How new players are trying to change the logistics and transportation landscape… and what it takes for them to be successful

A view on the US market and beyond

The digital age seems to be upon us. But while some industries are already reaping the benefits of the “new digital future”, others are struggling to find their way. The logistics and transportation industry – a trillion $ business – is clearly one of the latter examples. It wasn’t until recently that the big industry players have started making changes to their business models, e.g. regarding freight transparency, online booking or automation of processes. This lack of initiative has created a perfect playground for young and dynamic companies who try to disrupt this industry. And by now, there are so many new players already out there that they cannot be neglected anymore. Although many of these startups are still rather small in terms of revenues, they have got the attention of the big incumbents as potential competitors and/or acquisition targets. This is due to two factors which they all have in common:

- A clear USP with regards to digitalization or automation that can significantly impact the logistics industry.

- The backup of double digit millions in equity funding.

So far, over $1.5B have been invested in this sector in the US alone. Some global players have already acquired startups and their technology to gain competitive advantages and not fall behind. C.H. Robinson, for example, acquired the domestic online quoting platform Freightquote for $365M. Hellmann Worldwide Logistics has been using the rate management and auto-quote system of Freightos since 2016 and Jeff Bezos and Bill Gates both invested in the startup Convoy which described itself as the “Uber for trucking” when it got launched.

Simon-Kucher & Partners analyzed the current logistics startups in the US (and beyond) and segmented them based on their offered USP and target market. This article focuses on the ones which have got most attention by investors so far, and thus have received the highest amount in equity funding (as of the end of 2017).

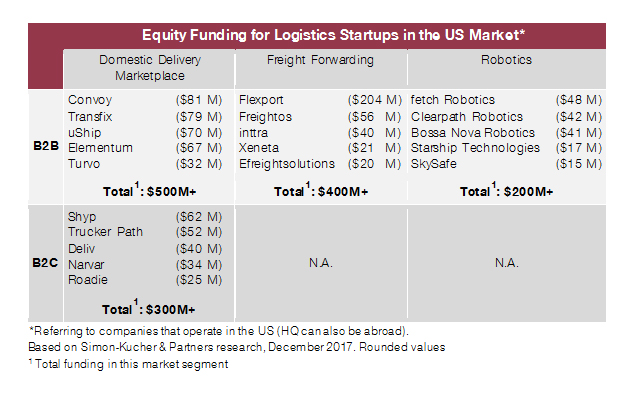

More than $1.5 Billion invested into core logistics startup segments in the USA

Current equity investments have been flowing mainly into three logistics categories, which can partially be distinguished by the affected customer group (business to business (B2B) vs. business to consumer (B2C)), thus creating four segments in total. In each segment the five players with the highest equity funding are highlighted in the table below.

The first category Domestic Delivery Marketplace includes companies that try to provide a transparent platform for customers who want to ship cargo or packages from A to B in the US. As most of these companies either focus on businesses or end consumers, it can be split into two separate segments.

In the B2B segment uShip developed a solution to connect shippers with carriers to send large, fragile, and unpacked items. Customers easily can get rates for their unusually shaped or big products and send them to their destination. DB Schenker recently signed a contract with them to develop a common platform and connect truck drivers and shipments more efficiently, enhancing truck driver jobs. As trucking remains the most common means of shipping goods, especially in the US, there are many other startups tackling this issue: Companies like Convoy and Transfix for example are also trying to find the fastest and cheapest way for shippers to bring their truckload to the desired destination.

In the B2C domestic delivery segment, Shyp has managed to raise $62M in investments. Their business model focuses not only on the pure shipment but on the enhancement of the entire customer experience incl. parcel packaging, pick-up etc. Customers just need to open the door and hand over their product to the courier. In comparison to Shyp the startup Trucker Path is not only focusing on freight shipping and tracking, but in providing navigational assistance and freight matching. The first product the company released was a trip planning and resource locating mobile app, followed by a marketplace to connect freight companies with carriers.

The second category consists of startups in the Freight Forwarding industry. Today’s (commercial) processes in freight forwarding are still predominantly offline with every single touch point involving several phone calls, emails and manual paper work. Therefore, freight forwarding startups try to optimize the booking and management of shipments for shippers, by establishing a seamless way of commerce through online applications. Flexport and Freightos are two of the biggest startups in this segment. The idea of both startups is to connect shippers with carriers and freight forwarders for ocean and air transportation. Their USP: Improvement of the sales process in terms of convenience but also finding competitive prices for shippers.

The last segment contains startups in the Robotics industry. To meet the need of rising customer expectations and enhance the supply chain performance, startups are leveraging advancements in several technology sectors. Autonomous vehicles, last mile drones and warehouse automation robotics are key to achieving that goal. Fetch Robotics for example takes advantage of its robotics expertise to provide mobile robot solutions for e. g. commercial applications or material handling. Another solution in this sector is provided by the startup Starship Technologies. This company produces fleets of self-driving delivery robots designed to deliver goods locally.

A view beyond the US: Startups also conquering international markets

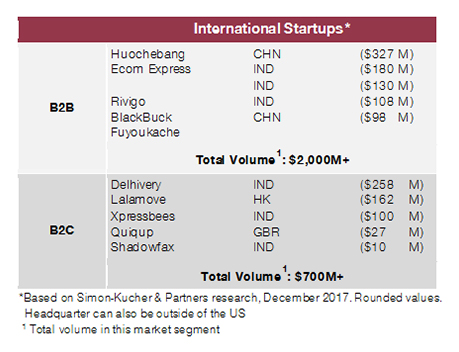

The logistics startup scene does not end at the US border. Especially in Europe and Asia, startups are emerging in the logistic sector as new technologies are enabling greater efficiency and more collaborative operating models. The graphic below shows some of the biggest startups which operate outside of the US.

The Indian-based startup Delhivery is a logistic-focused e-commerce startup that offers a variety of services such as last mile delivery, third-party and transit warehousing. Like Delhivery, Xpressbees is also from India and focuses mainly on e-commerce, by creating a strong technology platform as well as a last mile management system. Xpressbees recently also started diversifying their offerings and entered the B2B logistics segment.

Founded in 2013 in Hong Kong, Lalamove offers delivery technology in cities across Asia. Through a mobile and desktop platform, the startup is able to connect customers with professional van, motorcycle and truck drivers. A similar business model is also true for London-based startup Quiqup, which expands their service beyond food delivery through a network of self-employed drivers. In June 2017 the British retailer Tesco announced it had partnered with Quiqup to offer a delivery service.

In the B2B segment, Huochebang and Fuyoukache from China are both focusing on enhancing the truck logistic industry by providing an online platform to help truck drivers finding cargo. Besides China, also Indian startups accumulated big investments for their vision to change the industry. Rivigo’s goal is to help clients managing long haul trucking by coordinating delivery trucks which operate between different cities. One of Rivigo’s closest rivals in India is BlackBuck. The startup operates a marketplace that connects organizations with truckers to move their goods and therefore tries to maximize truckloads with additional capacity. Besides the trucking industry in India, there are also other startups like Ecom Express that take a wider approach on logistics by providing end-to-end solutions in the e-commerce industry.

Looking ahead: What will the future bring?

It is difficult to predict how these startups will develop within the next 5 or 10 years. Needless to say that equity funding does not necessarily translate into revenue and thus business success. In this analysis Simon-Kucher purposely did not mention any revenue figures, because we believe that they are only a very small indicator for success at this point in time In 3 to 5 years from now that should be different and you will most likely see which of these companies have managed to establish themselves in the market. Furthermore, while this article only mentioned the top 5 in each of the segments, the future market leader might not be on that list yet.

Also interesting to see will be the changes among the traditional logistics players and how they will adapt to the new competitive environment. We have already seen a few acquisitions and cooperations of incumbents with some of these startups. This will likely not be the end. Especially in the domestic delivery marketplace and freight forwarding Simon-Kucher anticipates a lot more action.

Advice from the experts: How to be successful?

There are many factors that will influence the success of each of these startups. Simon-Kucher states the three most important ones here:

- Set foot into the market before it is too late! There will only be one true winner per segment and market in the long run. That means startups need to hit the turbo button and try to establish themselves in their market (either as standalone or collaboration with an existing logistics company).

- Clearly define and segment your offer! E.g. Carriers, shippers, forwarders and end consumers might all get a different value from a certain startup offer. Thus, before coming up with a price for their services, startups clearly need to define product options and packages based on individual customer segments.

- Capture customer willingness to pay! Startups are bringing a new customer experience to the logistics industry. It is important that they fully capture the value of those services from the very beginning, before a “freeby” mentality gets established among customers and the profit potential gets lost. This will be the crucial deciding factor between failure and success.

This article has originally been published in a revised version in Journal of Commerce (JOC) in February 2018.