Sustainability is now an immutable factor for most businesses to remain relevant and competitive. Our Global Industrials Sustainability study aims to understand how the industrials sector is already monetizing opportunities. We also explored the companies’ own willingness to pay as customers of other B2B products and services. Read more to see what we found out:

Companies are increasingly focused on sustainability and making choices that are good for both the environment and business. But it can be a challenge to strike the right balance between protecting our planet and driving commercial value. Our Industrials Sustainability study shows a substantial opportunity for companies to practice sustainability in a way that does both.

We asked over 1,400 professionals from across the global industrials sector about their preparation and ability to pursue sustainability-related opportunities. Here are our five key findings:

Using sustainable materials is the primary and preferred strategy

Businesses engage in different activities to reduce their CO2 emissions. But the focus is on two key strategies: the use of sustainable materials and innovative technologies. These are respectively the preferred approaches for most companies. Generally, selecting suppliers with low CO2 footprint is not considered as important. And most industries, aside from Chemicals and Semiconductors, do not find purchasing CO2 certificates to be adequate.

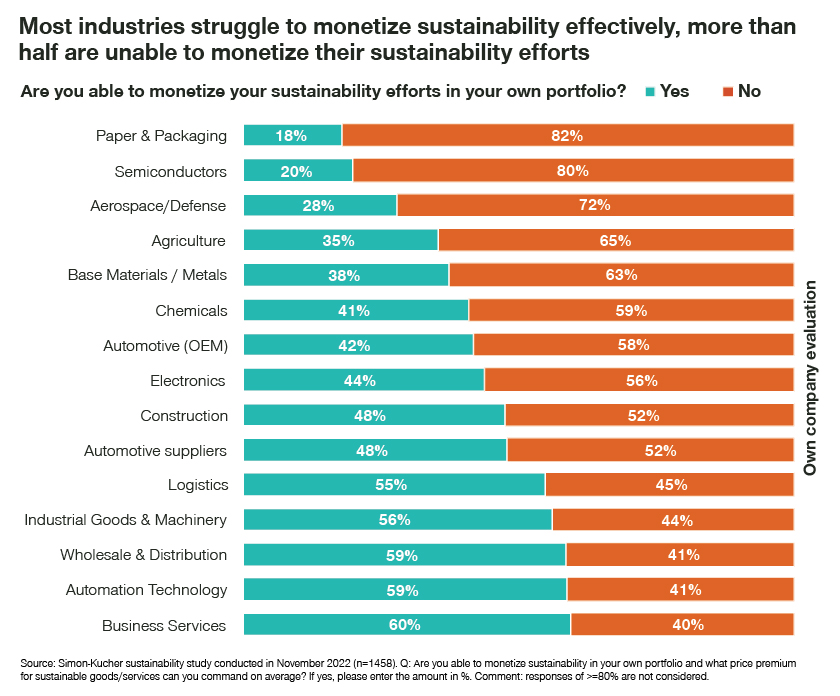

Most industries struggle to monetize their efforts

Although B2B businesses understand the significance of sustainability and embed it into their corporate strategies, our study shows how many are unable to outline their sustainability priorities and capture new market opportunities. Overall, more than half are unable to monetize their efforts. However, there are significant differences between the sectors. Whereas the Paper and Packaging, Semiconductor, and Aerospace and Defense industries have particularly low monetization rates, other industries are much more confident about their ability to monetize green solutions. Across regions, monetization rates are lowest in Europe at 46 percent compared to 55 percent in Asia and 52 percent in the US.

In their role as B2B customers, they expect suppliers to innovate

Successful sustainability efforts cannot be designed just internally. Customers have a clear set of expectations from their third-party suppliers and service providers as they strive to reduce emissions across the whole supply chain. Most participants across all industries recognize the difference between offsetting or certificate purchase only versus measures that truly reduce the carbon footprint. And strategies to reduce CO2 emissions are clearly preferred.

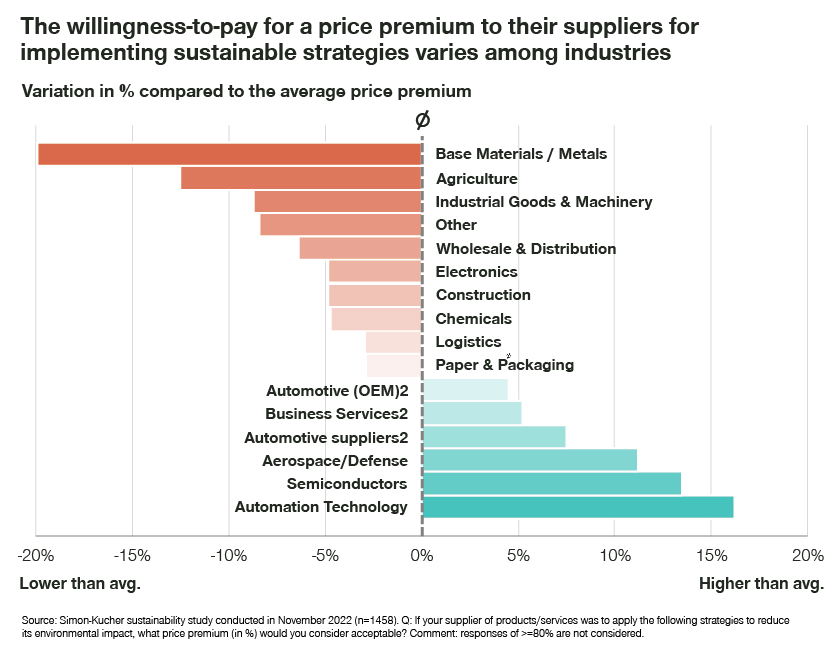

Willingness to pay a premium varies significantly by industry

We found there is a greater willingness to pay in highly technical and innovation-driven industries such as Automation Technology, Semiconductors, and Aerospace and Defence. Automation Technology, for instance, has a 15 percent higher than average price premium across all industries.

However, even within an industry, willingness to pay varies enormously. It is, therefore, important to go into the details and determine for each solution, for example, the total cost/benefit of ownership to the customer. There won’t be any standard solutions with standard prices in sustainability (apart from certificate trading).

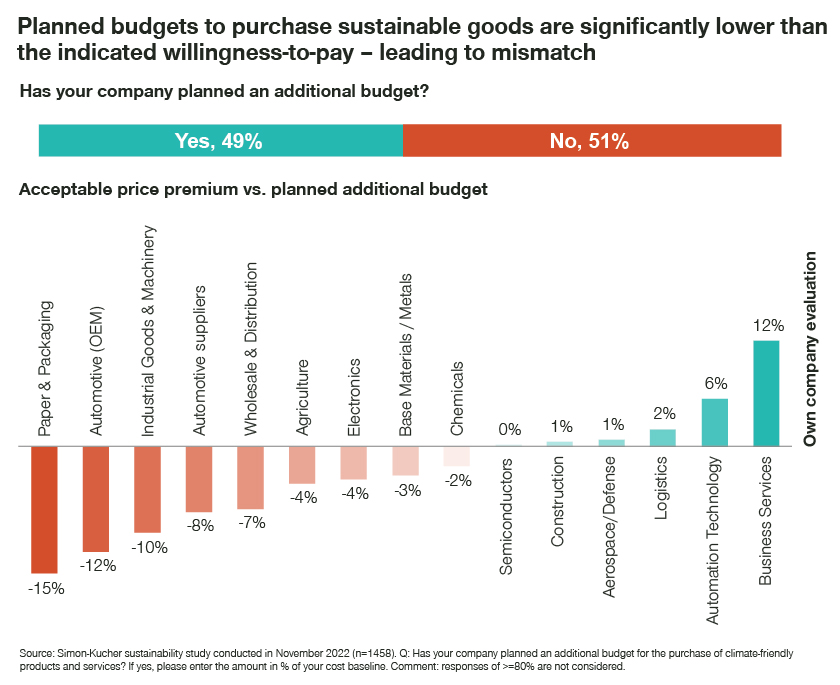

Companies often lack dedicated sustainability budgets

Despite the existence of (partly) significant willingness to pay, a clear gap exists in the companies’ proposed sustainability budgets. More than 50 percent of the surveyed companies do not have a dedicated budget set aside for sustainable products. The disparity between acceptable price premium and planned budget varies across industries. For example, our study found that the Paper and Packaging industry’s planned budget is 15 percent lower than its expected acceptable price premium. Alternatively, in other industries, the budget is even higher than the current willingness to pay.

For a greener future, the time is now

We can see from the study’s results that the B2B sector is increasingly educating itself about sustainability. However, the level of awareness and education amongst companies is still very mixed.

Companies that are early adopters clearly have the first mover advantage. After they push for more sustainability and implement changes in their processes, they have a significant competitive advantage when industry regulators pass green laws that compel markets to adjust.

As customers, B2B companies are clear about the kind of solutions they want to see from their suppliers – and are often willing to pay for them. Since the B2B industry is too varied, a ‘one-size-fits-all’ solution is futile. So, suppliers will benefit from the ability to correctly assess the needs of different subsegments and identify the optimal price for green solutions. It’s a critical factor for the future, especially where customers are more sensitive about sustainability.

To find out more about our Global Industrials Sustainability study, download the full study report.

With the growing importance of sustainability, the B2B landscape across the globe is also changing. There are many opportunities for substantial growth worldwide.

At Simon-Kucher, we have the expertise to help businesses overcome barriers, maximize current market opportunities, and take steps to boost long-term profitability.

If you’re looking to level-up your sustainability business model, reach out to us today.