Many companies face a common challenge: Revenue growth is currently driven primarily by price increases while volume remains stagnant. As customers grow more price-sensitive and low-cost competitors gain share, leaders must act decisively to connect value and price to realize further growth and strengthen their positioning.

Over the past several years, B2B companies have seen persistent inflation and increasing costs. While many have managed to sustain top-line growth through successive price increases, these gains have masked an underlying challenge: the stagnation of volume growth. Customers, faced with rising costs across the board, are more reluctant than ever to accept price hikes unless they are matched by meaningful improvements in value. At the same time, many B2B firms are still operating with legacy propositions shaped by old market dynamics, now increasingly disconnected from customer expectations. These inherited models often fail to address current customer expectations or competitive pressures, limiting companies' ability to defend share or expand volume. To move forward, business leaders must take a hard look at what they’re selling and how it’s positioned. In many cases, this means rethinking the core proposition, realigning price and value, and shifting to a mindset of value-led growth. The B2B companies that do this well won’t just protect their margins, they’ll unlock new demand and regain commercial momentum.

Avoid overreaching in price, value and volume are now key priorities

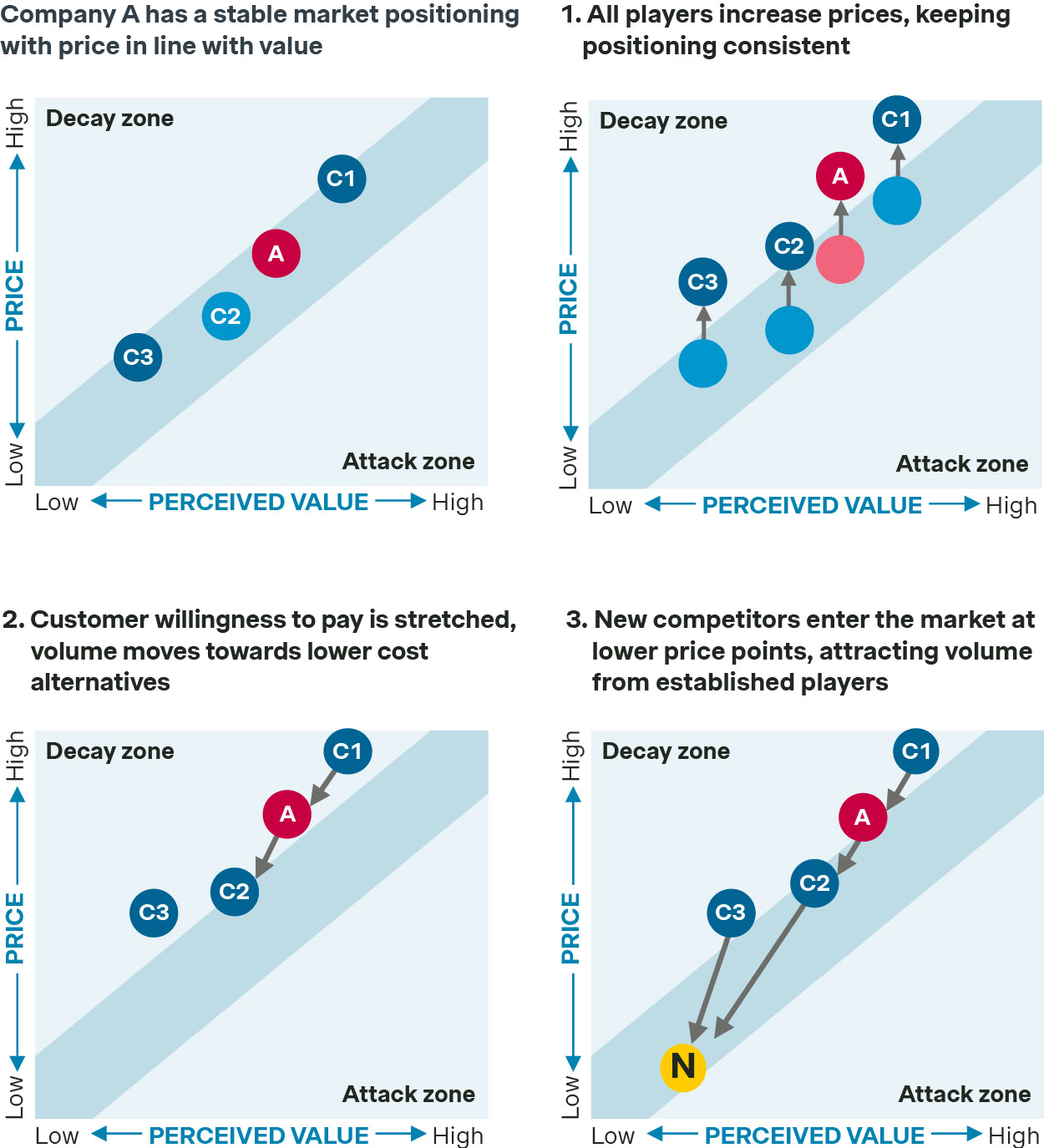

The path to profitable growth has become increasingly fragile in the aftermath of sustained inflation. In many markets, we see three clear market responses happen following this trend:

- Markets increased prices: B2B Companies raised their prices in response to rising costs, often without making meaningful changes to their value propositions.

- Customer willingness to pay was stretched: Buyers, already facing economic pressures, did not see sufficient added value to justify higher prices, leading to erosion in perceived fairness and putting pressure on products and services priced at a premium.

- Customers started looking for alternatives: This shift in perception triggered a move toward lower-cost substitutes, such as private labels, foreign suppliers and market entrants, that offered more attractive price-value trade-offs.

In the consumer sector, this is clearly visible in the growing strength of private labels. According to our 2024/2025 shopper study, 53% of consumers choose private labels either predominantly (32 percent) or exclusively (21 percent) over branded products, eroding the volume base of traditional premium brands. Retailers are actively pushing back against supplier price increases, promoting their own store brands as credible and cost-effective alternatives to defend both volume and margins.

In B2B, low cost competition from China is prevalent in European markets. Both chemicals and industrial robotic products are increasingly imported from China and at significantly lower prices (This trend is intensified by US tariffs imposed on Chinese products, diverting Chinese supply towards European markets)

Together, these developments have placed traditional premium offerings under increasing pressure, forcing a strategic rethink for companies reliant on legacy propositions.

To reverse this trend, B2B companies must urgently revisit their proposition, rebalance price with value, and refocus on volume as a core driver of sustainable growth.

Three strategic directions to bring value in line with price

To address these pressures, B2B companies must revise their approach across proposition, sales, and pricing levers. Drawing on recent projects, we outline strategic directions for B2B companies to balance price with value and position volume as a driver of sustainable growth.

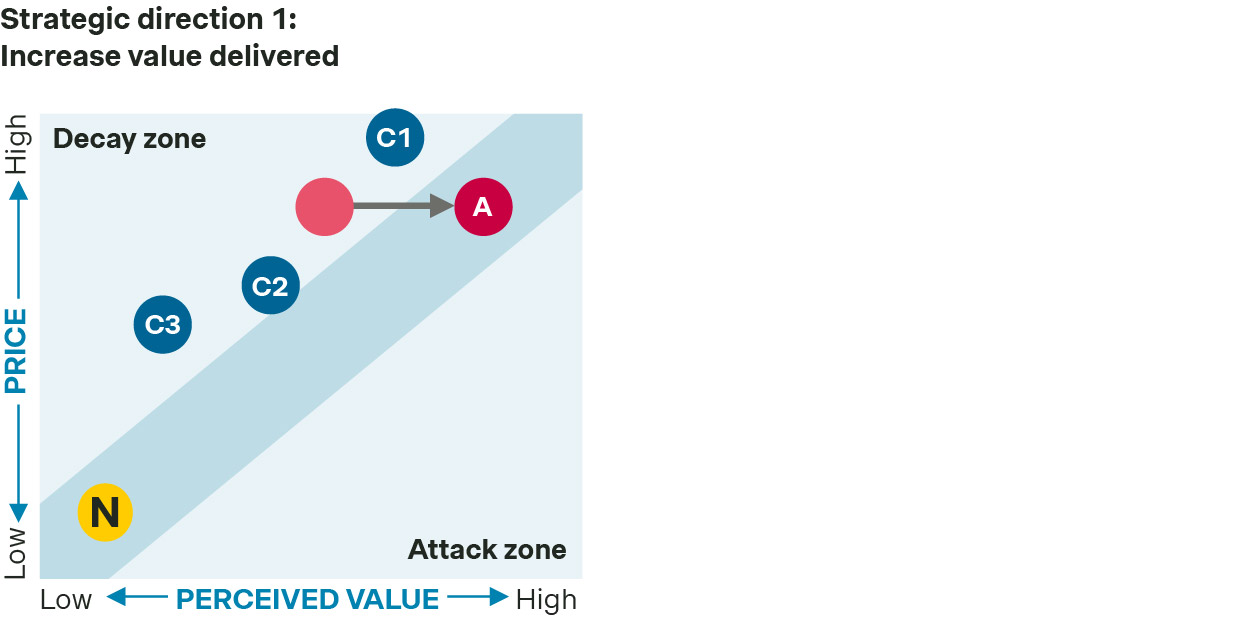

Strategic direction 1: Increase value delivered

When value is lacking in the price-value equation, increasing value delivered, while seemingly the obvious answer, is often easier said than done.

Most B2B companies have an innovation roadmap. But is it ambitious enough? Fast enough? Does it include what current and future customers really value? And does it enable us to justify our price premium? If the answer to these questions is not undeniably yes, there is likely potential. Themes such as sustainability and AI enable B2B companies to create value in different ways: By directly monetizing innovations, or by focusing on retention and lifetime value.

Besides the core proposition, we see opportunities for B2B companies to increase value to customers by focusing on additional services. If the core offering is at risk of being commoditized, additional value can be created through packaging, delivery and customer support services. Focusing on brand value rather than product value has proven to be a key differentiator.

Case example: A specialized IT services company had a clear ambition: To justify a significant price increase to its customers, while minimizing churn. We challenged them to look at their proposition: If they were to charge an above current market standard rate, what would they need to offer to their customers? We identified capabilities they needed to develop, and services to include in their offering. Price and value went hand in hand in this case.

Case example: A European market leader in educational textbooks experienced a decline of several percentage points in market share and turned to Simon-Kucher for support. Our research revealed that customers perceived the value of the products to be too low versus the price they were paying. The objective was therefore to enhance value creation and align more closely with government priorities as well as the expectations of today’s teachers. By launching a dashboard with an online toolbox and exercise platform, the company enhanced customer value and aligned with the shift toward digitalization.

Often a lack of value is not the true issue, it’s the company’s ability to convey that value to their customers. Too often marketing emphasizes the wrong message, while sales focuses too narrowly on price, rather than demonstrating product or service value. Improving value selling requires business leaders to equip sales teams with the right tools and training to shift conversations from cost to business impact.

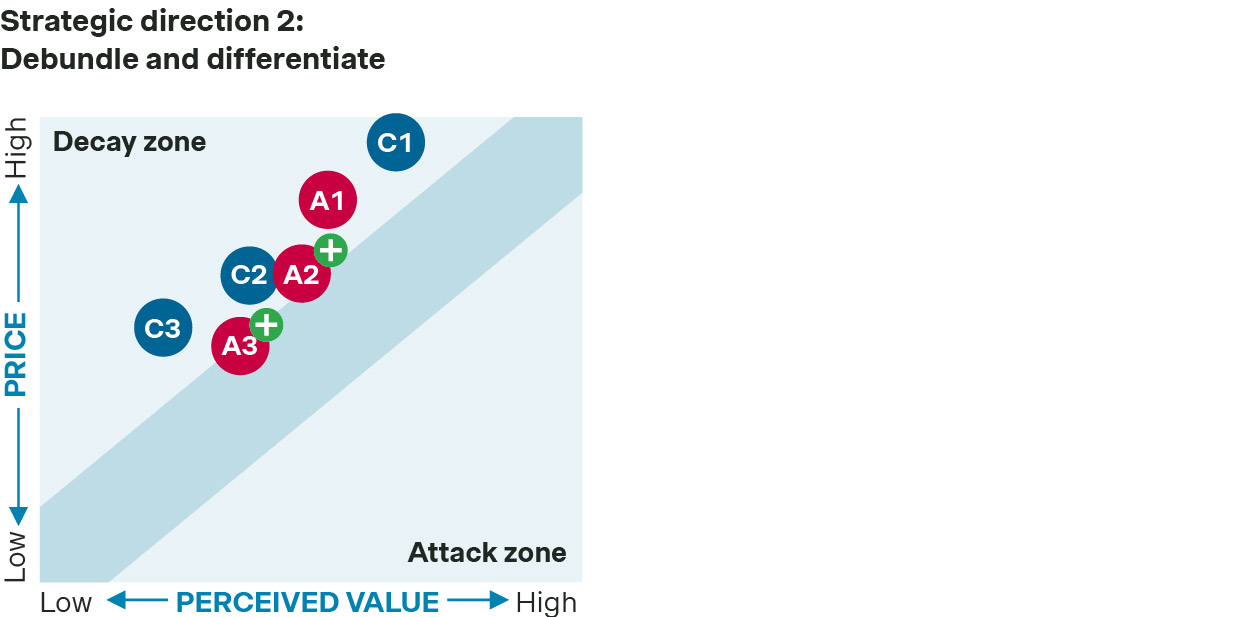

Strategic direction 2: Debundle and differentiate

A direct price decrease is in most cases considered a bad strategic move, as it erodes positioning and destroys profitability, while new volume is locked behind assumptions and executional challenges.

When full-service offerings become unaffordable or misaligned with needs,debundling is a smart move. By separating “nice-to-have” features, companies can lower entry price points without diluting their brand. B2B Companies can apply this to preserve their premium brand while expanding access to smaller accounts. This model not only defends volume but also creates room for upselling as customer needs evolve. In practice, debundling can mean stripping out less-used service layers, optional features, or premium SLAs while keeping core value intact. The goal is not to compromise value, but to adapt packaging to customer willingness to pay.

Case example: A construction products manufacturer approached Simon-Kucher looking to optimize their price-value positioning. In market research we discovered their value delivered was excellent but only appreciated by a small market segment. Together we debundled their core product: Increasing profitability by taking away elements customers did not perceive as valuable (reducing COGS), and introducing a revenue model for these elements as add-ons.

Alongside debundling, another opportunity is to introduce a dedicated, lower-cost proposition, especially when targeting price-sensitive segments or regions. Unlike a stripped-down version of a premium product, this is often a clean-sheet design tailored to essential needs. It enables B2B companies to expand their reach without undermining its flagship brand. This approach is particularly effective when lower-cost entrants are eroding market share, or when new growth must come from budget-constrained buyers. Care must be taken to clearly segment the offering and manage channel conflicts, but when executed well, this strategy combines volume recovery with brand protection.

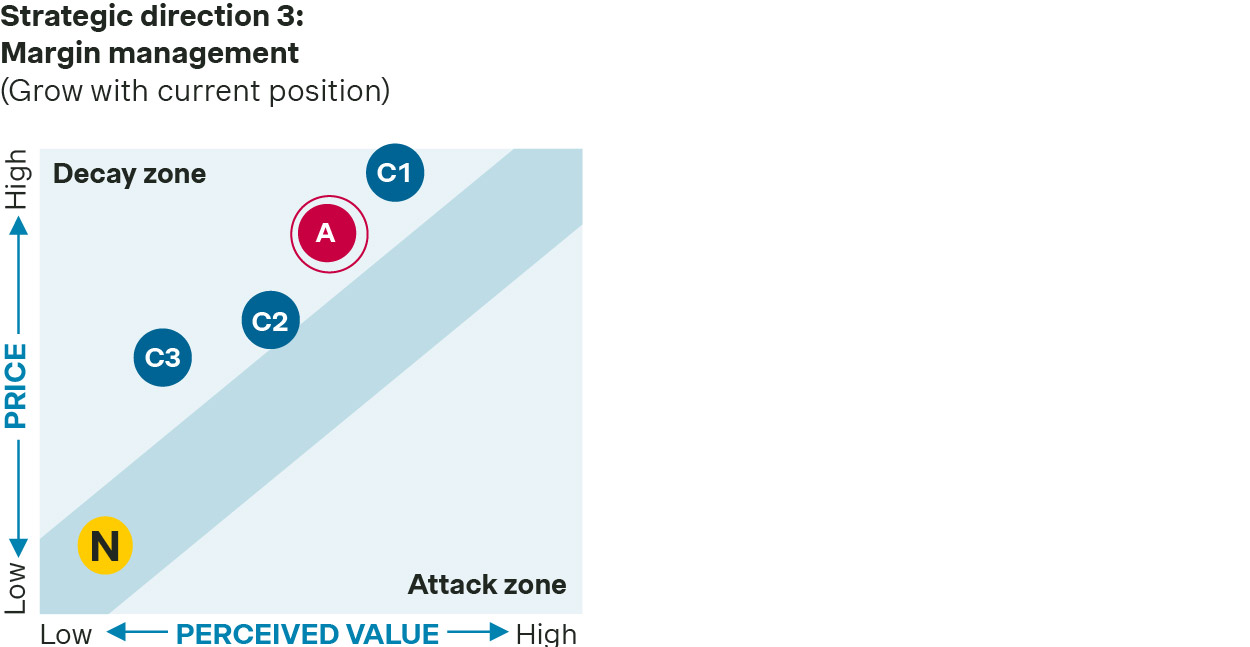

Strategic direction 3: Margin management

If customers are unable to accept a price increase but profitability is squeezed thin, B2B companies should look to improve profitability smartly. Improving profitability doesn’t always require new revenue, it often means better managing existing margins. This includes refining pricing logic, tightening discount practices, and reducing cost-to-serve.

Case example: Experiencing strong price pressure, a Dutch technical wholesaler turned to Simon-Kucher to assess and improve profitability without losing customers to price increases. Our 360-degree pricing audit highlighted customers and products that were currently unprofitable and were to be repaired. Additionally, we assigned pricing roles to their portfolio, separating the runners from the long tail. While the price for the runners was kept stable (or in some cases, decreased), many of the long tail products saw a small price increase, leading to an overall profit increase of 3 %pt, with no volume loss.

Additionally, cross- and upselling strategies are often underutilized as tools to drive volume and margin. Expanding within the existing customer base is often more efficient than acquiring new ones. Cross- and upsell can be leveraged to drive customers towards more profitable products and services, while increasing account value and foster long-term loyalty.

Now is the Time to Act: Reposition for Growth

B2B leaders can no longer rely on pricing alone to drive results. To reignite volume and defend market position, leaders must take bold, proactive steps to realign their proposition to today’s realities. That means making tough choices: where to increase value, where to simplify, and where to differentiate. Those who succeed will unlock profitable growth, even in challenging conditions.

At Simon-Kucher, we help companies translate strategic ambition into commercial results. Whether you're looking to repackage your offer, improve sales execution, or take control of your margin, we bring the tools, benchmarks, and insights to make it happen. Reach out to our experts to start the conversation.