How will the ACCC Inquiry findings on retail deposit products impact the banking industry in Australia? Read about the report’s implications and the ACCC’s seven recommendations to enhance consumer outcomes and market operations.

The Australian Competition and Consumer Commission (ACCC) recently assessed how banks determine interest rates on retail deposit products. The Inquiry examined the competitive dynamics and consumer outcomes in the supply of deposit products by authorized deposit-taking institutions (ADIs).

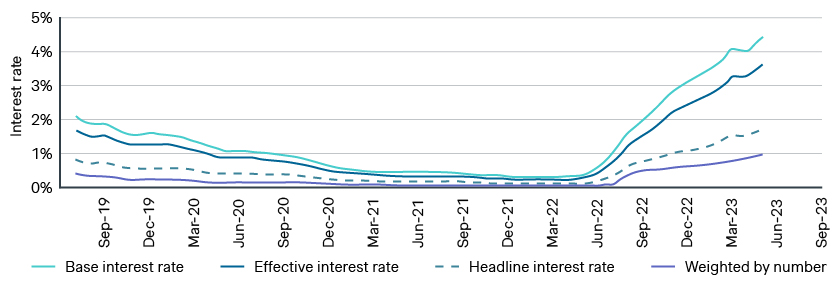

Concerned about the transmission of RBA cash rate increases to savers, the report specifically examined how ADIs adjusted deposit account rates in response to changes in the cash rate target and offered seven key recommendations.

Key findings from the report:

- The retail deposit market is marked by selective and opaque competition, with limited new entrants impacting incumbent banks. While smaller players compete aggressively, their scale requires caution in increasing funding costs. Meanwhile, incumbent banks respond to price competition by retaining high-value customers through targeted pricing strategies, without triggering broad pricing changes that may lead to margin reduction.

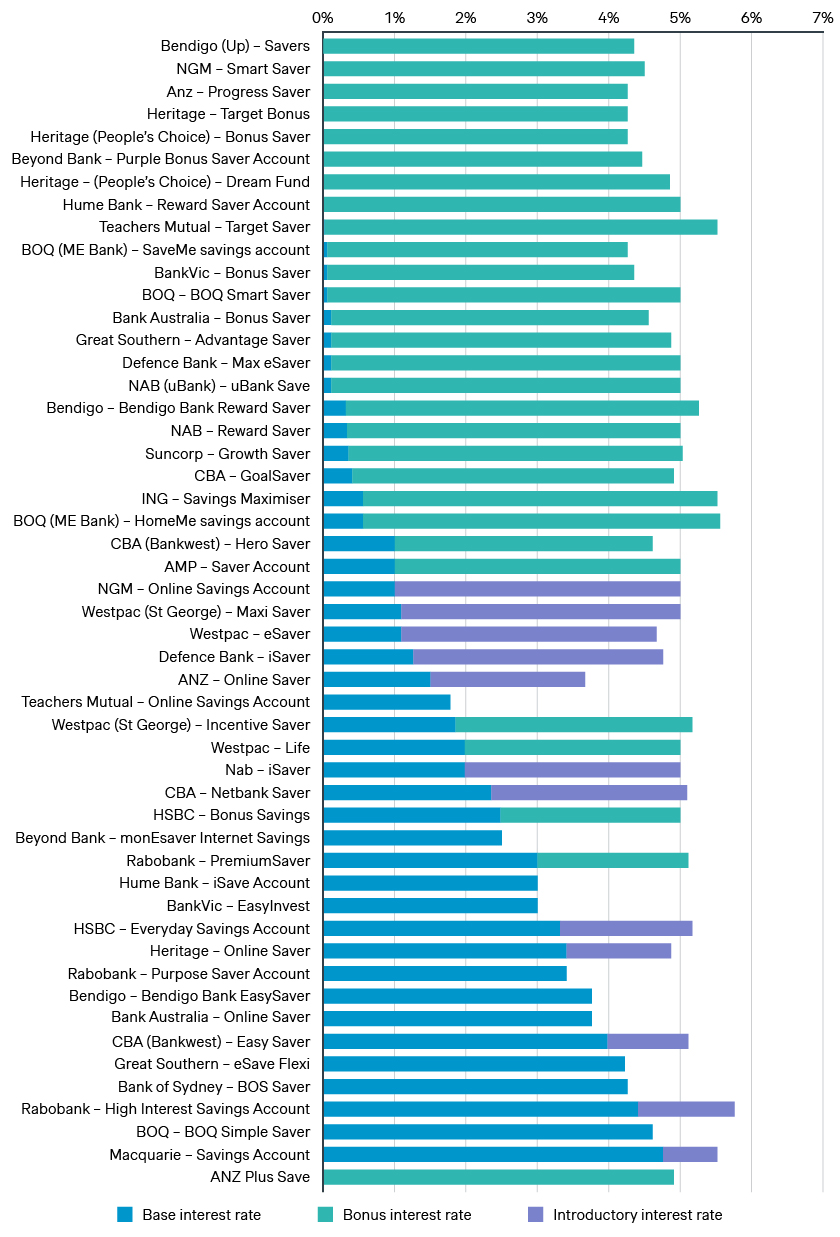

- Strategic pricing for retail deposit products, including interest rates and fees, creates complexity, making it challenging for consumers to compare offerings and make informed decisions. Banks also segment customers with product design and conditional interest rates, creating notable rate variations within comparable products, even within the same bank. This complex structure raises concerns about transparency and fairness, particularly for less engaged customers.

- Consumers face barriers to switching between deposit products, such as changing direct debits, recurring payments, redirecting income, and proving identity. These barriers, combined with customer inertia and low engagement, also mean that customers are holding their savings in suboptimal accounts and missing out on potentially higher interest rates.

- Most bonus interest accounts (71 percent) did not receive the bonus, as per the ACCC report. The conditional nature of bonus rate savings accounts has meant that the effective interest rate received by customers is considerably lower than the headline rates advertised.

The ACCC recommendations and what they mean for banks

The ACCC has put forth seven recommendations aimed at improving customer access to beneficial savings products.

- Continue monitoring prices and competition in the retail deposits market

- Provide customers with alerts to prevent breaching bonus interest rate conditions

- Mandate banks to record and report bonus rate achievement for their products

- Ensure clearer disclosure of introductory interest rates and alternatives

- Notify consumers directly of interest rates changes and prompt them to switch for better rates

- Increase transparency of comparison websites’ commercial arrangements with banks

- Review merits of bank account portability by the Australian Government

The report emphasizes the need for mandatory communication from banks about interest rate changes and alerts to customers regarding potential loss of bonus interest entitlements, addressing concerns surrounding transparency and customer fairness.

The recommendations may influence deposit competition, but this is contingent upon shifts in customer behavior, such as improvements in customer engagement and current inertia.

Anticipated increases in transparency, driven by clearer disclosures of interest rate changes and bonus rate achievements, as well as enhancements in comparison websites, are expected to boost customer engagement and foster increased competition among retail banks. Facilitating easier switching between deposit products in a more competitive environment could lead to higher customer churn. Customers are becoming increasingly sensitive to interest rate changes and product offerings, particularly following introductory periods or rate adjustments. This could make it harder for banks to retain their deposit base, a crucial source of funding, which will require changes to current product offerings and pricing strategies to mitigate the risk.

The proposed changes also have the potential to significantly impact bank profitability, as increased transparency can put pressure on banks to offer more competitive rates and reduce fees to retain customers. Greater customer awareness may result in higher bonus payout ratios and lower margins if banks raise deposit rates to offer more attractive deals for customer retention or if customers actively switch to other deposit products post-introductory periods. However, any increase in deposit rates could trigger higher mortgage rates, as banks aim to maintain Net Interest Margins (NIMs) at current levels. As a result, this can exacerbate cost-of-living pressures for mortgaged customers amidst already elevated interest rates. Alternatively, banks may turn to volatile capital markets for cheaper funding, introducing additional risk in bank portfolios.

Three main opportunities arising from ACCC recommendations

Despite the challenges, the recommendations also present an opportunity for banks to differentiate themselves and take advantage of the increased competitiveness. Key opportunities for banks to capitalize on include:

- Emphasizing customer engagement for stable deposits – Banks can focus on the improved customer engagement to build stronger relationships with their customers and increase loyalty and retention, leading to more stable and predictable deposit bases.

- Creating innovative deposit offerings to attract new customers – The increased competition and heightened customer awareness should incentivize banks to create innovative, customer-focused deposit offerings featuring enhanced features and competitive interest rates. They can attract new customer bases by differentiating from competitors.

- Promoting ethical practices for increased customer retention – By embracing the ACCC's focus on fairness and transparency, banks can demonstrate their commitment to ethical practices, and improve public perception and customer confidence, leading to longer-term acquisition and retention.

Are Australian banks ready? Key questions to reflect on

Banks should consider the following questions to prepare for the recommendations and understand their implications.

- Can we implement the recommendations effectively with our existing resources?

- How will we adapt our pricing and product mix to stay competitive in the new environment?

- Are we prepared for increased competition and potential customer churn?

- How can we mitigate the impact of higher funding costs from increases in effective interest rates and/or bonus payout ratios on profitability?

- What proactive steps can we take to attract switching customers and retain existing ones?

The ACCC retail deposit Inquiry marks a turning point for the Australian deposit market. These findings show that banks need to reevaluate their pricing approaches strategically, as this will impact the P&L. The recommendations, while posing challenges, hold the potential to create a more simplified, transparent, competitive, and fairer landscape for consumers.

If you would like to speak to our team about how you can apply these recommendations to improve your business or what these could mean for your bank, then get in touch with us today.