Form placeholder. This will only show within the editor

When it comes to value creation in industrials and business services, the old reliance on multiple expansion and financial engineering is giving way to something more tangible: operational excellence. While operations have always been part of the PE playbook, they have now become the primary engine of value, outpacing every other lever. Our latest Industrials and Business Services Value Creation Study reveals a decisive shift in how investors drive returns.

PE in industrials has been forced into a reality check over the past few years. When capital was cheap and growth looked endless, you could underwrite a story around pricing or expansion and rely on multiple arbitrage to do a lot of the work. Today, with inflation, tariffs, and rates where they are, that story doesn’t build conviction.

Our study confirms what many are already experiencing: operational improvement has surged to the top of the value creation agenda. It’s the lever investors trust because it’s tangible, bankable, and shows up quickly in the numbers.

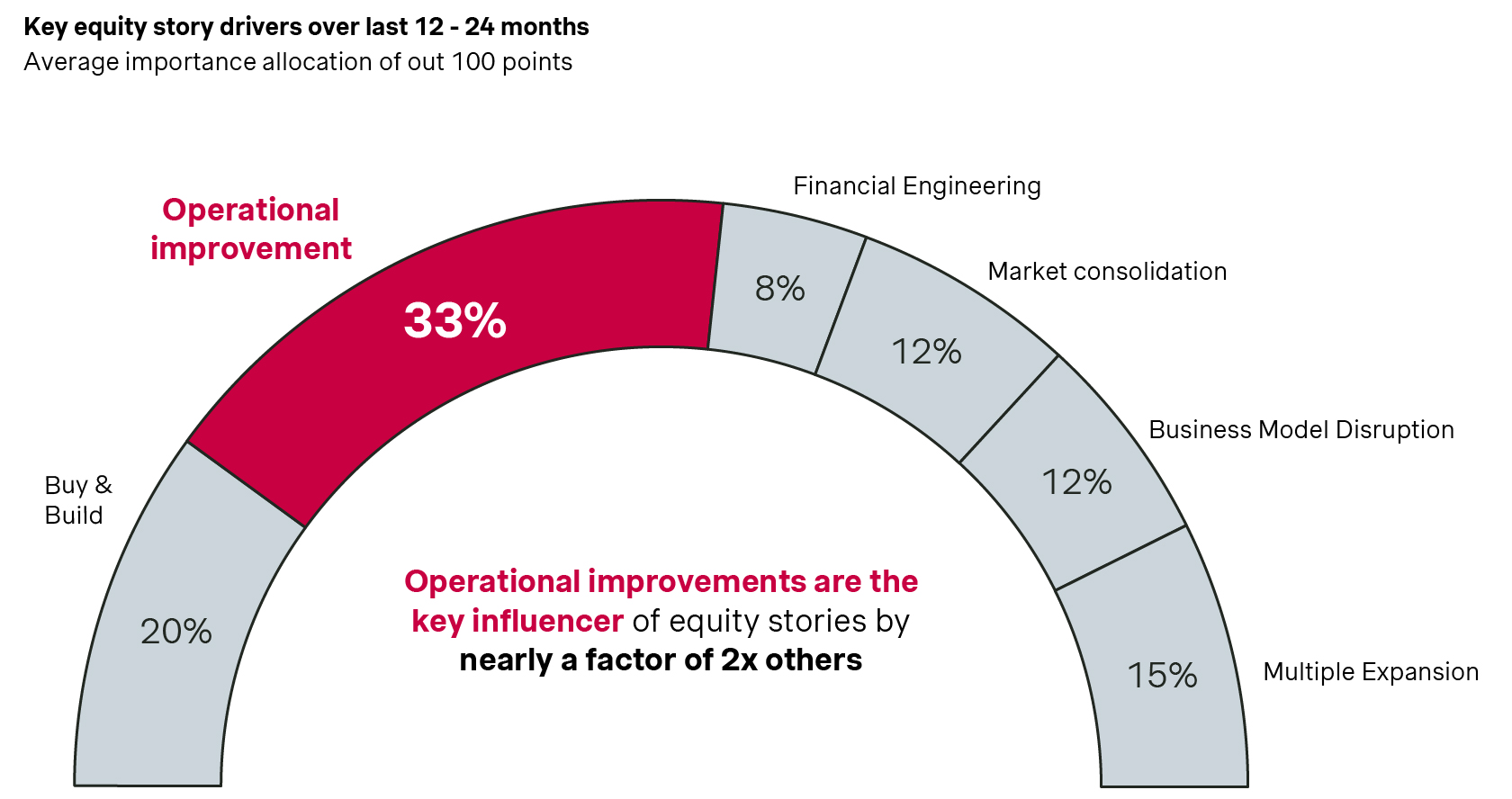

The figures are stark: 33% of deal teams and operating partners allocate importance to operational improvements in driving the equity story, almost double the next lever (Buy & Build at 20%) and far ahead of things like consolidation, disruption, or financial engineering.

What this tells is the story of a move away from levers that either depend on market conditions (multiple expansion, consolidation) or capital structures (financial engineering), toward levers that are within management’s influence. In an environment defined by volatility, you bet on what you can control, and that’s execution in operations.

Raising the bar in diligence

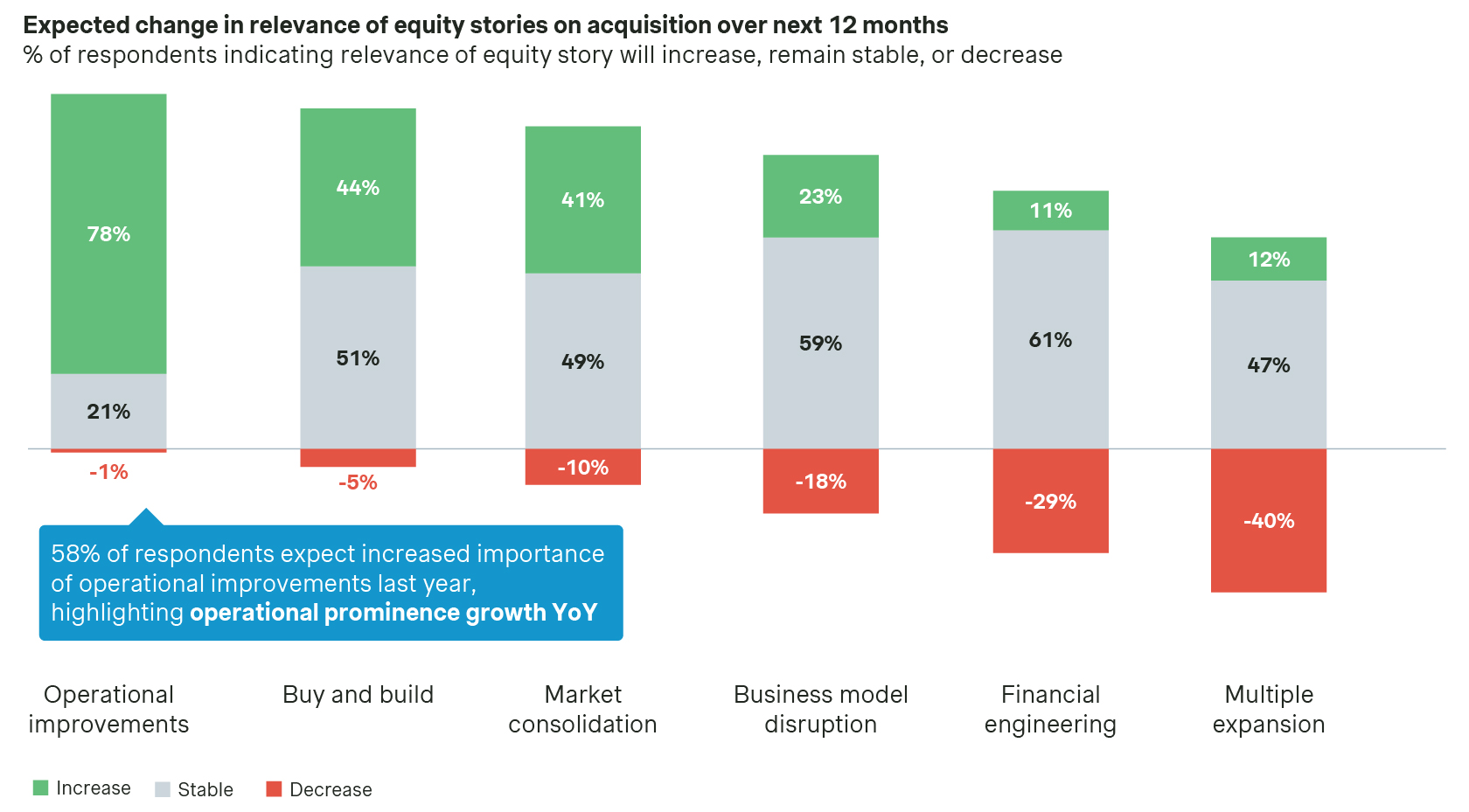

78% of respondents expect operational improvements to grow in importance over the next 12 months – a 20% increase over the previous year. Anyone not embedding operational rigor into diligence and post-close execution is already behind.

It’s no longer enough to validate the market and the fit. You need to go deeper. That means testing how disciplined a company really is: can it enforce pricing, execute sales, and support growth with scalable marketing?

Pricing, sales, and go-to-market efficiency should be assessed during diligence and prioritized from day one. Knowing where the cracks and opportunities are early on makes it possible to move faster on the initiatives that matter most.

Execution is the differentiator

An alarming 67% of initiative failures come from controllable reasons. That means the majority of underperformance isn’t about macro shocks, geopolitical risk, or tariffs but about execution discipline.

This breakdown tells the story:

Poor implementation (53%): Failures in planning, resourcing, and management. In other words, the strategy was fine, but the execution engine wasn’t there.

Unrealistic business case (37%): Targets that were too optimistic or based on shaky assumptions. This is where better diligence and sharper underwriting could have prevented issues.

PortCo resistance (35%): Lack of alignment or buy-in at the portfolio company level. This is where change management and capability building come in; if the people on the ground aren’t committed, the plan stalls.

Industrials aren’t easy environments to shift. They’re often long-tenured workforces, analog processes, and legacy systems. Building capabilities means not just telling people “this is the new way,” but making sure they have the structure, the KPIs, and the reinforcement to internalize it.

Change management, which sometimes gets dismissed as “soft,” is actually financial in nature: it’s the enabler that ensures the operational improvements you underwrite show up in the numbers.

Data is critical too. You can’t manage what you can’t measure. When companies don’t have visibility on their true margins, their pricing leakage, or their supply chain inefficiencies, no amount of strategy will fix it.

What creates durable value in industrials is when strategic choices are translated into tools, processes, people, and behaviors that keep delivering after the initial push. With cycles volatile and capital costs higher, exit multiples are rewarded most when operational excellence is embedded.

Value creation has become iterative, not linear

Another interesting development: our survey indicates a move from static, company-by-company value creation plans to something much more dynamic, agile, and portfolio-driven.

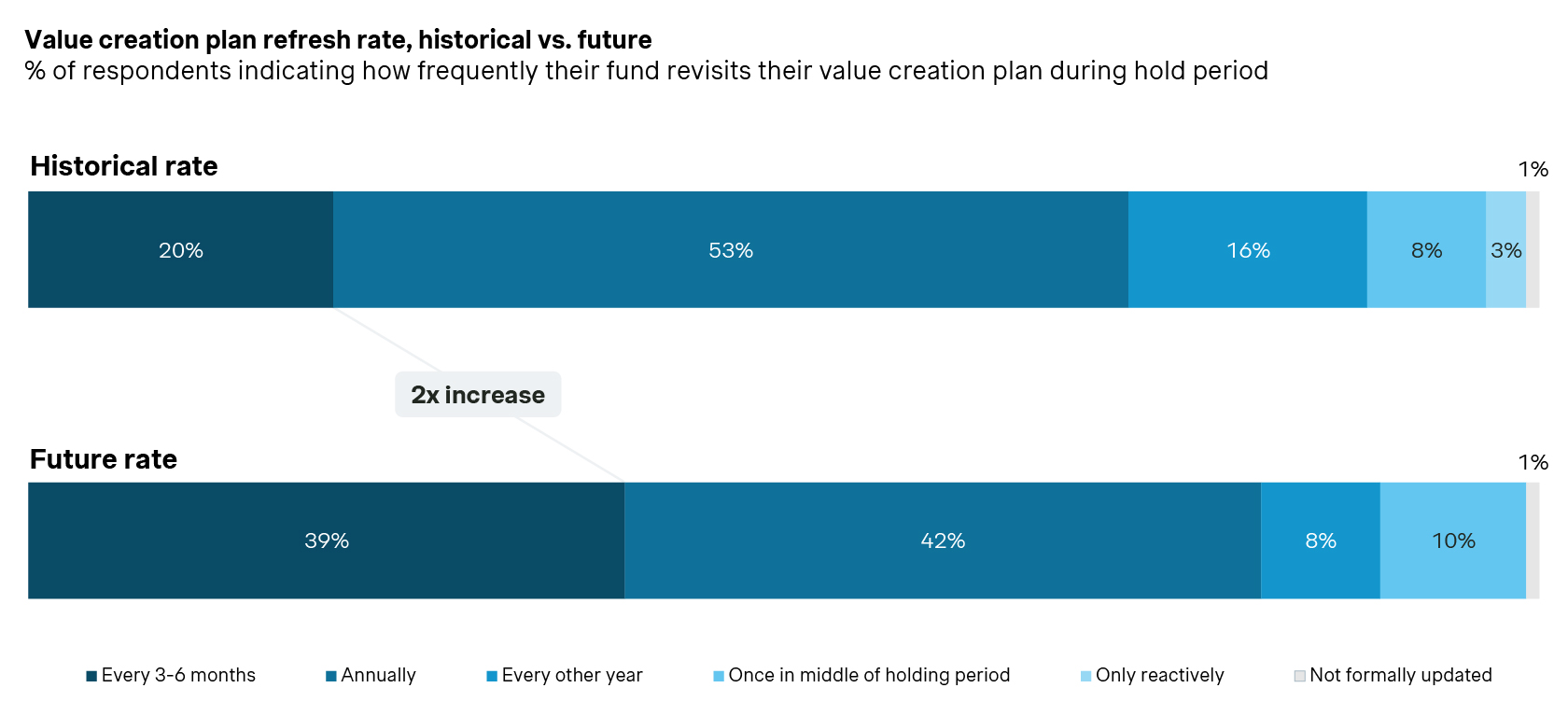

Historically, only 20% of firms reviewed their value creation plans every 3–6 months. Going forward, that’s expected to almost double to 39%. At the same time, the share sticking to an annual review drops sharply (from 53% to 42%).

This development reflects the broader environment: uncertainty has forced PE to move from long-term planning to constant adaptation and agile refresh cycles.

Leading firms are analyzing initiatives across the portfolio to collectively reveal patterns: which types of initiatives tend to move fastest, which consistently lag, which have the biggest financial impact? This allows them to double down on what works and reallocate support where it’s needed most. Instead of relying on each operating partner’s instincts within a single company, firms can start to systematically manage value creation almost like a portfolio of financial assets.

The trade-off, of course, is that it requires much stronger data infrastructure and governance. To run those comparisons, you need standardized KPIs, consistent reporting, and a willingness from portfolio companies to be measured against each other. That’s not easy, especially in industrials where systems are often fragmented. But the firms that crack it will be able to run their portfolios much more dynamically, reallocating attention and capital to maximize overall returns.

Simon-Kucher’s Value Creation 2.0 framework combines quick-win EBITDA uplift with long-term capability building, powered by quarterly value reviews, dynamic resource allocation, and live dashboards that track impact across pricing, sales, operations, and cash. Whether it’s a single PortCo initiative or portfolio-wide playbooks, we bring a consistent, evidence-backed system that reduces execution risk, accelerates ROI, and elevates PE value creation from strategy into measurable results.

Operations: the prerequisite for the next value creation phase

A company that’s bloated, inefficient, and cash-poor can’t credibly pursue digital selling or growth adjacencies. Streamlining and stabilizing operations allows for investment in the next layer of value creation: pricing sophistication, go-to-market upgrades, and digital enablement. We’re in the operational era because the environment demands it, but the firms that win will use this as a platform to pivot back toward growth when the market allows.

And because execution risk is the #1 reason value creation fails, the winners won’t just identify ops levers, they’ll build the systems, processes, and capabilities to deliver them.

Simon-Kucher recommendations:

Make ops the default value driver: pricing, sales, and go-to-market efficiency should be assessed during diligence and prioritized day one

Focus on levers with fast impact and low failure risk, especially pricing and sales, activated in the first 6 months

Execution risk is real, but controllable: prioritize ruthlessly and ensure full ownership and resourcing behind initiatives

Move beyond the GenAI buzz and focus on high-impact, scalable GenAI use cases in data, ops, and product

With quarterly updates, ensure VCPs guide real decisions, not just reporting cycles

At Simon-Kucher, we help you unlock value across the full deal lifecycle and portfolio. From operator-grade diligence that pressure-tests growth, pricing, and GTM levers pre-LOI, through to commercial transformation, exit prep, and vendor due diligence, we ensure confidence in underwriting and delivery.

Interested in our 2025 Value Creation Study results in more detail?