Private label isn’t just an inflation story

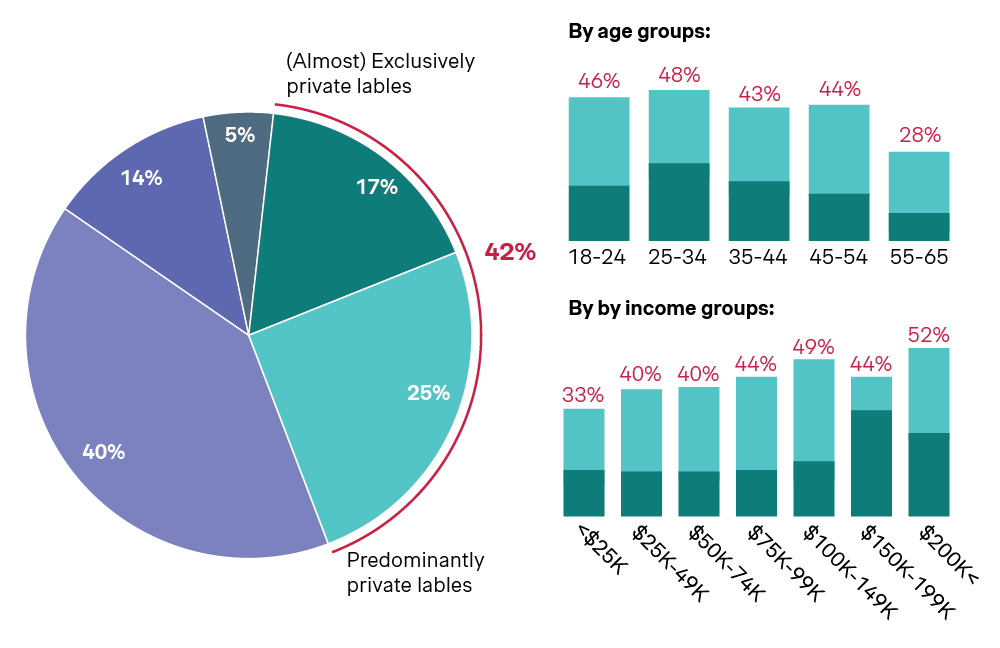

The surge of private label purchasing during last year’s inflationary recovery period wasn’t a fluke, it was a reset. As price pressures reshaped consumer behavior, shoppers reevaluated what mattered most to them. Our 2024 Private Label Shopper Study found that 54% of consumers increased private label purchases year-over-year, with 42% primarily or exclusively buying private label items. In 2025, new tariff pressures are reinforcing this shift, turning a short-term inflation response into a more permanent consumer mindset.

Tariffs are the next catalyst and a wake-up call for all

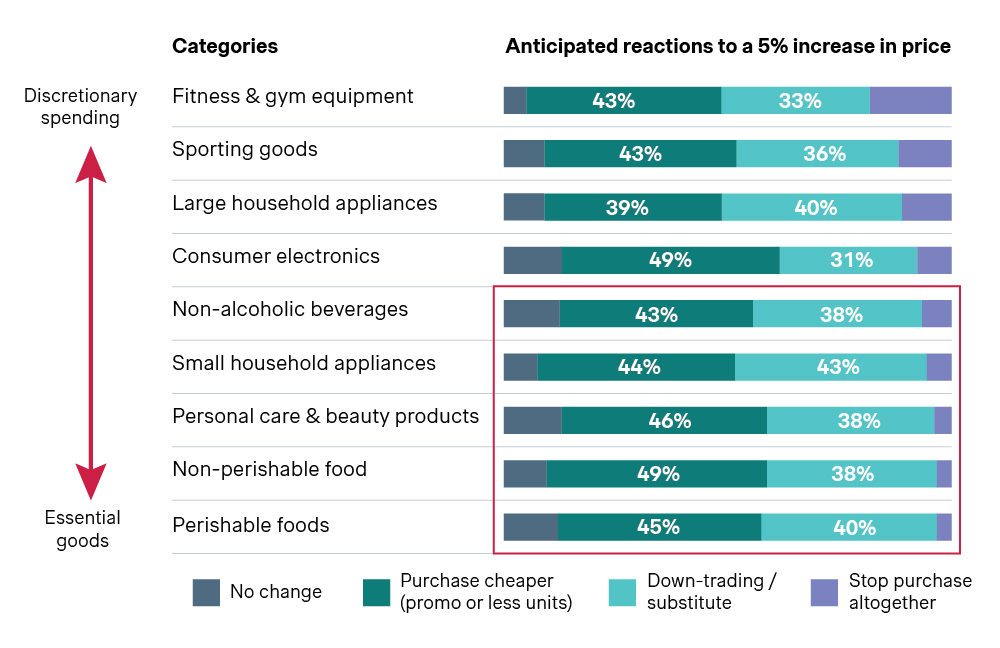

Our 2025 US Consumer Tariff Market Study confirms that tariffs are already prompting significant changes in buying behavior. In response to a modest 5 % price increase from tariffs, 43–49% of consumers say they would seek cheaper alternatives, and 38–40% plan to down-trade. These responses mirror the same value-seeking behaviors that powered private label growth during the inflationary period. Even if tariffs were rolled back tomorrow, the behavior might not reverse. 78% of shoppers say they plan to maintain or increase their private label purchases regardless of future price fluctuations.

This change in global trade makes it critical for businesses to act strategically when investing in and expanding their private label offerings. As tariffs accelerate value-seeking behavior among consumers, building a robust private label strategy will position companies to better capture share in categories with the most down-trading opportunity (i.e. perishable and non-perishable foods, personal care and beauty products, small household appliances and non-alcoholic beverages). As such, a thoughtful and targeted private label strategy allows companies to maintain competitiveness, protect margins and restrengthen brand loyalty amidst the changing economic climate.

Demographic and category insights

Private label’s strongest growth is coming from younger and higher-income consumers, which challenges the outdated assumption that value-seeking behavior is limited to low-income shoppers. Nearly 46% of 18–54-year-olds and 49% of households earning over $100K report they now predominantly or exclusively purchase private label.

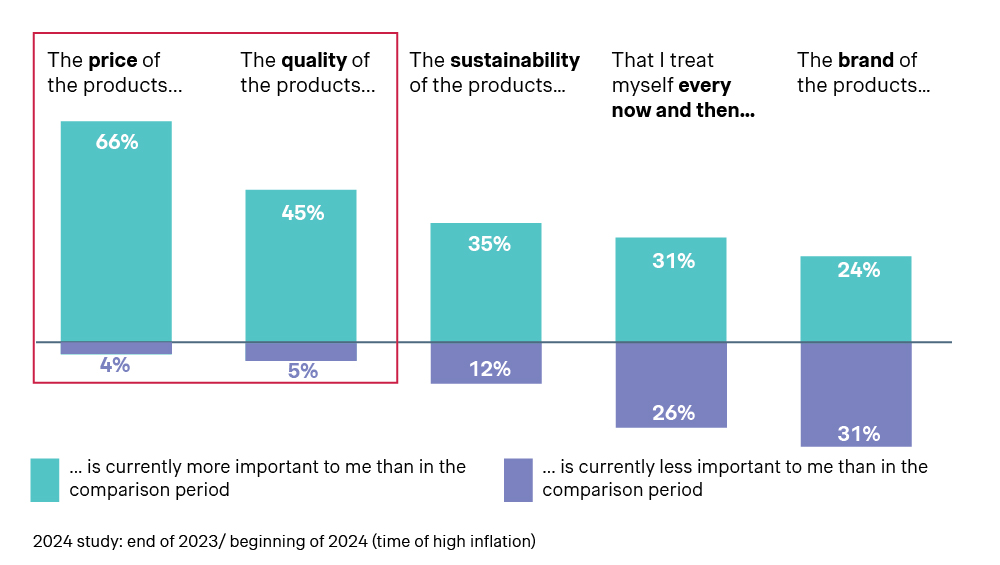

Price is becoming increasingly important to consumers, while brand loyalty is declining, creating more opportunities for private label growth. 66% of shoppers find price more important than the previous year, while 31% say brand factors are less important in their buying decisions. As shoppers prioritize value-driven purchasing choices that deliver quality at affordable price points, private label will be at the forefront of meeting this demand.

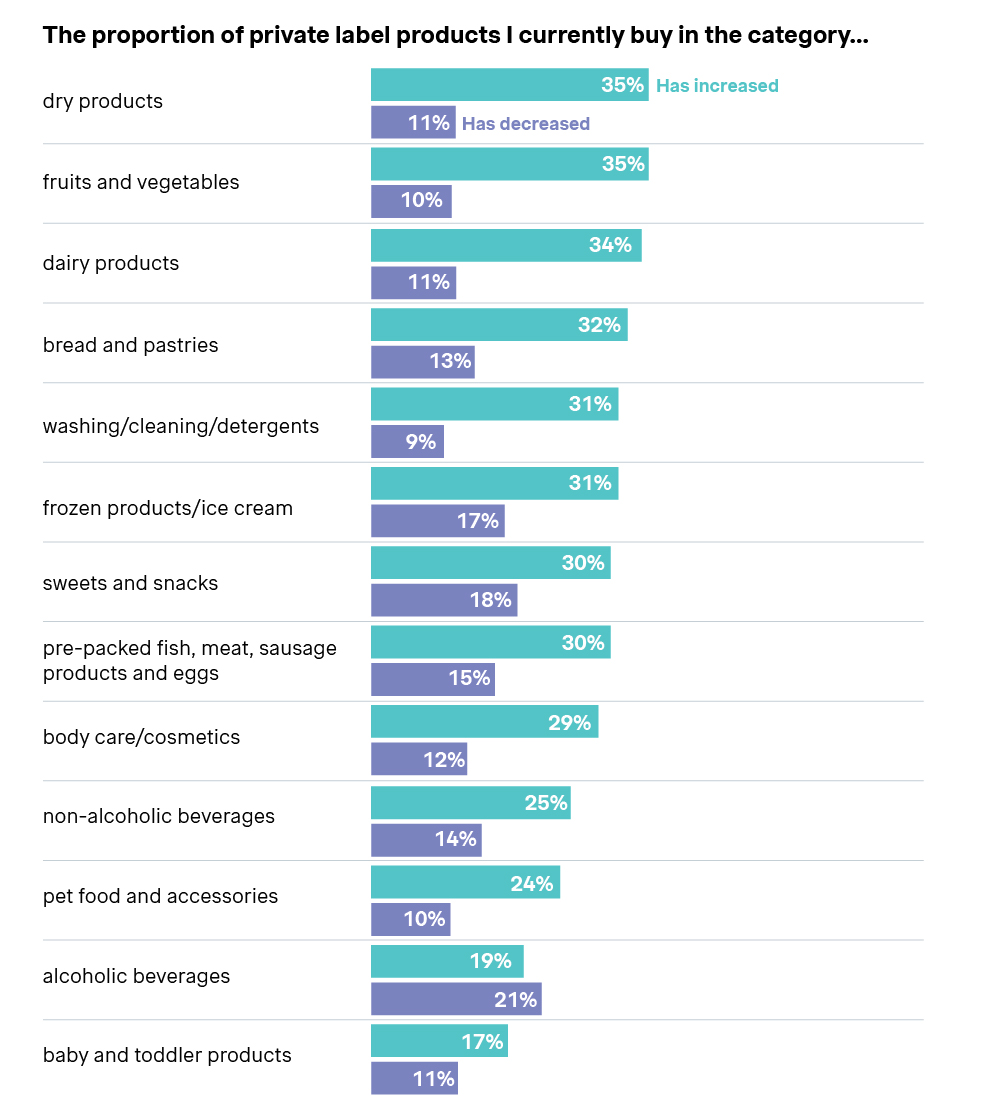

From a category perspective, the biggest private label gains are in perishables, pantry staples, and household goods, with dry goods, dairy, and produce leading the charge. In contrast, categories like pet care, alcohol, and baby/toddler products remain more brand-loyal, highlighting the ideal focus areas to tap into this growth.

Private label opportunities for retailers and manufacturers

The sustained interest in private label products presents a wealth of opportunities for both retailers and manufacturers. To capture and maintain market share, it’s essential to optimize your strategies in line with consumer preferences.

- Curate the right private label assortment: It’s not just about expanding; it’s about expanding strategically. Tailor private label offerings to meet core shopper missions, ensuring strong coverage in high-frequency categories like dry goods, dairy, and cleaning supplies, while also identifying gaps in premium and specialty tiers. The right mix drives both trial and loyalty.

- Design pack architecture to win across channels and segments: A tiered pack architecture serves different shopper needs and price sensitivities. Smaller packs drive trial and basket fillers, while larger formats deliver value and margin. Pack preferences vary across channels: online customers favor bulk and multi-packs, while convenience stores thrive on grab-and-go formats. Manufacturers should adapt their pack strategies to meet the unique demands of each channel and align with consumer expectations.

- Build a pricing architecture that flexes by tier: Manufacturers should support retailers in building a tiered pricing strategy, including value, mainstream, and premium, that is anchored in distinct pack sizes, product features, and perceived quality. Thoughtfully filling price gaps left open by national brands helps retailers stay competitive across shopper segments without diluting perception, while also preserving margin opportunities for manufacturers.

- Premiumize the offering for higher-income shoppers: Today’s value-seeking affluent shoppers are open to trading down if the product feels premium. Manufacturers can unlock growth by creating higher-quality formats with elevated packaging, clean labels, or functional benefits. These packs command higher price points while still being competitive against national brands, appealing to shoppers looking for value without compromise.

- Build promotional strategies with intent: Deep discounts are not always the answer. Retailers should leverage loyalty and basket data to serve smarter offers, such as targeted discounts on frequently bought categories, cross-sell recommendations, or reminders to repurchase. Personalized promotions not only boost conversion but also build brand equity for private label lines.

- Negotiate smarter with manufacturers: As private label scales, supplier relationships become even more strategic. Focus on long-term partnerships that ensure consistent quality, reliable supply, and room to innovate, particularly in premium or differentiated formats.

- Use data to test and scale what works: The best-performing manufacturers use retailer sales data (loyalty and basket data) and in-market testing to optimize strategies including pack and price combinations and personalized promotions. Rapid test-and-learn loops allow for smarter assortment and faster innovation cycles, ensuring private label lines evolve with the shopper.

Navigating tariffs and driving private label growth

Today’s tariffs reinforce behaviors (mindful spending, brand flexibility, and value prioritization) that are here to stay. Businesses that treat this as an opportunity rather than a headwind can reposition themselves to win in a more price-sensitive, quality-driven market.

Whether through supply chain agility or targeted private label innovation, the brands that stay ahead of these shifts will be best positioned to capture the next wave of consumer loyalty.

At Simon-Kucher, we help consumer businesses future-proof their offerings and unlock better growth through a data-driven approach to commercial strategy, pricing, category management, and product innovation.

Explore our latest reports for actionable insights:

2025 US Consumer Tariff Market Study

US Private Label Shopper Study

Contributing author: Heidi Liu