Salient trends reshaping the B2B data & information sector

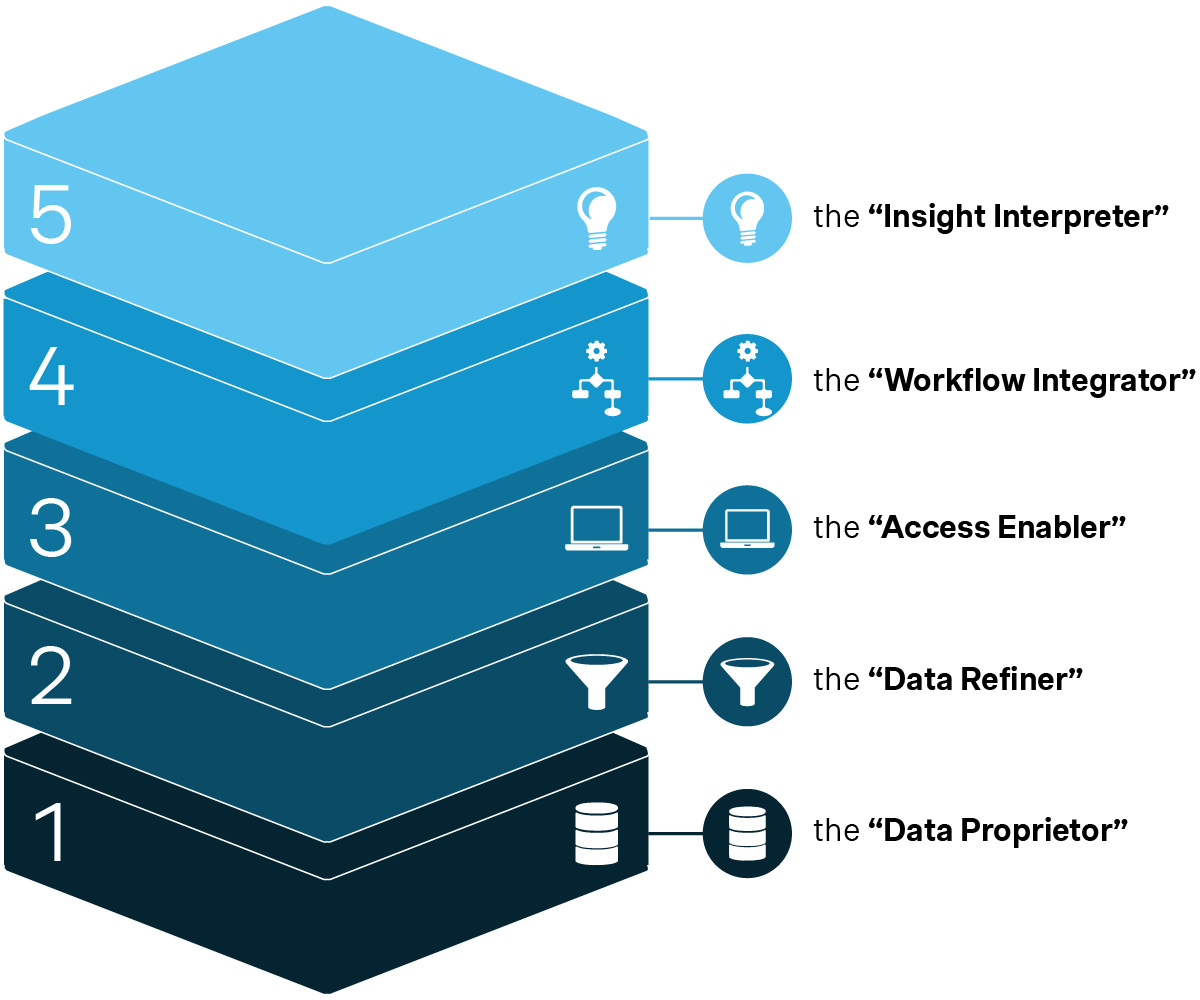

Five layers of value

The global B2B data & information (BDI) sector has long been a crucial provider of data, insights, news, analyses, and related workflow tools to support all manner of business decision-making by companies (and public sector entities) in almost every industry. Over the past few decades (and in some cases, even centuries), most BDI companies have evolved from their early beginnings as compilers and publishers of printed industry news, reports, and directories into high-tech digital businesses. Today, there are BDI companies highly-specialized in macroeconomic, capital markets, consumer, energy & commodities, life sciences, legal, and countless other data categories covering every corner of the economy.

From our experience working with BDI companies of all sizes, public and privately held, and across a myriad of data categories, we summarize that all ultimately provide value to customers in one or more of five archetypical layers:

- Value layer 1: Proprietary data & content (the “Data Proprietor”)

This is the foundational layer: companies here create and compile exclusive datasets/content that are not easily replicated, typically through privileged access that no one else has in the covered market. Examples of companies here include those providing transparency into “old world” physical industries like natural resources and opaque financial asset classes like private markets.

- Value layer 2: Data collation & processing (the “Data Refiner”)

Value here is delivered through the complex and non-trivial activity of collecting, cleaning, and combining (often large numbers of) datasets into useful data products oriented to target customer use cases. Many BDI companies have been successful in this layer by scraping and normalizing public domain data, e.g. providers of legal research platforms and intellectual property databases.

- Value layer 3: Delivery mechanisms (the “Access Enabler”)

Here, BDI companies add value not strictly just by providing data, but rather by providing data through multiple and enhanced technical delivery mechanisms such as APIs, real-time feeds, cloud-based data warehouses, or even dedicated solutions installed on customers’ premises. These tend to be in high-data-volume industries where speed, format and/or frequency of delivery are vital, such as in low-latency financial public markets data.

- Value layer 4: Analytical & workflow tools (the “Workflow Integrator”)

This is the user interface layer, providing software tools (such as data analysis widgets) that allow users to mine and interrogate the underlying data/content in their own preferred ways, to embed the data/content directly into their workflows, or to allow customers to co-mingle their own data with the BDI provider’s to harvest insights. Examples here include providers of identity verification and supplier management data platforms, and more generally those that provide customers with the ability to flex assumptions and run scenarios on their underlying proprietary data model.

- Value layer 5: Interpretation & insights (the “Insight Interpreter”)

Often with expert human-in-the-loop (though increasingly relying on AI-led interpretation), this layer involves creating insights from or opining on the underlying data/content, e.g. BDI companies that deliver industry or consumer trend reports and market volume or price forecasts. BDI companies that deliver editorial/journalism and sector benchmarking data products also fall within this value layer. Notably, many companies focusing on this value layer even derive revenue from services such as access to their expert analysts to answer questions and discuss outlooks for their industry.

Simon-Kucher Value Layer Framework

Four salient trends reshaping the sector

The advent and rapid proliferation of large language models and generative AI use cases over the last few years have created a lot of noise and strategic questions amongst BDI management teams and private equity investors. However, it is important to note that BDI is a sector that has always continuously evolved due to major technological shifts. AI is just the latest in a series of such shifts, from digitization to the internet, cloud computing, and exponential generation of data. Therefore, a lot of the trends that BDI companies need to contend with today are not entirely new – they have just been accelerated by AI.

There are four salient trends that should be understood and navigated. The impact and implications of each trend to any BDI company is dependent on which layer(s) of value that company currently delivers.

- Trend 1: From selling seats to selling rights

Historically, most BDI companies have set pricing based on how much data/content they provide and how widespread an audience they serve within a customer’s organization. Many BDI companies used to sell on a per seat basis (many still do today). Some realized the number of direct recipients of their data is not a good proxy for value and shifted to pricing by enterprise metrics like size of team or company. More sophisticated Data Proprietors such as price reporting agencies (PRAs) and financial index providers (which fundamentally create their own IP) have gone a step further and charge based on specific use cases their customers use their data for (data rights). The increase in demand for data to be used for AI use cases such as model training and retrieval-augmented generation (RAG), as well as technological developments that make it easier for AI models and agents to connect to any external dataset such as Model Context Protocol (MCP) means that Data Proprietors and Data Refiners need to quickly figure out their monetization strategy for such rights. Companies that do this well will have material revenue opportunities, and those that don’t risk leaving much-deserved money on the table. This trend is also a forcing function towards increased customer centricity in BDI companies, as it requires them to really understand what customers use their data/content for.

- Trend 2: AI tech disrupt incumbent BDI platforms

Across many data categories, most notably in those where BDI incumbents are primarily Data Refiners that have historically created a lot of value – not because they have non-public proprietary data but because they collect, clean and make usable publicly available data, these incumbents’ product moats are rapidly being undermined by pure tech challengers that use AI to create lower cost and often more user-friendly alternatives. As already observed in domains such as legal research platforms (with the likes of Harvey) and regulatory intelligence, this lowering barrier to entry can pose significant risk to incumbents. These incumbents also tend to be Workflow Integrators and/or Insight Interpreters, helping customers put data into context and embedding it across a customer’s organization. For these companies, all three layers of value are under threat, but the Data Refiner layer is the weakest. They need to swiftly rebalance their value proposition away from that layer and double down on their monetization strategy as Workflow Integrators and Insight Interpreters, building even deeper insight products or more advanced AI-native data workflows leveraging their specific industry domain expertise to maintain differentiation against AI tech pure-plays.

- Trend 3: Unified data platforms as a distribution channel

Data Refiners exists because, in many data categories, the problem isn’t access to data but ensuring it’s clean, standardized, and structured. This same challenge drives companies to build enterprise data lakes or warehouses on platforms like Snowflake and to consolidate all their data from multiple BDI providers. In some domains, tech players have been trying to stake a claim as the platform of choice for integrating data (and running AI use cases) in a particular industry, e.g. Microsoft Fabric and Anthropic in financial services, AWS in healthcare, and Microsoft Azure in energy. These, as well as established user platforms like BlackRock’s Aladdin for the investment management community, will become increasingly important “data emporiums” for Data Proprietors to reach and sell to prospective customers where they already are. This is especially vital if they don’t deliver value well on the Workflow Integrator and Insight Interpreter value layers, because these data platforms can help reach new customers and unlock new value for their data. As these platforms mature and improve on their mission, Access Enablers that already monetize APIs or feeds into such platforms should also make sure their pricing is commensurate with the end customer’s use case value.

- Trend 4: New value from “old” data

Even before large language models and GenAI hit the mainstream psyche in 2022, virtually every BDI company by necessity has always been seeking ways to create, collect, or combine new data or information pieces to enrich their product set and up-sell more content to their customers. Continued advancements in generative AI capabilities means that more and more datasets can be productively used through natural language copilots or ingested into systematic use cases like algorithmic trading. In particular, beyond numerical datasets, now even unstructured qualitative content like news, social media sentiment, and scientific research papers can be coded into machine-readable text usable by AI. As spotlighted by headlines of deals struck between traditional media companies and AI tech players such as News Corp with OpenAI and Wiley with Anthropic and Perplexity, AI technology will continue to unlock new commercial value in many types of “old” datasets. Data Proprietors (and to a lesser extent, Data Refiners) need to understand where they have potential to augment their products with additional datasets to deepen their moat, whether by obtaining access to these datasets themselves, or by striking up the right strategic or product partnerships.

Three key strategic actions

There are three key strategic actions every BDI company must do to navigate through the current confluence of trends, thrive, and grow.

Action 1: Understand your value layers from your customers’ perspectives

Most BDI companies articulate their value proposition as a combination of multiple value layers. However, it is not enough to just have a lofty inkling of the make-up of this value proposition. BDI companies need to be able to parse, in hard quantitative terms, their current revenue through the prism of these five layers to determine exactly what percentage of customers’ total willingness to pay is attributable to which value layer.

Action 2: Assess the impact each trend will have on your market

Not every data market will be impacted to the same degree (or at all) by each of the four trends above. The only constant is that the impact these trends inflict will happen fast, in a matter of months rather than years. BDI companies should constantly monitor these trends, and more importantly, strategically anticipate how each one might change their target customers’ use cases, needs, and the competitive dynamics in their market.

Action 3: Define your strategy by the value layers to invest in

The previous two actions, done well, will allow a BDI company to formulate a robust strategy based on picking the value layer(s) for which they will either defend an existing moat or build a new one around. This strategic choice is critical to guide the company’s investments and to align its go-to-market, product strategy, and packaging & pricing.

The fast pace of technology-driven change and commercial innovations currently afoot will make the global BDI sector champions in the next decade look very different from those of the last. The winners will be the ones that can most astutely discern in which layers durable value truly lies – and commit to it with clarity and conviction.

Special thanks to article contributors Charles Griffiths-Lambeth (Director, London), Oliver Peacock (Director, London) and Hrishi Rajadhyaksha (Senior Director, London).

At Simon-Kucher we work with B2B Data & Information companies across all categories and markets with developing future-proof commercial strategies to drive sustainable revenue growth. Get in touch with us to discuss your specific opportunities and challenges.