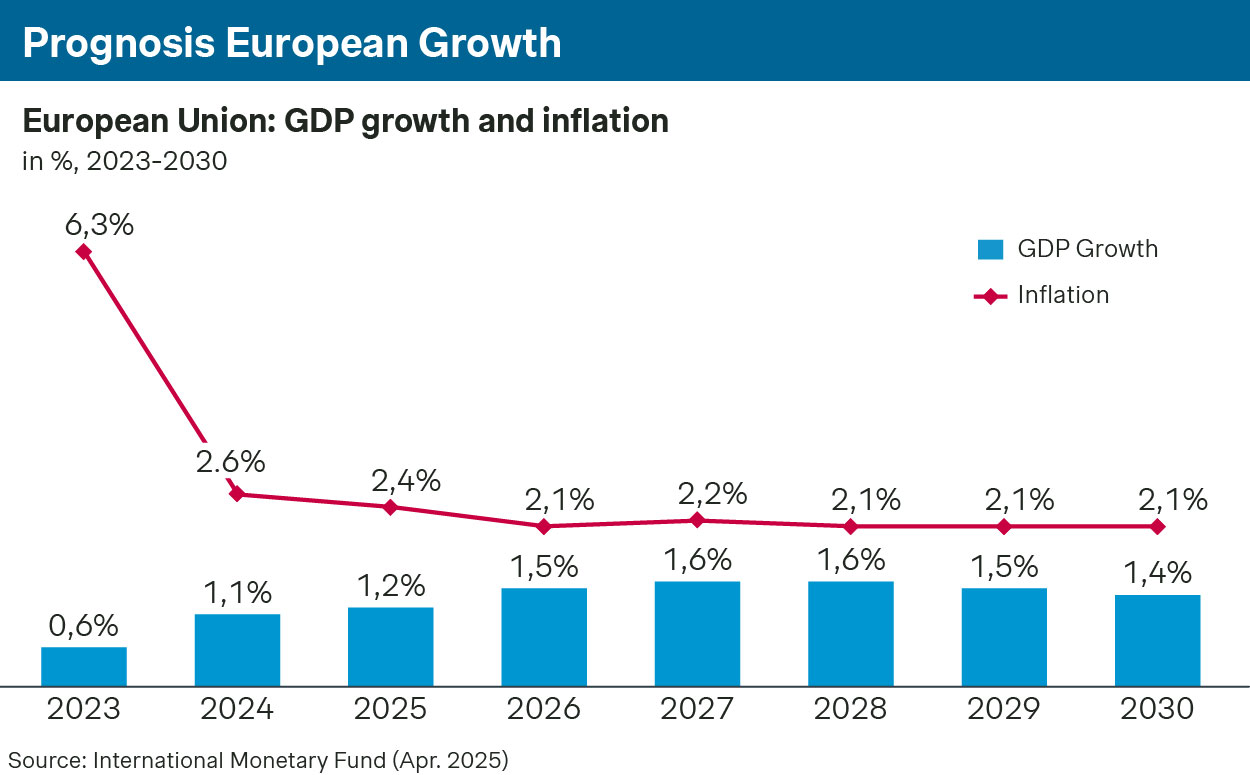

Europe is facing uncertain economic times. On the back end of macro-economic uncertainties, high energy costs, high recent inflation and geopolitical tensions including the US tariffs, market growth in Europe is no longer a given. The economic outlook for the European market in the coming years is expected to remain limited and to slow further in the long term, potentially further impacted by recent tariffs in global trade. Therefore, private equity owners face a pressing question: How to speed up growth in a stagnating market environment?

Consequently, European companies need to adapt to a situation of structural low market volume growth. Private equity owners need to take the lead to ensure a timely change.

From reactive to proactive growth in Europe

For more than a decade, companies have been used to a situation of long-term stability and underlying market growth and have been able to rely on government intervention to provide support when this long-term stability was rocked, for example during Covid times. As such, many B2B companies have developed a reactive sales approach: rather than developing and shaping the market themselves, they have gotten used to getting approached and receiving inbound leads.

The new economic reality is not a temporary upheaval of supply chains and demand, but a more fundamental shift in the economic climate and overall European competitiveness and a government fix is unlikely. Therefore, this new market situation requires a structural change in business and governance and an overhaul of ways of working for companies in Europe.

Adaptation starts with acknowledging the situation: in the short- and medium-term, market (volume) growth remains challenging and to sustain and speed up growth companies need to reinvent themselves commercially: aggressively pursuing growth through market share gain, developing new clients and entering new markets. The commercial model of old times needs to be changed to reflect this increasing focus on sales.

Outperformers in the market recognize this challenge and are actively pursuing commercial actions, thereby significantly outgrowing the market:

- Redesigning the commercial organization to focus on proactive sales

- Prioritizing customers through smart segmentation

- Developing pragmatic segment/account plans for structured market approach

- Rightsizing and strengthening the commercial team

- Clarifying governance and incentives

- Reinventing and broadening propositions

- Developing new propositions to address the needs of different customer groups, rather than one-size-fits-all

- Building a low/no frills offering that supports broad mid-market offering to address multiple price poins / willingness-to-pay

- Strengthening competencies to upgrade value selling skills

- Entering new segments and markets

- Actively hunting new customer groups through a combination of digital and traditional sales

- Expanding the commercial reach by expanding to new markets and market segments

From our project experience

Case 1: Plastics

Challenge: Market has rapidly changed due to increased energy prices, large raw material cost fluctuations and entrance of low-budget competitors. As a result, margins are under pressure. Sales team was not equipped to face this new reality: a reactive commercial approach, strong dependency on dealers and a lack of forecasting insights limited the company’s ability to respond effectively.

Solution: To achieve a turnaround in commercial approach, we focused on the shift from a reactive to a proactive way of working, by:

- Developing a pragmatic sales forecast to strengthen the interplay between sales, planning, production and stock, enabling efficient execution and better handling of ad-hoc orders

- Implementing a structured dealer approach to foster more collaborative relationships, where high-performing partners are rewarded, and greater reciprocity is expected

- Optimizing pricing with a clear margin differentiation between commodity and specialty products, and tailoring deal prices based on customer value

- Monetizing services by distinguishing between core offerings and value-added services, charging selectively based on customer value

- Realigning the organization to embed the new commercial approach, with clear roles and responsibilities, and sales incentives that reinforce desired behavior

Approach: Together with the sales team, we ran an integrated change program across all commercial levers. Rather than isolated fixes, the turnaround in commercial approach was driven by the interplay between the solutions. Moving from a reactive to a proactive mindset required close collaboration, providing the team with the right tools and training, and hosting many workshops to discuss ideas and solutions.

We supported the team in building capabilities to drive the solutions forward, ultimately being able to focus their time and energy on key tasks of reaching new clients and tapping into previously underserved markets.

Case 2: Building materials

Challenge: Market has slowed down in recent years and is now relatively stable. Future market value growth is limited around 2.5% CAGR max. Company just merged two adjacent companies under one umbrella, and both had to accelerate their growth well beyond market growth to meet 2030 revenue goals.

Solution: To outperform the market and realize 2030 revenue goals, we focused on maximizing customer reach with existing product portfolio, through:

- Mapping current client segments based on i.) willingness to pay and ii.) end-users (public versus private)

- Identifying key factors such as purchase criteria, important positioning factors, distribution strategies and pricing strategies for each of these client segments

- Critically assessing existing product-market combinations and identifying approaches for adjacent markets to be addressed using abovementioned success factors

- Keeping separate brands with different positioning and unique selling points, while leveraging operational synergies to increase cost-effectiveness

- Entering new markets through moving downstream towards the end-customer on the value chain and selective M&A in neighboring countries

Approach: Realizing a successful execution of this solution required a transformation in three areas: sales, marketing and logistics. For the salesforce, we helped set clear goals with measurable results while the company focused on increasing manpower and improving mentality. Marketing-wise we helped create a value story around sustainability, while for logistics we mapped the strategy for fully utilizing synergies between the two brands. This approach is expected to outperform the market CAGR with +5%.

Case 3: IT-Services

Challenge: Spending on IT services has spiked during covid years as remote working became the norm, cloud adoption soared, and new promising technologies came to market. Growth in the sector however is back to single digits and especially the providers that rely on a (large) human component in their services are struggling to grow faster than the market.

The struggle for our client was twofold: Limited up-/cross-sell of products and services and too low margins due to legacy of commercial organization.

Solution: To raise volumes (and margins!) across the board we took the following measures:

Volume focused:

- Optimization of packaging and pricing of workplace offerings with better differentiation and more cybersecurity products for higher sales velocity and better up-sell paths

- Definition of cross-sell strategy with clear next-best-offer action plan to further drive penetration within existing customer base

Margin focused:

- Design of overarching product-agnostic services layer (SLAs) for monitoring and support and recurring service plans for more advanced needs to better monetize value delivered

- Design of top-down rate cards and discounting guidelines for the internal organization to better differentiate value for time and material services

- Bottom-up optimization of prioritized legacy contracts to repair historic agreements that yielded too little margin

Approach: In close collaboration with the finance and sales teams we hypothesized opportunities for improvement, prioritized these, and focused on the workstreams above. To test the hypotheses and substantiate the outcomes, we ran extensive primary customer research on their needs and willingness-to-pay.

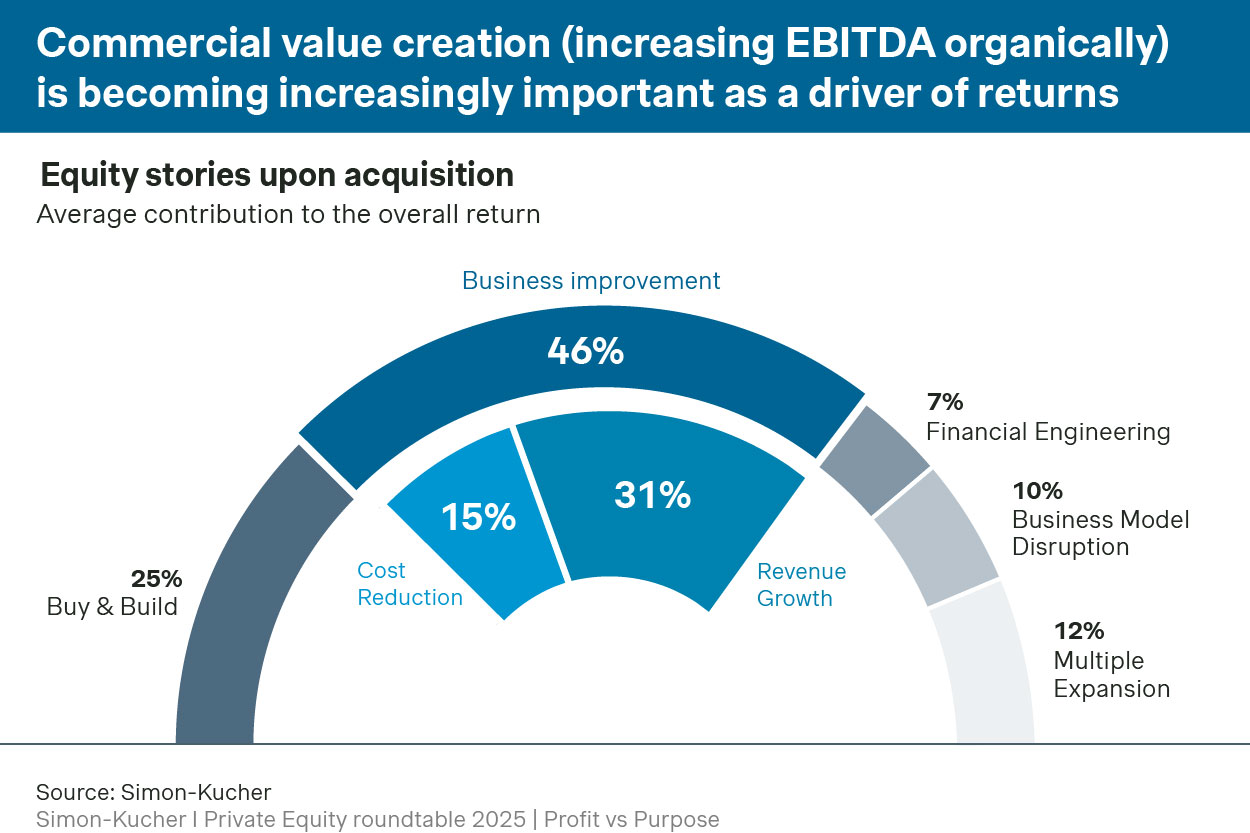

Private equity in the lead

Private equity owners need to take the lead to nurture portfolio companies in becoming these outperformers, especially since post-deal commercial value creation has been identified as a key element of the equity story. By providing a broader market perspective, set direction and initiate and speed-up the commercial transition, they can stimulate their portfolio companies to come out ahead of competition and win market share in stagnating markets.

Private equity toolkit

Realizing commercial growth for portfolio companies is a continuous process throughout the deal cycle, which consequently starts out with a strong due diligence process pre-acquisition. Top-line growth potential in portfolio companies is heavily driven by their commercial power and best practice dictates targeting sales performance in these due diligence processes. This requires that in commercial due diligence not only the commercial performance is understood but also the maturity and capabilities of the sales organization which are driving the commercial performance.

Key questions for sales due diligence are the following:

- Sales performance: How efficient and effective is the current sales force when benchmarked against direct market peers?

- Sales leadership: Is the current sales management team the right fit to navigate the target sales team into the next phase?

- Sales process: How does the sales process support the overall sales strategy and is this the optimal process going forward?

- Organizational culture: How sales-focused is the company when compared to its focus on other operational aspects such as product, finance or technology?

While due diligence offers insights into commercial potential of investment targets, the real challenge occurs after the acquisition. Private equity should drive their portfolio companies to focus on three core elements:

- Getting the basics right: Commercial excellence starts with a solid base to build upon before implementing any strategies for improvement. Private equity can help optimize underlying basics through the following steps:

- Restructuring the commercial organization based on portfolio best practices

- Leveraging network to help install the right people in key sales positions

- Setting ambitious but realistic KPI’s for the sales team to meet

- Reworking propositions: Private equity can fulfill a key role in proposition expanding for the company:

- Assess current successful product-market combinations to identify expansion areas based on different customer needs and willingness to pay

- Draft new propositions for these expansion areas and tailor them by price point, service level, etc.

- Facilitating salesforce trainings through network or portfolio high performers

- Continuous improvement: Finally, private equity should ensure these sales improvements yield continuous benefits rather than a one-time boost by implementing a set of continuity initiatives:

- Implementing sales excellence programs focusing on skill development and sales methodologies

- Tracking performance of both new propositions, sales conversion rates and individual sales representatives through performance dashboards

- Gather structured feedback loops from customers and sales teams to foster continuous learning and refinement of sales strategies

Growth is no longer a given

As market conditions develop, growth increasingly moves from a given to being earned. To realize growth during the holding period, commercial improvements are therefore essential. The role of private equity therefore needs to shift from primarily driving buy & build to an all-round growth enabler, leveraging their skills, network and money to ensure future investment value.