Apple has an impressive history of breaking price barriers, but consumers were surprised to see a price cut at this year’s iPhone launch. Based on findings of a recent Simon-Kucher study, technology experts Nick Zarb and Nathan Weinrauch discuss what this means for Apple’s future revenue growth.

When the iPhone X was launched in 2017, it was dubbed the most expensive iPhone ever. At a starting price of $999, speculation began as to whether consumers would pay this extravagant amount for “just a cellphone!” But the iPhone X turned out to be Apple’s top selling device at the time, and average selling prices (ASPs) rose by over $100 ($796 in Q1 2018 vs. $694 in Q1 2017). Even Apple themselves originally underestimated the phone’s success, with consumers sitting on waiting lists for several months after launch. Having successfully broken the $1,000 psychological price threshold, Apple has continued to introduce more expensive devices ever since… that is until September 10th this year.

Consumers were pleasantly surprised to learn that Apple decided against steep increases this fall. Prices remain the same for top of the range devices (2019’s 11 Pro vs. 2018’s XS), and the iPhone 11 came in at $50 lower than 2018’s XR. We all know Apple as a brand that works hard to preserve its margins, so what’s going on exactly?

The decision may be a way of passing on some cost efficiencies to customers, but is more likely aimed at generating an uptick in sales volumes to offset the maturing market. Especially in China, the iPhone is seen as more of a commodity, as the popularity of WeChat makes ever price-sensitive consumers less reliant on iOS. Through both clearer branding (Pro is easy to recognize) and a bigger price gap to premium, Apple is simplifying consumer choice and clearly differentiating the market into premium and mass. And thanks to the discontinuation of the X in 2018 and XS in 2019, customers who want an upper end device now must purchase the latest model.

Meanwhile, the smaller price differential to previous models could also have a positive effect. If fewer customers decide to opt for older devices (XR or 8) and instead choose the 11, ASPs may even increase. Plus, the break in price hikes could have something to do with the highly anticipated arrival of new technology. Many experts believe that Apple will introduce 5G and OLED screens for next year’s devices. So consumers shouldn’t get too relaxed. There could still be room for Apple to go higher than it’s ever gone before!

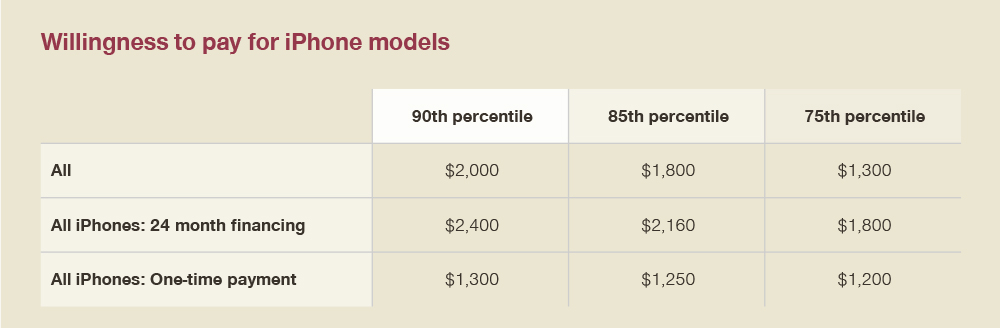

To find out whether Apple could push through the $2,000 barrier, we took our questions to the market. In our recent study, we asked 10,250 representative consumers in the US about their willingness to pay, as well as their consideration set. Here’s what we learned from those looking to purchase the new 2019 models, prior to their announcement:

- There is room to grow prices even further: Our study reveals clear room to increase prices beyond the $700-$1,500 range that Apple currently charges. 25% of consumers receiving monthly finance terms would be willing to pay over $1,800 for a top range device – significantly more than the $1,499 price for the iPhone 11 Pro Max released this fall.

- Apple could even achieve prices up to $2,400: Depending on the payment plan, there is still an opportunity to charge prices up to $2,400. However, without significant value add through innovative new features or functionality, it likely would be difficult for Apple to achieve this.

- Higher willingness to pay with monthly payment plans: The $2,400 figure is primarily driven by consumers who opt for 24 month 0% financing. They would be willing to pay over $99 per month for 24 months ($2,400 in total) – on average 50% more than up-front payers.

- Apple chose the revenue-optimal price point for its current new iPhones: Not all consumers are willing to cough up the $2,400 sum. The study data showed that revenue dropped by 3% on average for prices $50 above the current price, by 5% for $100 more, and by 9% for $200 more. Volumes dropped by 9, 15, and 25% respectively. Therefore, Apple played it safe this year with the $1,499 price.

- But, younger consumers will continue to drive demand for larger, more expensive models: There is a strong trend toward larger screens, which is strongest with younger and less affluent consumers: 60% of 18-24 year olds and 37% of those with household incomes below $100k would consider the iPhone 11 Pro Max. As younger and less affluent consumers see phones as their primary computing devices, they are willing to pay more for larger screens and more advanced features. This demographic trend bodes well for future iPhone ASPs, as Apple can grow with these consumers as their incomes increase.

Simon-Kucher insights: what’s next for Apple?

Simon-Kucher have long been firm believers that the iPhone is “the best priced product in the world” and this accolade is likely to hold in future years. We expect Apple to continue to strengthen its unique position and grow revenues through several world-class pricing strategies:

- Anchor pricing is key to continued success in growing ASPs

Remember the Gold Edition Apple Watch? Sales may have been limited when it was launched at $10,000, but this price enabled Apple to shift the entire perception of just how a smartwatch should cost. $349 seemed acceptable, when actually it was much more than competitor products. Similarly, a customer may walk into an Apple store just to check out the latest model, but walk out with a device that better suits their budget, spending a little more than they originally planned. Apple is the master of anchor pricing – a strategy where, thanks to irrational consumer psychology, a high-priced device makes others seem like a good deal. High prices not only help reinforce Apple’s positioning as a premium brand, each successive increase at the top pulls up spend at the lower end. So, if the rumors are true and Apple is planning to launch advanced features and new innovations in 2020, then we expect to see further anchor pricing tactics at play. A more niche, expensive device would enable an even higher tier of iPhones, serving the segment with the highest willingness to pay while delivering a powerful impact across the entire portfolio. - Price segmentation limits switching to competitors

Apple smartly offers several versions of each iPhone model at roughly $100 increments based on storage capacity, allowing consumers to self-select based not only on size, features, and functionality, but also their willingness to pay. This results in multiple different available price points, from $450 to $1,499. Given younger consumers’ typically more limited budgets, but their desire for large, Apple-branded phones, this kind of price segmentation will be another key to success. We expect over time for Apple to maintain and potentially broaden this range of price points, as well as to offer targeted discounts for students and Black Friday deals as an additional form of price segmentation. - Services are the secret weapon to a $2,400 iPhone (at $99/month for 24 months)

There’s no doubt that Apple is generating more and more revenue from customers through services, seeking to grow long-term customer lifetime value(CLTV) over the ASP of devices. Given that Apple likely sold over 100 million iPhones, Macs, and iPads in the US last year, and now has a full services suite across music, TV, and gaming, the revenue opportunity is huge. The launch saw Apple TV+ thrown in free for a year for customers who buy a new device (worth nearly $60). This not only adds value and drives sales volumes, it instantly creates millions of users that Apple can convert to paying users later on. And as a long-term strategy to increase CLTV, we still see room for Apple to increase overall spend from customers. If Apple is truly smart, they will start incorporating paid services bundles into their iPhone upgrade program alongside AppleCare. This would not only increase the offer’s attractiveness, it would move customers more quickly to the “iPhone as a service” subscription model, locking them into the overall ecosystem even more tightly, and for even longer. That $2,400 price potential is really $99 over 24 months. Once you add up Apple’s services along with the cost of an iPhone, it’s not hard to see how they could get customers there sooner rather than later.

About the study: The study “Willingness to pay for upcoming 2019 iPhone models” was conducted by Simon-Kucher & Partners in August 2019 in the US. In total, 10,250 US consumers were sampled, and 400 identified with propensity to purchase the upcoming 2019 iPhone models were asked about their willingness to pay for new models as well as their consideration set.

Neutrality declaration: Apple Inc. is not a client of Simon-Kucher & Partners now or previously.