As pharmaceutical companies grow, launch innovative therapies, and expand their portfolio, strong pricing practices are essential for lasting success. Integrated global price management brings governance, technology, and dedicated pricing expertise together to enable smarter decisions and stronger compliance. When aligned effectively, pricing becomes a strategic advantage that fuels sustainable growth and market impact.

In an agile life sciences industry, pricing is a strategic driver of sustainable growth. Despite its importance, pharmaceutical pricing remains one of the least optimized business levers. As companies expand globally, launch innovative therapies, and navigate increasingly complex regulatory environments, one truth becomes clear: ad hoc pricing no longer works.

Too many organizations still depend on scattered spreadsheets, outdated systems, and inconsistent price governance putting revenue, compliance, and agility at risk. Misaligned pricing policies and slow decision-making create friction across affiliate and global teams and expose companies to price erosion and lost opportunities.

But it doesn’t have to be this way.

At Simon-Kucher, we believe the answer lies in integrated global price management: anchored in robust governance, powered by the right technology, and supported by a purpose-built pricing organization. This is how companies unlock long-term profitability and move from pricing chaos to strategic control.

Why price management needs a transformation

Global price management is the backbone of any strong pricing and market access (P&MA) strategy. Yet across the industry – from emerging biotechs to global pharma leaders – many companies still rely on fragmented processes and Excel-based workarounds that can’t scale.

Outdated price governance models are no longer fit for today’s market complexity. We see five recurring gaps that stall pricing effectiveness and expose companies to strategic risk:

- Fragmented data: Price information lives in disconnected systems, often updated manually by affiliates. It’s hard to retrieve, verify, or harmonize.

- Inconsistent definitions: Terms like list, net, and average selling price (ASP) vary by affiliate, payer type, and channel, making comparisons unreliable and compliance tricky.

- Siloed decision-making: Many affiliates make pricing decisions in isolation, without clear alignment to global strategy or visibility into cross-market impact.

- Reactive governance: Pricing policies are only revisited during lifecycle events. Most teams miss chances to steer price proactively or simulate future scenarios.

- Opaque processes: Pricing approvals lack traceability, slowing down launches and increasing compliance risk, especially in international reference pricing (IRP) markets.

Most companies fall short on one or more of these. Policies are reactive, approvals are opaque, and processes differ market by market. And while the symptoms may look operational, the root cause is strategic: pricing governance hasn’t kept pace with business complexity. These aren’t minor inefficiencies. They’re structural barriers that delay launches, erode margin, and create blind spots in governance.

Why good governance unlocks great pricing

Strong pricing governance ensures decisions are strategic, consistent, and auditable. It connects global strategy with local execution and speeds up approvals while minimizing risk. When governance works, you build pricing as a competitive advantage.

Companies that outperform tend to:

- Use a unified pricing taxonomy across markets.

- Build scalable digital workflows with clear audit trails.

- Maintain live visibility into IRP linkages and pricing corridors.

- Align affiliates on global guidance with local flexibility.

- Review pricing policies regularly; not just at launch or loss of exclusivity.

In our work, we’ve seen companies unlock 2-3% additional margin simply by improving how they govern pricing: not changing the price itself but changing the process around it.

The hidden costs of poor governance

When pricing decisions are unclear or slow, the entire organization feels the impact. The risks go beyond missed revenue:

- Profit leakage from poorly enforced or outdated price corridors

- IRP spillover effects causing unintended price erosion in reference markets

- Slow response times to evolving market dynamics and payer demands

- Affiliate frustration due to lack of visibility or inconsistent rules

- Decision-maker fatigue from endless déjà-vu debates

- Missed opportunities because pricing strategies aren’t agile enough to meet launch or competitive timelines

Let’s look at two examples from our client work:

Case 1: Price miscommunication triggers IRP damage A UK affiliate mistakenly communicated a confidential net price instead of the requested list price, which was recorded in an official national database. This error led to price reductions in reference markets like the Netherlands and Israel, resulting in millions in lost revenue. The root cause? Lack of clear definitions, controlled processes, workflows, and access rights. |

Case 2: Belgium launch delays due to data gaps A pricing team needed to submit price information to the Belgian ministry. Without a central system, they had to email multiple affiliates, wait for responses, and reconcile inconsistent definitions. The fragmented communication led to delays and confusion. A structured, centralized approach would have enabled the team to gather consistent information much faster, ensuring a smoother and timelier launch. |

Both cases highlight the real-world costs of outdated pricing infrastructure. A reactive pricing model doesn’t just limit effectiveness but puts margins at risk.

From chaos to control: A better approach to price management

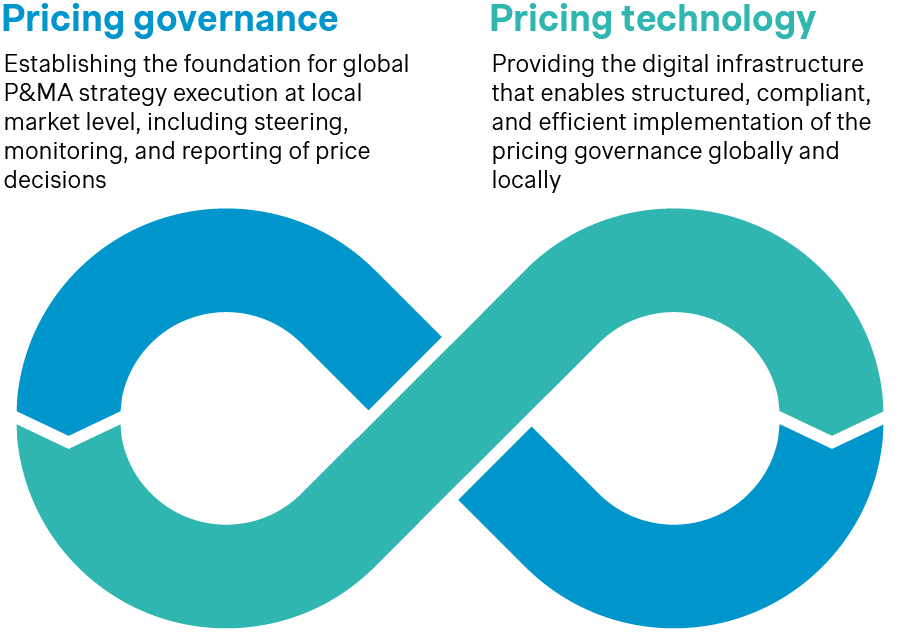

Pharma companies must ensure that they look at price management comprehensively if they want to mitigate the risks, grow their bottom lines, and further expand business. What does this mean? Optimal price management integrates pricing governance (the "business perspective") with the right pricing technology for implementation (the "system perspective").

Step 1: Pricing governance

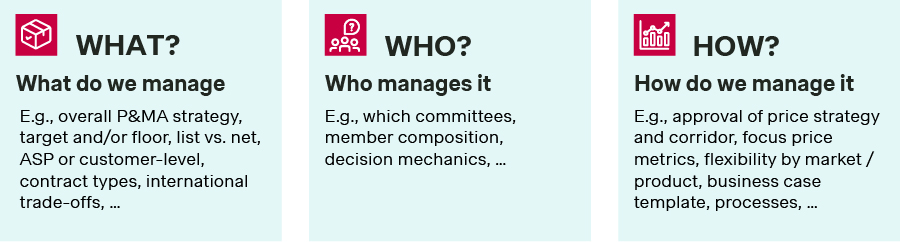

We recommend a governance model based on three foundational questions:

Question 1: What do we manage?

You need clarity on what’s being managed across the organization. This includes:

- List vs. net pricing

- ASP definitions

- Price floors and targets

- Escalation thresholds

- Contract types and payer-specific structures

Even though this seems trivial, for many pharmaceutical and biotech companies, the question “what is your list price” would not yield the same answer across the different countries, as every affiliate would have their own definition.

Standardizing these elements builds a common language across countries and brands and is the rock on which proper price management can be built.

Question 2: Who manages it?

Clear roles and responsibilities are essential. Define:

- Which committees own strategic and operational decisions

- Who initiates price requests, performs analyses, approves, or is simply informed

- How pricing decisions escalate depending on risk level and market importance

This avoids bottlenecks and ensures the right people make the right decisions at the right time.

Question 3: How do we manage it?

This is where process discipline meets strategic control:

- Set price corridors with defined escalation rules

- Develop business case templates and approval workflows

- Classify price requests by level of risk to determine appropriate oversight

- Establish clear KPIs to measure pricing efficiency and compliance

Without this structure, even the best P&MA strategy will struggle to scale globally.

Step 2: Pricing technology

Even the most robust governance model needs technology to bring it to life. Without a modern pricing infrastructure, governance remains theoretical and hard to enforce. Pharmaceutical companies, especially biotechs, must not view price management technology as a luxury but approach it as a natural next step for evolving their price management.

A global price management system provides:

- A single source of truth for pricing data across all SKUs and markets

- Real-time analytics for price waterfalls, margin tracking, and IRP risk

- Self-service tools for managing VAT, FX, and country-specific rules

- Streamlined approvals with automated workflows and full traceability

The impact? Faster decisions, better compliance, and more time spent on strategy instead of chasing down spreadsheets.

Key principles for ensuring that global price management sticks

Investment in your global price management strategy and system is a strategic transformation. We've helped dozens of companies succeed by following seven key principles:

- Software follows strategy. Define your governance before selecting tools.

- Business and IT must align. Co-create the solution with both teams at the table.

- Start with high impact use cases. Avoid “feature bloat” that confuses users.

- No plug-and-play. Customize workflows, roles, and metrics to your unique needs.

- Choose your partner wisely. You need deep pharma pricing expertise, not just IT support.

- Plan for change management. Train, communicate, and adapt processes as you scale.

- Design for the future. Your system must evolve with your products and markets.

When done right, global price management turns pricing into a source of strategic advantage.

The results speak for themselves. Companies that embrace structured governance and robust pricing systems report measurable benefits:

- Faster market response times

- Improved affiliate satisfaction and transparency

- Lower IRP exposure and more control over net price erosion

- Stronger alignment between pricing, access, and commercial strategy

- Enhanced performance tracking through meaningful KPIs

Most importantly, they shift from reactive firefighting to proactive value creation.

Ready to move from governance confusion to growth clarity?

At Simon-Kucher, we specialize in helping pharma and biotech companies build pricing strategies that scale. From defining governance to implementing technology, we bring the cross-functional expertise needed to drive sustainable pricing excellence.

Contact us to find out how we can help you build a smarter, more agile pricing model that meets today’s demands and tomorrow’s ambitions.

Our LS Genius | Price Manager goes beyond basic pricing tools. The solution helps pharma and biotech teams drive product value, streamline decisions, and stay compliant, across products, markets, and teams. Explore the key features powering confident pricing execution in healthcare.