Recap

The 1950s marked the birth of the semiconductor industry, with transistors emerging as high-cost, niche products primarily used in military and research applications. Early manufacturing was highly manual, with low yields and high costs keeping production volumes small. Pricing was largely dictated by the need to recoup R&D expenses, and government funding—particularly from the U.S. defense sector—played a crucial role in sustaining the industry. By the decade’s end, companies like Texas Instruments and Fairchild Semiconductor had entered the market, and the shift from germanium to silicon had begun, setting the stage for future innovation.

Introduction

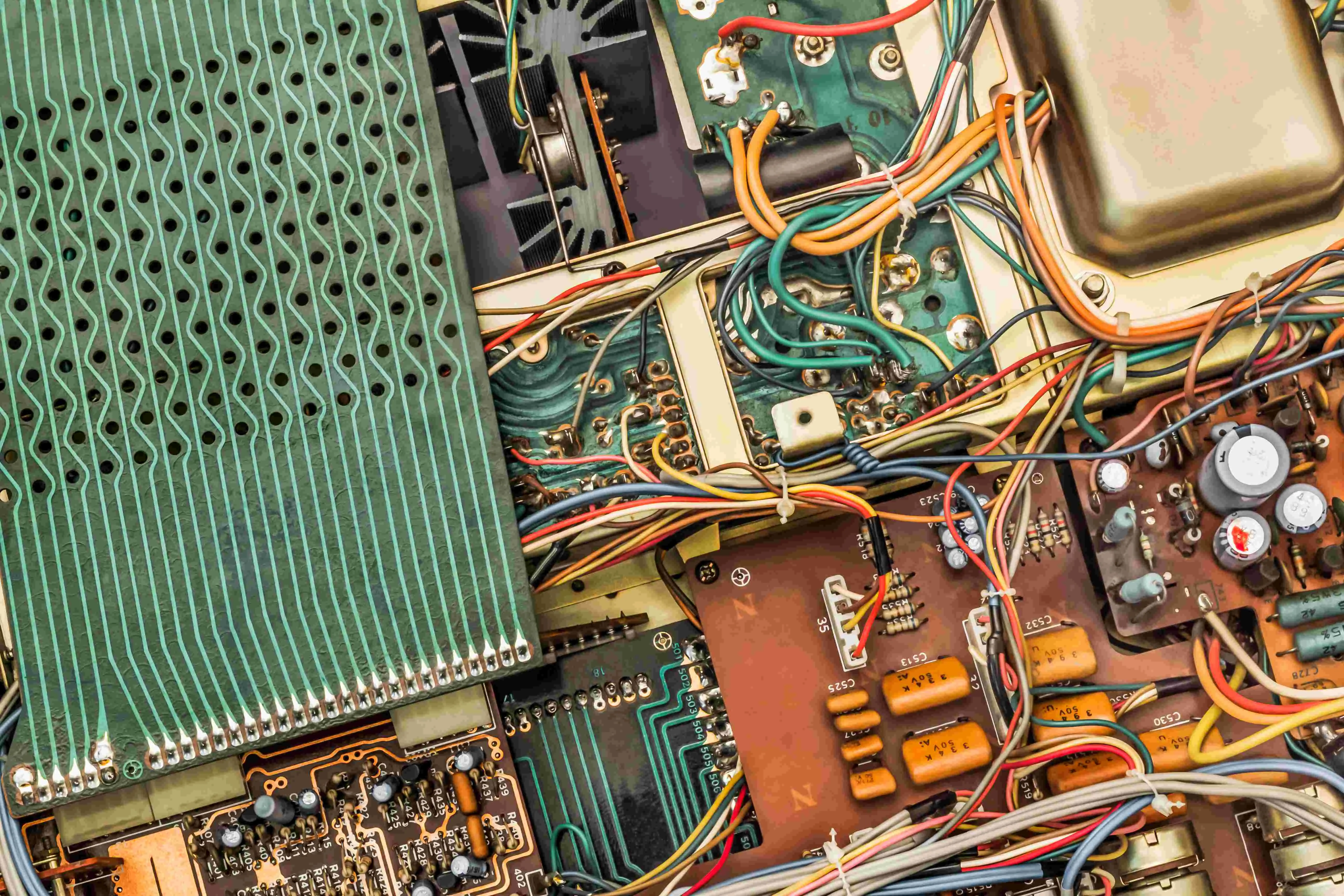

The 1960s were a pivotal decade in the semiconductor industry, characterized by major technological leaps that brought transistors out of their standalone packaging and into integrated circuits (ICs). Building on the groundwork laid in the 1950s, when transistors were expensive, niche components, the 1960s saw the semiconductor world begin to harness the advantages of scaling and integration. This rapid evolution not only expanded the market for semiconductor devices but also ushered in new pricing strategies, cost structures, and competitive dynamics.

At the heart of these changes was the transition from discrete transistors toward IC-based designs that combined multiple transistors and components on a single piece of silicon. The implications for pricing were far-reaching: manufacturers needed to adjust their cost models to account for higher yields, new production complexities, and rising demand from emerging applications such as computers, communications, and aerospace. By exploring this decade in detail—from the initial experiments in integrated circuits to the moment they became commercial mainstays—we gain valuable insights into how semiconductor pricing began to follow the famous curve of consistent cost declines that would define future decades.

The defining shift of the 1960s was the movement from separate transistors, diodes, and passive components toward combining these into a single, monolithic integrated circuit. Although the idea of integrating multiple components on a single substrate had been discussed in the late 1950s, it was in the 1960s that these concepts reached commercial viability.

Key contributions to the widespread adoption of the integrated circuit

Jack Kilby and Robert Noyce drive innovation

Jack Kilby of Texas Instruments and Robert Noyce of Fairchild Semiconductor are often credited with leading the effort that made integrated circuits a reality. Kilby’s 1958 demonstration of a working integrated circuit, followed closely by Noyce’s contributions to planar technology, showed that miniaturizing an entire circuit on a silicon wafer was more than a theoretical exercise.

Planar process innovation

Noyce’s planar process, developed at Fairchild, was revolutionary because it allowed semiconductor manufacturers to produce more reliable ICs at scale. It introduced photolithography to define circuit features, significantly improving yields. This planar approach remained at the heart of semiconductor manufacturing for decades, fundamentally influencing cost and pricing strategies.

Initial skepticism, then rapid adoption

In the early 1960s, integrated circuits were far more expensive per unit than discrete transistors, partly because yields were low and the manufacturing process was still maturing. Many companies initially questioned whether incorporating multiple components on a single chip made economic sense. However, as research continued, ICs began to showcase higher reliability, smaller form factors, and eventually cost advantages—factors that would dominate price discussions by the decade’s end.

Key market drivers of the 1960s

Military and aerospace demand

Like the 1950s, military and aerospace applications drove early volumes for integrated circuits. Programs such as the Apollo space missions demanded ultra-reliable, lightweight, and power-efficient components. NASA’s emphasis on advanced electronics spurred government contracts that could absorb the high costs of early ICs, helping manufacturers refine their processes without facing immediate cost pressures.

Mainframe computers

IBM and other computer manufacturers began adopting integrated circuits for certain logic and memory functions. Although vacuum tubes and discrete transistors still played a role in larger systems, the 1960s marked the first notable shift toward IC-based modules in computers, particularly for specialized functions where reliability and density were paramount.

Telecommunications and consumer electronics

While consumer adoption of integrated circuits lagged the aerospace and computer markets, telecommunications infrastructure started incorporating ICs for switching and signal processing. By the latter half of the decade, smaller consumer electronics—such as advanced radios and early calculator prototypes—began experimenting with IC solutions. These consumer devices foreshadowed the explosion in mass-market demand that would characterize the 1970s and beyond.

Major industry events of the 1960s and their impact on pricing

Formation of new semiconductor companies

The 1960s saw the birth of several key semiconductor firms—many founded by engineers from the so-called “Traitorous Eight” who left Shockley Semiconductor Laboratory to establish Fairchild Semiconductor. Spin-offs from Fairchild, in turn, led to the formation of companies like Intel (1968). This proliferation of new players fostered competition, innovation, and, eventually, more aggressive pricing strategies as multiple businesses sought to carve out market niches.

Transition from bipolar to MOS technologies

While bipolar transistors (used in TTL, or Transistor–Transistor Logic) continued to dominate the early integrated circuit market, metal-oxide-semiconductor (MOS) technology was quietly gaining momentum. MOS offered higher transistor densities and the promise of lower power consumption, though yields initially remained challenging. As some firms invested in MOS, they looked to differentiate themselves via higher integration levels—gradually influencing industry-wide conversations around cost reduction and volume-based pricing.

Government and NASA partnerships

Like the 1950s, government contracts—particularly from NASA and various defense agencies—played a significant role. These organizations often operated on cost-plus contract structures, which ensured that semiconductor manufacturers could recoup their R&D expenditures. The difference in the 1960s was scale: ICs were becoming increasingly important in high-profile missions, such as Apollo, generating a more substantial revenue stream that helped companies refine processes and, over time, reduce costs.

Rise of the "price-to-performance” paradigm

By the mid-1960s, forward-looking industry observers recognized a pattern: every new generation of integrated circuits packed more transistors into the same or smaller die area. This observation, later encapsulated in Moore’s Law (published by Gordon Moore in 1965), suggested that the number of components on a chip could double roughly every one to two years. Although Moore’s Law was initially intended as an observation rather than a pricing doctrine, it shifted the industry mentality from cost-plus approaches to an emphasis on improving cost-per-transistor.

Timeline of critical pricing milestones in the 1960s

By the close of the 1960s, although discrete transistors still represented a significant slice of the semiconductor market, integrated circuits were on the cusp of becoming mainstream. Their price trajectory began to slope downward at a faster rate than discrete transistors had in the previous decade, powered by the synergy of government-backed R&D, competition among new entrants, and the compelling value proposition of functional integration.

Notable pricing models: shift toward value-based and volume-based approaches

With integrated circuits offering both increased functionality and better reliability, semiconductor companies in the 1960s began experimenting with new pricing models.

Value-based pricing

Because ICs could replace a collection of discrete components, some suppliers priced them based on their overall system value rather than a simple cost-plus margin. For military or aerospace buyers, the ability to reduce size, weight, and power consumption (SWaP) could justify a premium over traditional discrete solutions. This approach generated higher margins but depended on convincing buyers of ICs’ superior total value.

Volume-based discounts

As commercial interest in integrated circuits expanded—especially among computer and telecommunications equipment manufacturers—semiconductor firms began offering volume-based discounts. These arrangements incentivized large customers to commit to bigger orders, in turn giving manufacturers the economies of scale needed to drive down unit costs.

Contract tiers and “project partnerships”

In some cases, semiconductor companies entered partnerships with large computer or aerospace firms. The semiconductor supplier would custom design an IC for a specific application in return for guaranteed purchase volumes. While costly to develop, these partnerships ensured stable revenue and accelerated learning curves—both factors that indirectly pressured pricing downward by improving production efficiency.

By the decade’s end, these emerging models collectively signaled that pricing strategies would no longer hinge solely on direct cost-plus formulas. Instead, the perceived value of integration—measured in performance, reliability, and reduced system complexity—became an increasingly important factor.

Transistor count vs. average selling price per IC (1960–1969)

This chart illustrates the fundamental dynamic that would become “Moore’s Law”: transistor density rose at an exponential rate, while simultaneous manufacturing refinements and economies of scale drove average selling prices down.

Figure 1: Figures are representative mid-range estimates. Actual data varied by manufacturer and data type. The transistor count reflects an average or typical small-scale integration device, such as a basic Transistor-Transistor Logic (TTL) or Diode-Transistor Logic (DTL) logic IC. High-complexity chips could exceed these figures by the late 1960s. The ASP data captures what was reported in trade publications.

Conclusion: the 1960s – the inflection point toward modern semiconductor pricing

If the 1950s were the infancy of semiconductors—driven by discrete transistors and dominated by cost-plus defense contracts—then the 1960s represented the industry’s critical leap into adolescence. The integrated circuit transformed the conversation from “Is solid-state technology viable?” to “How can we exploit integration to deliver more functionality at lower cost?”

Key enablers of this shift included the planar process, advancements in photolithography, government funding for large-scale aerospace projects, and the introduction of new semiconductor entrants that fueled competition. Pricing structures began to revolve around value and volume rather than simple cost-plus formulas. As transistor counts soared—doubling or more every couple of years—the per-transistor cost started on a steep downward slope that would define semiconductor economics for decades.

Key lessons

The 1960s taught the industry that integration is an essential catalyst for cost reduction and market expansion. Although integrated circuits initially commanded premium prices, their superior performance, reliability, and form factor quickly justified higher costs in critical applications—thereby fueling the investment needed to refine manufacturing processes. The result was a self-reinforcing cycle of technological innovation and market acceptance that steadily drove down prices.

This decade also underscores the importance of strategic government and corporate partnerships. By funding large R&D projects and committing to volume purchases, these partnerships gave semiconductor manufacturers the runway to mature IC technology. The lessons from the 1960s resonate today: in a market defined by exponential growth in functionality and performance, pricing power often follows those who invest early in next-generation manufacturing and secure stable demand to justify scaling up.

In our next article—focusing on the 1970s—we will see how the foundation laid in the 1960s enabled semiconductors to break into broader commercial and consumer markets, triggering even faster improvements in cost-per-transistor and revealing new competitive dynamics that still shape the industry today.