How can investors be crystal clear on the revenue and growth potential of their target? In this interview, David Vidal and Laura du Repaire highlight the value creation path that needs to be defined during pre-deal due diligence.

Laura, David, in recent years, private equity firms have achieved unprecedented success in delivering returns. How does this impact the ability of PE firms to identify profitable deals in future? Are PE firms set to lose their momentum?

Laura: It’s no secret that record levels of dry powder have pushed deal competition and asset prices up to an all-time high. Private equity firms won’t lose their momentum per se, but they are having to go the extra mile to realize an attractive ROI, and can no longer rely on the traditional approach of exclusively increasing efficiency and cutting costs.

David: To ensure deals are profitable, there needs to be a clear revenue growth plan with a strong focus on top-line enhancement initiatives. We learned from private equity professionals that 37% fail to reach their business case goals surrounding revenue upside. An alarming number, but not so surprising when we dig deeper into their value creation approaches.

In your experience, why do so many deals fail to live up to investor expectations? How can investors benefit from including value creation in their due diligence activities to ensure future profitable growth?

Laura: One of the most common pitfalls surrounding the revenue upside is that, under immense time pressure, investors rush through value creation in the pre-deal due diligence phase, and with too narrow a focus. Value creation requires a laser focus and a targeted tail of investigation – a qualitative and quantitative customer-focused approach based on what makes most sense for the specific target.

David: We always recommend validating the revenue growth opportunities and rescanning opportunities from the customer perspective. For instance, if management is looking at introducing new products or entering new markets, it is essential to incorporate the voice of the customer (VOC) to understand their needs and any gaps in the current product offering. The assumptions in the business plan may also change after analyzing the market dynamics and competitive and operational capabilities, so it is also important to test the projections in different scenarios.

What are some best practices for capturing the voice of the customer?

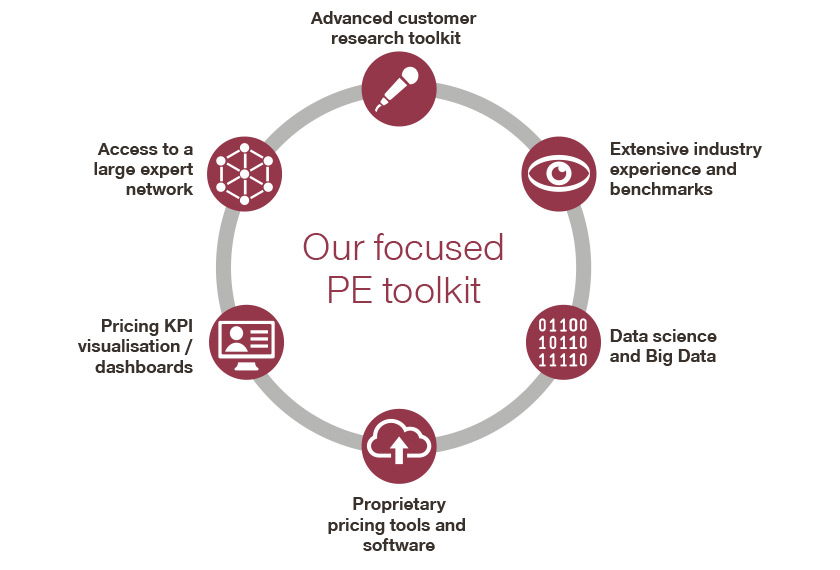

David: Usually, in the due diligence phase, there is limited time to interview customers. But it is possible – even in a very short time frame of two to four weeks. That’s why we advise on developing intelligence on customers right away, as soon as the value drivers are clear. We are perfectly equipped, since customer research is a standard component of our Due Diligence Toolkit. We know the right questions to ask, and the spectrum of possible answers, so we quickly identify top-line opportunities and solutions that others might miss.

It sounds like consumer insights are a very important source that you use. What other experience does Simon-Kucher bring to the table?

Laura: We peel back customer acquisition techniques and value extraction practices; brand positioning, pricing, customer service, product development, and all other top-line opportunities, to deliver a clear action plan on how to increase revenues and margins. Simon-Kucher has always been unique in our methodical approach to pricing, sales, and marketing topics: our recommendations are always supported by in-depth data analysis, KPI dashboards, and proprietary pricing tools and software.

David: Our role is to put the target’s business plan under the microscope and look at the “quality of revenue”. We assess the growth and revenue potential for the next two to three years, including a tailored 360 review of the company where we evaluate and challenge the market strategy and competitive dynamics. Our industry experience and benchmarks play a defining role here, thanks to our unbeatable experience in the top-line space.

Learn more about our work with private equity & venture capital firms here!