The tug-of-war behind financial data ownership

Who owns financial data? And who should pay for its use?

These questions sit at the center of today’s debate between banks, regulators, and fintechs. Regulators argue consumers own their financial data and should access it freely or grant access to others. Banks, meanwhile, contend that fintechs are building profitable businesses on data banks generate and maintain, yet cannot charge for.

This framing matters. Too often, the debate gets reduced to infrastructure costs. Banks pay to store and manage data, so shouldn't they recoup some expenses? But, that view misses the bigger picture. The real issue is value: what value does financial data create, who benefits, and how should it be priced?

Shifting focus from managing costs to creating value

Take credit card transactions. At one level, they exist only for billing and compliance. Customers may claim ownership because the data reflects their spending behavior. Banks counter that transactions were generated to fulfill obligations, not to produce insights.

Contrast this with stock exchanges. Every trade belongs to an individual trader, yet exchanges aggregate activity, enrich it, and sell the resulting market data. The raw view in a trader’s account is far less valuable than the market-wide insights.

This distinction, between raw data and enriched, aggregated insights, lies at the heart of monetization.

Understanding what makes financial data valuable

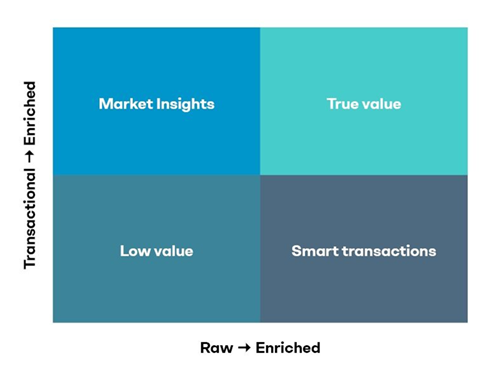

We can map financial data along two dimensions:

- Horizontal axis (R → E): from raw (regurgitated) to enriched (cleaned, contextualized, value-added)

- Vertical axis (T → A): from transactional (individual records) to aggregated (cross-customer, market-wide).

This yields four categories:

- Low value (raw + transactional): Basic records needed for compliance

- Smart transactions (enriched + transactional): Personalized, contextualized customer-level data

- Market insights (raw + aggregated): Broad views of activity without deeper context

- True value (enriched + aggregated): Predictive, monetizable data products at scale.

Why this matters

Instead of asking if banks can charge for “data” in the abstract, we ask which form of data creates value as a product.

- Raw data: should remain broadly accessible, reflecting regulatory intent and customer rights.

- Enriched and aggregated data: represents new value creation. Institutions have a clear case to monetize it.

The dividing line is simple: once data becomes insight, it earns the right to be priced.

How banks and fintechs can turn data into opportunity

For banks

- Audit data assets to separate raw records from enrichment opportunities.

- Invest in enrichment capabilities to move data from cost center to revenue driver.

- Build a product strategy: define value propositions, segment customers, and price accordingly.

For fintechs

- Expect continued free access to raw customer data.

- Focus on services built from enriched insights.

- Compete with banks on enrichment, or partner with them to co-create data products.

What banks can learn from retail data monetization

Retail has already proved this model at scale, and below are three key lessons that we've seen in the industry.

- Identical transformation: Major retailers converted raw transactions into customer segmentation analytics for manufacturer targeting. Simon-Kucher supported a leading global retailer in building this capability, forecasting a 625% increase in digital marketing revenue over four years with 75-90% contribution margins compared to traditional retail margins. Banks can achieve similar margin expansion, though their base is different (with typical net interest margin being 3-5%).

- Closed-loop measurement: Retailers now link ads directly to purchases, creating precision marketing platforms worth billions sold primarily to CPG brands and advertisers. Banks can build similar platforms for financial services companies, insurance providers, wealth managers, and advertisers, connecting marketing to account openings, loan approvals, and investment decisions.

- Strategic asymmetry: Retailers choose whether to keep enriched data internal (higher value through ecosystem multiplication) or sell externally. Banks can't, as regulation forces raw data sharing. This constraint makes external monetization through data enrichment critical for financial institutions, transforming a compliance burden into a growth opportunity.

Smarter data use could be tomorrow's revenue

Data monetization goes beyond simply charging for customer information. The key is understanding the difference between raw data, which is a basic utility, and enriched insights, which have real strategic value. Recognizing this and developing thoughtful strategies around data will allow organizations to turn regulatory requirements into genuine growth opportunities.