A global phenomenon with local peculiarities

Neobanking has outgrown its “alternative” label. Globally, digital-first banks now count more than 1.4 billion accounts, a figure that continues to expand at a compound annual growth rate (CAGR) of roughly 13%. What began as a niche for tech-savvy early adopters has turned into a mass-market movement reshaping how consumers engage with money.

The United States, often a late bloomer in financial innovation despite its deep capital markets, is finally catching up. The country’s neobank customer base has jumped from 86 million to nearly 150 million accounts in just the last 30 months, a surge that mirrors the global trend but also exposes the unique contradictions of the US market.

Our proprietary global consumer study, spanning 16 markets, provides a rare, data-backed look into this transformation. The results expose what is genuine momentum versus what remains hype, and how the US market stacks up against its international peers.

Momentum, maturity, and the rise of digital banking

Results from our recent Neobanking Study illustrate a market in full transformation, one that has reached critical mass and is now redefining competitive dynamics.

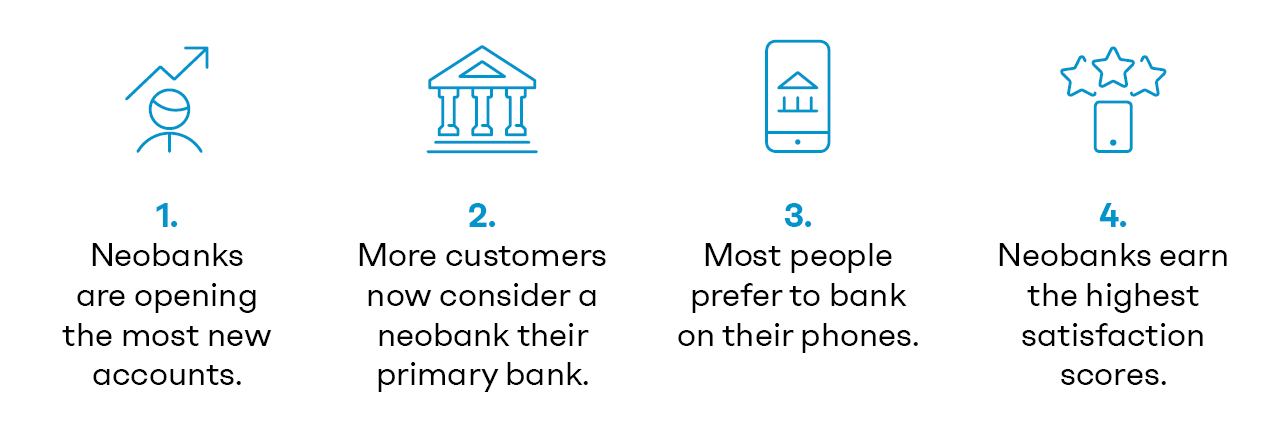

Four key results are:

Neobanks are winning the acquisition game, accounting for 40% of all new account openings, edging out large nationwide banks (38%) and leaving regional players far behind (22%).

Nearly one in three US customers (28%) already considers a neobank their primary banking relationship, with the number peaking for the 30–39-year-olds, with roughly one-third of clients claiming a primary banking relationship with a neobank.

The behavioral shift is unmistakable: 70% of respondents strongly prefer digital channels, while only 13% favor physical banking, which is a stark contrast to the ongoing expansion of US branch networks.

Customer sentiment is another differentiator. Satisfaction scores are highest among neobank clients, with 52% describing themselves as “very satisfied,” compared to 40–41% for national and regional incumbents. Interestingly, neobanks are not winning primarily through lower pricing. Instead, customers cite convenience, user experience, and fee transparency as decisive factors.

The mixed reality behind neobanking growth

Yet, the US neobanking story isn’t all glory and disruption. Behind the growth lies a more nuanced reality, one of light and shadow. A few leading players, notably SoFi and Dave, have achieved or are approaching profitability, marking a potential turning point for the sector’s business viability. Nevertheless, US players are falling behind in several structural dimensions.

Clouds on the horizon

- Weak monetization: Average revenue per retail client in US neobanks hovers around $70 - $80 annually, well below the global average of over $100. Some of the largest banks generate as little as $20 – $30 per client per year, a level that’s far from sustainable. Unsurprisingly, profitability is still rare and beyond the few exceptions, most still struggle to break even.

- Investor skepticism: The sector’s valuation correction has been sharp. Chime’s post-IPO stock price has halved, dampening enthusiasm for new listings.

- Crowded battlefield: Roughly 20 neobanks with more than 1 million clients are fighting for the same customers, often with minimal differentiation.

Why the US lags behind

The reasons are both macro and micro in nature. US neobanks operate under a set of structural limitations that constrain profitability and innovation alike.

At a macro level, regulatory hurdles make it difficult to obtain full banking licenses, forcing most neobanks to depend on sponsor banks and limiting their access to interest income. The revenue model remains skewed toward interchange and fee-based earnings, while leading global peers are expanding income sources through lending and investment-driven net interest income. Compounding this, investor sentiment continues to favor subscription-style recurring revenues, an approach that fits software businesses far better than it does financial institutions.

At a micro level, the challenges are equally significant. Compared with international competitors, US neobanks have been less aggressive in broadening their propositions. Where players like Revolut have diversified into crypto and cross-border payments, or Nubank has launched adjacent services such as eSIM and marketplace offerings, US peers have stayed narrowly focused on core banking functions. This conservatism translates into limited monetization creativity, with most still dependent on basic checking and debit card products and lacking compelling upsell or ecosystem extensions. Finally, their domestic focus has become a self-imposed constraint. Despite proximity to two of the world’s fastest-growing digital markets, Canada and Mexico, few US neobanks have made meaningful cross-border moves, missing chances to build scale and learn from nearby digital disruptors.

Outlook: Consolidation, convergence, and course correction

The US neobanking sector is entering a defining stretch. The next 12-24 months will likely define which banks emerge as institutions, and which lose momentum.

On that note, we predict five major trends to evolve over the next 1–2 years:

- Growth remains unstoppable: The shift in new account openings toward neobanks will inevitably reshape US banking market share and revenue pools.

- The NII imperative: Sustainable profitability will hinge on developing interest-driven models, not on interchange or brokerage fees alone. Neobanks neglecting this reality will struggle to scale profitably.

- Winners will consolidate power: Large US neobanks that have already diversified revenue and achieved profitability will gain outsized influence. We expect only 3–5 local household names to survive in the medium term.

- Global challengers are coming: With Revolut expanding and Nubank seeking a US banking charter, competition is about to intensify, and domestic neobanks must step up their game to survive.

- Incumbents should take notes: Traditional banks have much to learn, from subscription models to gamification, from agile product development to the culture of constant iteration that defines successful neobanks.

A market maturing, not declining

The US neobank story isn’t one of overhype fading, it’s a shift from experimentation to industrialization. The explosive growth of the last three years has proven customer appetite; the next phase will prove business resilience. Those who master monetization, deepen customer relationships, and find the right balance between scale and innovation will not only survive but redefine what “mainstream banking” means in the US.

We help scale-up digital banks in their path to profitability and traditional banks to adopt key learnings from neobanks, from product innovation to building faster-moving organizations and developing cutting-edge designs through growth hacking. Reach out if you want to find out more.