Diagnostic testing allows pharmaceutical companies to identify the right patients for cell and gene therapies to maximize therapeutic and commercial success. However, ensuring access to diagnostic testing is complex. Our experts provide insights on barriers pharma face and how to overcome them.

Typically, cell and gene therapies (CGTs) tackle rare diseases with a relatively small, restricted patient population. Yet, the industry continues to thrive and make important advancements in many disease areas. As such, pharmaceuticals are increasing their focus in this field.

However, CGTs are expensive both in terms of development and treatment. This is likely to cause problems down the line as the industry grows, especially with regards to reimbursement. So, what can companies developing CGTs do to maximize therapeutic and commercial success?

CGTs need to be delivered to the right patients through diagnostic testing

In order to maximize therapeutic and commercial success, it’s crucial to ensure CGTs are delivered to the right patients. This includes identifying target biomarkers (e.g., genetic mutations in both copies of the RPE65 gene for Luxturna) or determining the presence of molecular profiles which are associated with better outcomes in patients.

Similarly, tests to detect potential resistances (e.g., neutralizing antibodies against AAV vectors for Zolgensma) ensure the therapy will be effective. Additionally, diagnostic testing can aid in the benefit-risk decision-making, for example to exclude patients likely to be at increased risk of serious adverse reactions.

In short, diagnostic testing is the key to identifying the relevant characteristics to ensure that a cell or gene therapy is delivered to the right patient.

That said, there are barriers to ensuring seamless access to diagnostic testing, which revolve around the topics of recognition, reimbursement, and resources. In this article, we deep dive into barriers associated with each topic and outline how pharmaceutical companies can overcome them.

Recognition barriers

While diagnostic testing is common in some oncology indications, the concept isn’t established in many CGT indications. This explains why diagnostic testing for CGTs isn’t often standard practice since clinicians lack awareness. Clinicians can also be inexperienced about sample collection and preparation or simply unaware about locations of specialized laboratories to test for relevant biomarkers.

Taking this into consideration, how can pharmaceutical companies overcome this lack of recognition?

Solution: Create awareness and educate stakeholders

A key step is to ensure that testing gets included in clinical guidelines and is supported by key opinion leaders (KOLs).

To raise awareness around diagnostic testing as well as the need to update diagnostic pathways, pharmaceutical and diagnostic manufacturers can present or sponsor conferences and symposia. These events also provide an opportunity to interact with KOLs, build expert networks, and introduce new products as well as requirements for use.

Moreover, pharmaceutical and diagnostic manufacturers can provide e-learning platforms or offer webinars to train and educate stakeholders. This removes barriers for new diagnostic tests and prevents low uptake or potential errors in interpreting results due to lack of testing capabilities.

Reimbursement barriers

Diagnostic testing for CGTs is often more expensive than comparable testing in oncology. This is partly because some CGTs rely on newer test methods, such as next-generation sequencing with liquid biopsy. In these cases, funding isn’t always available.

Another hurdle is that funding might be limited to certain criteria and/or conditions. The UK, for instance, publishes a National Genomic Test Directory which defines the testing criteria for rare and inherited diseases.

In some cases, funding, may be available but will be insufficient to cover testing costs. This can happen when a new assay needs to be developed, requiring testing a small patient population. In such instances, the cost of a diagnostic test and the funding available don’t always align. Moreover, regulatory restrictions limit reimbursement. For example, biomarkers sent outside of Germany for testing at central labs to bundle resources won’t receive funding.

So, what can pharmaceutical companies do to ensure that funding barriers do not prevent access for diagnostic testing?

Solution: Secure public funding or consider pharma funding

There are different levers pharma can put in place to ensure diagnostic testing. For instance, pharma can work to improve public reimbursement (e.g., by eliminating funding restrictions, securing new codes, or budget inclusion).

The image below highlights two examples where public funding activities have succeeded:

That being said, identifying opportunities to securing public funding isn’t always easy. It can also be dependent on the following:

- Whether funding decisions between the CGT and the diagnostic (i.e., a companion diagnostic) are linked

- To what extent funding decisions are centralized

- Whether or not a patient’s out-of-pocket (OOP) payment is a relevant market segment to consider

However, if there are temporary or permanent public funding gaps, pharma funding might be an option. There are four main types of funding that pharma can consider to overcome reimbursement barriers: Direct funding, indirect funding, commercial agreements, and patient assistance programs.

While these options require investment from pharma companies, the payoff will be much greater as it ensures access to a cell and/or gene therapy.

Direct funding

Pharmaceutical companies can pay directly for diagnostics tests and other resources.

AstraZeneca directly funded the setup of five laboratories across Canada that focused on EFGR testing. In doing so, AstraZeneca improved patient access to treatments as payer’s funding decision for the diagnostic test was delayed. Public funding was only made available some years post-drug launch.

Indirect funding

Indirect funding can include payment via research fund or donations.

AstraZeneca, for instance, donated to France’s National Cancer Institute (INCa) to support biomarker testing in hospitals. These donations came before the required testing platforms and funding for biomarker testing had been established.

Commercial agreement

This is a temporary agreement that is negotiated to bridge a funding gap.

For example, Roche and Foundation medicine set up a commercial agreement in Spain that provided a discount to the healthcare system in the form of one free test for every 10 patients tested and treated with atezolizumab. With this, Roche ensured access to their drug while payers were able to release some budget pressure.

Patient assistance program

In these cases, pharmaceutical companies cover part of all the costs of testing, typically in collaboration with a diagnostic partner.

Novartis provides a good example here. The company partnered with QIAGEN and NeoGenomics Laboratories to provide the PIK3CA test at no cost for patients in the US. NeoGenomics Laboratories conduct tumor tissue and plasma testing using the test kit provided by QIAGEN. Based on test results, patients get access to Novartis’s FDA-approved Piqray treatment, which specifically treats breast cancer patients with the PIK3CA mutation.

Resource barriers

As we’ve previously highlighted, since CGTs focus on rare diseases, the relevant tests typically concern a small patient pool. They also often rely on new, more expensive methods. As such, laboratories might lack the required resources for diagnostic testing or not prioritize testing for CGTs.

The reason for the latter is that conducting new tests with low testing volume is currently considered too risky. Firstly, because at this time integrating new tests into a lab’s workflow is cumbersome, and secondly because low sample amounts tend to lead to long turnaround times.

This explains why these tests aren’t revenue drivers for labs. Therefore, the low-test volume of diagnostic testing for CGTs is seen as high-risk. In fact, the lower the prevalence of the indication (rare to orphan) the higher the risk.

Solution: Foster Dx collaboration & partner on activities

To overcome the aforementioned barrier, labs need to have sufficient resources such as testing capacities and capabilities. Current operations also need to be improved so that the integration of new tests is a smooth process. This is where collaboration between pharma and diagnostic manufacturers can really help overcome barriers to seamless access to diagnostic testing.

While partners have shared and individual responsibilities, diagnostic manufacturers can provide the following to pharmaceutical companies:

- Develop and refine diagnostic tests

- Pursue and acquire market authorization

- Apply for reimbursement

- Provide education and training

- Ensure availability of testing options

Case Study: Myriad genetics

|

Barriers will be impossible to overcome without careful planning and preparation

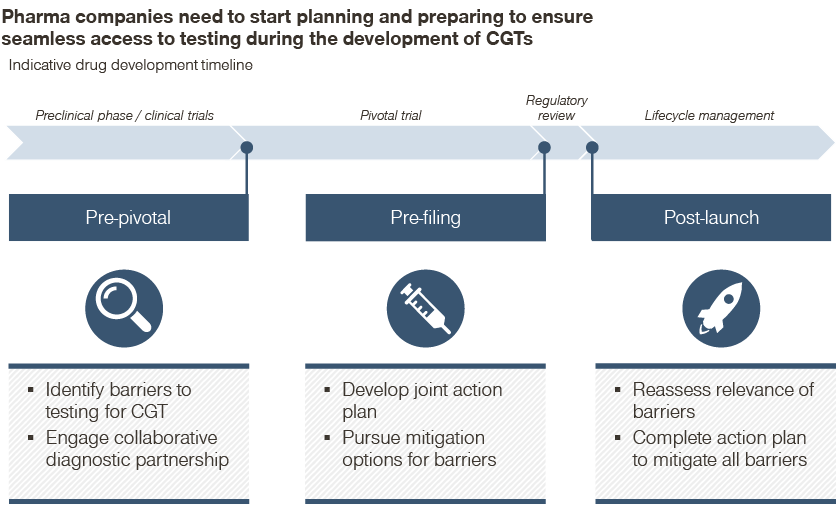

Importantly, not all barriers affect different CGTs the same way and there is no one-size-fits-all solution to mitigate them. Therefore, pharmaceutical companies need to start planning and preparing at different stages in the cell and/or gene therapy development process.

Before the start of the pivotal trial, it’s important to identify the recognition, reimbursement, and resource gaps. Especially as driving awareness, applying for funding, and developing commercial assays in a collaborative diagnostic partnership can all take years to accomplish.

Once barriers have been identified, a joint action plan between pharma and diagnostic manufacturers needs to be developed during the pivotal trial. This will assign responsibility for pursuing mitigating options to the identified barriers. Post-launch, the relevance of the identified gaps can be reassessed and the remaining mitigation options can be implemented.

Get in touch with the author to learn more!

Further insights:

Cell & Gene Therapy: Curing the "Incurable"

Launch planning for cell & gene therapies

International Price Referencing in CGT

Value-based care toolkits for cell and gene therapies