Medical innovation is advancing faster than most health systems can fund. With rising life expectancy and a growing burden of NCDs, that gap is increasingly visible in Southeast Asia. At the Simon-Kucher Southeast Asia Innovative Financing Roundtable, leaders from across healthcare, pharma, and private insurance discussed how better partnerships could make access more equitable for patients and create funding models robust enough to last.

Southeast Asia’s health systems are straining under the weight of unmet patient needs. Economic growth has lifted incomes and awareness among the middle class, but access to timely, high-quality care is unevenly distributed. The pandemic exposed how underprepared many healthcare systems were for ongoing, long-term care.

As deferred treatment returned, many private health insurance plans saw higher use than they had priced for, pushing costs up for everyone at unsustainable levels. At the same time, government budgets, already stretched thin, have limited flexibility to fund new health priorities, leaving households to pay more out of pocket. While private health insurance may not address healthcare challenges for all, it can bridge part of the affordability gap in emerging markets, but only if it evolves beyond its traditional, reactive role.

Partnerships will be critical. The ecosystem exists – insurers, providers, regulators, manufacturers – but each still operates largely in silos. Collaboration is hardly a new idea, yet across much of Southeast Asia, it remains more principle than practice. Aligning public priorities with private capabilities is now the region’s most urgent health financing task.

The economics of equitable access

Modern medicine is advancing faster than the systems that finance it. Health infrastructure built for occasional, hospital-based treatment was never planned for the continuous, distributed care patients now expect. In short, funding models have not kept up.

Access will only improve when financing models reflect this new reality. That means aligning pharma, insurers, and other stakeholders around sustainable ways to pay for treatment as it happens, not just when illness peaks.

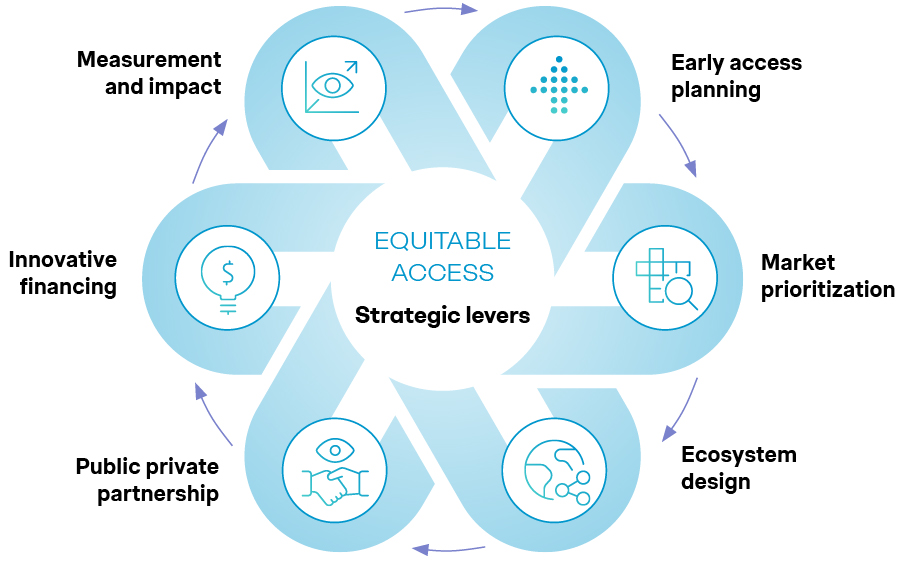

Equitable access demands more than goodwill. It requires strategy, investment, and clear priorities. Our Equitable and Sustainable Access framework identifies six levers that help close this gap: early integration, market prioritization, ecosystem design, public–private partnership, innovative financing, and impact measurement. These are outlined in detail in our whitepaper: Equitable Access in Emerging Markets.

Among these, partnerships and financing matter most. Governments cannot fund universal care alone; private insurers and the healthcare industry can assume part of both the risk and the reach. The opportunity is there, but successful implementation and scaling call for a complete overhaul: mapping stakeholder interests, sharing data, and designing products to match how people actually seek medical care.

Source: Simon-Kucher insights

Why good ideas don’t always scale

Partnerships fail when new ideas are forced into old frameworks. In practice, coordination – rather than intent – is what limits progress, particularly in emerging markets. A lack of data sharing is one symptom: without it, governments and insurers cannot price risk, design products, or plan policy.

Even in markets with strong infrastructure, misalignment persists. Digital and data play a crucial role. In some countries, the healthcare system has implemented Electronic Health Records; however, these are locked for clinical use only or held by governments as the custodians of the data. That separation limits how valuable, real-world evidence can shape actuarial pricing or broader health policy insight.

Stakeholders agree on the access problem but view it through narrow lenses, optimizing within their own lanes. This produces fragmented insurance constructs that rarely scale.

The future lies in purpose-built private health insurance partnerships that are modular, disease-specific, and priced to match real patient journeys. When insurers and pharma collaborate early to design coverage that spans prevention, screening, and treatment, they not only manage risk more dynamically but bring predictability to patients’ costs. This requires early collaboration between insurers and pharma. True progress happens when these partnerships are grounded in patient needs, informed by data, and sustained through financial discipline.

Early examples around the world show what’s possible when those silos are broken down. In Japan, a global insurer and a healthcare company redesigned breast cancer coverage to remove screening barriers, pairing access with tailored insurance benefits. The government in China established a multi-tier insurance framework blending public and private coverage. In Vietnam, pharma companies have co-designed products with private insurers and third-party administrators to match actual usage.

Mapping stakeholder interests: The missing discipline in emerging market healthcare

Any collaboration that hopes to scale, begins with this question: whose problem is being solved, and how do interests align?

Pharma: Seeks faster and broader reach but typically focuses on emerging markets too late in development. Embedding value and affordability earlier in R&D creates clearer propositions and realistic price points. Without it, new therapies can struggle to gain traction or deliver sustainable access.

Insurers: Need financially viable, scalable products that can be easily executed in practice. In addition, the lack of data on real-world outcomes makes it difficult to price risk accurately. Shifting from ticket-size metrics to preventive-care value could improve outcomes within existing cost structures and customer bases.

Governments: Must work with available resources while meeting rising expectations for broader coverage. In many markets, public funds focus on the most vulnerable, while private insurance could increasingly complement coverage for higher-income groups. Yet weak coordination and minimal data exchange policies compounds inefficiencies and push spending beyond sustainable limits.

Regulators: Protect patients and preserve system stability but usually move at a different pace than the market. When rules shift too fast or lag behind medical progress, pricing models unravel and patient access narrows. What’s needed is not tighter control but consistent coordination through early data sharing and ongoing dialogue.

Providers: Aim to improve patient outcomes but are incentivized for volume, not value. Replacing fee-for-service models with payment systems that reward prevention and efficiency is the foundation of real reform.

Patients: Ultimately are caught between innovation, access, and cost. In markets dominated by copays or out-of-pocket spending, treatment decisions are driven as much by financial strain as by medical need. Education, transparency, and affordability must converge for access to be meaningful – in practice and not just policy.

Mapping these interests early clarifies who pays, who benefits, and what trade-offs each player must make before products are priced or policies are launched. In emerging markets, where sustainable healthcare financing ecosystems are more fluid, this step is indispensable. Otherwise, healthcare partnerships default to short-term pilots and good ideas fail to scale.

From pilots to building private health insurance partnerships that last

Around the world, small pilots show the feasibility of multi-stakeholder models. The challenge now is to scale.

Key design principles for scaling

- Build an end-to-end approach across the patient journey

Insurance design works best when it is scalable and follows the full patient journey, from prevention and screening to diagnosis, treatment, and follow-up. When benefits mirror each stage of care, patients move through the system faster and face fewer cost surprises.

End-to-end product design also reduces waste. Annual or monthly limits can delay treatment, while inpatient-only benefits encourage unnecessary hospital stays. Broad covers often miss where patients need support most. For insurers, pricing tied to the care pathway, not arbitrary categories, makes costs more predictable, risk easier to manage thus ensuring broader reach.

Making it work

Start with a benefit map in clinical language: screening done, diagnosis confirmed, treatment started, follow-up arranged. Payment triggers should be simple, auditable, and flexible enough to cover various patient segments, including those that require day-surgery and home-based care, and not solely hospitalization vs. outpatient benefits as is currently structured by existing insurance plans.

- Create modular, scalable products that address real health needs

A better approach starts with a simple base of protection that improves access for all, then builds modular add-ons for prevention, outpatient care, or disease-specific needs. Modular products also make it easier for insurers to scale and communicate value clearly: each component is simple to explain, adapt, and sell across markets.

Engaging policyholders through small, proactive commitments, such as completing screenings or arranging follow-ups, can strengthen both outcomes and accountability. This approach keeps the foundation stable while giving patients clearer choices and payers room to innovate responsibly.

Making it work

Design products around clear, essential needs and deliver them through low-cost digital channels. Add modular options as demand builds. Align incentives across regulators, insurers, and distributors to enable scale and trust.

- Encourage data sharing to price new therapies fairly

New therapies can be covered sustainably when prices reflect evidence. Combining clinical outcomes, claims data, and electronic health records in a shared, secure environment allows doctors, pharmaceutical companies, and actuaries to work from the same facts.

When that happens, early price estimates fall within ranges that families can afford and insurers can sustain, while uncertainties in clinical evidence are addressed. Data exchange also enables a financially aligned framework, where each actor sees value whether through risk-sharing or prevention-led cost reduction. Regular reviews then keep prices aligned with real-world results, so patients are not charged for risks that never occur.

Making it work

A lean dataset covering eligibility, stage at diagnosis, treatment paths, outcomes, and usage is a strong foundation. Agreements that specify data protection and the frequency of results review keep collaboration credible. Transparent price updates, backed by evidence, build both affordability and trust.

- Establish a financing risk framework for sustainability

A sustainable healthcare system depends on distributing financial risk across all key stakeholders. Governments can define the structure advocating for scale, insurers provide core coverage, patients contribute through co-payments, and industry partners can help close remaining gaps. Shared accountability strengthens system resilience while maintaining access to essential treatments.

Some markets, recognizing the limits of public funding, have brought together regulators, investors, manufacturers, and patient groups to redesign cost sharing. Through clear funding ratios, data-driven decisions, and coordinated support along the care pathway, these models spread risk more evenly and make innovation affordable without exhausting public budgets.

Making it work

Agree early on transparent cost-sharing principles. Use real-world data to calibrate contributions and ensure accountability as models scale.

Private insurance and the future of sustainable health partnerships

Across emerging markets, the test of healthcare systems will be whether partnerships can move from pilots to scale. Those that prove coordination, transparency, and shared risk can work will define how access is financed in the coming years.

The most effective pilots focus on a country approach, target a single disease area or patient thread, and follow it end to end, mapping both the clinical and financial journey. Pharma already traces patient pathways; the next step is to add cost. Linking care milestones to real expenses makes pricing realistic for insurers and feasible for payers, while proving that prevention, screening, and treatment can be priced together to manage cost and improve outcomes.

Early movers will carry risk, but that can be shared through pilots where cost, data, and recognition are distributed across partners. Governments can strengthen this process by setting clear guardrails and frameworks for collaboration.

Emerging markets have fertile ground for such partnerships, but progress will depend on country-led strategies. Each market’s regulatory landscape and financing mix differs, so pilots will need to align with national health priorities, from supplementary insurance tiers to benefit standards and public–private delivery networks. Governments and regulators will provide structure, while the private sector brings innovation, capital, and operational agility. The outcome will not be privatization but co-created capacity that accelerates access and equity.

The future will belong to partnerships that make both economic and social sense for every player: governments that enable, payers that share risk, providers that deliver value, and patients who can afford better care and outcomes. When collaboration moves from principle to practice, emerging markets will then be defining what sustainable, equitable healthcare models look like.

Contact us to continue this conversation.