Having helped multiple B2B clients implement dynamic and digital pricing to achieve 4-6 percent margin improvement, we have launched a new series discussing the growth potential, challenges, and pitfalls of B2B dynamic pricing. In our first article, expert Kiran Pudi outlines why, how, and when B2B dynamic pricing should be developed and employed for commercial excellence

In the digital age, advanced analytics and machine learning (ML) models have become essential tools in business, without which companies struggle to compete. These engines have become cornerstones in driving commercial excellence, which essentially consist of three elements:

- Go to market – can be elevated through ML-powered customer segmentation and churn management. ML-based analysis can identify clusters and segments, as well as drivers of churn, revenue, and margin growth. ML-based models can also reveal new customers, or target existing customers more effectively, opening other routes to market

- Sales enablement – peer pricing indexes, sales performance management, and customer profitability analyses realized by ML-based models support sales teams to better target customers, set prices, and identify up- and cross-selling opportunities

- Pricing – ML-based pricing models leverage complex algorithms, providing optimized pricing suggestions to help businesses improve their commercial strategy

While we believe that all these elements are essential to drive growth, suboptimal pricing can make or break a business, creating a domino effect across all steps in your strategy. In this series, therefore, we will focus on ML-based pricing applications, why and when they are needed, as well as how best to implement and use them.

What is dynamic pricing in the B2B context?

Dynamic pricing refers to price or discount settings at a granular level for a product/ customer, and at a transaction level for a given set of market factors. It gives the ability to react to subtle changes to market dynamics. Dynamic pricing models are built on the foundation of multiple drivers – such as market dynamics, customer profiles, demand, and production features.

Although initially only prevalent in travel, retail, and hospitality industries, dynamic pricing has quickly gained momentum in B2B industries. A key factor for this sudden rise can be attributed to the sheer amount of data that is being generated and made accessible to businesses, making dynamic pricing far more feasible.

What is its link to machine learning?

In theory, dynamic pricing engines can be built without the aid of ML. Pricing managers can track all the different market dynamics and develop rules-based engines to suggest an appropriate price for a given set of factors. However, the complexity stems from various factors impacting the price in different ways. Finding the right balance without aid of ML is challenging and ultimately, an impossible task.

Dynamic pricing allows businesses to capture subtle variations in price drivers that will then impact the final price. Traditional methods, on the other hand, are typically rules- or gut-based and led by humans (pricing/sales managers) who only tend to react to big market swings. In other words, while a person wouldn’t change the price when faced with a subtle change in a driver, a dynamic pricing engine would, as it can calibrate the change in context regarding historical data much better than humans can. A modern and, arguably, more powerful approach, therefore, is to integrate ML.

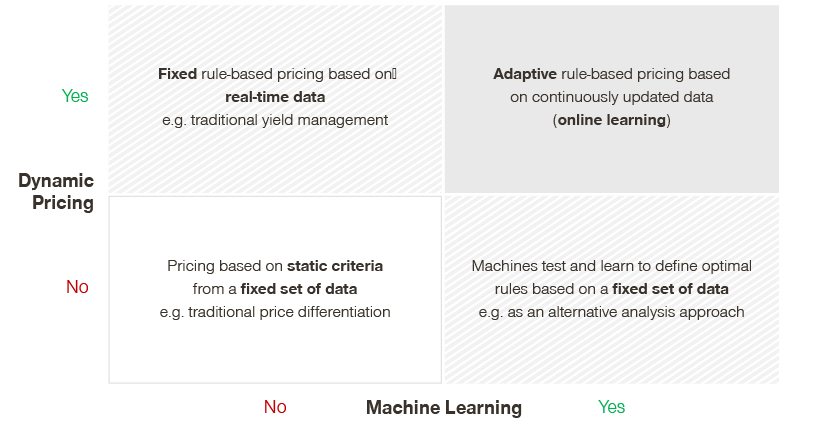

Dynamic Pricing and Machine Learning can be combined to automate frequent price decisions

Broadly, ML can be leveraged for pricing at two levels, with increasing sophistication:

1. Price forecasting

Price forecasting is a powerful technique, especially for raw material forecasting. A forecast model is built to predict the directional and/or actual change in prices between days, weeks, or months.

This technique is suitable for forecasting prices for raw materials that have market indexes. The same technique can also be applied to demand forecasting. Forecasts can be used in multiple ways, e.g., in procurement and price setting of downstream products. It’s important to note that forecasting is not for an individual company or competitor’s price, but rather for the market index.

In the chemicals industry, building block chemicals like benzene, ethylene, caustic soda, and acetic acid are all suitable for price forecasting. Other examples would be base metals, such as steel and copper. However, for forecasting to work, the number of factors impacting the price shouldn’t be too low or too high.

2. Dynamic pricing

Dynamic pricing is a technique to build price architecture to ensure all pertinent price drivers are fairly represented in pricing decisions. Pricing decisions are based on a combination of market factors determined by running regression analyses of historical transactions. ML models help identify each variable’s impact on price. These price drivers can range across different buckets, such as market, customer, volume, and product.

What are the advantages of dynamic pricing over traditional methods?

Advanced analytics-based pricing will identify opportunities to align pricing to prevailing market dynamics and unearth opportunities

Pain points with the current architecture |

|

Future architecture |

|

As mentioned above, unlike traditional methods, dynamic pricing allows businesses to react to even to subtle market variations. For instance, with traditional methods, it’s typical to change prices in response to only significant movements, like in production capacity. Such responses are often:

- Delayed – as the prices should have already been updated to subtle changes

- Drastic – as price changes need to accommodate for a number of subtle past changes all in one go

- Risk prone – as too much importance can be given to a single factor while others are overlooked

ML-based dynamic pricing is a sophisticated technique to ensure the optimal price at a transactional level. There are several benefits of dynamic pricing over traditional methods. Essentially, it allows pricing managers to react dynamically to market situations and to set tailored prices based on prevailing market dynamics:

- Time factor: It provides more real-time or frequent price changes based on prevailing dynamics, allowing managers to better react to market changes

- Automated: The above point is made possible through automation, as pricing engines can quickly analyze trends and suggest optimized prices

- Customized: Dynamic pricing tools can provide tailored pricing to a product and customer combination in a particular market situation, rather than a one-size-fits all approach. They accurately leverage different factors than traditional models – such as volume, shipment, and urgency – to arrive at more pertinent pricing

- Ongoing margin impact: It can drive margin impact at a transactional level by pushing each transaction to an optimal price, while constantly auto-tuning and self-learning to better fit business needs

What is the relationship between price forecasting and dynamic pricing, and when are these tools applicable in B2B?

It would be an advantage for businesses to know how to adjust their prices with a clear idea of potential future spend along the value chain. Price forecasting models can help to make better commercial and pricing decisions.

While these tools greatly improve business strategies, a few conditions must be met in order to apply them correctly.

For price forecasting these conditions are:

1. Market price index

- Market price indexes are essential in price forecasting. Several building products (e.g., base chemicals and commodity indexes) have a market index

- All over the world, B2B companies reference these indexes to determine their buying and selling decisions. Often, such indexes are included in contracts

- Forecast engines are used to forecast short-term market index prices, like the next week or month.

2. Number of factors impacting price

- The number of factors driving the index shouldn’t be too low or too high

- For instance, it would be difficult to build forecasting models for a chemical like methanol, as there would always be multiple factors driving the price up and down

- Acetic acid, on the other hand, is primarily used in four to five downstream applications, making it an ideal product for forecasting

3. Time frame

- The accuracy of forecasting models is inversely proportional to the time horizon

- Typically, short-term forecasting models (spanning a day, week, or month) will have acceptable error rates (within 3 to 4 percent)

- However, models that span longer periods of time (next quarter or six months), are not realistic, and will forecast with a high error rate

For dynamic pricing these conditions are:

1. Number of product stock keeping units (SKUs)/segments should not be too high

- ML pricing is applicable to product segments rather than product SKUs

- Price can be set at a product segment or category level, which can then be translated to SKU-level pricing through rules or price laddering

- Using ML to set SKU-level pricing could lead to limited SKU level data and generate fewer effective results.

2. Threshold level of price variability

- There should be a threshold level of price variability for regression results to make sense

- However, the variability should be within acceptable levels. Limited price variability indicates limited impact of price drivers in price adjustments. Too high a variability indicates that too many factors are driving the price, which can’t be captured in a well fit model

3. Multiple price drivers

- Price should be dependent on more than one or two drivers

- There is also a limit to how many drivers a model can fit – the ideal number of price drivers is eight to 10

- For instance, when price is predominantly driven by raw material price then dynamic pricing is less applicable.

4. Threshold number of transactions and customers

- To run regression models, a threshold number of transactions is required

- Similarly, a threshold number of customers is also needed to generate meaningful results

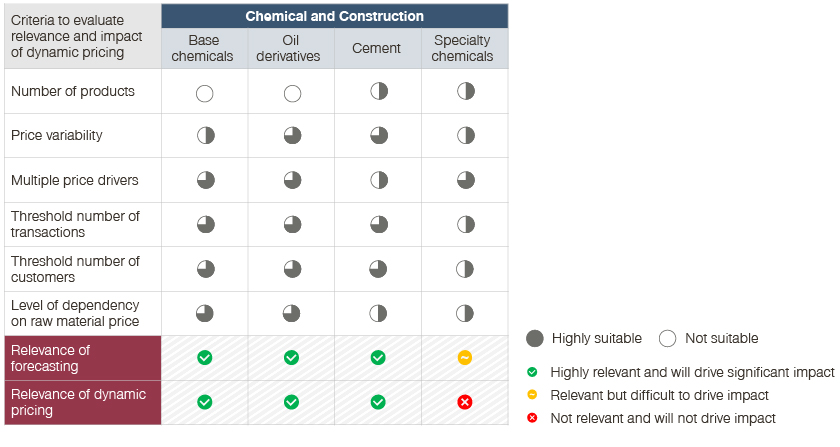

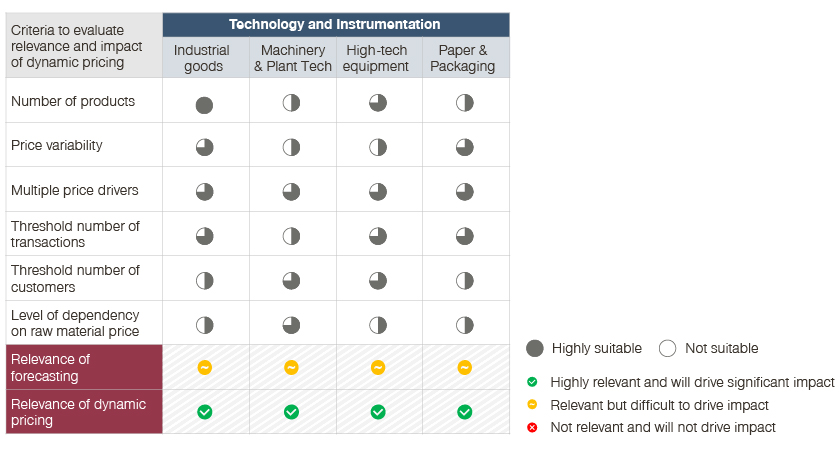

Keeping these criteria in mind, while dynamic pricing is applicable to most B2B industries, its relevance and impact vary within sub-sectors. For example, dynamic pricing is highly suitable to the base chemicals sector but would not work so well in the specialty chemicals sector.

While dynamic pricing is applicable to most B2B industries, its relevance and impact vary within the sub-sectors

Stakeholders must be aligned from the start

To successfully build a dynamic pricing engine, all relevant stakeholders must be aligned at every stage. This will ensure that the appropriate business goals and intended outcomes of the model are executed.

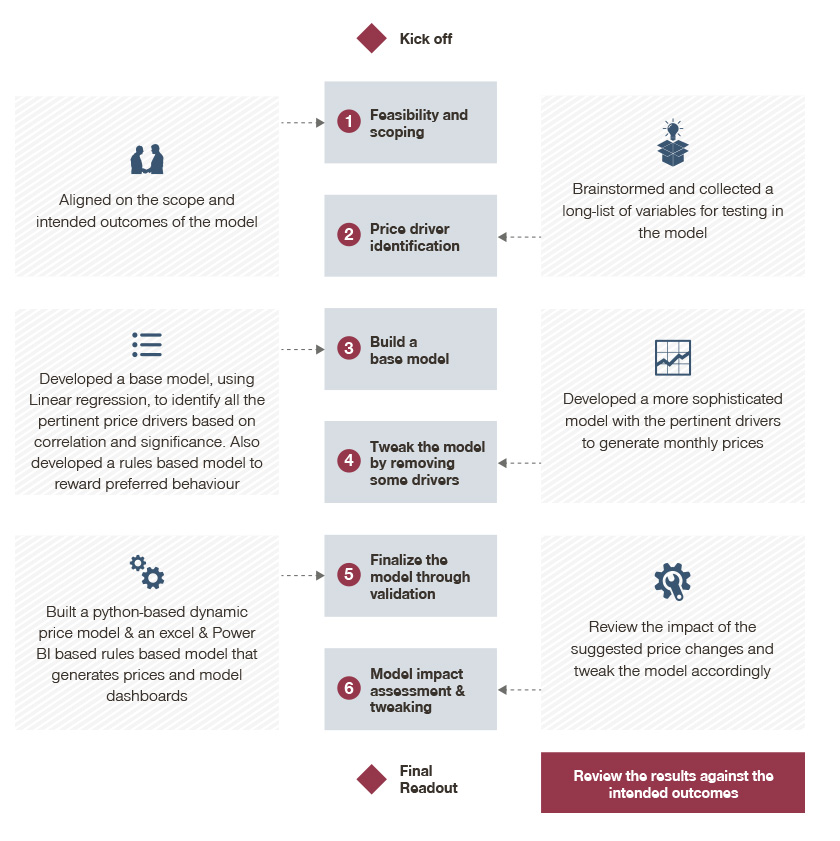

As with any project, for there to be a strong foundation it’s crucial to get the first stages right. When designing a dynamic pricing model, it’s important to start by ensuring that all teams are included in deciding which products are in scope. In fact, each stage, as depicted in the image below, influence each other, and it’s only through interactive, cohesive, and open communication that they can be implemented effectively.

Pricing engines will complement the current price setting process by suggesting a price at product + customer combination

Later in the series, we’ll discuss in detail the change management challenges that can arise when introducing dynamic pricing, further highlighting the importance of including all teams (from sales and marketing, to finance and data) into the decision-making and design-building process.

Key Takeaways

ML-based dynamic pricing allows B2B enterprises to better leverage opportunities and improve growth margins. However, as stated above, certain factors must be taken into consideration for the model to work effectively.

It’s impossible to build an effective dynamic pricing engine without first involving all stakeholders. This is key to generating outcomes you wish to achieve based on your business goals. The next step is to identify and choose appropriate price drivers to include in your model. Once these two crucial stages are complete, then you can go ahead and test, train, and run the model to promote your growth.

Now that you are armed with the basics, keep an eye out for Part 2 where we will guide you through some key questions that must be answered to design a successful model. We will also touch upon which algorithms to use given your business needs, as well as how to evaluate the model’s performance.

While ML-based dynamic pricing engines are vastly beneficial to businesses, they are difficult to execute without a systematic approach. We have helped several B2B clients implement tailored models to achieve their business goals. If you have any further questions regarding B2B dynamic pricing feel free to get in touch with our experts.

Read more from the series:

- Part 2: Seven Design Decisions to Consider when Developing B2B Dynamic Pricing Engines

- Part 3: Seven Solutions to Change Management Challenges in B2B Dynamic Pricing