Commercial and technical maturity ideally go hand in hand, but achieving them usually requires a step-by-step approach. The commercial strategy and pricing logic need to be set before the technical environment can be built to maintain, measure, and leverage further improvements. Usually, companies need to develop their pricing maturity before they can apply technical expertise and leverage commercial developments.

- Old School: Having established some degree of pricing maturity (strategy, pricing logic), it’s usually enough to revise it and start building technical pricing capabilities on top of it. The challenge for companies in this situation is to not overcomplicate their technical solutions and risk burdening the commercial organization. Instead, they need to improve in the areas that create economic value.

- Leapfrogger: This position is the trickiest for companies to be in. While they might have all the right technical expertise and design in place to leverage pricing, without a clear pricing logic, commercial strategy, and price levels, they might lack the technical maturity required to match their pricing ambition. Companies in this option space first need to design their pricing maturity and then do a gap-fit before increasing their digital pricing capabilities.

- Pricing Star: The goals of a Pricing Star are to reap the benefits from digital pricing excellence and stay on top of the market. At this stage, companies are fine-tuning their commercial and technical maturity, but commercial ambition should take the lead. Pricing Stars will have a challenging task of pinpointing which elements of their pricing structure can be optimized and which insights can be added. For example, a Pricing Star should ask itself whether its additional services are fully monetized and if they follow a coherent and value-based pricing strategy, embedded in digital solutions.

“The greatest risk to the transition is to push for digital maturity before having pricing maturity in place. This often leads to designing costly and complicated technical solutions that, from a commercial perspective, never truly take off."

Figure 2: The Preferred Path from Pricing Amateur to Pricing Star

Putting the digital transformation into practice

Putting the digital transformation into practice

Even after companies have gained a good understanding of their end point and have fixed the basics, the digital transition can be challenging. Defining the pricing needs are key for a successful journey.

There is a vast range of system solutions that can be used to enhance pricing, from holistic ERP transformations to detailed target pricing software. The range of solutions can be overwhelming, so it is key to clearly define which part of the business process needs to change.

Pricing performance can be simplified and broken down into three stages:

- Price setting: Price setting is needed to improve pricing maturity. These projects include the design principles for pricing as well tailoring the pricing structure. Part of this process is to define list prices, discounts, approval levels, and margin thresholds and integrate these into a harmonized price waterfall.

- Price guidance: Once the pricing strategy and structure are in place, it’s key to enable sales in their quest for better prices. Here, setting up a digital price engine that includes a user interface and standardized output is critical for success. Configure, Price, Quote (CPQ) software can be useful to enrich CRM environments and take price guidance to the next level.

- Price governance: Once pricing is fully in place, measuring price performance is increasingly relevant to tweak and improve the system and the sales organization. Peer pricing solutions and analytics dashboards allow meaningful comparisons to be made at granular levels.

An important reminder is to start by defining which parts of the pricing processes need to be optimized. If a company is doing highly tailored business, the best approach might be to just have a light version of price management without extensive quoting, since every quote will be different. However, a company doing more standardized high-volume business might benefit from highly integrated quoting that is directly linked with order processing and invoicing.

The more holistic the need to change business processes across the entire commercial organization, the more likely an off-the-shelf solution will encompass the full process effectively. Due to the increased maturity of these off-the-shelf software solutions, there is currently a slight trend toward standardization in the market. This trend is also sparked by the increasing number of diverse solutions that are available, which results in a broader choice of solutions that fit specific needs. In addition, customization is now more and more feasible within standardized solutions, especially driven by the introduction of low-code.

However, the more granular the need for digital pricing tooling, the more likely companies are to consider choosing a customized solution, which can also be built from scratch. If companies choose to develop their own solution, they need to be sure they have the necessary technical and pricing expertise within the organization. Confidence in the ability to drive that process and maintain the solution afterward should be a key criterion in deciding whether to create a solution or buy one.

Ensuring the transformation lands

Digital pricing transformations will only land when companies start with a commercial strategic perspective to bolster organizational change.

Based on our experience, there are four key takeaways from companies that have experienced success in their digital transformation journeys.

- Strategy precedes software. Companies that do not understand and define their commercial strategy will face great difficulty in determining what elements should be included in their pricing structure. Without a well thought-out structure, creating the set of requirements needed for selecting the appropriate pricing tools and software is impossible.

- Lead with commercial perspective. Companies that start the project from an IT perspective often do not succeed. Although enthusiasm toward IT capabilities can be the catalyst for digitizing the pricing process, IT departments are usually not in the position to grasp the business’s needs. This results in IT solutions that lack important commercial functionalities or are overcomplicated and therefore not successfully implemented. For this reason, companies that sync their commercial and digital blueprints are more likely to succeed.

- It is a people business. While a digital pricing transformation done well can automate a large share of the pricing, it will never be able to capture the commercial nuance the sales team can see. The pricing solution should enable sales teams to be more data driven. However, companies need to make sure that sales don’t consider a pricing engine to be the single source of truth, and management needs to embrace the role of sales in the new commercial way of working.

- Ensure continuity. Front runners often embed digital pricing in the organization through clear processes and responsibilities. Digital pricing transformations are not a one-time exercise; as market dynamics evolve, so should the pricing solution. Clearly defining responsibilities in line with the operating model helps ensure the digital pricing transformation is successful and sustainable. Monitoring pricing performance is a key part of understanding the improvement potential and the success of your digital transformation. To increase the chance of success, companies need to set up a dedicated pricing team to support the organization along this journey.

In conclusion, digital pricing transformations are crucial drivers for profit improvement. However, without a clear commercial focus, these projects fail. To become a Digital Pricing Star, companies need to clearly define their commercial strategy, pricing structure, and digital needs. Only once their commercial and digital roadmaps are in sync can firms start reaping the benefits of digital pricing.

B2B Growth Seminar

To help business leaders from B2B companies navigate growth in current volatile times, we organize a B2B Growth Seminar near Den Bosch (NL). During this seminar, Simon-Kucher experts will discuss new insights on how to achieve commercial success in volatile times. Our keynote speakers will share their visions and learnings on topics such as Digital opportunities in 2023, Margin management in uncertain times, Organizing the commercial team to boost sales, Transition to recurring revenue and Monetizing sustainability.

Please be aware the seats are limited and therefore it is recommended to quickly register via this form.