India's luxury market is the fastest growing market in Asia, with continued expected growth. It’s the perfect time to enter and operate in India. However, luxury brands need to adapt to local ways of working to thrive in this complicated market landscape. Our experts dive into how to build a winning GTM strategy tailored for success in India.

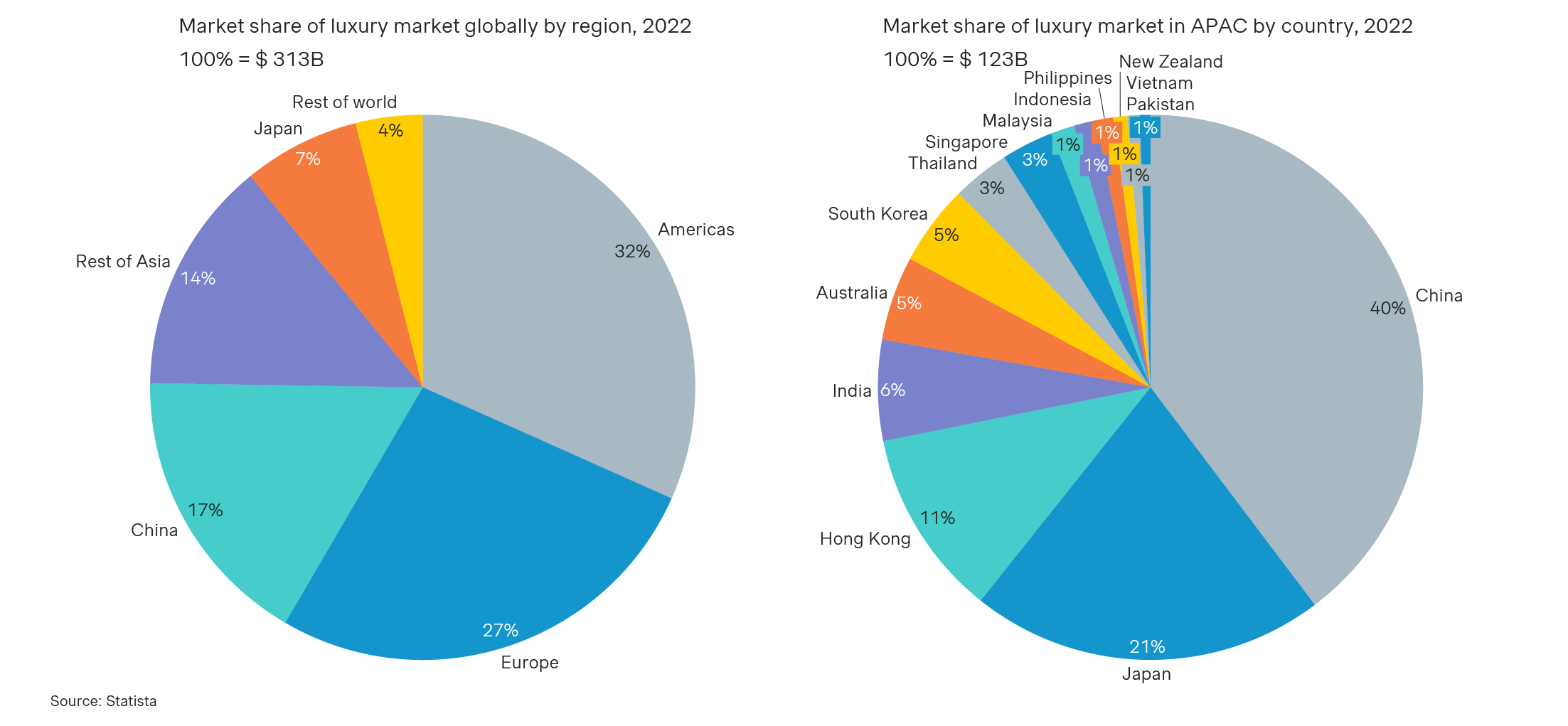

Globally, the luxury market has been growing at a CAGR of 4.3 percent and is projected to generate revenue of 369 billion US dollars in 2024, up from $313 billion in 2022. In 2022, the Asia-Pacific (APAC) region contributed approximately 38 percent to the global luxury market. While in 2024, the biggest markets in APAC; China, Japan and India are estimated to generate $56 billion, $32 billion, $8 billion, respectively.

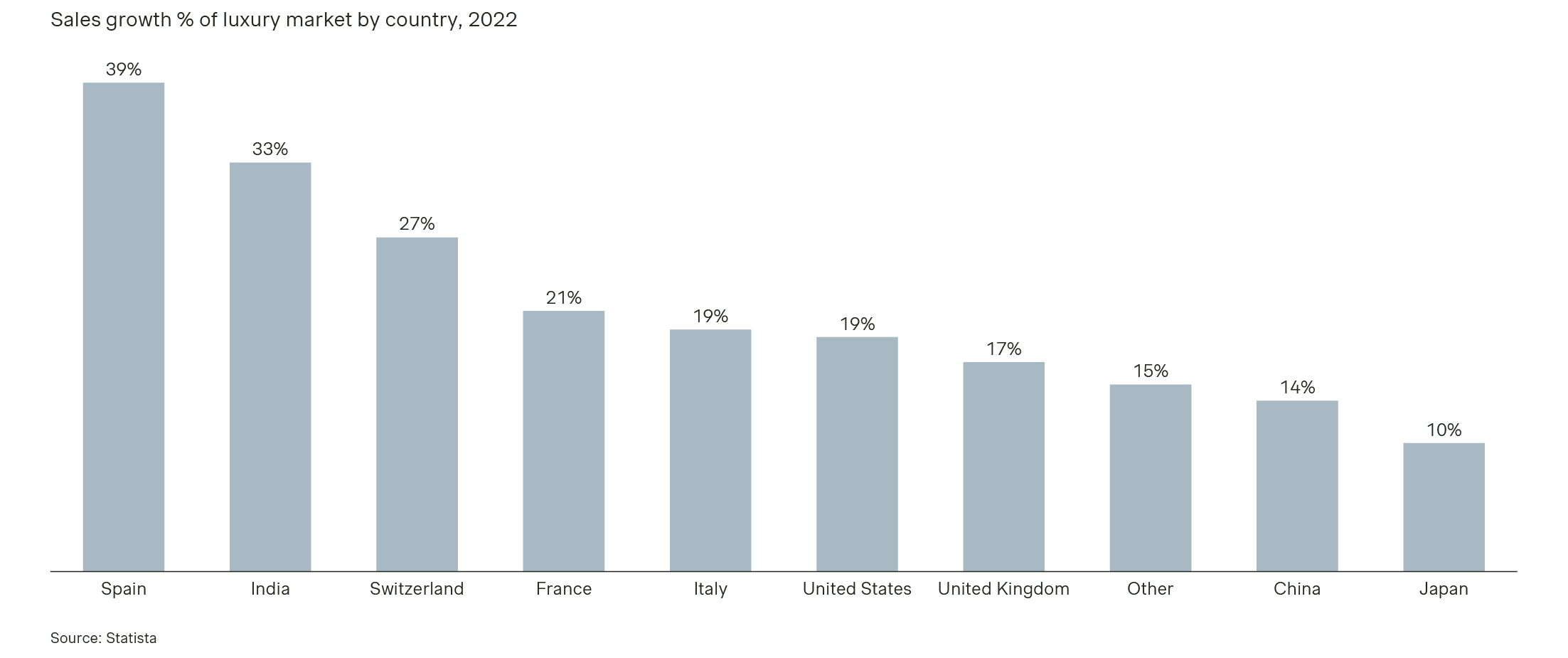

Even though India is a relatively smaller market, its robust growth rate of 33 percent as of 2022 positions it as the fastest growing Asian market and the second fastest in the world. Additionally, India ranks as the third largest luxury market in Asia, surpassing countries like Thailand, Vietnam, and even South Korea.

How different is the Indian luxury market vis-à-vis other markets?

India’s luxury market differs from others in a few critical ways.

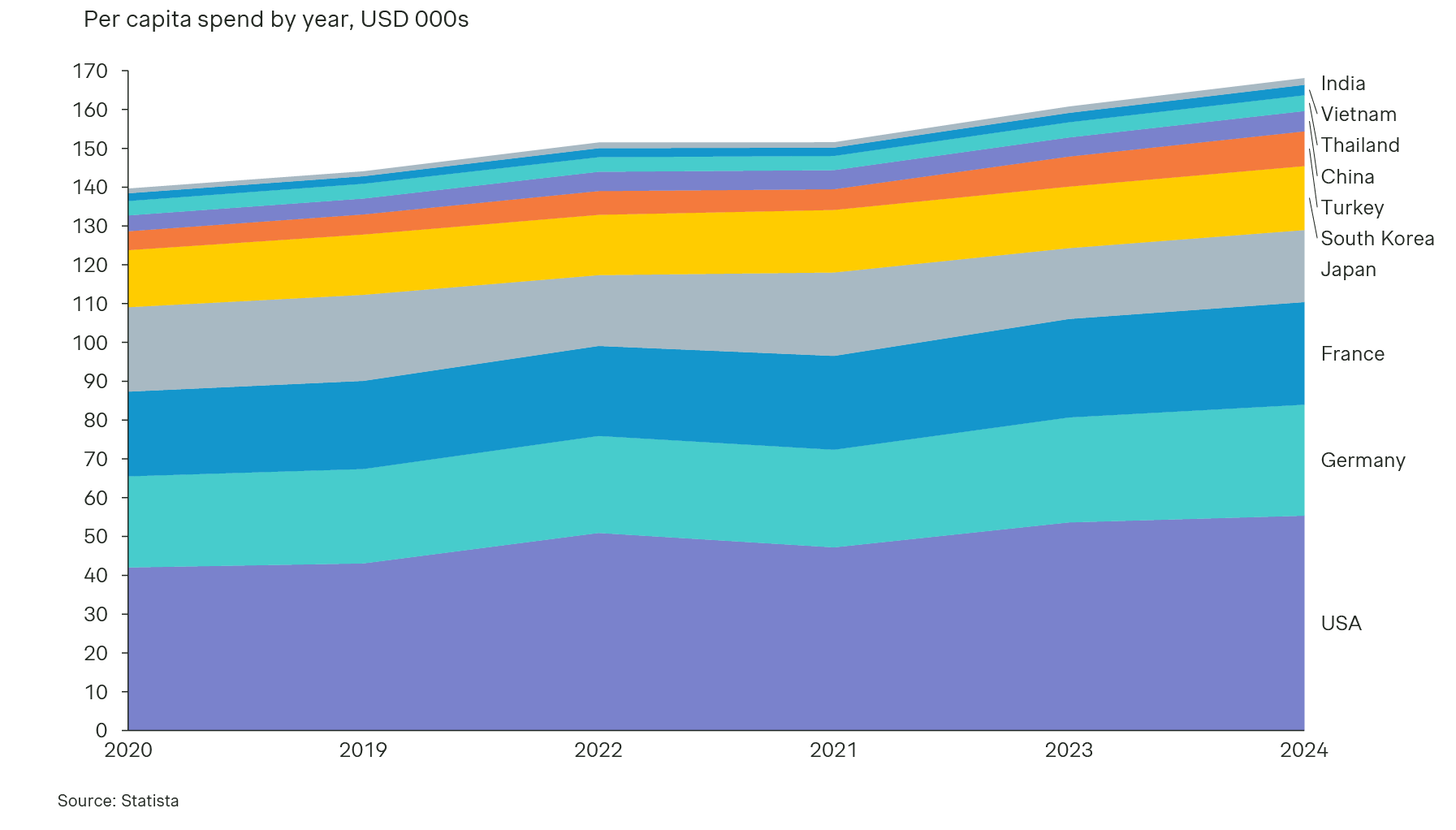

First, the overall per capita spend for Indian consumers is lower by a factor compared to the West, China, and some markets in Asia. This applies across all product categories, not just luxury. This difference translates somewhat into the luxury market, despite targeting high net worth individuals who tend to have similar spending powers across geographies.

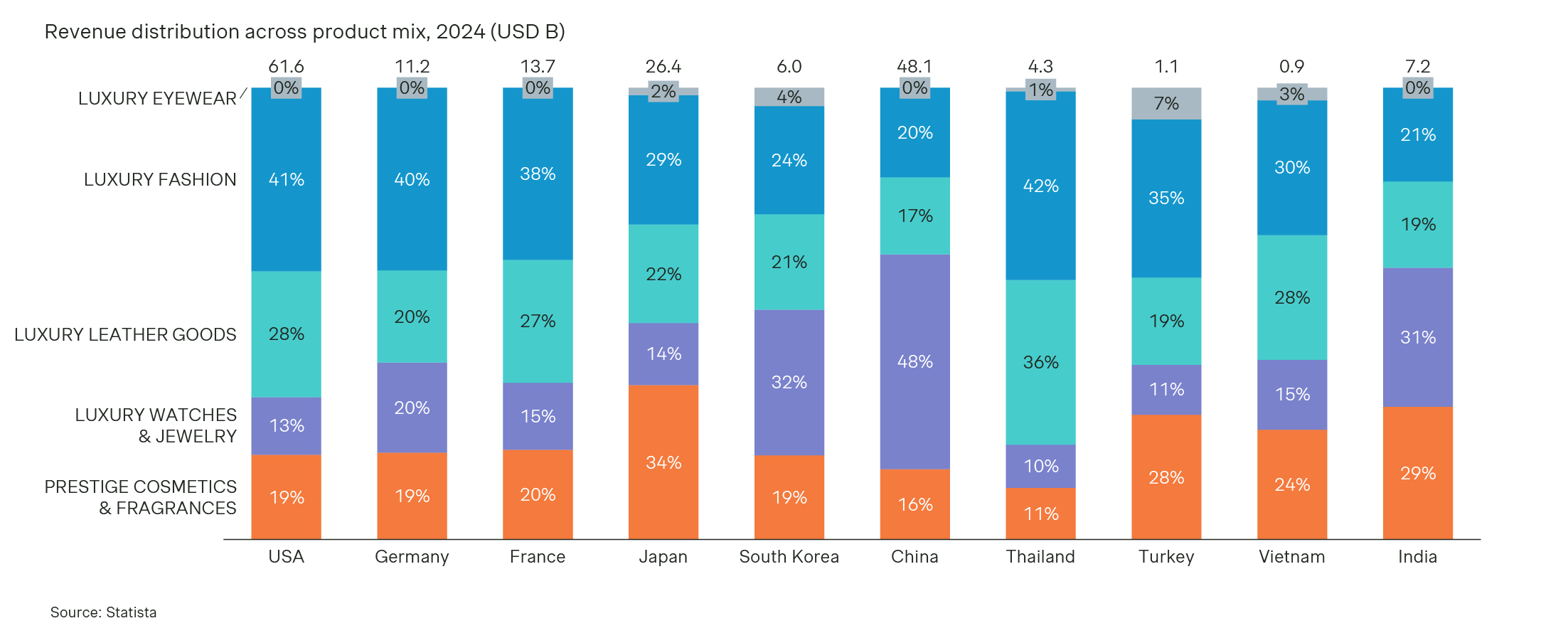

Additionally, Indian consumers have distinct preferences for product categories within the luxury segment, compared to their global peers. For example, Indian consumers prioritize cosmetics and jewelry, using around 60 percent of their luxury spending on them, while Chinese consumers allocate 48 percent of their luxury spending to luxury watches and jewelry.

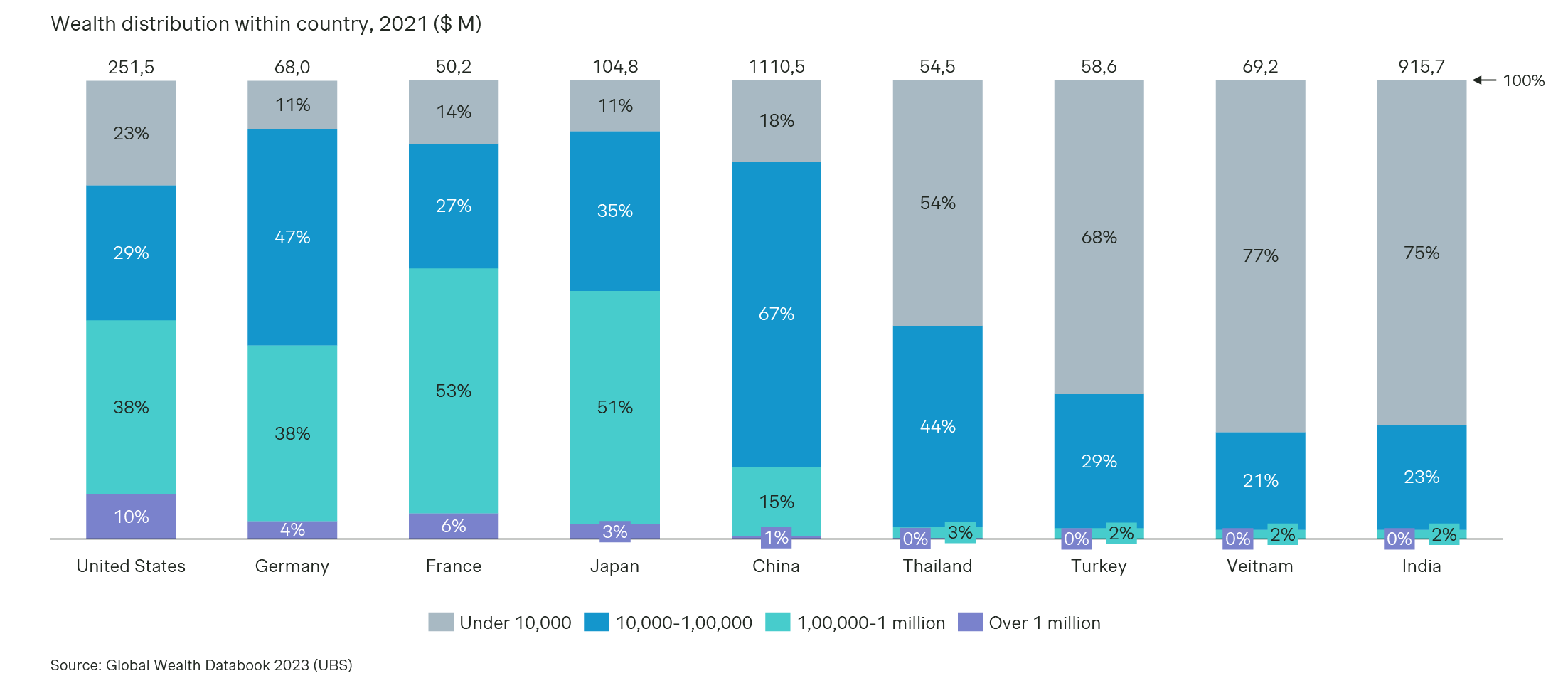

The target customer segments in India are smaller in comparison and have lower incomes compared to their global counterparts. This can be attributed mainly to the country’s wealth distribution profile. Around 75 percent of Indians have a total wealth of less than $10,000, with only 2 percent exceeding $100,000. The percentages in other markets, like the US and Europe, are vastly different. In China, only 18 percent of people have an income below $10,000.

The final, and perhaps the most important difference, lies in how the go-to-market (GTM) approach is typically used. Most luxury brands in India have opted for joint ventures with local luxury retailers rather than establishing exclusive brand outlets (EBOs).

Louis Vuitton, Kering, and Richemont, the top three luxury brands globally by revenue, cumulatively generated around $128 billion in 2022. These brands have had a presence in India for some time now. Let’s examine their GTM strategies when they entered the Indian market.

The French luxury fashion house, Louis Vuitton, was the first international luxury brand to enter the Indian market in 2002 with its store in Delhi. Owned by Kering, Gucci initially entered India in 2007 through a franchisee arrangement but switched to direct entry via a joint venture in 2009. Finally, the Geneva-based luxury goods group Richemont entered the “single brand” retail space in 2014 with a $5 million investment. India is witnessing a steady influx of international luxury brands establishing their presence in the market, entering through different routes.

Is it necessary to form a joint venture with a local player?

Even though the ease of doing business today in India has significantly improved in the past years, it still presents several challenges, especially for global brands aiming to launch EBOs.

It demands a deep understanding of the local business norms, operating culture, and the ability to navigate through the intricate regulatory framework. They face another obstacle with the mandatory 30 percent local sourcing requirement, despite the permission for 100 percent foreign direct investment (FDI) in single-brand retail and 51 percent in multi-brand retail.

Moreover, India has large local conglomerates like Aditya Birla, Reliance, and Tata emerging as dominant players in the retail space and building a portfolio of retail assets. Several global, regional, and local brands are leveraging these assets to sell to customers, rather than investing in their own EBOs. Partnering with these local giants will help luxury brands quickly gain foothold and increase customer touchpoints.

Opening EBOs will also result in direct or indirect competition between global players and these local industry leaders. This strategy will require deep pockets and long-term thinking and staying power. It is crucial to conduct a thorough analysis of value chain and economic analysis before implementing an EBO strategy.

History demonstrates that collaborations were the preferred route in the past. For instance, in 2018, Ralph Lauren entered into a license agreement with Aditya Birla Fashion and Retail Limited (ABFRL) to open its franchise stores in India. Italian luxury house Valentino launched its first store in Delhi in partnership with Reliance Brands Limited in November 2022.

The online platforms also serve as a launchpad for international luxury brands entering the Indian market. During 2022, Myntra, an ecommerce fashion platform onboarded 25 international fashion labels and 50 foreign beauty brands. Today across the platform, a user can buy from over 400 international brands like Bvlgari, Movado, Tissot, etc. Myntra has also partnered with ABFRL’s The Collective, a multi-brand luxury lifestyle retailer, to offer a wider range of high-end products on its platform under the Myntra Luxe section.

Conclusion

India holds a prominent position in the luxury market. Indian consumers, on a global stage, are one of the fastest growing segments. Despite India's ongoing challenges in terms of ease of doing business, no luxury brand can afford to overlook the market. Hence, working with large local retail players is a viable and effective GTM strategy.

Are you also looking at ways to enter the Indian market with a partner? Or are you an Indian retailer looking for cooperation with larger brands? Contact our experts today to get deeper insights into current go-to-market and growth strategies, and the competitive Indian luxury market landscape.

APAC Insights

Stay informed on the latest market trends and industry insights from the APAC region

Form placeholder. This will only show within the editor