Energy has become a board-level differentiator. Our Chemicals, Energy, and Materials Study 2025 shows how industrials companies are securing affordable, reliable, and low-carbon energy, and what separates resilient portfolios from exposed ones. From PPAs and self-generation to hydrogen horizons and policy design, here’s how to translate energy risk into a durable cost and growth edge.

In 2025, location strategy starts with a simple filter: can this site secure reliable, affordable, and increasingly green energy at scale? Energy costs and access now sit alongside tax and labor as defining factors in site competitiveness and investment attraction. Our study identifies this shift in both Europe and the U.S., but with different implications for how companies source, finance, and lock in their energy future.

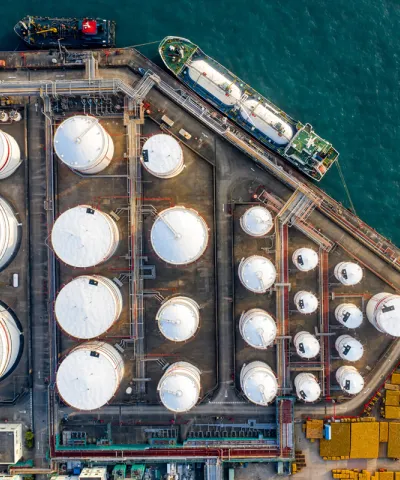

Most players now have a plan. 88% of respondents report an approach to securing renewable energy. These range from power purchase agreements (PPAs) to direct investments in own generation, with hydrogen and biogas in the mix. PPAs remain the standard, offering price stability without heavy balance-sheet exposure.

At the same time, CAPEX-heavy routes are rising. In Europe, 32% of companies pursue own generation versus 19% in the U.S., a logical response to sharper energy price pressure and a desire for long-term cost certainty.

Hydrogen is moving from talking point to planning parameter

In Europe, 3 out of 4 executives expect hydrogen to become relevant to competitiveness within the next decade. This reflects decarbonization roadmaps and regulatory momentum.

North American views are more polarized. Some anticipate impact within 3–5 years, others push relevance beyond 2035, mirroring incentive-driven, economics-first adoption curves.

Technology costs, renewable availability, and offtake clarity will decide speed. Timing will vary by region and industry.

Barriers to scaling low-carbon energy are stubborn and familiar

Regulation and financing conditions top the list of barriers. Despite the European Green Deal’s funding, EU firms more frequently cite insufficient subsidies or market incentives (39% EU vs. 26% U.S.).

Large, simple incentive frameworks create strategic clarity. Compliance-heavy rules add paperwork costs without moving adoption. In practice, the sites that win combine line-of-sight to green energy with policy structures that de-risk capital over long tenors.

Your next best decisive move: Unlock energy transition

Energy providers need to secure affordable low-carbon supply via bankable PPAs, hybrid structures, and targeted own-generation CAPEX. This will allow them to balance cost, flexibility, and reliability while accelerating the transition.

Prioritize sites and partners with line-of-sight to renewable capacity and de-risked financing; build offers that match industry logic (tenor, mobility, load shape); and set clear trigger points to scale hydrogen-ready options as economics and infrastructure mature. This will make the core of your commercial strategy.

How Simon-Kucher can help

Energy is now an integral playbook for industrials companies. Those that secure sustainable energy today will anchor investment, margin, and growth tomorrow.

Simon-Kucher helps industrials businesses secure energy resilience and design winning procurement and partnership models. Download the Chemicals, Energy, and Materials Study 2025 to dive deeper into these power plays and to shape a portfolio that outperforms through volatility.

Form placeholder. This will only show within the editor