*The insights and recommendations shared in this article are based on the circumstances of April 23rd, 2020

Over four months since the initial outbreak of COVID-19, it is now an established and accepted view that ecommerce is the way to go during intensive restrictions on public movement. Online food retailers in particular have found a way to thrive amidst an otherwise bleak economic outlook. The real question is, what changes to the retail environment are here to stay? Based on the results of our recent survey, we discuss the new face of online grocery shopping in a multi-part article series. In part 1, we share the critical success factors for retailers.

It is unlikely that shoppers who initially engaged in “panic buying” of essential items will fully return to physical store visits in the long term. Exploration of online options during the weeks, or months, of home isolation will ingrain the preference toward convenience. Our recent survey of online grocery shoppers in the UAE and KSA indicates that approximately 25% of online grocery shoppers expect to increase spend as a result of COVID-19. More than half of these individuals are choosing to do so thanks to the added convenience.

Stores will have to adapt their format

While the spotlight is focused on pure-play “etailers”, omnichannel players are likely to weather the storm most smoothly. Deeper integration of formats will enable them to leverage store inventory for online purchases while still being able to offer the ever-so-popular experiential element that customers are likely to crave as the restrictions on movements are eased.

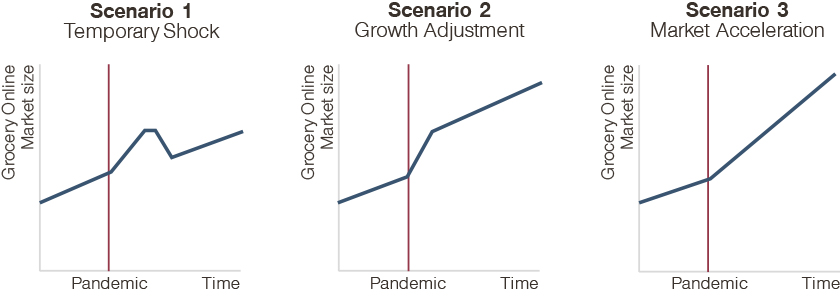

Taking grocery as an example, we have considered three indicative scenarios for the trajectory of ecommerce. Scenario 2 and 3 are more likely to materialize. However, the winners will be businesses that not only offer online sales, but maintain a focus on key priorities for customers even as they struggle to serve the volume of online orders: breadth of product range, rapid delivery, and consistent quality. The economic downturn that has officially shifted toward a recession will also put pressure on wallet size, adding pricing to the growing list of parameters that retailers must optimize. Our survey indicates that 56% of online grocery shoppers in the UAE and KSA are economizing (e.g. hunting promotions and opting for value packs).

Are businesses ready to adapt to changes triggered by COVID-19?

The question on everyone’s mind is, how ready are businesses to adapt? Many retailers in the GCC region have demonstrated that the answer is “not-so-ready”. Amongst the five key parameters for online businesses to consider, several key questions resonate most strongly today:

- Customers: Do businesses have loyalty programs already in place that cater to different customer segments? Businesses that have jumped forward to serve immuno-compromised individuals, for instance, are likely to capture greater loyalty.

- Channel: Physical businesses want to go online, but have they determined if it is more optimal to develop their own online portal vs. partnering with third parties or online marketplaces?

- Product landscape: For retailers with 60,000+ SKUs, which are the ones that should go online? How does this vary across clusters within metropolitan areas?

- Pricing and promotions: Are businesses ready and able to leverage data-driven insights to engage in dynamic pricing?

- Supply chain management: Do businesses have trade terms in place that minimize exposure to procurement risk? How adaptive are retailers to supply chain risks such as food security measures that have seen countries lock down exports of entire crop categories?