In today’s MENA healthcare environment, private hospitals serve three customer segments: private insurance companies, cash-paying patients, and public insurance entities. Among these, private insurers typically represent the largest share of hospital revenue, making effective price increase negotiations critical to sustaining profitable growth. Learn more here in our expert deep dive on how healthcare providers can better target this key stakeholder group.

As private insurers adopt sophisticated contracting strategies and negotiation tactics, healthcare providers must sharpen their own negotiation capabilities and pricing methodologies to protect long-term revenue growth.

Our Simon-Kucher experts recommend basing effective negotiations with private insurers on four core components:

- Negotiation preparation and process

- Value-based negotiation strategy

- Price increase allocation approach

- Price performance monitoring

1. Negotiation preparation & process

A lack of a clearly defined negotiation preparation process often creates ambiguity around roles and responsibilities across functions. This uncertainty can put critical timelines at risk. For example, private insurance contracts may lapse before new agreements are finalized. In these situations, hospitals may operate under outdated contract terms, leading to financial losses, or experience patient flow disruptions due to temporary coverage gaps.

To prevent this, our Simon-Kucher experts have supported hospitals by:

- Establishing a standardized negotiation process that clearly defines each stage from preparation through implementation. This includes clear assignment of functional responsibilities and detailed activity planning.

- Initiating negotiation preparations proactively well ahead of contract renewal dates. Depending on strategic importance and relationship history, preparation may start up to six months before expiration.

- Developing a clear roadmap for cross-functional collaboration, with Revenue Management leading negotiation coordination while the Finance team provides profitability insights and the Key Account Management team handles client-facing interactions

This structured approach supports alignment, efficiency, and consistency, strengthening long-term relationships with insurers.

2. Value-based negotiation strategy

In the MENA region, negotiations between hospitals and private insurers often become narrowly focused on numerical targets for price increases, overlooking the value proposition that justifies these adjustments. But when discussions center only on percentages without clearly articulating the underlying value, hospitals offering superior clinical quality may find themselves at a disadvantage.

Here’s how we’ve helped hospitals enhance their negotiation outcomes:

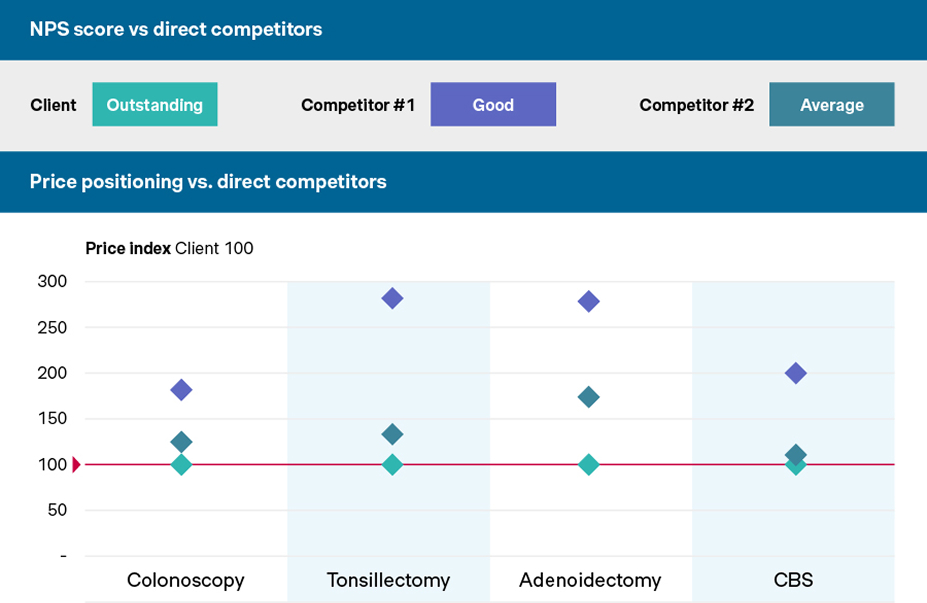

- Highlighting superior clinical outcomes and patient satisfaction: Supported by pricing benchmarks, relevant accreditations, strategic partnerships (e.g., affiliations with Mayo Clinic), and key opinion leaders (see figure 1).

- Providing support throughout the negotiation process: Our team acts as strategic advisors and sparring partners to hospitals' Key Account Management teams.

By shifting the discourse with insurers from numerical benchmarks to negotiations that recognize enhanced clinical outcomes and the impact on patient care, providers can achieve an incremental 4% increase in private insurance revenue.

Figure 1

Source: Simon-Kucher insights

3. Price increase allocation approach

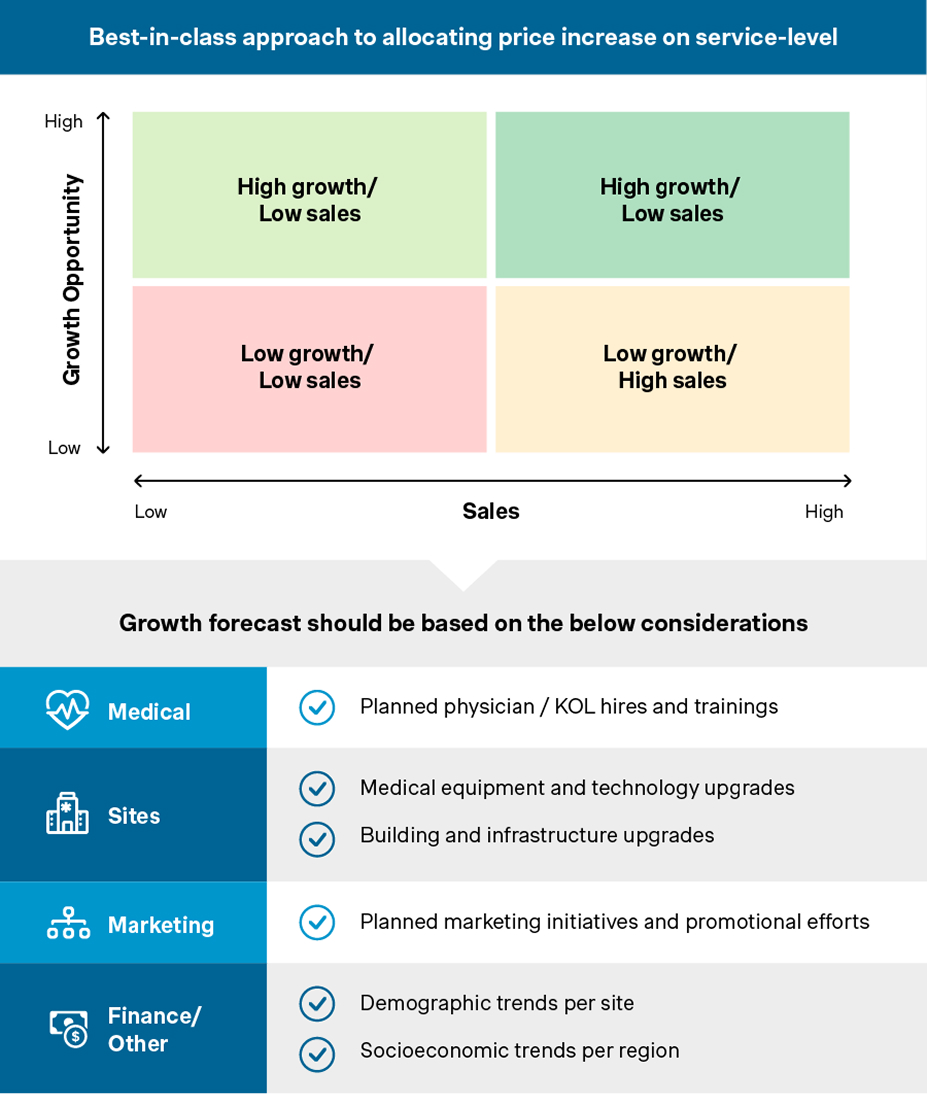

After agreeing on the overall price increase with each private insurer, hospitals typically allocate the increase equally across services and branches, regardless of growth potential. This limits the effectiveness of negotiations and leaves meaningful revenue opportunities untapped. Strategically aligning price adjustments with expected growth areas within the market strengthens the financial impact of hospitals’ pricing decisions.

We have enabled hospitals to systematically optimize their price increase allocations by:

- A methodology that uses growth forecasts to prioritize price increases for services and locations with the highest growth potential (see figure 2).

- The integration of strategic factors such as physician recruitment plans, infrastructure upgrades, demographic shifts, and targeted marketing initiatives into allocation decisions.

This internal insights-driven approach amplifies pricing impacts, generating incremental growth of 1% on the private insurers’ revenue.

Figure 2

Source: Simon-Kucher insights

4. Price performance monitoring

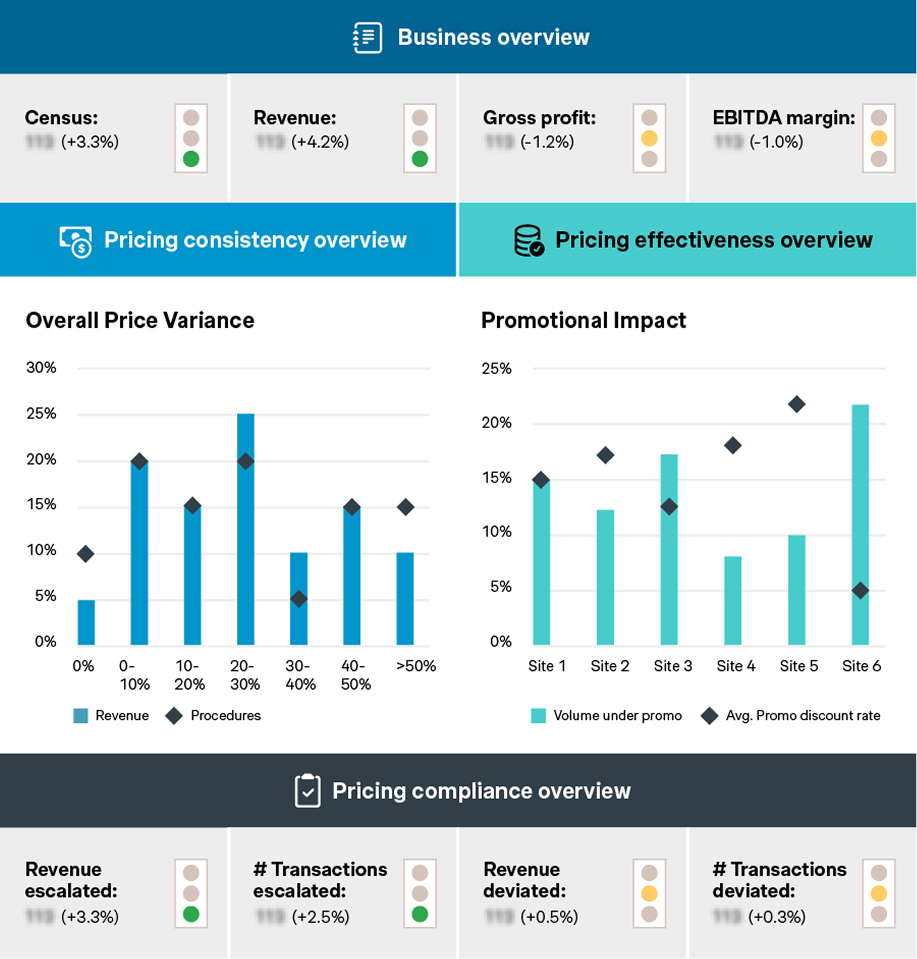

Hospitals in MENA often lack a systematic approach to price performance monitoring. This results in difficulties ensuring and assessing price consistency and effectiveness. Challenges range from ensuring top-tier clients receive the most favorable terms to objectively evaluating the success of pricing decisions.

Our Simon-Kucher experts have helped hospitals strengthen their price performance and monitoring by:

- Defining meaningful KPIs and establishing a monitoring scorecard to ensure clarity and trackable metrics (see figure 3).

- Assigning clear responsibilities for monitoring across teams and defining tracking frequency, balancing effective monitoring with operational feasibility.

- Developing a playbook to regularly assess and adjust the pricing approach based on business impact and evolving needs.

This structured monitoring process significantly enhances pricing governance, compliance, and strategic decision-making.

Figure 3

Source: Simon-Kucher insights

Wrap up

Successfully negotiating price increases with private insurers in the MENA healthcare market requires a strategic, structured approach from preparation to execution and monitoring.

At Simon-Kucher, we support leading providers in achieving price negotiation excellence. This includes:

- Outlining proactive negotiation processes with private insurers

- Developing value-based negotiation strategies that emphasize clinical and patient care outcomes

- Aligning price increase allocation with growth forecasts

- Designing clear price performance monitoring mechanisms

Our experience shows that adopting these practices can deliver more than a 5% improvement in RoS in Year 1, while also elevating pricing capabilities to support long-term revenue growth and secure a competitive edge in the MENA healthcare market.

Want to know more? Don’t hesitate to reach out to our Simon-Kucher experts.