New Medicare MFPs (Maximum Fair Price) are now public. We compare these negotiated prices with MFN (Most Favored Nation)-style international benchmarks and assess what it means for the future.

Even those outside the United States are aware of Black Friday, the tradition of deeply discounted sales on the Friday after Thanksgiving as retailers try to get a quick jump on the holiday gift giving season. This year, the Centers for Medicaid and Medicare Services (CMS) got into the action with their Black Friday sales after the results from the latest round of negotiations as part of the Inflation Reduction Act (IRA).

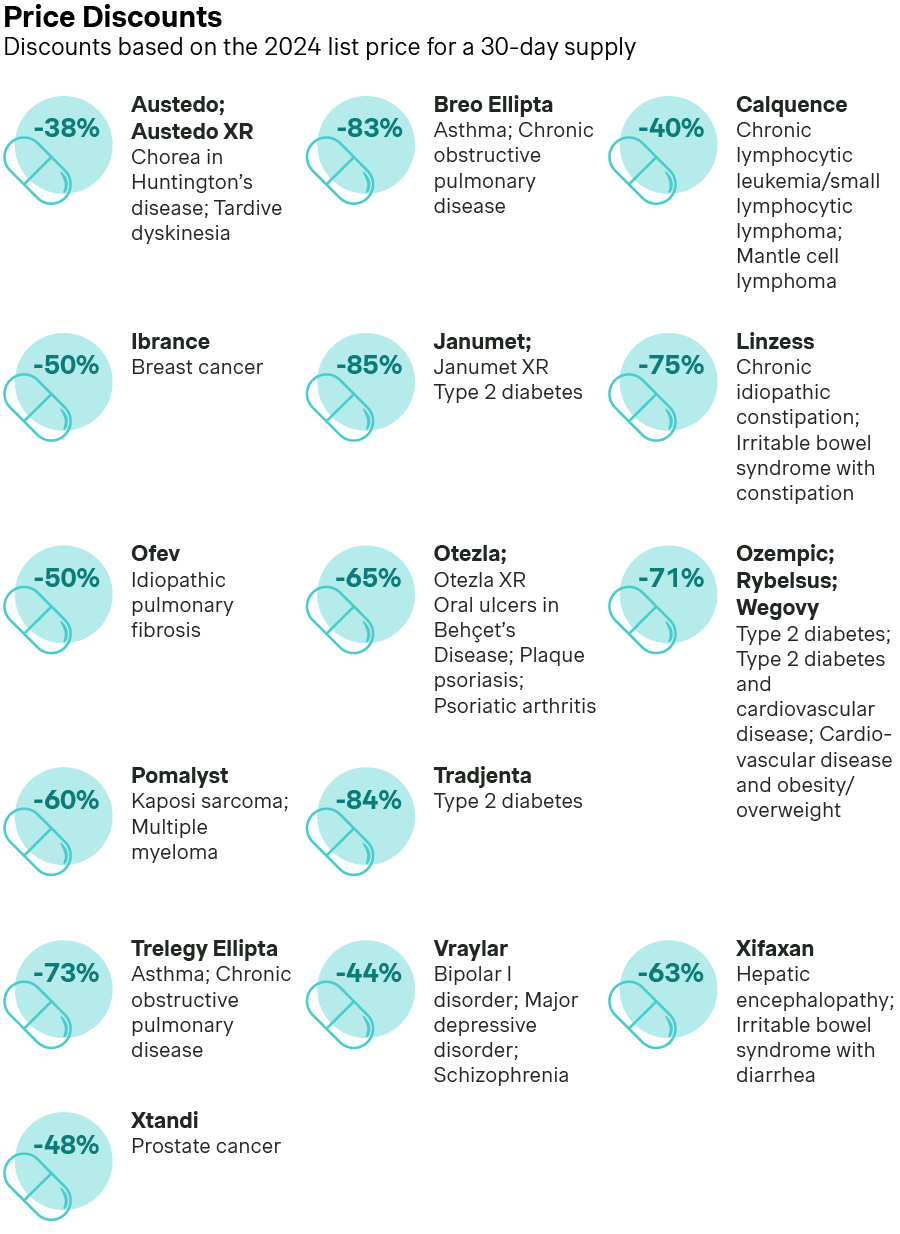

Earlier this year, CMS selected 15 drugs to negotiate a Maximum Fair Price (MFP) based on Medicare spending, time on the market, and a number of other criteria according to the statutes laid out in the IRA. The license holders of these drugs were notified in February of this year and went through a negotiation process that concluded at the beginning of November. The results of those negotiations were required to be released no later than November 30th, but CMS decided to release them a few days early as they did in 2024. The discounts on these drugs relative to their Wholesale Acquisition Cost (WAC) ranged from a low of 38% to a high of 84%.

Source: New Lower Drug Prices Under the Medicare Drug Price Negotiation Program

Inside the MFP negotiation process

As described in the statute, CMS developed an initial offer for each drug, and the manufacturers and CMS traded offers and counteroffers over the course of three meetings and additional interaction points outside of those meetings. In eight out of the 15 cases, CMS and the manufacturers came to an agreement on a price before the statutory deadline.

However, in the final seven cases, CMS issued a ‘final offer’ to the manufacturers which they accepted by the statutory deadline. Unfortunately for manufacturers, failing to accept the ‘final offer’ for their drug doesn’t only mean that the drug under negotiation would be ineligible to be reimbursed through Medicare, but that all of the manufacturer’s drugs – even those not up for negotiation – would also no longer be eligible for reimbursement under Medicare. In terms of negotiating power, this is quite the trump card.

Rising focus on MFN pricing

Few things in pharmaceutical pricing and market access have dominated the news over the past several months, or ever, than the topic of ‘Most Favored Nation’ pricing. This is an initiative by the White House to bring the prices paid for pharmaceuticals by Americans and the U.S. government more in line with the prices by ‘similar’ countries outside the U.S.

As part of the recently announced GENErating cost Reductions fOr U.S. Medicaid Model (GENEROUS), participating manufacturers must offer a price to Medicaid that is no lower than the second lowest price from a basket of countries from the Organisation for Economic Co-operation and Development (OECD). These markets are Germany, France, Italy, the UK, Japan, Canada, Switzerland, and Denmark. As described in the demonstration project, the average price from each market is adjusted based on the GDP – purchasing power parity of each country.

How MFP outcomes compare to potential ‘MFN prices’

While international reference pricing is not a formal part of the process for IRA negotiations, we thought it would be interesting to nevertheless compare the prices from the recently announced MFPs to what a theoretical ‘MFN price’ would look like (Table 1).

| Brand name | Generic name | MFP Discount | MFN Discount | Reference country |

|---|---|---|---|---|

| Breo Ellipta | fluticasone, vilanterol | -83% | -90% | France/Switzerland |

| Calquence | alacabrutinib | -40% | -61% | Denmark |

| Ibrance | palbociclib | -50% | -85% | France |

| Janumet | metformin, sitagliptin | -85% | -84% | Denmark |

| Janumet XR | metformin, sitagliptin | -85% | -76% | Canada |

| Linzess | linaclotide | -75% | -89% | Switzerland |

| Ofev | nintedanib | -50% | -84% | Denmark/Switzerland |

| Otezla | apremilast | -65% | -87% | Denmark/France |

| Ozempic | semaglutide | -71% | -87% | Denmark/Switzerland |

| Pomalyst | pomalidomide | -60% | -64% | Canada/Japan |

| Tradjenta | linagliptin | -84% | -92% | Denmark |

| Trelegy Ellipta | fluticasone, umeclidinium, vilanterol | -73% | -88% | Germany/Japan |

| Vraylar | cariprazine | -44% | -91% | Canada* |

| Wegovy | semaglutide | -71% | -73% | Canada |

| Xifaxan | rifaximin | -63% | -87% | Canada* |

| Xtandi | enzalutamide | -48% | -73% | Denmark/Italy |

*Lowest price as they are currently only launched in one reference market

As part of the GENEROUS model, manufacturers must self-report the net prices after all discounts and rebates. There are a lot of details still to be communicated as to what a ‘net price’ is, but for this analysis we simply used the list ex-manufacturer price, net of all statutory/mandated discounts. Any confidential discounts were not considered for this analysis.

In addition, the details of how the exact MFP prices are effectuated across different SKUs can be quite complicated, and a more thorough analysis of these numbers still needs to be done. However, at a high level, we see that for three of the products, Wegovy/Ozempic, Janumet/XR, and Pomalyst the MFP discount from WAC is fairly close to what an ‘MFN price’ would be – once again, simply looking at the list ex-manufacturer price. For eleven products, the CMS-negotiated MFP is considerably higher than what an ‘MFN price’ would be using the model laid out in GENEROUS. One product, Austedo/XR, is not available in the reference markets and could therefore not be analyzed.

What these early signals mean for the future

As mentioned above, international reference pricing is not part of the negotiation framework for CMS as part of the IRA. However, if it were, we can see that it would have resulted in greater discounts for the Medicare Part D program.

Our Simon Kucher “Center of Excellence for MFN” will continue to follow all developments around Most Favored Nation pricing and its potential impact on all channels in the United States. Stay tuned!