Just twelve months ago, value creation conversations were dominated by “what’s our digital angle?” AI pilots were everywhere, but most amounted to hope, hype, and hack. This year, the mood has shifted: AI has matured into a lever firms now feel real pressure to deliver impact on. Our Industrials and Business Services Value Creation Study 2025 reveals a clear turning point in how investors view digital, and specifically the application of AI and GenAI.

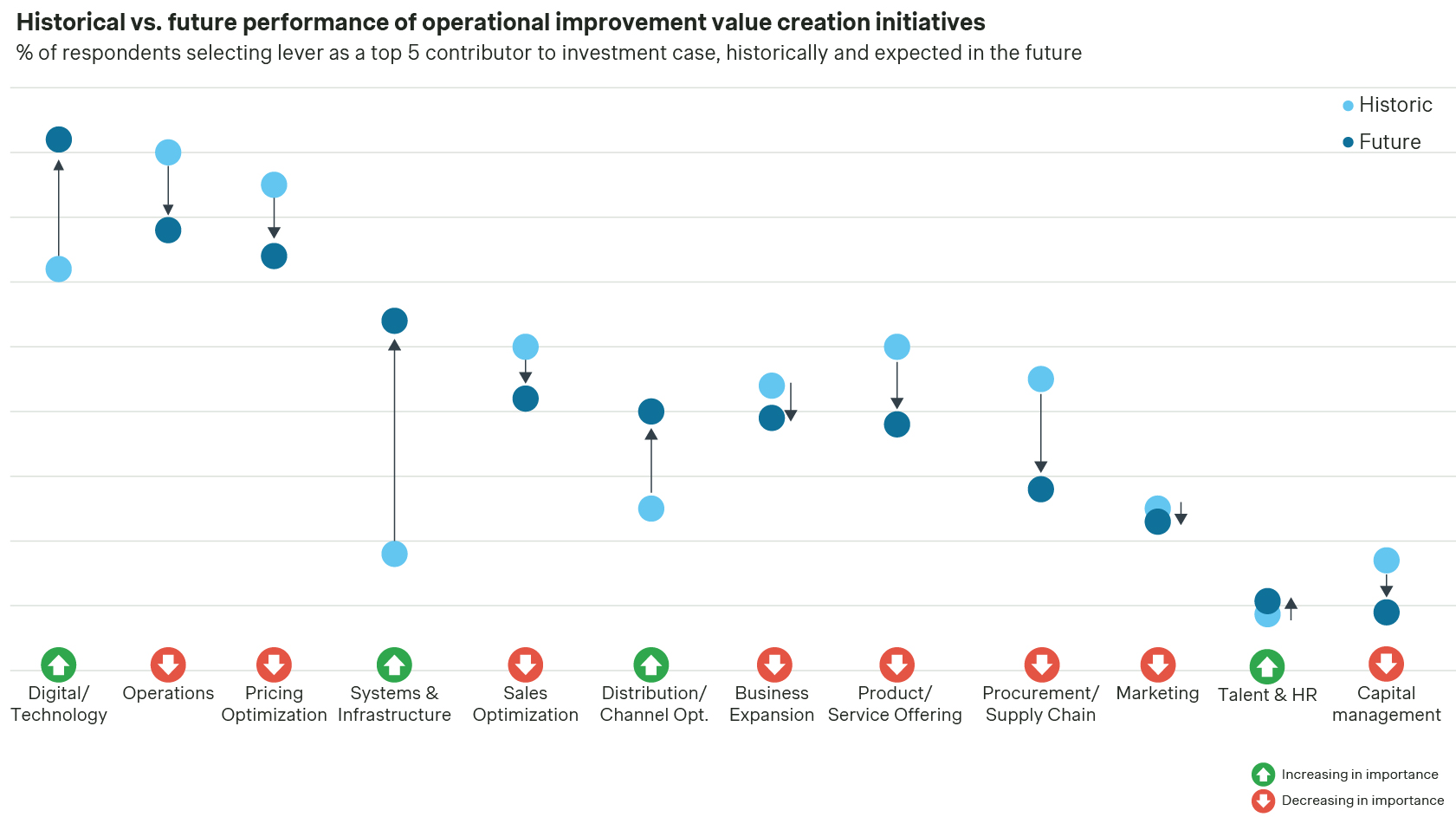

Operations and pricing still dominate today’s value creation agenda, offering the fastest, most reliable paths to margin improvement. But looking forward, these levers are overtaken by digital, with 82% of respondents in our 2025 Industrial and Business Services Value Creation Study naming digital a top contributor to the investment case going forward. Operational excellence remains essential, but the differentiator in the next phase of value creation will be how effectively firms layer digital on top of operational strength.

What’s equally striking is the rise in systems & infrastructure, historically seen as more of a back-office enabler, now being recognized as a critical prerequisite for making digital work. Companies are realizing you can’t just drop AI on top of a business and expect results; you need clean data, integrated systems, and the right digital foundation.

AI: a crucial lever in the digital toolkit

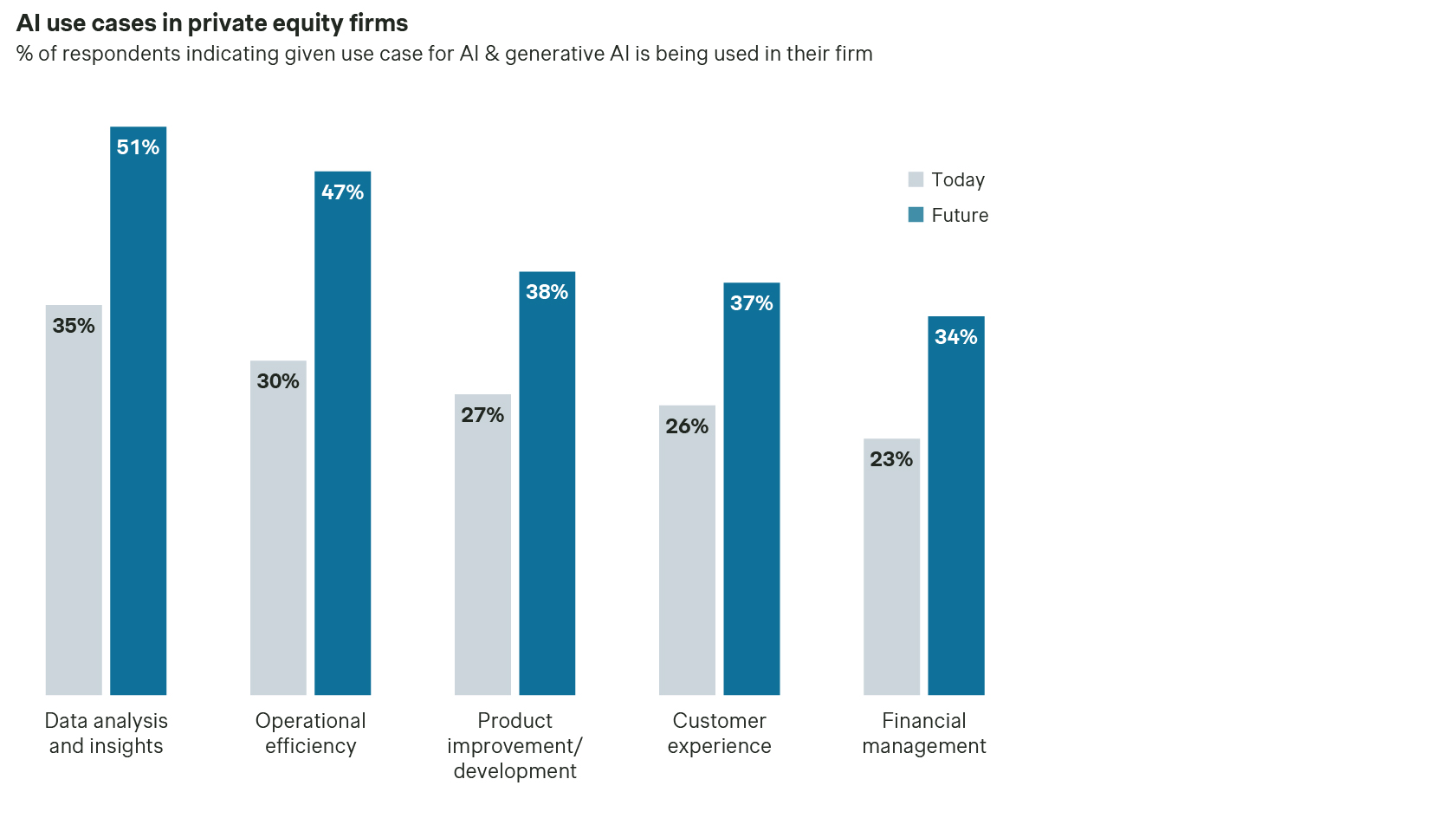

AI is already playing an increased role in value creation, especially in data analysis and insights. Today, 35% of PE firms use it here, but that number is expected to jump to 51% in the future. The same pattern shows up in operational efficiency, where adoption is set to rise from 30% today to 47%.

The AI journey in industrials

If you’re in tech or software, the use cases are obvious and the adoption curve is fast. But in industrials, you can’t just flip a switch and suddenly have AI embedded across a legacy manufacturing footprint or a global salesforce that’s been working the same way for 20 years. Progress is more incremental, and the journey up the AI Maturity Curve looks very different.

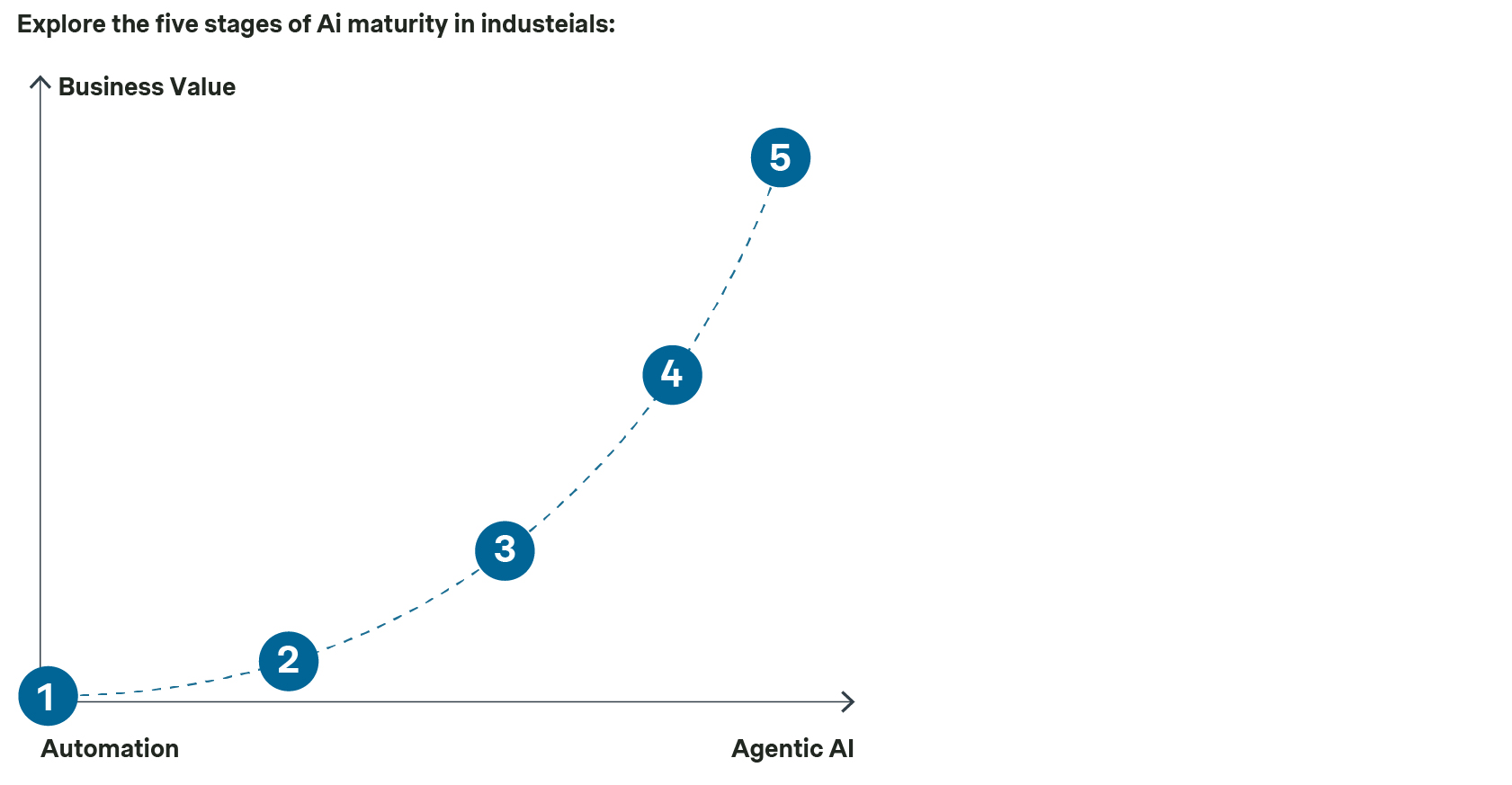

Our curve shows five distinct stages: from basic automation (stage 1), to machine learning (stage 2), into human-AI hybrid models (stage 3), then generative AI (stage 4), and ultimately agentic AI (stage 5).

Most industrials today are clustered at the early stages, using AI primarily for automation and efficiency. But AI’s role expands well beyond efficiency. The real business value accelerates in the later stages, where AI shifts from cost savings to revenue generation. Firms expect much greater impact in product improvement and development (growing from 27% to 38%), customer experience (26% to 37%), and financial management (23% to 34%). These areas point to the next wave of AI-driven value creation: moving from back-office and operational use cases into commercial and strategic levers that directly shape revenue and margins.

The maximum value depends on the type and frequency of decisions a company makes, and plays out differently across subsectors:

Industries with high, repetitive decision volume (like chemicals, logistics, and manufacturing) see immediate gains in areas such as forecasting accuracy, process automation, and predictive maintenance.

Industries with complex pricing models or customer interactions (like machinery, components, or industrial services) require a more structured approach. Here, the focus is on building trust in AI-driven decisions, from pricing to customer engagement, before adoption can truly scale.

For most industrial companies, the AI journey begins with efficiency. And for good reason: AI-driven process optimization can deliver double-digit cost savings and is relatively easy to implement, with clear ROI and low risk. But efficiency alone won’t define the winners of tomorrow. The next phase of AI adoption must move beyond cost reduction and into topline growth. That means not just doing things cheaper, but using AI to fuel entirely new offerings, differentiate products and services from competitors, and tap into markets that were previously out of reach.

For many industrial and business services firms, this also requires evolving their monetization approach, from deciding which markets to target, to selecting the right price model, to enabling sales teams to deliver on new AI-enabled offerings. In business services especially, sub-verticals are already grappling with how to future-proof traditional input-based revenue models in light of efficiency gains.

Many firms are partnering with specialists who can translate digital into the industrials context: Experts who know how to connect the technology with commercial outcomes, operational improvements, and the realities of execution on a factory floor or in a traditional sales channel.

Turning AI from hype to impact with Simon-Kucher

At Simon-Kucher, we help private equity investors and portfolio companies move beyond AI buzz and pilots, embedding use-case driven AI strategies that deliver measurable business impact. Our focus is on concrete use cases, ensuring faster impact. Each initiative is directly tied to a clear benefit, whether that’s immediate cost savings or monetizable new offerings.

Crucially, our approach avoids the common “waterfall” mindset of building all the infrastructure and cleaning all the data before any value is delivered. Instead, we start with the AI use case itself, clean only the data that’s required, and scale infrastructure over time, moving from proof-of-concept and MVPs to fully scaled, production-ready AI that drives sustained value.

Our AI and GenAI framework:

Readiness and strategy: We assess organizational readiness, identify risks, and align AI ambitions with commercial priorities.

Prioritization: We generate and evaluate use cases across the value chain, ensuring AI investments target high-value, feasible opportunities.

Pilots with purpose: We design and launch minimum viable pilots within weeks, validating ROI against clear KPIs.

Scale and sustain: We industrialize successful use cases, embed governance and operating models, and ensure AI adoption sticks across teams and processes.

AI is not just an experiment, but a driver of EBITDA uplift, margin protection, and new revenue growth.

Interested in our 2025 Value Creation Study results in more detail?

Form placeholder. This will only show within the editor