Consumer awareness of the sustainability of their diet has grown rapidly in recent years. About two thirds of consumers indicate they are willing to change their eating habits for environmental reasons. Anticipating this trend and adopting credible emission labeling will result in a solid competitive advantage for food and beverage manufacturers.

As of 2020, 57 percent of European consumers want sustainability information to be compulsory on food labels. In several other industries, like automotive or utilities, carbon footprint awareness has led to significant market shifts. The food industry and our diet, being one of the most polluting parts of our lifestyle, are expected to be significantly impacted by this development. Front running consumer goods companies, like Oatly, are already actively indicating emissions on their labels. Such actions might seem limited to mainly Hollywood stars at hipster coffee shops, but an example can be drawn from the Toyota Prius, which was in a similar situation in the early 2000’s – later turning out to be the start of a revolution in the car industry. Companies should acknowledge that consumer interest in sustainability is or will be mainstream in the near future.

Roughly 50 years ago, the US Food and Drug Administration (FDA) made the first recommendation to develop a system that would establish the nutritional quality of food products. An increase in consumer awareness about health led to consumers requesting more information on their food to improve their diet choices. A couple of decades later, nutrition labeling has been adopted globally and is subject to hefty regulations. What can we learn from similar historic developments and what can producers do right now to anticipate the future of carbon labels effectively?

Supply chain: End-to-end analysis is a key enabler

Whilst measuring calorie content is a common and straightforward process, estimating the environmental impact of products is complex. Front running companies that proactively indicate the carbon footprint of their products have shown analyzing their entire supply chain is complicated and time-consuming, even for less complex products. Unilever, has announced it will provide carbon footprint information on the labels of all 70,000 products. According to Unilever, ““It’s a very big commitment, but we are clearly seeing that consumers want to know how the products they buy contribute to their own carbon footprint.” Analysis results depend heavily on a broad range of assumptions on what to include and digitalization is expected to ease this process and enable organizations to map their supply chains more clearly, identifying bottlenecks and tracking products from their origin to consumption. Organizations like the Carbon Trust provide practicable advice on how to move from traditional carbon management to a holistic approach across the supply chain.

Voluntary Sustainability Standards: Three levers for success

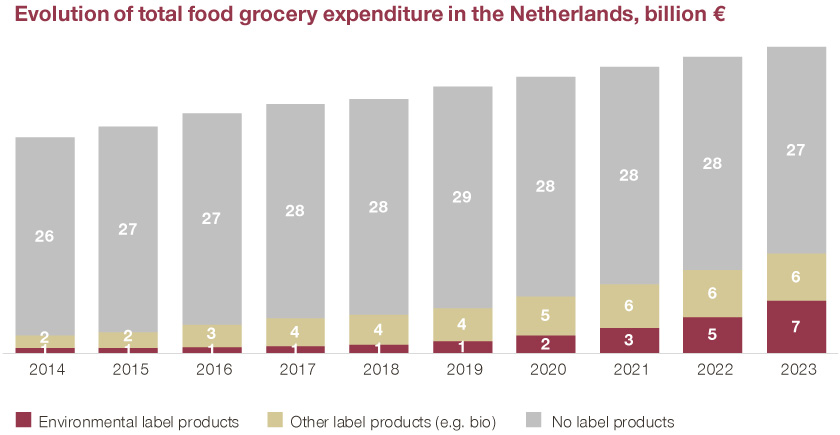

Similar to the early days of nutrition and animal welfare food labeling, consumer demand is creating a growing interest in proactively communicated environmental impact in the food industry. Different brands and independent organizations are reacting to consumer demand with the creation of quality marks and certificates regarding sustainability. Voluntary Sustainability Standards (VSS) are gaining market share, and are the main drivers of increased consumer expenditure on quality mark premiums in supermarkets. Our analysis forecasts that 15 percent of Dutch store-bought food and drinks will be containing VSS related to environmental issues by 2023:

To capture this growing market, worth over six billion euros in the Netherlands alone, we identified three crucial steps to short-term success:

- Define target customer segments

- Identify segment needs and value drivers

- Successfully communicate added value

1. Define target customer segments

Studies from leading global grocery experts found that a large majority of consumers are willing to change their diet due to environmental reasons. However, these findings should not be misinterpreted as an increased willingness to pay. Ability and willingness to pay a price premium for products with a reduced carbon footprint are highly dependent on geographical and social-economic factors. According to a recent analysis by the European Consumer Organisation, 68 percent of consumers in Austria think sustainability information should be compulsory on food labels; in the Netherlands only 43 percent agree with this statement. Additionally, a large variance between product segments exists. For instance, in 2019, 30 percent of store-bought milk purchases contained a sustainability label while for cheese this number was only 4 percent. Organizations need to break their customers down into smaller, more detailed groups to enable a targeted approach and effectively meet consumer demands.

2. Identify segment needs and value drivers

Sustainability, and more specifically the “carbon footprint” of a product, is a broad and complex concept. Different consumer segments value very different environmental notions. Brands should identify specific dimensions that drive the perceived value of their products and match the product portfolio with customer values. Dutch “frontrunners”, estimated to be 11 percent of the domestic population, are seeking to purchase more sustainable products but price remains a barrier. Dutch “doubters”, who are not yet actively changing or planning to change their consumer behavior (about 35 percent of Dutch citizens), name ambiguity and lack of trust in quality marks as the largest barriers in switching to more sustainable choices.

3. Successfully communicate added value

It is no secret that products do not sell themselves. This is where value communication comes in: It focuses on converting value into revenue by translating the value a product provides customers into a suitable communication strategy. As long as limited regulations are formulated around carbon labeling, organizations and brands are responsible for enabling their customers to recognize the added value of their environmentally-friendly products.

Future of carbon labels: Effective anticipation saves costs in the long run

As the number and popularity of carbon footprint VSS rises, so does the need for food producers to back up their claims with solid evidence. Cooperation between organizations and VSS to enable a standardized footprint analysis is beneficial from an economic standpoint. Additionally, as observed in the development of other similar quality marks, consumer trust is critical for increased adoption and willingness to pay. Consumer trust is proven to be significantly higher with a smaller amount and more widely adopted quality marks. It is likely that we will ultimately move to one or two commonly accepted standards. Betting on the right horse early on will allow organizations to prevent the need to switch to a different standard and save costs in the long run.

Convergence to more standardized and regulated carbon labeling will limit the opportunity for brands to differentiate. Quality marks are likely to move from a niche market to increased main stream adoption in the upcoming decade. The enforcement of carbon labels is highly dependent on regional governmental ambitions, yet carbon taxing is gaining ground on the European social agenda. Carbon Trust research found that 67 percent of consumers agree that a recognizable label for sustainable products is a good idea. With or without public enforcement, growing awareness and willingness to pay for sustainable diet choices creates opportunity for most food and beverage manufacturers present in the Netherlands.