Customer loyalty is the foundation of sustainable telco growth. Yet, many operators still underleverage their most valuable asset: the existing customer base. In this final chapter of our 2025 Global Telecommunications Study blog series, we explore the 'Loyalty' and 'Paying' pillars of our HELP framework. Our experts share strategies to retain high-value customers, extend tenure, and realize profitable opportunities.

In the previous two articles, we examined the importance of customer happiness and engagement in driving customer lifetime value (CLTV). The final stage is translating those positive experiences into long-term loyalty and consistent revenue growth.

In a market where acquisition costs remain high and ARPUs face downward pressure, driving customer lifetime value (CLTV) through longer tenure and ARPU growth in the customer base offers telcos a far more sustainable growth path than the ‘red ocean’ of aggressive acquisition tactics.

Our Global Telecommunications Study 2025, based on insights from over 15,700 consumers across 31 markets, reveals that global telcos capture just 60% of their full customer value potential. The “Loyalty” pillar (measured by average customer tenure) scores an average of 6.6 out of 10 (Top 10%: 8.6), while “Paying” (measured by average ARPU), lags at 4.3 (Top 10%: 8.0).

These figures emphasize a significant opportunity for telco operators. They can improve retention and drive incremental value from their existing customer base.

Loyalty as the closing act in customer value creation

Loyal customers are the economic backbone of the telco industry. 95% of CLTV comes from customers with three or more years of tenure. These customers account for 75% of the subscriber base.

Retaining existing customers is 10 times more cost-effective than acquiring new ones, and on average, these customers spend 7% more than newly acquired subscribers.

However, the remaining quarter of customers falls into the “opportunity seeker” segment. These customers are more likely to churn when presented with an alternative and typically only stay up to 3 years, which is only slightly above the typical contract duration across most markets. Reducing churn in this segment requires targeted retention measures, from tenure-based rewards to differentiated service tiers.

Contract duration is a critical loyalty proxy in the HELP Index. Extending tenure (even modestly) can have a disproportionate impact on CLTV. This is particularly important for high-ARPU customers, who, while the most profitable, also present the highest churn risk.

Three ways telco operators can strengthen loyalty

1. Elevating the loyalty program proposition

Loyalty programs drive a 43% increase in CLTV, making them the single most powerful engagement-to-loyalty conversion tool. Yet, while 80% of operators offer a program, only half of customers are enrolled. The other half are aware but unregistered. This batch represents a prime conversion opportunity.

In such a setting, telco operators should:

- Simplify enrolment through one-tap sign-ups in the telco app and at physical touchpoints.

- Offer a mix of monetary rewards (bill credits, device discounts) and non-monetary perks (priority support, exclusive event access), appealing to both transactional and emotional loyalty drivers.

- Use gamification to keep customers active, reinforcing progress with milestones, badges, or tier upgrades.

2. Preventing churn proactively

Tap into predictive analytics to identify early churn signals such as reduced app usage, changes in payment patterns, or negative service interactions. This allows telcos to intervene before attrition occurs.

Personalized outreach, service recovery gestures, and targeted offers can turn at-risk customers into brand advocates.

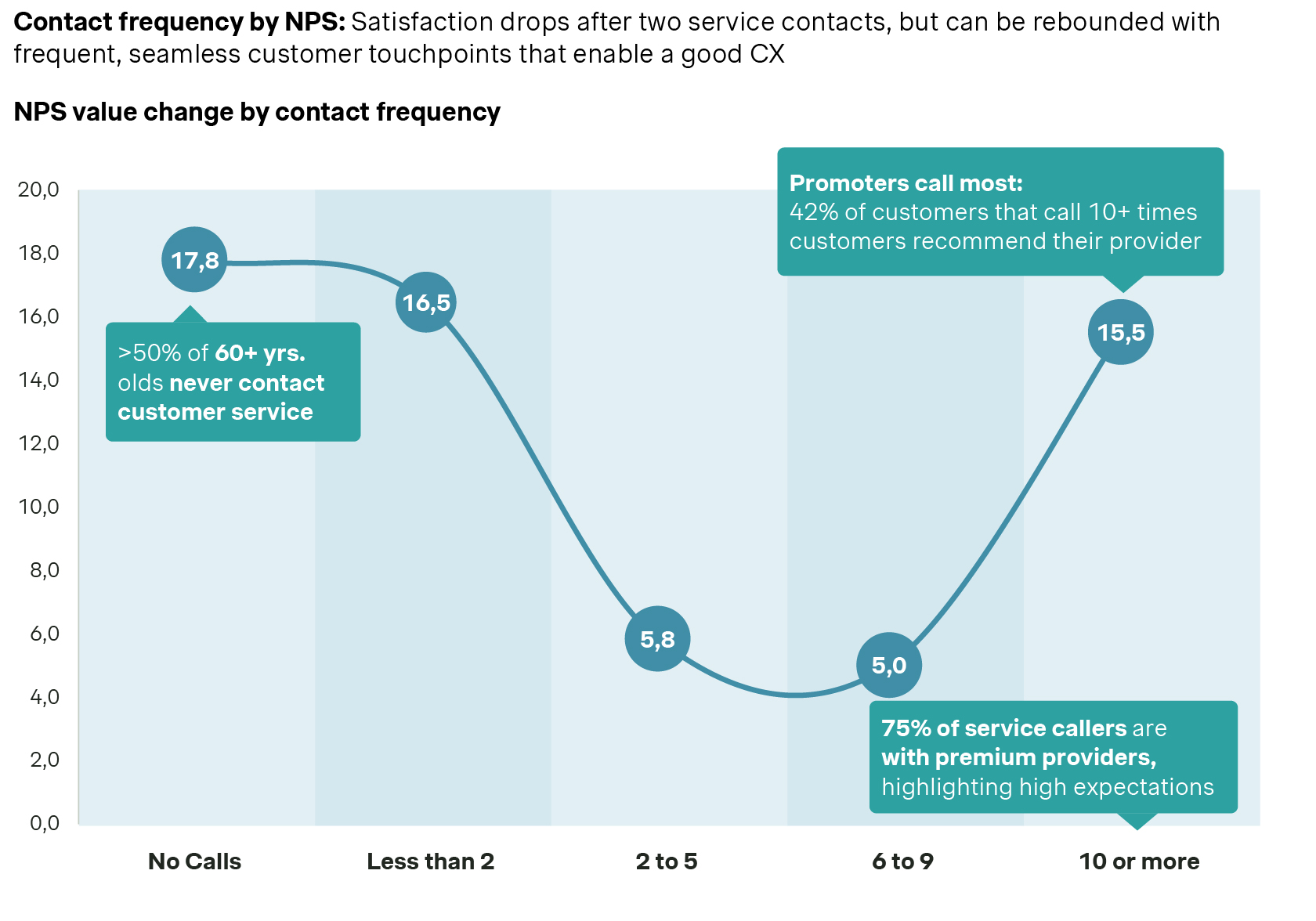

3. Service experience as a retention asset

High-quality, multi-channel support remains a decisive loyalty factor. Consistent interaction across service touchpoints doesn’t only build trust but can almost completely compensate prior dissatisfaction on earlier service encounters and thereby encourage longer tenure.

From loyalty to paying: Monetization without erosion

Once loyalty is secured, the “Paying” pillar focuses on maximizing the revenue potential of each relationship through up-selling, cross-selling, and value-added services (VAS).

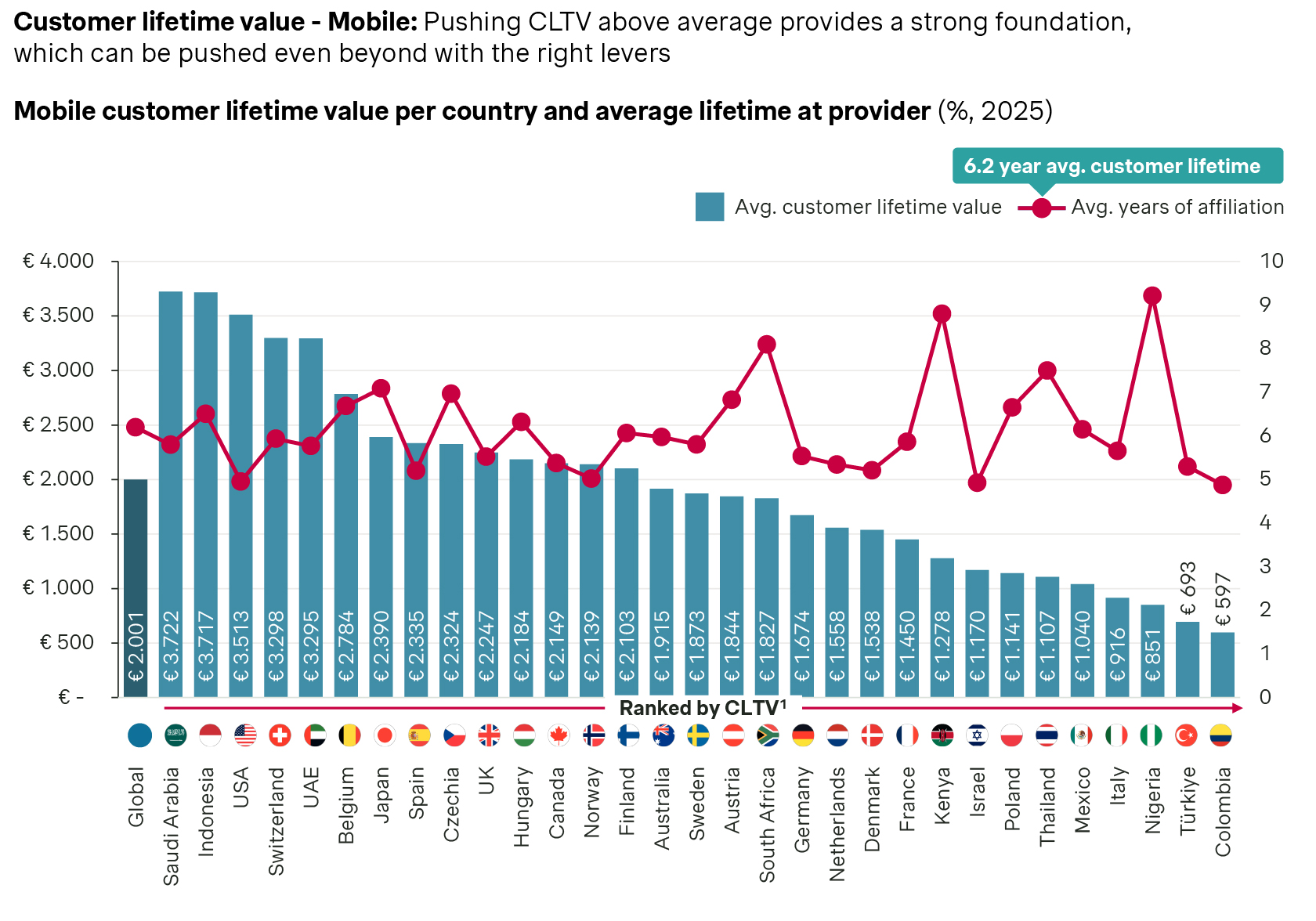

Our study shows that CLTV, while highly dependent on tenure, can be further amplified through ARPU increases.

- Mobile CLTV averages €2,000, with an average tenure at six years.

- Broadband CLTV is 43% higher, despite shorter lifetimes, due to elevated ARPUs.

Operators with the highest “Paying” scores deploy structured monetization and pricing strategies that add value for customers. At the same time, this approach strengthens their relationship with the brand.

Four monetization accelerators for telcos in 2025

1. Identify and communicate key portfolio differentiators

Many operators are shifting from data-volume-based tariffs to speed- and service-based plans, creating room for premium positioning. Speed tiers, network priority, and exclusive features like multi-SIM or premium customer service consistently rank among the highest-value drivers in our adoption/value scoring.

The key: design bundles with one ‘leader’ feature, a small number of complementary ‘fillers,’ and no ‘killers’ that diminish perceived value.

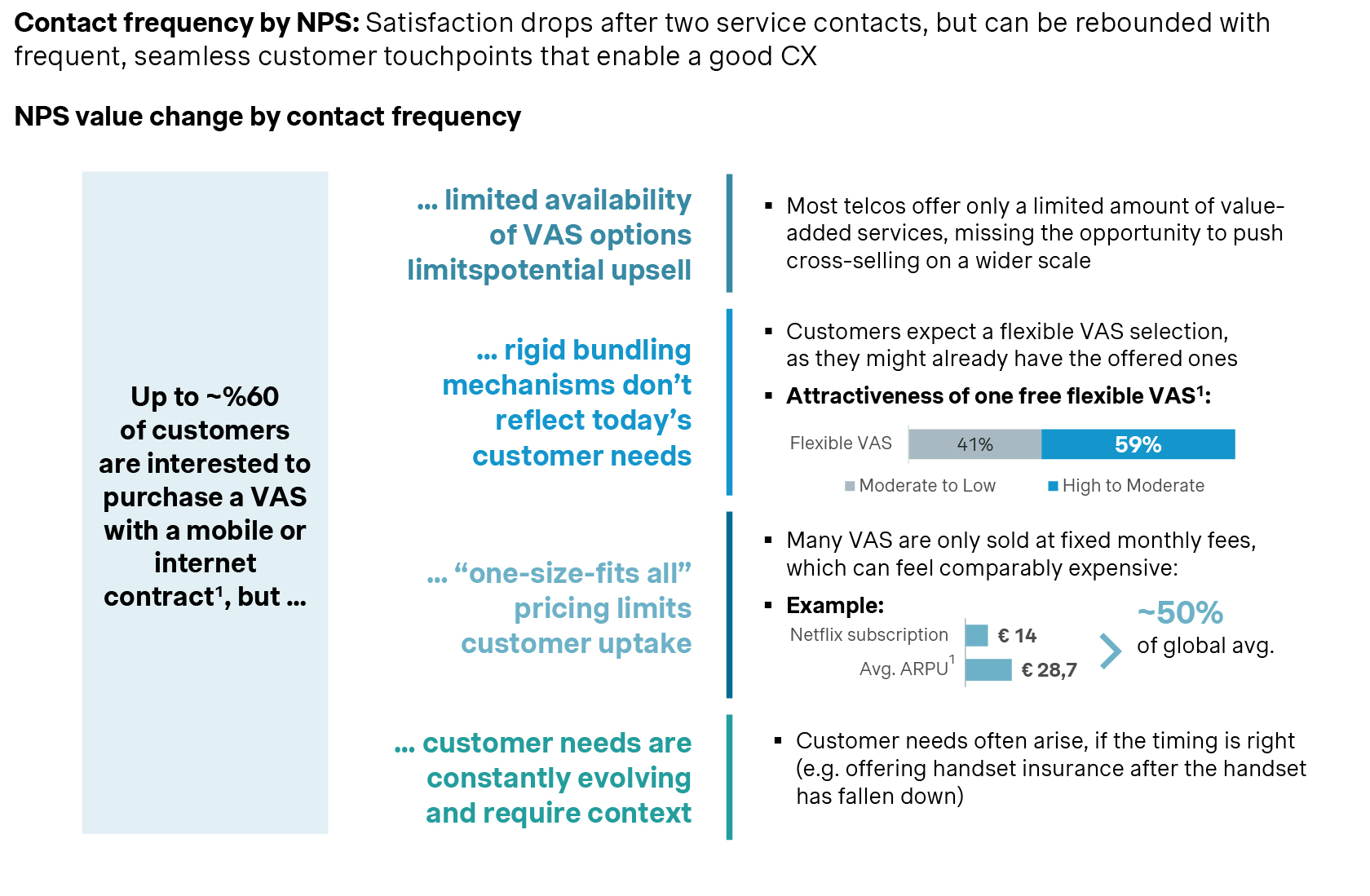

2. Transform VAS sales initiatives

Around 60% of customers are open to purchasing value-added services alongside their core plan. Yet, uptake is hindered by rigid bundling, limited choice, and “one-size-fits-all” pricing.

Context-based micro-offers, such as 1-day data packs or a free trial of a streaming service, delivered at the moment of need can replicate the ‘impulse purchase’ model that has driven incremental revenue in retail.

3. Introduce new handset monetization models

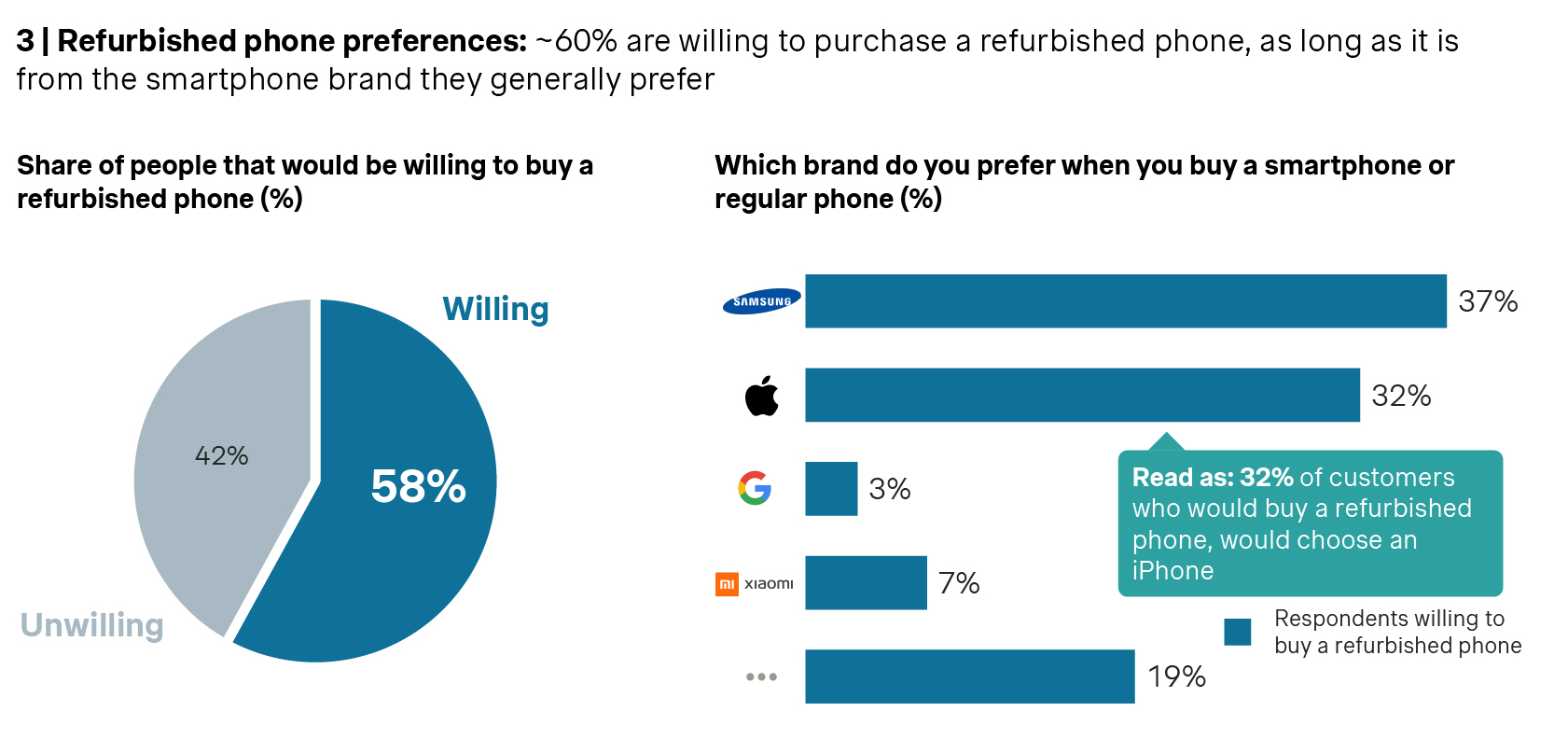

With 80% of customers replacing devices less than every two years, the potential for alternative models is significant. Options like Device-as-a-Service or offering refurbished premium handsets capture value across the device lifecycle.

For example, flagship smartphones (like the iPhone) retain around 47% of their value even after two years, making refurbishment both profitable and sustainability-positive. Around 58% of customers say they would consider buying a refurbished device, particularly from a brand they already trust.

4. Drive convergence in a margin-optimized way

Fixed-mobile convergence (FMC) can deliver 26–51% higher ARPU, but its lock-in effect has weakened, working for only ~40% of operators.

The next wave of FMC monetization pairs convergence with non-monetary benefits, such as premium service access, unified billing, or exclusive partner perks. This is appealing to the 55% of customers open to such benefits without expecting heavy discounts.

Next-best actions for telco leaders

Telcos can operationalize “Loyalty” and “Paying” pillars of our HELP framework laid out in the Global Telecommunications Study 2025 by:

- Integrating loyalty and monetization KPIs into the same dashboard as engagement and satisfaction metrics, ensuring cross-functional accountability.

- Deploying AI-driven personalization to tailor offers, rewards, and service experiences at scale.

- Testing and iterating commercial models (e.g., modular bundles, flexible VAS) to meet evolving customer preferences without overcomplicating the portfolio.

- Aligning paying with loyalty milestones by rewarding tenure with exclusive upsell opportunities rather than indiscriminate price hikes.

Before you go …

Our HELP framework demonstrates that customer value is built in sequence. Happiness fuels engagement, engagement drives loyalty, and loyalty enables profitable monetization. For telcos, the path to sustainable growth lies not in chasing the next subscriber at any cost, but in nurturing the customers they already have.

By investing in retention levers, enhancing loyalty programs, and adopting monetization strategies that put the customer experience first, operators can close the 40% value gap and future-proof their business.

Simon-Kucher’s latest telco study makes it clear: Loyalty and Paying are not endpoints, but ongoing disciplines that determine who will lead the industry in value creation over the next decade.

Interested in our 2025 Global Telecommunications Study results in more detail?

Form placeholder. This will only show within the editor