The state of luxury in 2025 reveals a shift toward more measured, sustainable market growth. But that does not necessarily mean opportunity is scarce. Our Global Luxury Consumer Trends Study 2025 uncovers where luxury items remain in high demand, which segments are set to outperform, and how consumer expectations are evolving. Whether you lead a legacy Maison or a fast-growing newcomer, understanding today’s luxury shopper, and planning for the long term, will sharpen your strategic focus.

A more cautious growth outlook, but new avenues to explore

Has luxury’s era of unfettered expansion given way to a new steady-state of sustainable growth? Euromonitor anticipates a 3.4% CAGR from 2024 to 2029, modest compared with recent highs, yet underpinned by high-potential segments. Experiential luxury (think curated travel journeys, private gallery tours, or bespoke art commissions) rises alongside traditional luxury fashion favorites such as leather goods and fine jewelry.

Growth pockets are appearing in unexpected places. For example, our study shows that India is the star performer among emerging markets. The secret lies in identifying where consumer demand is most resilient.

This measured growth outlook challenges luxury brands to pivot from volume-driven strategies toward precision playbooks. Which segments will you prioritize? How will you mobilize your brand’s unique heritage to unlock value for the modern luxury consumer? And how can you address untapped potential in emerging geographies, like India?

Navigating the evolving luxury goods industry requires foresight, agility, and a deep understanding of where luxury sales remain resilient.

Global luxury consumer profiles: Understanding regional nuances

Not all luxury audiences think alike. Our Global Luxury Consumer Trends Study, conducted across 1000 respondents in Europe, the United States, India, and China, identifies the seven faces of luxury – seven distinct consumer profiles, each with its own spending rhythm and value drivers. You’ll recognize these archetypes among your own customer base:

Icon Collector Occasional buyers who invest in high-value, timeless pieces from established Maisons, and prize legacy over trend | Fashion-Forward Icon Frequent purchasers focused on statement items and ahead-of-the-curve brands, influenced by social media | Power Patron Regular buyers at premium price points who covet both classic icons and limited editions to reinforce prestige | Quiet Luxury Enthusiast Selective, occasional buyers of understated, logo-free pieces, seeking subtlety and enduring quality

|

Statement Collector Connoisseurs of ultra-rare, highly curated items that promise future appreciation | Status Shopper Novice purchasers drawn to seasonal trends to showcase social elevation, often guided by influencers | Bespoke Aficionado Occasional, high-value buyers who prioritize tailor-made craftsmanship and one-of-a-kind experiences | |

Which of these profiles reflects the customers you serve, and how might your messaging or product mix evolve to match their priorities?

Our study shows that in Europe and the US, mature shoppers prize craftsmanship, heritage, and, yes, price considerations. Nearly three in four of these consumers compare prices across brands before finalizing a purchase.

In contrast, aspirational buyers in China view luxury as a lifestyle choice, from their wardrobe to their travel and entertainment, with over two-thirds defining themselves this way. Meanwhile, in India, emerging consumers enter the market primarily to signal social status; a quarter of respondents cited social recognition as their main driver.

Aligning product, communications, and pricing with the right archetypes is the cornerstone of future success in the luxury sector.

Shifts in market: Where spending remains robust

Despite a more cautious overall growth rate, consumers in India and China continue to drive industry resilience. Nearly two-thirds of respondents in these markets reported spending over €20,000 on luxury goods in the past 24 months.

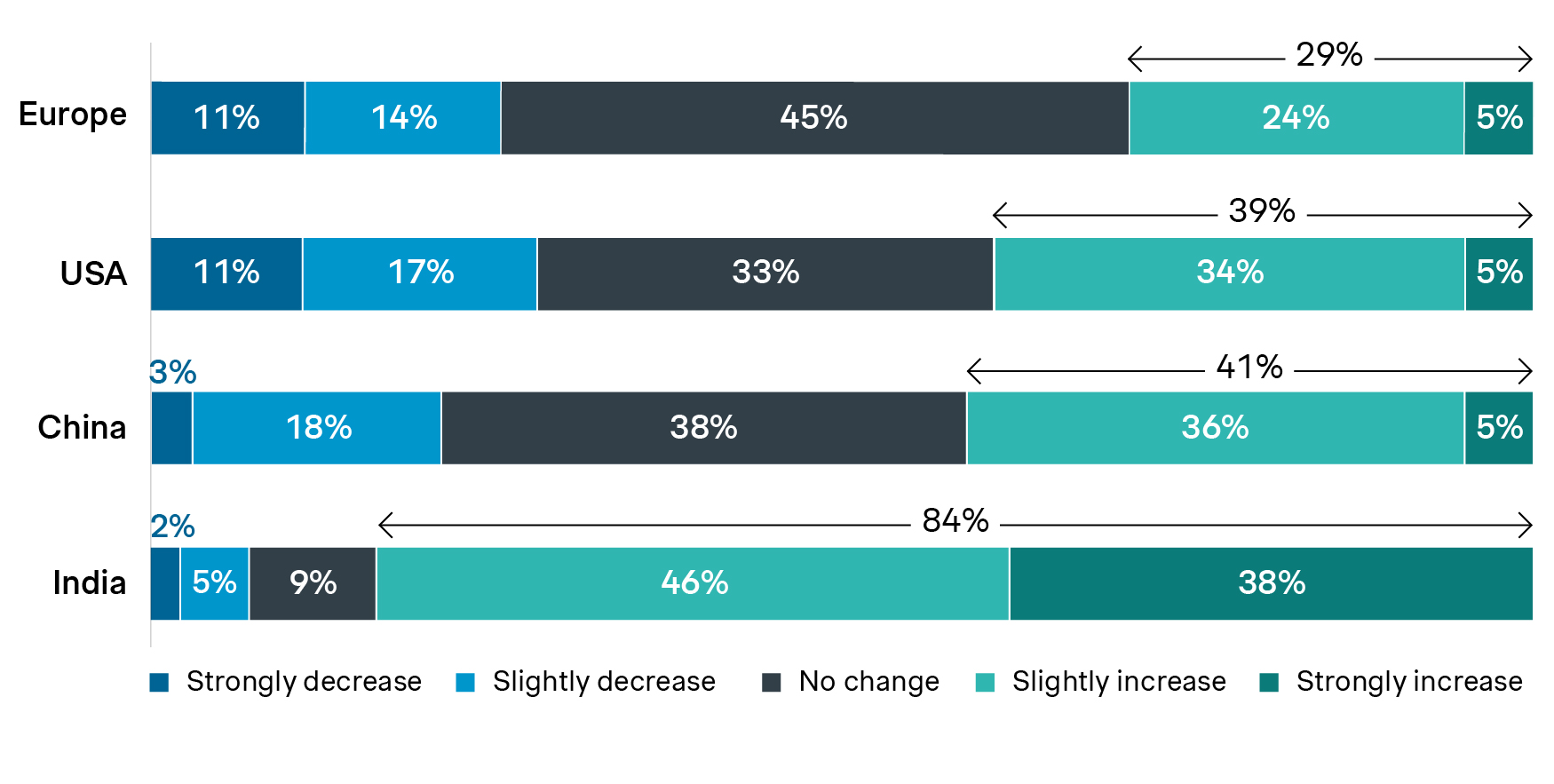

More strikingly, 84% of Indian consumers plan to increase their luxury spending over the next year, primarily by adding more items to their wardrobes, mirroring a similar trend in the US and China. In Europe, growth is expected to come more from purchase frequency than basket size.

This regional dynamism prompts a critical question: is your commercial model flexible enough to meet divergent growth drivers? From premiumization levers in mature markets to volume plays in emerging segments, your pricing and channel strategies must reflect localized demand curves.

Decoding luxury price perception

Have luxury price increases reached a ceiling? The answer varies by market. In Europe, the US, and India, over 60% of consumers perceive prices as higher today compared with two years ago. Yet, only about one-third of American shoppers feel value for money has declined, and less than 10% cite a value drop for luxury watches, showing strong resilience of the category. Chinese consumers, in contrast, remain comparatively unfazed by price increases, underscoring their enduring focus on exclusivity and prestige.

This variation in luxury price perception underscores the importance of nuanced value communication. For example, highlight craftsmanship, limited editions, and heritage pedigree where price scrutiny is high. Or, in markets with lower sensitivity, amplify brand storytelling and elevate the experiential purchase journey. Ultimately, understanding luxury consumer sentiment around pricing will help you balance margin ambition against potential brand-equity erosion.

Channel dynamics: Bridging physical and digital touchpoints

Despite the growth of e-commerce, in-store experiences remain central in established markets. Over 70% of shoppers in the US, China, and Europe still prefer buying luxury in person. However, India challenges the trend: less than half of its luxury consumers shop in-store, and online discovery is their primary entry point.

How integrated is your omnichannel strategy, from digital discovery to after-sales care? Overall satisfaction with the luxury shopping journey is highest in India (NPS +60), suggesting brands that master a seamless digital experience will win loyalty. Yet 38% of US luxury consumers express dissatisfaction with CRM communications, signaling that post-purchase engagement remains an untapped frontier.

These insights suggest that a one-size-fits-all omnichannel approach risks diluting impact. Instead, a good strategy includes tailoring channel investments, such as enhancing creativity in mature markets and doubling down on digital brand immersion (virtual try-ons, live-streamed events, and AI-driven personalization) in growth regions.

What about experiential luxury?

Experiential offerings, whether private fashion previews or bespoke atelier visits, combine tangible and intangible value in a way that purely product-centric models cannot match. As pressure on conventional growth mounts, how can you pivot from transaction to transformation? The answer lies in curating memorable, personalized shopping experiences that leave a lasting emotional imprint.

From ultra-exclusive behind-the-scenes access to limited-edition collaborations, experiential luxury taps into the deep well of luxury consumer sentiment. It addresses both the quest for unique social currency and the desire for meaningful connections with the brands they love.

There’s more…

Simon-Kucher’s latest Global Luxury Consumer Trends Study represents a comprehensive assessment of consumer sentiment across Europe, the US, India, and China. This research, led by our consumer sector experts, equips you with:

- A clear growth playbook tailored to regional dynamics.

- Refined consumer segments to inform product roadmaps and marketing strategies.

- Pricing frameworks calibrated to perceived value and willingness to pay.

- Omnichannel guidelines that optimize engagement and conversion.

Download the study and secure actionable recommendations to elevate your growth strategy. For more in-depth insights, contact our sector experts today.

Register for our upcoming luxury webinar

Form placeholder. This will only show within the editor