Deposits aren’t dead – they’re just mismanaged. The banks that outperform in this next phase should rethink their strategy now.

As monetary policy transitions from tightening to a phase of gradual normalization, deposits have returned to the spotlight. No longer just a source of funding, they are an increasingly important driver of profitability in today’s environment. Yet, many banks continue to rely on legacy approaches: uniform rate adjustments, commoditized product offerings, and undifferentiated campaigns that lack targeting or control.

To win, banks need to move beyond managing deposits as standalone products and adopt a portfolio-wide view. This approach brings together segmentation, pricing precision, behavioral insights, and active steering to improve customer acquisition, enhance interest margins, and bring a nuanced approach to meeting ALM needs. It marks a shift from passively following market flows to actively managing deposits as a strategic asset.

This article outlines what that shift involves, why now is the right time to act, and how banks can progress from foundational fixes to fully embedded high-performing deposit strategies.

The missed opportunity – and the path forward

From flat pricing and legacy products to real margin growth

Despite the renewed focus on deposits, many banks continue to rely on outdated tactics that limit financial performance and reduce balance sheet control. Too often, pricing actions are applied uniformly across broad segments, resulting in margin inefficiencies. Meanwhile, product portfolios remain cluttered with legacy offerings that create operational complexity. Campaigns tend to be reactive, triggered by funding pressure rather than customer behavior or strategic intent. And even when the right levers are pulled, fragmented execution frequently gets in the way, with misaligned processes across pricing, treasury, distribution, and operations slowing momentum and diluting impact.

These issues compound in ways that are increasingly visible. The deposit mix skews heavily toward short-term balances, which undermines funding stability and strains asset-liability management. Even when pricing levers are activated, the link to measurable outcomes, such as profit margin, liquidity ratios, or funding tenor, is often indirect or delayed. Many banks find themselves absorbing cost without realizing corresponding value.

A small number of leading institutions are taking a different path. By aligning pricing, product design, campaign targeting, and execution, they are seeing meaningful improvements in both profitability and funding strength.

Most banks, however, are still in the early stages of this journey. The good news is that progress can be fast. With targeted changes across a few core levers, it’s possible to move from tactical fixes to integrated portfolio control in under a year. Our work shows that banks can achieve a margin improvement of 8–18 basis points – often within 12 months – even without large-scale system upgrades.

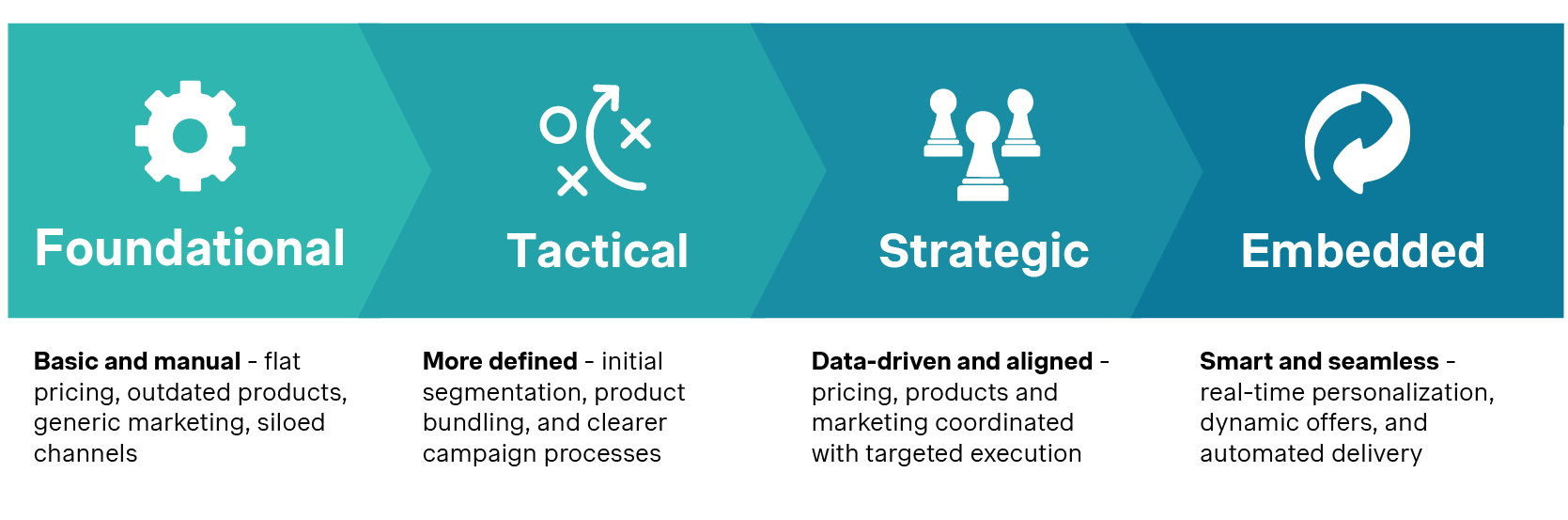

The deposit strategy maturity journey

A holistic deposit portfolio strategy

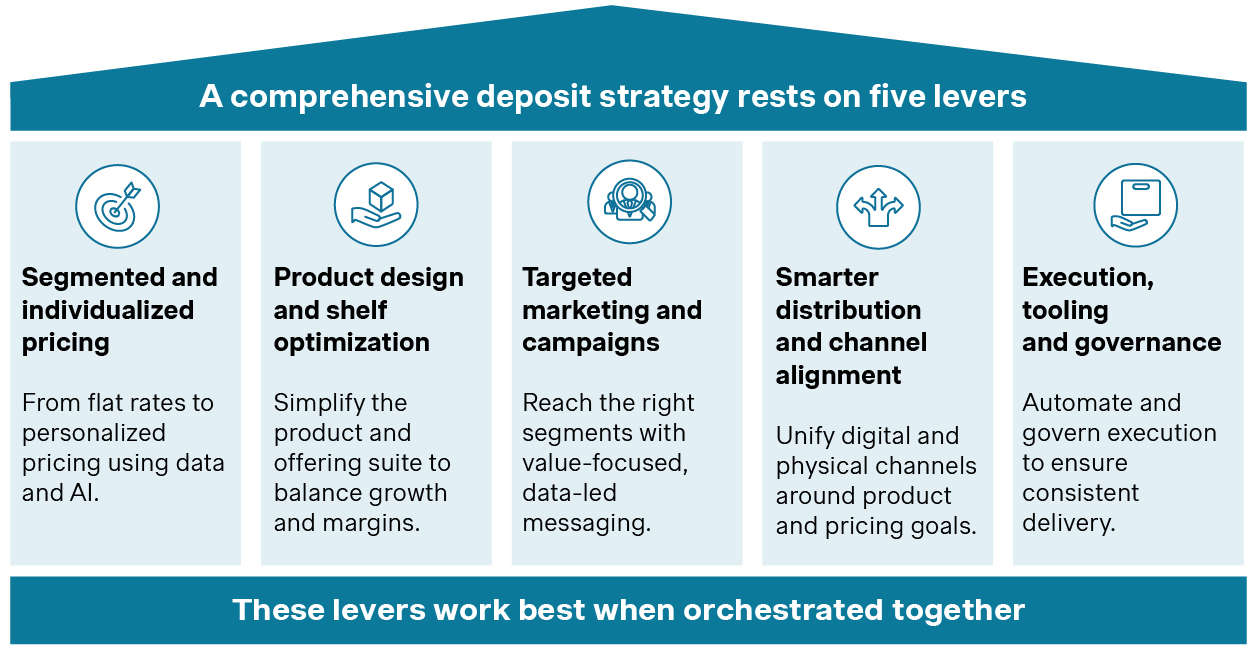

A comprehensive deposit strategy rests on five levers

Managing deposits as a portfolio means building a strategy around five essential levers – each critical on its own, but most powerful when executed together. These form the foundation of a modern, high-performance deposit business.

The visual below introduces these five pillars. We’ll explore each in more depth in dedicated articles throughout this series.

The five pillars of deposit portfolio management

Segmented and individualized pricing

Move beyond one-size-fits-all pricing by applying behavioral insights and AI-driven decision-making to optimize acquisition and retention while protecting margin.

Product design and shelf simplification

Design products to balance growth and margin objectives while simplifying the shelf to improve control, customer clarity, and performance.

Targeted marketing and campaign design

Reach the right customers with the right messages by using insight-led campaigns that use pricing selectively to support, not lead, the proposition.

Smarter distribution and channel alignment

Align all channels to pricing and product strategy to ensure consistent offer delivery and effective customer engagement.

Execution, tooling, and governance

Establish the governance, tools, and processes required to execute strategy at speed, scale, and with accountability.

Together, these five pillars form the foundation for sustainable value creation through margin improvement and funding robustness.

Maturity matters: Start where you are

Most banks can evolve in 12–24 months

Across regions, banks are moving at different speeds depending on market conditions and internal readiness. But the direction of change is consistent: from manual and reactive deposit management to automated, data-driven and strategic control.

The evolution typically follows a clear path – from simple, spreadsheet-based pricing to personalized offers powered by behavioral data and optimization models. As maturity increases, banks move from Excel tools to machine-learning–driven segmentation and eventually to AI-enabled pricing engines and portfolio management platforms.

Most banks are not starting from scratch. In fact, many already have essential elements of a comprehensive strategy, such as segmentation models, pricing infrastructure, or campaign tooling. However, these components often remain siloed or underutilized.

The opportunity lies in building from where you are. By focusing on high-impact improvements and addressing key capability gaps, banks can progress quickly with minimal disruption and measurable results.

Our approach adapts to each bank’s starting point. We work with existing systems, teams and data, layering in what’s needed to deliver visible progress within months, not years.

Real impact. Fast.

What does success look like?

When banks move from functional fixes to a coordinated portfolio approach, impact can be achieved quickly. Results often begin to materialize within 3 to 6 months at the tactical stage, with full transition to an embedded, enterprise-wide model typically reached within 12 to 24 months.

This progress does not require a full core replacement or major IT transformation. By building on existing infrastructure while introducing targeted tools, analytics, and execution enablers, banks can accelerate delivery with limited upfront investment.

Institutions we’ve worked with have delivered measurable outcomes such as:

- 5-10%- %increase in deposit balances, driven by a redesigned and optimized product shelf

- 10-12 bps uplift in net interest margin, enabled by segmented, data-informed pricing

- 14-18 bps cost reduction, through smarter use of targeted, elasticity-based offers

- 20-30% reduction in campaign costs (in terms of interest expense), by reaching the right customers with more relevant propositions

More than improving financial performance, a mature deposit strategy enhances the quality of the deposit base. By attracting longer-tenor, less rate-sensitive funding, banks can strengthen liquidity, reduce volatility, and improve alignment with ALM objectives while positioning the deposit portfolio as a reliable source of long-term enterprise value.

Why Simon-Kucher

We turn strategy into profit, at speed and at scale

Simon-Kucher is a global leader in commercial strategy, with deep expertise across deposit pricing, product design, and execution. We work as your partner from day one, collaborating closely with your teams to turn strategic ambition into sustained performance improvement.

We bring together pricing science, product design, targeted marketing, channel strategy, and execution expertise. From behavioral segmentation and elasticity modeling to shelf design, campaign targeting, and front-line enablement, we support the entire deposit value chain – not in silos, but as a coordinated system.

We are tech-agnostic, but implementation-aware. We collaborate closely with internal teams and existing vendors, guiding design and integration without disruption to your technology stack.

Whether you’re a retail bank, digital player, or multi-segment institution, we tailor our approach to your operating model and maturity stage. The goal is not just to design a strategy, but to embed it – and deliver impact that lasts.

Want to make deposits profitable again? Start here.

This post is just the beginning.

We’ll be unpacking each of the five strategic levers – pricing, product, marketing, channel, and execution – in greater detail throughout our blog series. Whether you’re looking to improve acquisition efficiency, reduce funding cost, or enhance portfolio quality, there is a clear path forward.

Get in touch to discuss how Simon-Kucher can help you design and deliver a deposit strategy that performs – efficiently, effectively, and with lasting impact.