In the twelfth year of our Global Pricing Study we conducted a comprehensive survey involving over 2,700 participants.

This survey focused on assessing companies’ commercial priorities, economic sentiment, pricing strategies, and their implications for management. This article will delve into the results for the North American construction industry, aiming to gauge the perspectives of key business leaders.

The North American construction industry experienced a dynamic and profitable year in 2023, despite the challenges posed by global economic headwinds. Overall, business leaders in North American building material manufacturing foresee a positive outlook for 2024. However, they anticipate that the ongoing pricing challenges will be more formidable in the coming year and are actively exploring solutions.

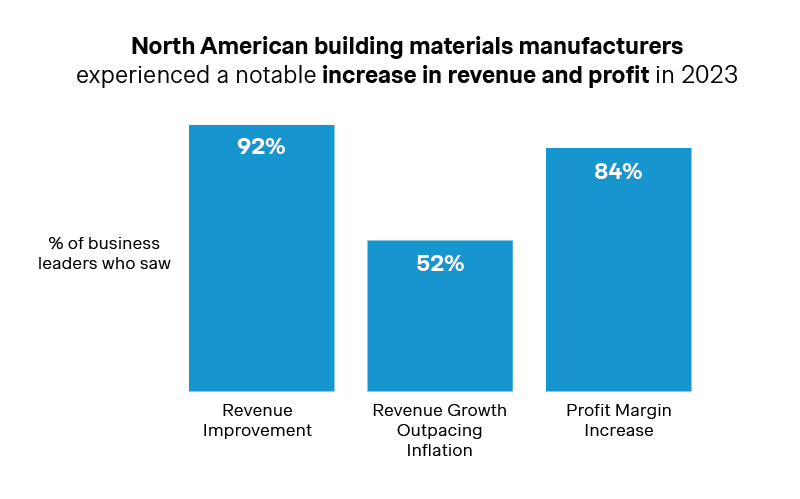

North American building material manufacturers experienced a notable increase in revenue and profit in 2023

Building materials manufacturers in the region demonstrated resilience and strategic savvy, as 92% reported revenue growth — with 52% outpacing inflation. This growth was supported by various factors, including market demand, product improvements, and notably, a substantial number of companies implementing price increases, with an average increase of 12%. In contrast, other regions faced greater challenges from rising costs and inflation in prompting price increases.

The ability to pass on cost increases to customers is a crucial aspect of maintaining profitability, and 84% of North American building materials manufacturers managed to do so effectively, even as they faced rising costs and inflation. Their success in this area indicates a stronger pricing power compared to their global counterparts — with 84% experiencing rising profit margins, a stark contrast to the 53% in other regions. Moreover, margin growth in North America's construction industry was driven not only by price increases but also by factors like volume and demand growth and changes in customer or product mix.

2024 Commercial Priorities and Market Outlook

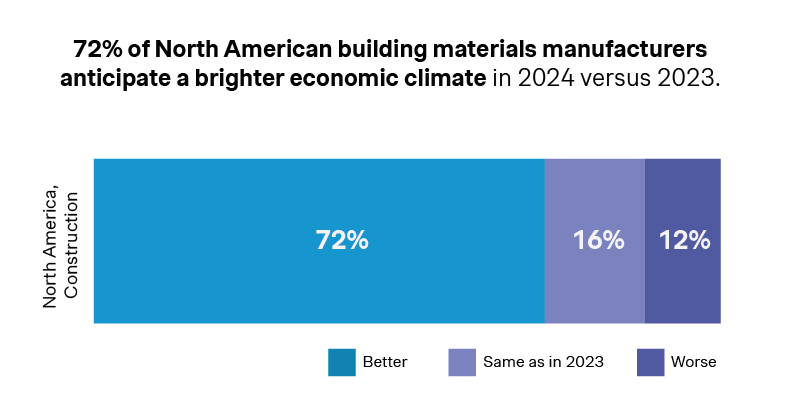

Looking forward, North American building materials manufacturers are optimistic about the economic outlook for 2024 in general, surpassing both the global industry average and other sectors. 72% are anticipating a brighter economic climate in 2024 compared to 2023, outstripping the all-industry average of 68% in North America versus a mere 39% reported for global building materials manufacturers.

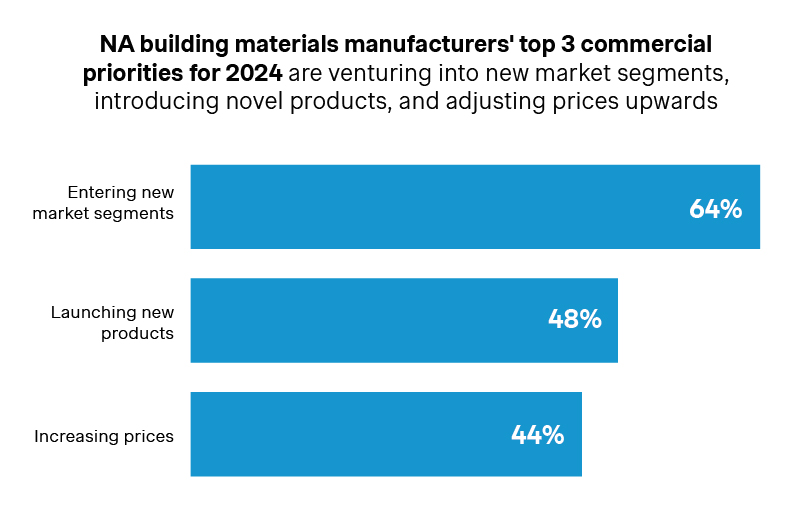

When considering essential business goals to enhance revenue growth prospects in 2024, the strategies are clear: entering new markets, launching new products, and continuing the trend of increasing prices.

But how challenging is it for companies to achieve these priorities and sustain revenue growth in the coming year?

Despite the optimistic outlook, achieving full implementation of price changes has proven challenging and is anticipated to become increasingly difficult

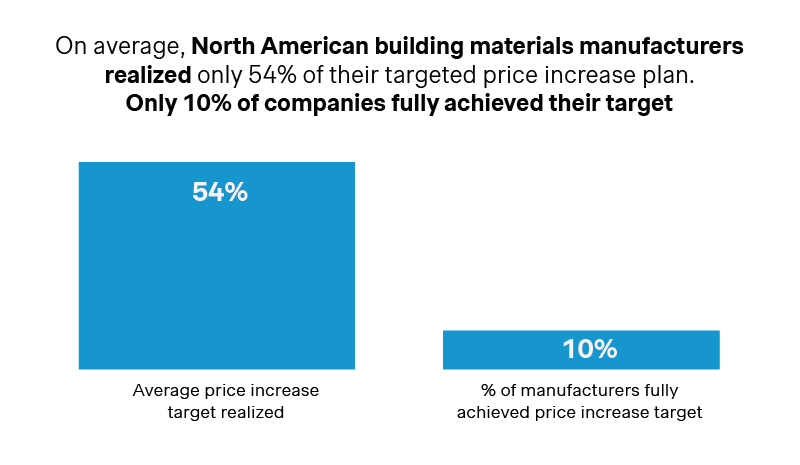

Building materials manufacturers were on average able to achieve only 54% of their initial price targets, and only a mere 10% fully reached their intended goals. This varied performance across companies was mainly attributed to the pressure from low-price competitors, greater price transparency, and ongoing price wars.

If companies are only achieving about half of their planned increases in a more accepting market environment, they may encounter hurdles if inflation starts to decline throughout 2024.

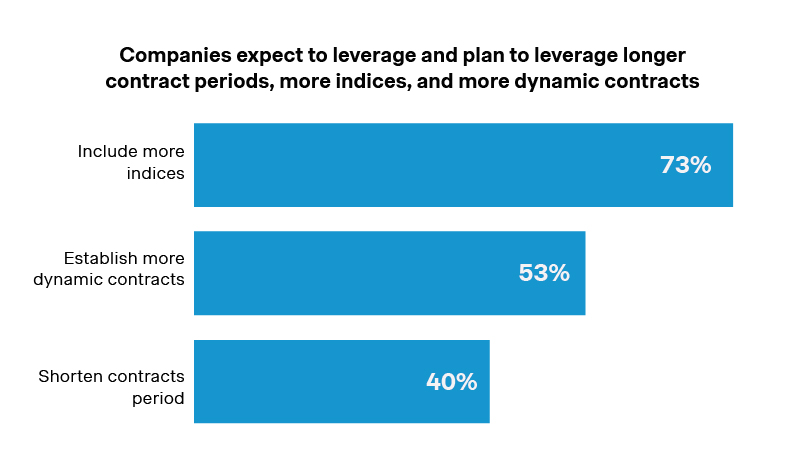

In addition, pricing negotiation is projected by business leaders to become more arduous in 2024. With inflation coming down, 60% of manufacturers expect more challenging contract negotiations ahead.

To tackle the forthcoming challenges, companies have been exploring strategies such as leveraging indices (73%), employing dynamic contracts (53%), and shortening contract durations (40%).

Are you prepared for 2024? What are the priorities on your pricing agenda?

The Road Ahead

The construction industry is not standing still, and North American construction and materials manufacturers are clearly looking at 2024 through a confident lens. As they gear up to face challenges head-on, their strategies are set to include exploring new markets, creating innovative products, and enhancing pricing strategies to stay ahead.

Simon-Kucher has extensive experience on the commercial topics building materials manufacturers are prioritizing:

- Best-in-class price increase performance through our pricing excellence program

Unlock successful price adjustments with our comprehensive price adjustment approach, leveraging the Simon-Kucher 9-Step Price Increase Framework. From configuration to preparation to implementation, our methodology ensures seamless adjustments at both the customer and product/service levels, driving tangible results for your business. - Go-to-market tactics refinement leveraging our expertise in sales and marketing excellence.

From evaluating sales effectiveness and CRM management to optimizing pricing and enhancing customer retention, our tailored solutions help you identify opportunities for growth and maximize revenue generation. With a focus on data-driven insights and proven strategies, we empower your organization to drive impactful sales and marketing outcomes. - Future-proofed new product development and ensure and measure value from the onset with our Monetizing Innovation approach.

Only 28% of new product innovations meet their original profit goals. Our comprehensive framework covers 9 critical areas of consideration, including monetization models, pricing strategies, value communication, etc. From concept to launch, we ensure that every step of your product development journey is optimized for optimal value creation and monetization.