Your product shelf might be costing you more than you think

Many banks find themselves struggling with product design. Some have accumulated too many overlapping products over time, creating internal complexity and customer confusion. Others have gone too far in the opposite direction, offering too few deposit choices to meet diverse customer needs or behavioral segments.

Optimizing the product shelf, ensuring the right balance of breadth, clarity, and relevance, is therefore a critical goal. Poorly structured shelves often reflect ineffective bundling, where products are combined in ways that fail to resonate with customers or even add to the confusion. Conversely, thoughtful bundling can streamline choices, create stronger value propositions, and help banks better align their offerings with customer behaviors and preferences.

When there isn't a purposeful and structured range of products, balancing growth, margin, and retention becomes a difficult task. The presence of legacy accounts, redundant features, and tiers that are no longer relevant can create confusion for customers and ultimately dilute profitability. Smarter product design, however, can lower your cost of funds and improve retention.

Smarten your product shelf. It’s more than just operational housekeeping. It’s a margin and growth strategy.

The hidden costs of an unoptimized product shelf

Too many, too few, or just misaligned. It’s costing you margin.

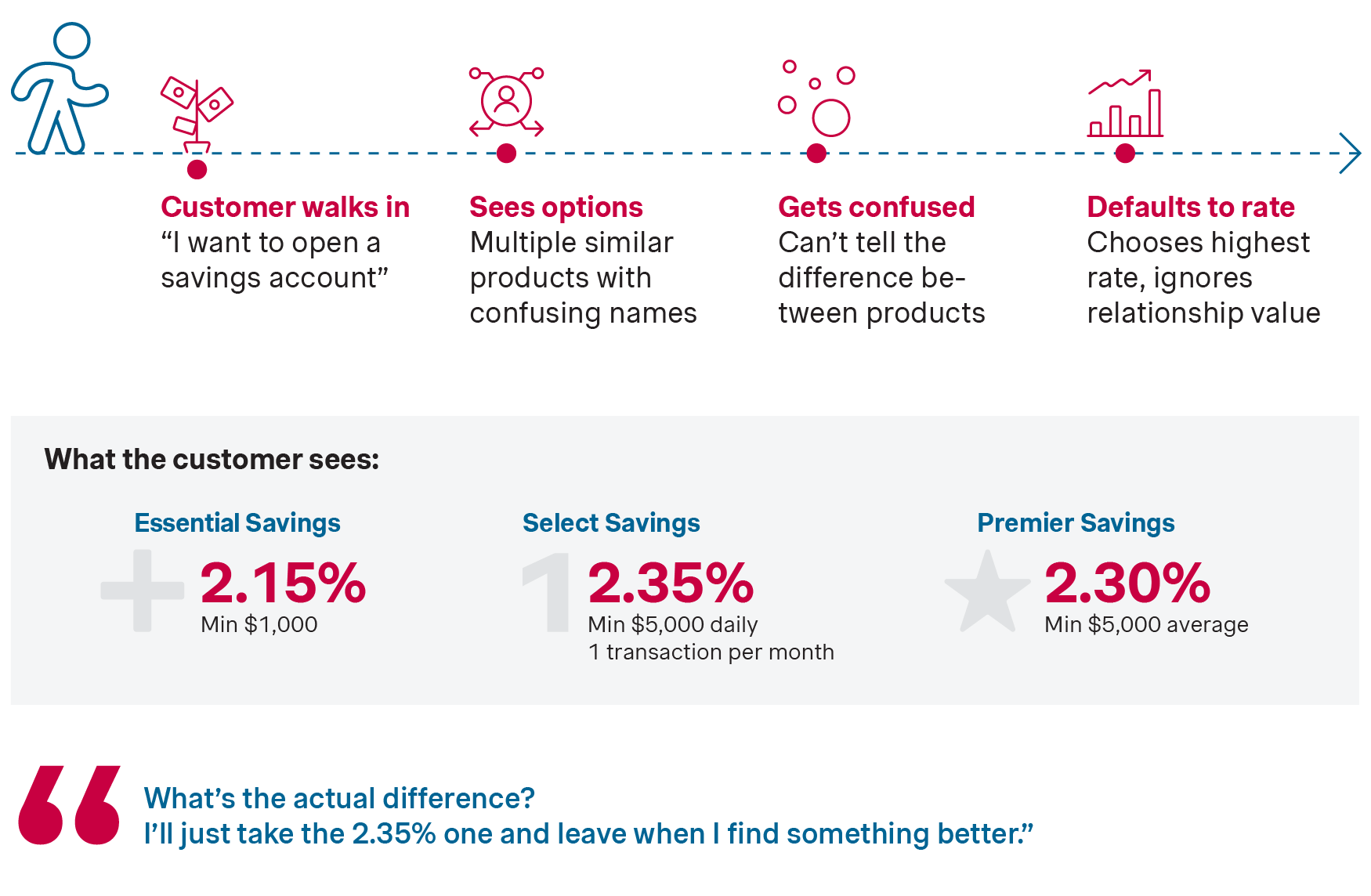

Whether a bank has too many products, too few, or simply misaligned offerings, the result is the same: a product shelf that fails to support strategic pricing, targeted marketing, or efficient execution. Even if the right products are on the shelf, unstructured or complexity at the point of sale (i.e., a poor bundling strategy) can undermine product effectiveness. This lack of a structured, purpose-driven design is the core of the problem, leading to missed opportunities for rate control, valuable product-level insights, and cross-selling potential.

Common issues stemming from a cluttered shelf include:

- Customer and employee confusion: Fragmented or overlapping offers make it difficult for customers to choose the right product and for relationship managers to provide clear guidance

- Operational drag: Redundant maturity tiers and legacy products that are still priced above the market add unnecessary operational costs and complexity

- Ineffective promotions: Promotional offers are often layered on top of each other without a clear logic or strategy, further confusing the message

All these lead to shelves that go against the Simon-Kucher north star: Easy to buy, easy to sell

Customer journey through confusing product options

What smarter product design looks like

Less complexity, more impact.

Achieving smarter product design means creating a product set that is rationalized and streamlined, with features that offer clear and distinct value propositions.

Here’s how to add strategic color to your product shelf:

- Introduce purposeful tiers: Create tiers based on customer balance, tenure, or needs to reward deeper relationships. A prime example is Bank of America's "Preferred Rewards" program, where customers are tiered based on qualifying balances to unlock benefits like interest rate boosters and fee waivers

- Add “sticky” features: Modern fintechs and neobanks have shown the value of adding features that engage customers beyond just the interest rate. These build loyalty through a better customer experience. For instance, Ally Bank's "Surprise Savings" uses AI to analyze spending and automatically transfer "safe-to-save" money, making saving effortless for customers

- Establish simple rules for promotions: Create clear, consistent rules for offers and bundles to avoid confusing ad-hoc deals. Chase Bank, for example, almost always has a simple direct sign-up bonus for opening a checking account and setting up direct deposit.

Linking shelf strategy to pricing and marketing

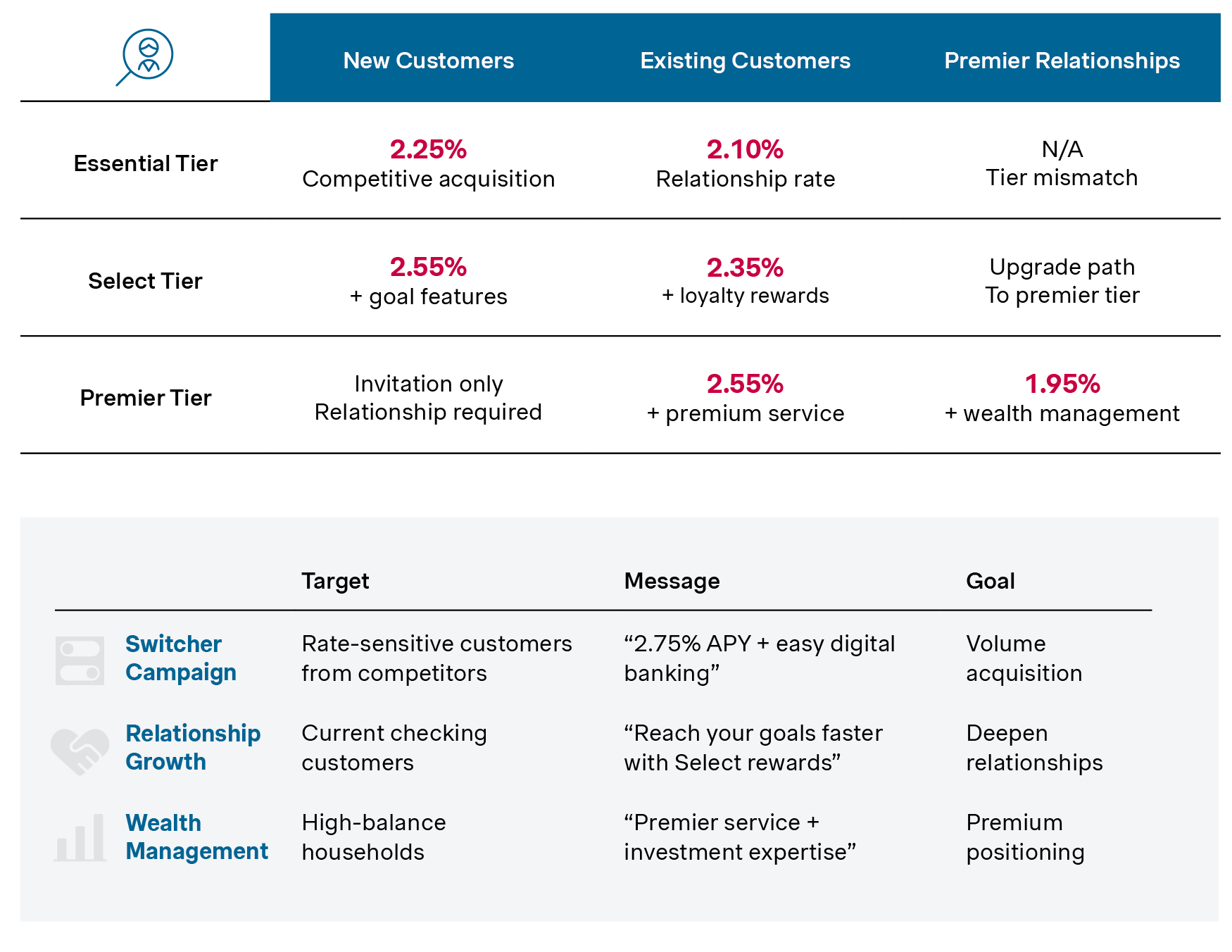

You can’t price or promote effectively if the shelf is broken.

A clean, well-structured product shelf is essential for an effective market execution. It enables:

- Smarter pricing segmentation: Move beyond one-size-fits-all rates by tailoring pricing to specific needs or by the amount of value exchanged. E.g. if affluent customers are providing you with high balances that disappear the moment you reduce your pricing by 1bp – the sticky funding value of these balances is very low. Price accordingly.

- Better campaign targeting: Pinpoint customer needs with precision. Instead of a generic savings promotion, you can target customers based on their product holdings. E.g. targeting those with a high proportion of CD maturity in the next 60 days with a compelling rollover offer, significantly increasing conversion rates

- Consistent customer messaging across channels: Ensure the value proposition is communicated clearly across all channels. In the example below, with three distinct savings products instead of nine, the message doesn’t get diluted, and your front-line staff can make recommendations with confidence

Segmented pricing by customer type and product tier

Ultimately, as an outcome, the marketing ROI improves significantly, and pricing becomes more surgical, and less reactive.

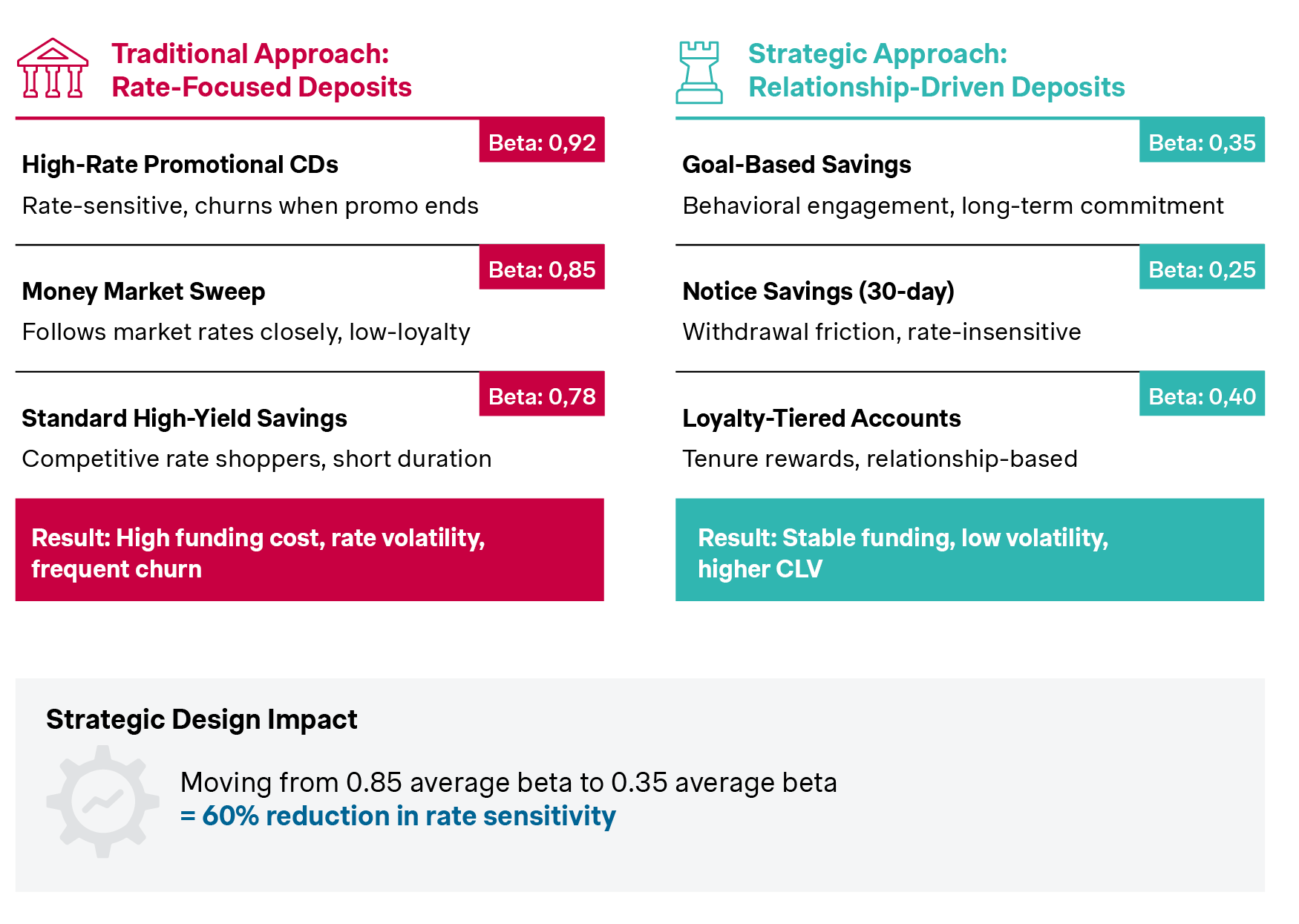

Design products that support your balance sheet

Product design shapes not just customer experience but also funding quality.

Product structures impact more than customer behavior. They shape the duration, stability, and liquidity profile of deposits. Longer-duration products (e.g., notice accounts, term-linked loyalty incentives) are more valuable from an ALM perspective as they provide a reliable funding base.

Smart designs can guide customers toward behaviors that align with balance sheet needs like:

- Incentivize average balance growth over time

- Introduce friction for withdrawals (e.g., 30-day notice)

- Offer loyalty features that reward retention

This helps banks shift away from chasing "hot money", funds that move quickly between institutions in search of the highest rate, and toward building stable, low-beta funding sources that are less sensitive to market rate changes.

Balance sheet impact - Deposit quality comparison

The goal should be to design products with duration and quality in mind, and not products that just focus on conversions.

What success looks like

From shelf clean-up to margin uplift, the results of strategic design are tangible and significant.

Our projects show that a focused approach delivers:

- 20% volume growth driven by restructured product tiers and strategically improved customer journey

- 8-18 bps improvement in NIM after removing outdated high-rate products and implementing new, optimized pricing

- Improved front-line adoption and retention excellence with simpler options and clear pitch lines, leading to 40% improved RAROC

- Faster onboarding and lower servicing costs from unified product design

An optimized clean shelf gives you pricing power and a better customer conversation.

How Simon-Kucher helps

At Simon-Kucher, we make product design strategic, not just structural. We partner with banks to conduct:

- Shelf diagnostics to identify overlaps, gaps, margin leaks and redundancies

- Design workshops to build purposeful product tiering and bundles

We also ensure:

- Cross-functional alignment so that pricing, marketing, and distribution are fully integrated

- Rapid roll-outs using proven playbooks for product migration and customer communication

Ready to clean-up your shelf and your margins?

Smarter product design isn’t a back-office task. It's a growth opportunity. Let's talk about how to simplify your shelf and amplify your results.