Digitalization is shaking things up in the automotive industry, and companies have to rethink their revenue models. But while innovative pricing creates an array of opportunities, the risks are also high! Simon-Kucher’s Revenue Model Dartboard helps OEMs navigate around the typical pitfalls and ensures that the process starts with a structured discussion and analysis.

New revenue models for a new world

The automotive industry is changing dramatically. New technologies such as eMobility and autonomous driving are entering the markets, and OEMs are under increasing pressure due to evolving customer needs. Meanwhile, Simon-Kucher’s recent Global Pricing & Sales Study reveals that two thirds of companies are challenging their current revenue models.

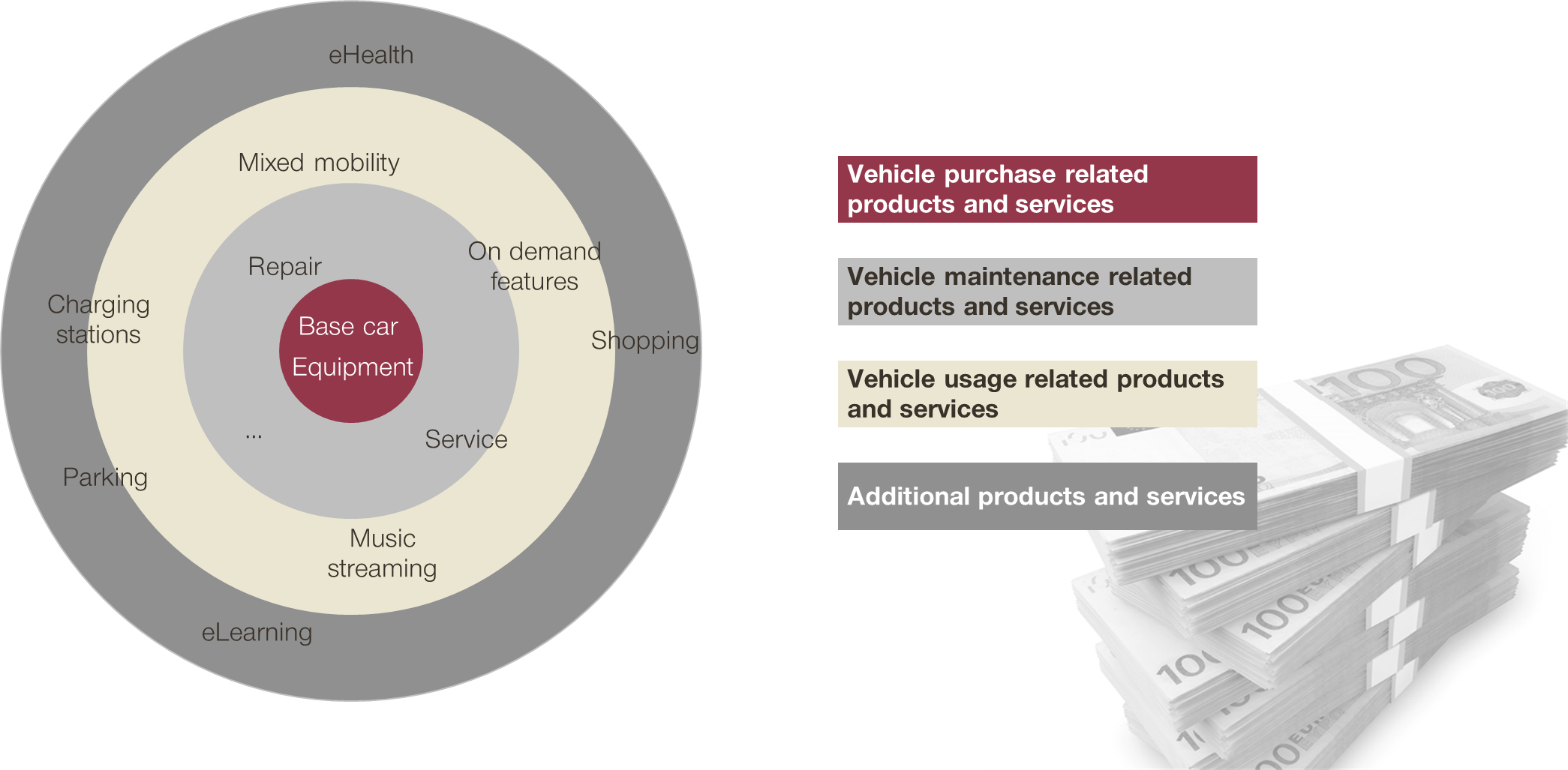

OEMs are not immune to the impact of digitalization, and they too need to check whether their business models are prepared for the digital age. Traditionally, their revenue models have mainly reflected their business of selling vehicles and aftersales products, namely spare parts, maintenance, and repairs. These are usually physical goods with a high share of variable costs, e.g. materials and wages. However, many future products will be partially or fully digital, and manufacturers are starting to enter new business areas related to how we already use vehicles in our daily lives. Real-time navigation, concierge services, and cooperation with music streaming platforms have been more or less successful in the market for a while now. Recent pilot projects include peer-2-peer car sharing, in-car parcel delivery, and parking services. In the future, OEMs are likely to explore completely new business areas such as in-car shopping, entertainment, eLearning, and even healthcare.

Unlike traditional products, these new products and services have a cost structure with a lower share of variable costs, which creates both profit opportunities and new challenges in terms of how to price these products. OEMs are experts for pricing one-off payments and have additional knowledge about leasing and financing (which today in many cases is only used as another form of discounting). However, there’s a clear lack of experience when it comes to subscription or pay-per-use models. They can learn a lot from companies in the internet and software industry, who have been using and refining these price models for years.

Developing a roadmap that’s right for your business

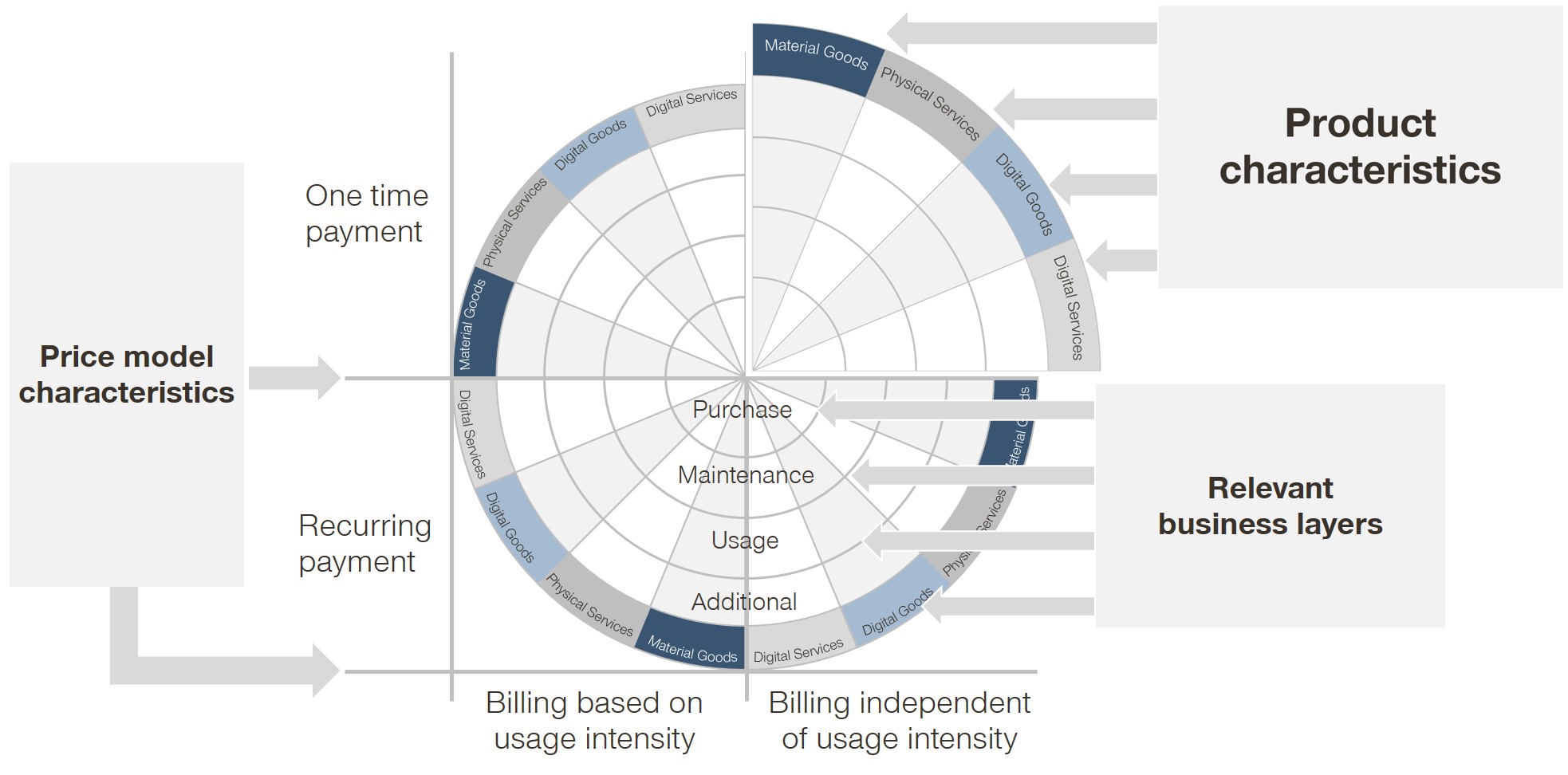

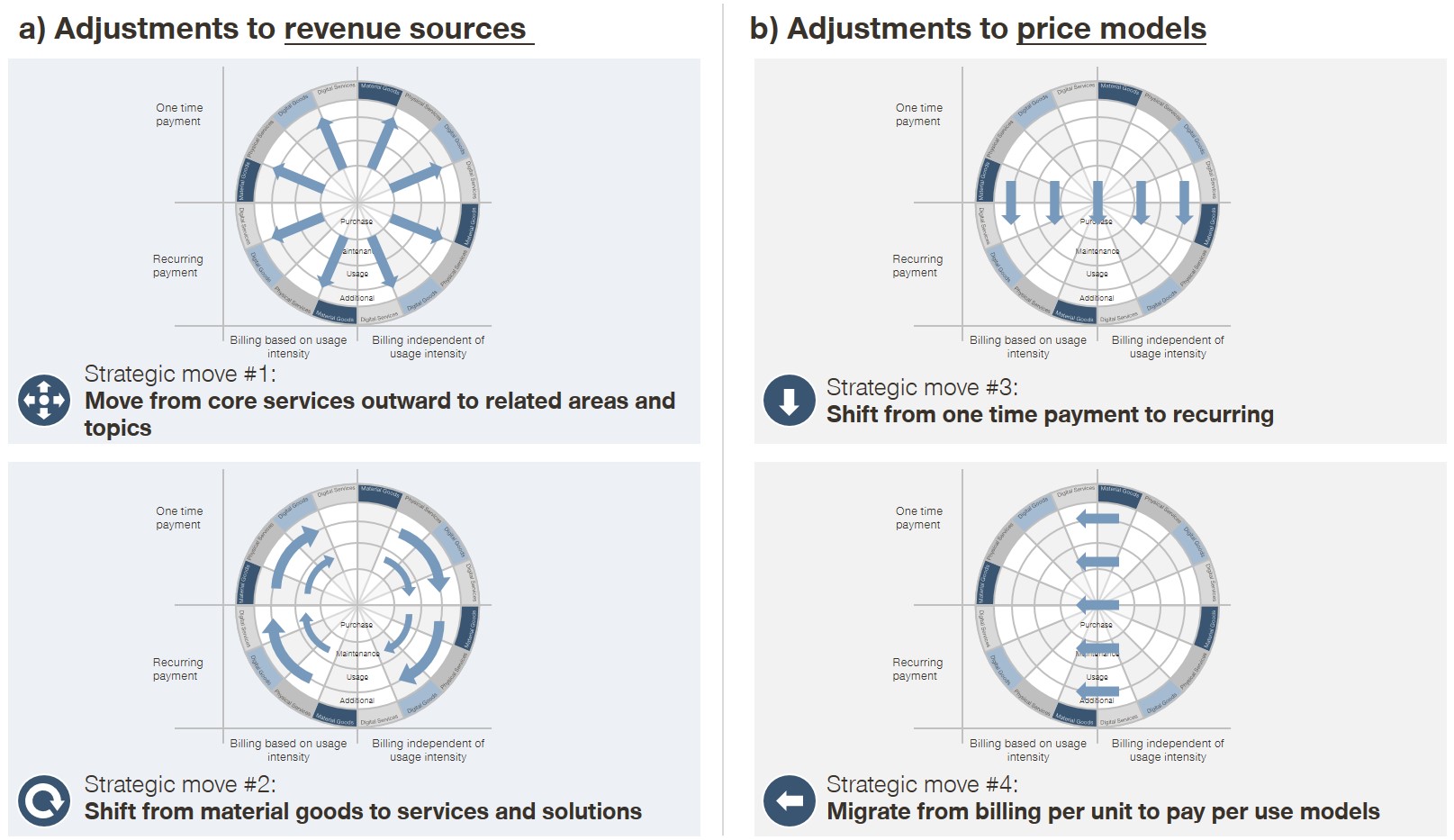

Changing the price model of an existing product can be a real game changer, but it also involves high risks. Rather than running in head first, the first step should be to have structured discussions on what will work for your individual company. There is no one-size-fits-all solution, and here the Simon-Kucher Revenue Model Dartboard can help. It has been used in multiple workshops and complex discussions with leading OEMs in the automotive industry. Whether developing new revenue models or adjusting price models for existing products in the portfolio, this useful helps companies identify the right approach.

The rings of the dartboard represent the current and future layers of the automotive business: The inner ring symbolizes purchase-related business models, the second ring maintenance models, the third usage-related models, and the outer ring covers any additional business models. The sections of the dartboard classify the business models according to the following product attributes: material goods, physical services, digital goods, and digital services. The two main axes group the price models by their most important dimensions. Are payments one time or recurring (subscription)? Is billing based on usage intensity (pay-per-use) or independent of use (e.g. flat rates)?

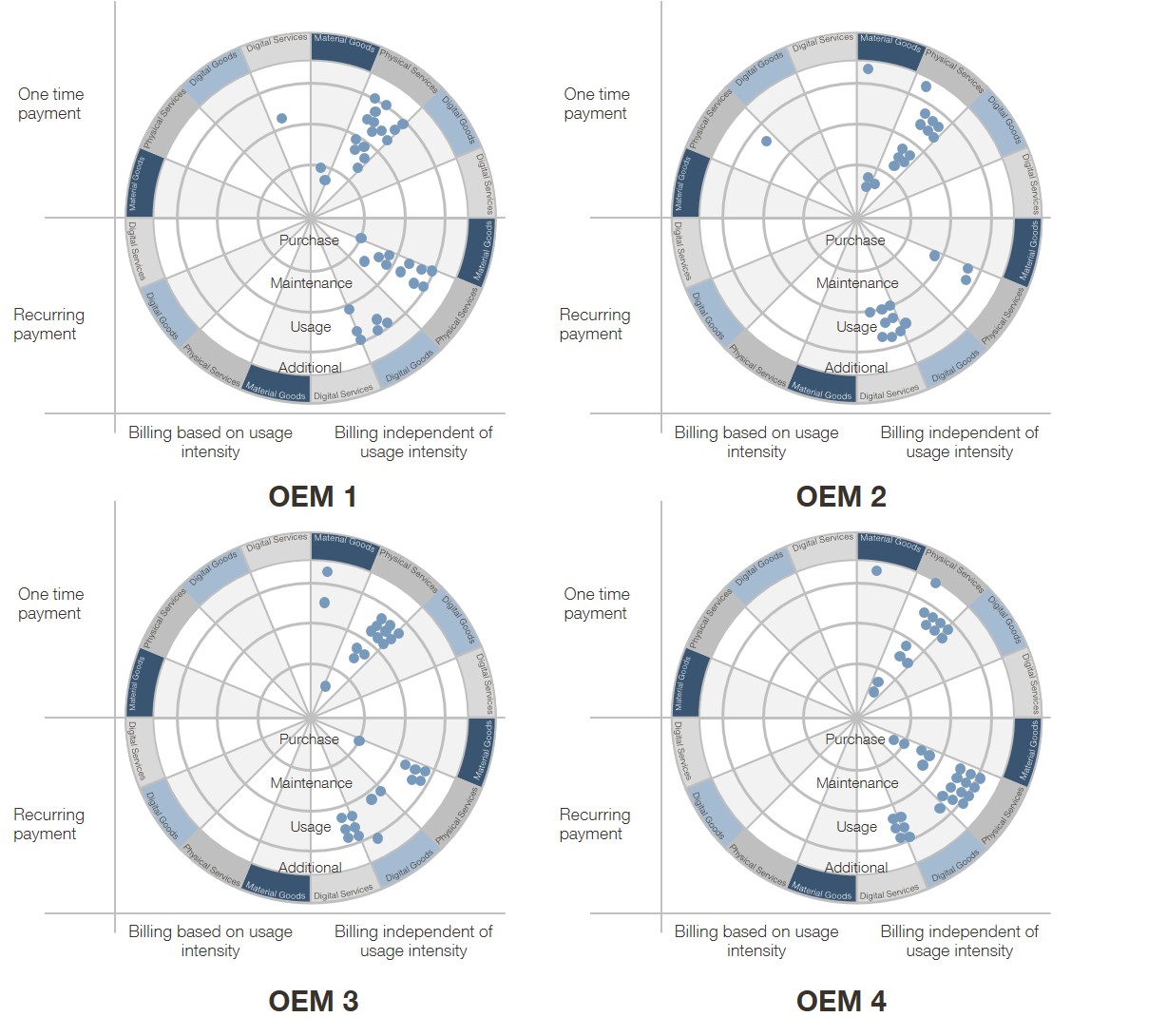

Using the dartboard, we conducted a comprehensive analysis to benchmark multiple manufacturers and identified a typical pattern for OEMs:

- There is a clear focus on physical products and services – based on one-time payments

- OEMs are starting to offer more and more digital products with recurring payments

- Real pay-per-use models are hardly used in the industry

What would this pattern look like for your company?

The dartboard can also be used to discuss strategic moves in a workshop format.

The key strategic moves here can be product-related:

- From core services to related areas and topics

- From material goods to services and solutions

Or related to the price model:

- From one-time payments to recurring subscriptions models

- From billing per unit to pay-per-use models

Several manufacturers are already one step ahead and are experimenting with subscription models. Some are even applying them to the actual vehicles themselves, with well-known examples including Book by Cadillac and Porsche Passport. All companies exploring this new territory will face the challenges of a typical subscription business and will need to master the trade-off between acquiring, retaining, and monetizing the customer base. And due to the enormous development and production costs in the automotive industry, monetization will be key to success.

Our experience shows that successful subscription businesses differentiate both prices and products. Offering multiple product alternatives (bronze, silver, gold) that target specific customer segments is the most common approach. But pay-per-use elements are another tool to offer the right level of flexibility or commitment to the customer. Automotive insurance companies such as Progressive or Metromile are an example of how digital metering solutions can provide a higher degree of flexibility to the customer base.

Get in touch with our experts

Simon-Kucher’s Revenue Model Dartboard is a framework that helps OEMs face the challenges of the digital revolution. It can help to structure initial discussions and workshops and has already proven successful with numerous leading OEMs in the automotive industry. Need to assess your company’s current situation, identify white spots in your portfolio, and determine strategic moves? Get in touch with our industry experts to find out more.