From one-off tests to everyday health tools, diagnostics is undergoing a fundamental shift. What’s driving the shift and which business models are best placed to ensure sustainable growth in scaling the innovation? Our final blog in the three-part series on at-home diagnostics sheds light on what leading companies are doing differently to succeed.

At-home testing is moving from centralized labs to living rooms, and from one-time transactions to continuous, integrated health journeys. But this shift is not driven by innovation alone.

Leading companies are rethinking how value is created and captured. They are designing business models that reflect changing consumer/patient behavior, align with new regulations, and navigate long-standing structural barriers.

The rise of home and self-testing

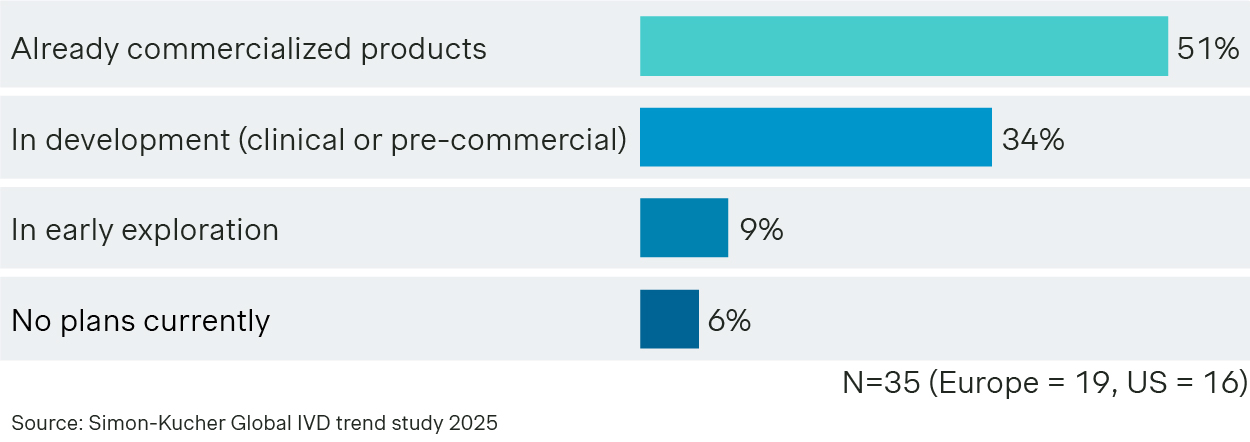

The momentum behind home and self-testing is undeniable. According to Simon-Kucher’s 2025 Global IVD Trend Study, over half of diagnostics companies have already commercialized home/self-testing products, with an additional 34% in active development. Only 9% are in early-stage exploration, and just 6% have no plans at all, confirming that at-home testing is quickly becoming foundational to the industry.

At-home product development status among diagnostics companies (%)

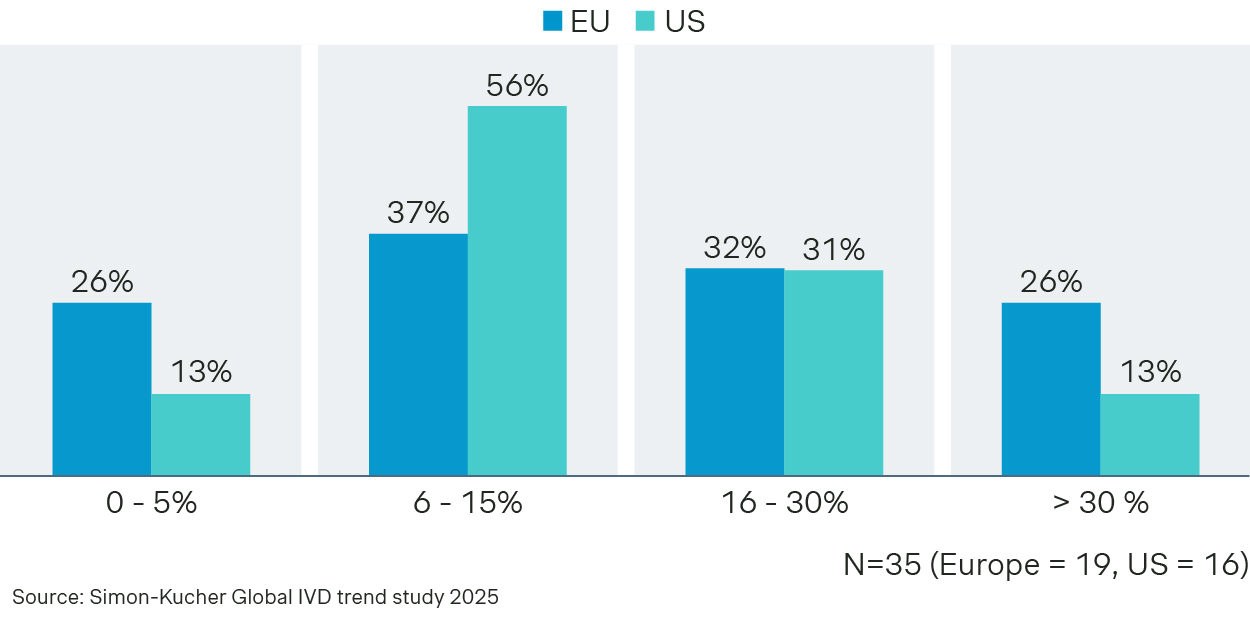

Investment is following suit. 46% of respondents expect 6–15% of R&D budgets to be allocated to home/self-testing by 2035, with 56% in the US forecasting this level. Globally, 32% anticipate dedicating 16–30% within the next decade.

Forecasted 2035 Diagnostics R&D budget allocation to at-home/self-testing by region (% of respondents)

As these trends accelerate, diagnostics leaders are rethinking not only what they develop, but also how they bring it to market. The future will be defined by business models that are as innovative as the technologies.

Key business models shaping at-home diagnostics

1. Direct-to-consumer (DTC) sales

Once led by disruptors like Everlywell and 23andMe, DTC models are now mainstream, with consumers/patients increasingly purchasing tests from pharmacies and online.

Why it works:

- Simple access

- Fast results

Barriers to watch:

- Limited insurance coverage means many buyers are still paying out-of-pocket

- Trust issues occur if tests are not linked to providers or follow-up care

2035 Outlook:

As user confidence grows and regulation matures, DTC testing will continue

2. Telehealth & B2B2C bundles

Diagnostics is becoming embedded in virtual-first care. Tests are bundled into chronic care programs, employer health benefits, and pharmacy-based services that blend digital and physical touchpoints.

Example:

A wearable-linked cholesterol test combined with telehealth follow-up, offered through an employer wellness plan.

Why it works:

- Scales access via existing care models

- Reduces friction between diagnosis and treatment

Barriers to watch:

- Lack of seamless EHR integration and provider skepticism

- Clinical utility must be proven in real-world settings

2035 Outlook:

Diagnostics will become a gateway to personalized treatment within broader health platforms.

3. Insurance-reimbursed home testing

Some home diagnostics - particularly for diabetes, cardiovascular health, and prenatal care - are gaining traction with insurers.

Why it works:

- Drives equity and access

- Encourages regular testing for chronic care

Barriers to watch:

- Regulatory delays and lack of reimbursement codes are major obstacles

- Clinical evidence and validation are expensive and time-consuming

2035 Outlook:

With growing pressure to reduce healthcare costs, reimbursed at-home diagnostics will become essential to population health strategies.

4. Subscription & preventive health bundles

Diagnostics-as-a-Service is rising. Subscription models offer recurring at-home testing (e.g., fertility, inflammation, gut health, infectious diseases) paired with dashboards and coaching.

Why it works:

- Encourages habitual, preventive use

- Integrates testing into daily routines

Barriers to watch:

- Consumers/patients expect reliability, not just convenience

- Low willingness-to-pay if value isn’t clearly shown

2035 Outlook:

Health management will mirror media subscriptions, with diagnostics, wearables, and telehealth bundled into lifestyle platforms.

5. Data monetization & health insights

Only a small fraction of diagnostics companies are currently leveraging the full potential of user data. But the opportunity can be significant if approached ethically.

Why it works:

- Anonymized datasets for pharma, public health, and AI development

- Patient-facing dashboards that encourage behavior change

- Clinician tools for long-term trend analysis

Barriers to watch:

- Data privacy and consent regulations

- Provider hesitancy without validated clinical value

2035 Outlook:

As AI-enabled diagnostics become mainstream, companies will need to decide whether to be a product business or a data platform.

Strategic actions for diagnostics leaders

As at-home diagnostics becomes core to care delivery, companies must evolve beyond products:

- Embrace DTC models: Prioritize convenience, user experience, and consumer-driven access

- Expand B2B2C partnerships: Embed diagnostics into telehealth, employer benefits, and pharmacy-led care pathways

- Pursue insurance reimbursement: Position select tests for chronic care within reimbursed population health strategies

- Adopt subscription and preventive bundles: Offer diagnostics-as-a-service tied to health tracking and coaching platforms

- Unlock value from data: Develop monetization models around anonymized health insights and AI-driven analytics

Final word and how Simon-Kucher can help

This wraps up our three-part blog series where we highlighted the rise of at-home diagnostics, the many challenges of scaling the innovation, and how reimagining business models can overcome hurdles for successful commercialization.

At-home diagnostics is clearly becoming the core of future revenue. Success will come to those who rethink not just what they sell, but how they deliver, monetize, and embed diagnostics into everyday health experiences.

Simon-Kucher’s diagnostics practice supports your business through the entire value chain. From defining innovation and growth roadmaps to enabling commercial and business model transformation, we work alongside your team to turn strategy into action, whether that means embracing DTC models, expanding B2B2C partnerships, pursuing reimbursement opportunities, adopting subscription-based offerings, or unlocking new value from data.

To discuss how we can help you unlock sustainable growth, contact our experts today.

Thanks to contributions from Olga Gavrilenko and Dhiren Nitsche!