Due to recent economic developments, both small and large multinationals are increasingly confronted with unexplainable regional price differences in Europe. These, often historically grown, price differences do not only pose a significant financial, but also a legal risk. Pro-actively managing these regional prices should therefore be top priority for every firm.

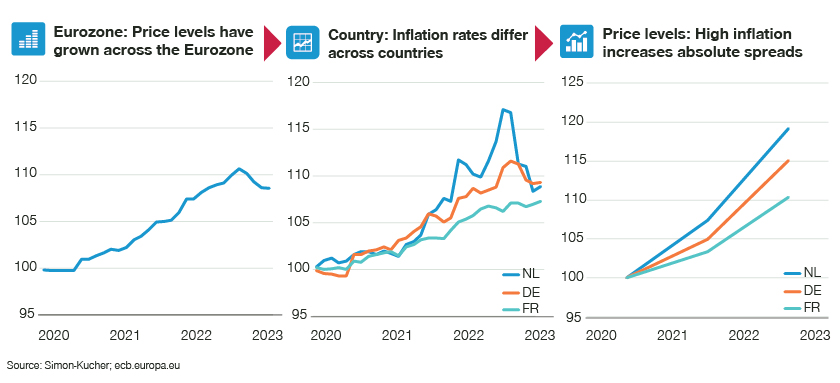

Currently, Europe is emerging from a period of high inflation which seems to have peaked in October 2022. While inflation for the EU is often presented as one single number for the entire region, the reality is 2022 inflation rates differed greatly across member nations. While Luxembourg saw 6% inflation last year, Latvia experienced 21%. In addition, each local government would have responded to their inflation rate differently, which introduced even more variety into the impact of inflation. This variety has been instrumental in exacerbating the price differences between different countries across the continent.

To protect their margins in this exceptional inflationary situation, companies have implemented significant price increases. Yet, due to the abovementioned varying inflation rates across countries in combination with local decision making, these price increases are often not universal across countries. As a result, in many cases the already existing price differences have grown further. These increasing price differences push buyers to seek cheaper alternatives across borders to keep margins, which are also under pressure, healthy.

The impact of undefendable price differences

Consider the following scenario: a manufacturer sells its products, through different local entities, in both the Netherlands and in Poland. The Dutch entity applies a selling price of €4, while the Polish entity sells the same product for no more than €2. With price differences of this magnitude, parallel trade often pays off. Although differences of this magnitude seem exceptional, they are more common than one might think.

The example above illustrates why historically grown, unexplainable price differences have always been a major risk for multinational companies. Yet, the exceptional inflation situation has caused these differences to become even greater. In additional, driven by the inflationary context, the European retail landscape is rapidly evolving and power of (international) buying groups continues to grow. Transparency in the market is also still increasing due to international mergers and acquisitions and the further emergence of the internet.

Therefore, it has never been more imperative for multinationals to take stock and have transparency into how their prices are structured and set up, as the risk of commercial, but also legal backlash is higher than ever before. Any pricing, discounting, and trade terms made available to retail partners must be legally defensible, fair, and achievable across the board.

Strategy to increase European price defendability

Business leaders can mitigate the risk of unexplainable price differences by increasing the defendability of prices across countries. For this to be truly effective, they should apply a five-step process to improve consistency in pricing and discount structures across countries.

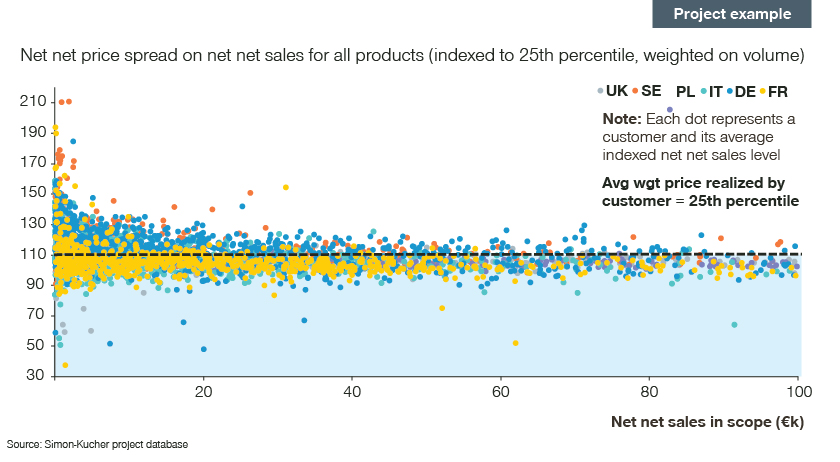

1. Eliminating outliers

Reducing outliers is a measure that can be implemented in the short term and has an immediate effect. When all current prices for comparable deals across countries and channels are put next to each other, it often turns out that many low prices are unexplainable. A simple but very effective measure is to raise all prices below the so-called '25th percentile'. A price below the 25th percentile implies that 75% of the prices (of comparable deals) are higher. Especially in the case of a significant price spread, raising these prices is often a no-brainer.

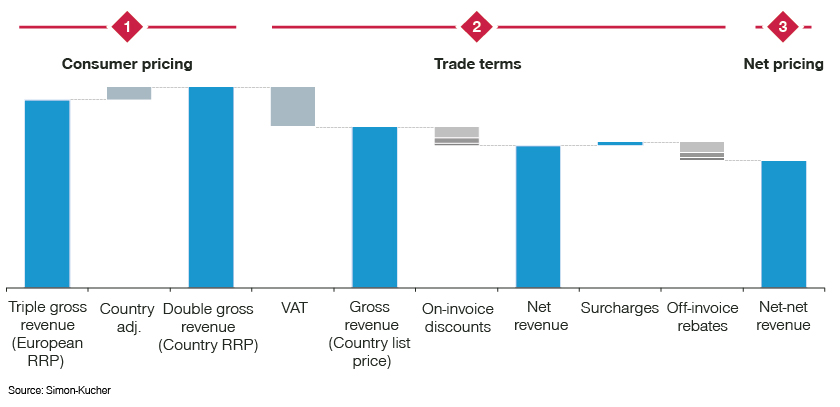

2. Develop clear pricing waterfall

Many multinationals still operate in a very decentralised way when it comes to pricing. As a result, local teams have very limited visibility into how a product is priced elsewhere. This often leads to completely different price structures being used in different countries.

Therefore, it is key to develop a uniform cross-country pricing waterfall. This does not mean, however, that RRPs/net prices should be the same all over Europe. After all, competition, local consumer willingness-to-pay, etc. differ across Europe. However, it is important that the different countries follow the same pricing structure, to ensure price differences between countries can always be explained.

RRP = Recommended Retail Price. Consumer price is at the sole discretion of the retailer.

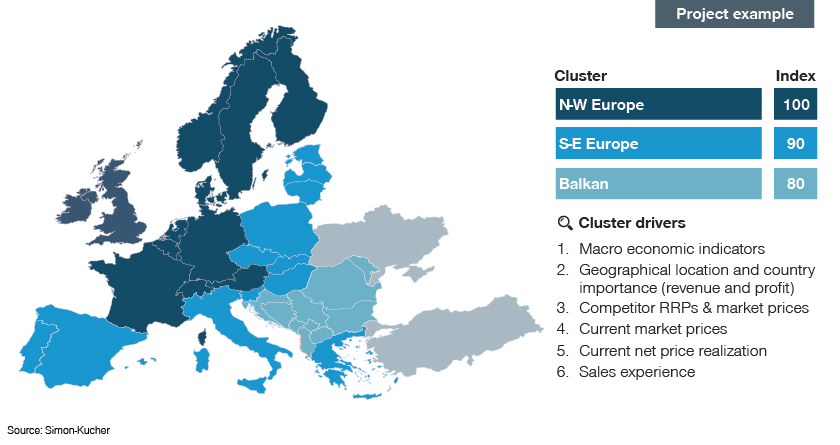

3. Set defendable regional RRPs

Although multinationals are not allowed to impose a fixed selling price or a minimum selling price on their customers, they are allowed to set a ‘recommended retail price’ (RRP). Without a designated RRP, manufacturers leave the door open for consumer pricing to differ across regions.

In an ideal, simple world, a multinational would apply the same RRPs all over Europe. The truth is, however, that consumer willingness and ability to pay are vastly different between western- and Eastern Europe. That is why in practice it is often logical and desired that RRPs differ within Europe.

The key is again to ensure that these price differences are consciously created and explainable based on factors such as competition, willingness to pay, market position, etc. One way to accomplish this, without overcomplicating things, is by establishing clusters of countries and aligning RRPs per cluster.

4. Install pay-for-performance discounting structure

While creating defendable RRP price clusters is a great way to limit unexplainable price differences at a consumer level, different retailers across regions could still receive very different net prices.

Therefore, multinationals also need to establish alignment in their discounting structure. Alignment between countries is one thing, but another critical element is ‘conditionally’. We still see, way too often, that a large part of the discounts is given without any required counter performance. In practice, this often implies that customers who complain most about prices or customers who maintain the best relationship with account managers get the best prices, not the ones who add the most value.

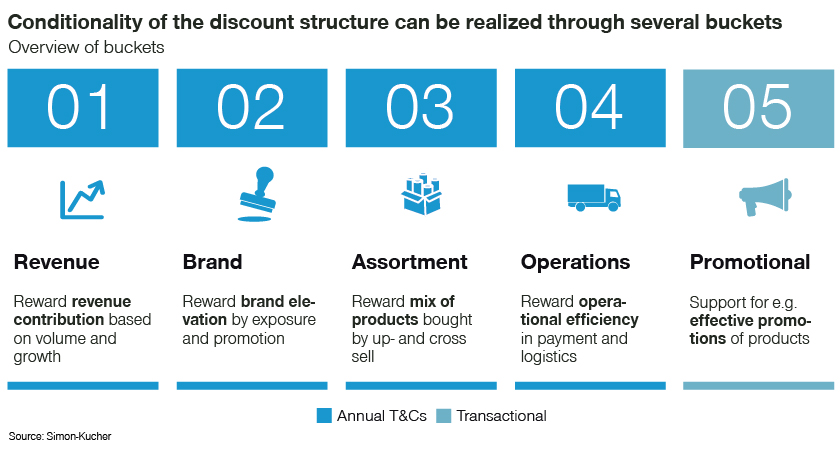

We suggest using a conditional discounting approach that incentivizes customer behaviour and rewards specific activities with higher discounts. These discount generating activities could include revenue contribution based on volume and growth, brand exposure, product assortment, operational efficiency, and product promotions.

5. Continuously reviewing pricing and discount measures

The final step in this approach is maintenance. Things are always changing, so it’s important to review pricing and discount structures on an ongoing basis to ensure they’re still relevant and effective.

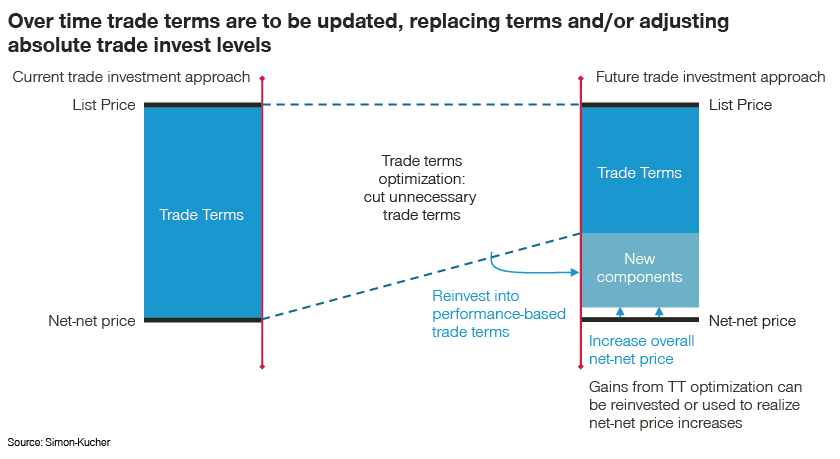

As far as RRPs are concerned, it is important to review from time to time whether they are still competitive (or whether there is potential to increase!). Did competitors adjust their RRPs? Are there any new players that have entered the market? Etc. Installing a conditional discount system is also not a one-off exercise. A multinational should check every now and then which part of its customers meets which discount conditions. For example, if it turns out that (almost) all customers qualify for a certain discount, it may be necessary to increase the requirements for this discount.

If you’re ready to start introducing consistency into your global pricing model, get in touch with one of our specialists. We’d love to help.