Dynamic pricing allows businesses to rapidly adapt to shifts in supply and demand. By accepting the fact that the willingness-to-pay of consumers and opportunity costs of firms fluctuate, businesses can set prices accordingly and optimize performance. By going beyond the idea of adjusting prices to evolving costs, dynamic pricing is the convergence of four previously independent worlds:

- That of economists and statisticians, estimating demand curves;

- Mathematicians, modelling optimization problems, and more recently game-theory frameworks;

- Information technologists, building digital systems and infrastructure, and finally;

- Executives within organizations facing pressure not to go extinct

Each of these dimensions has a longer pedigree than you might think – empirical work on demand curve estimation dates back to the seventeenth century (Davenant, 1699). These four worlds came together as modern Dynamic Pricing as far back as the late 1970s and early 80s.

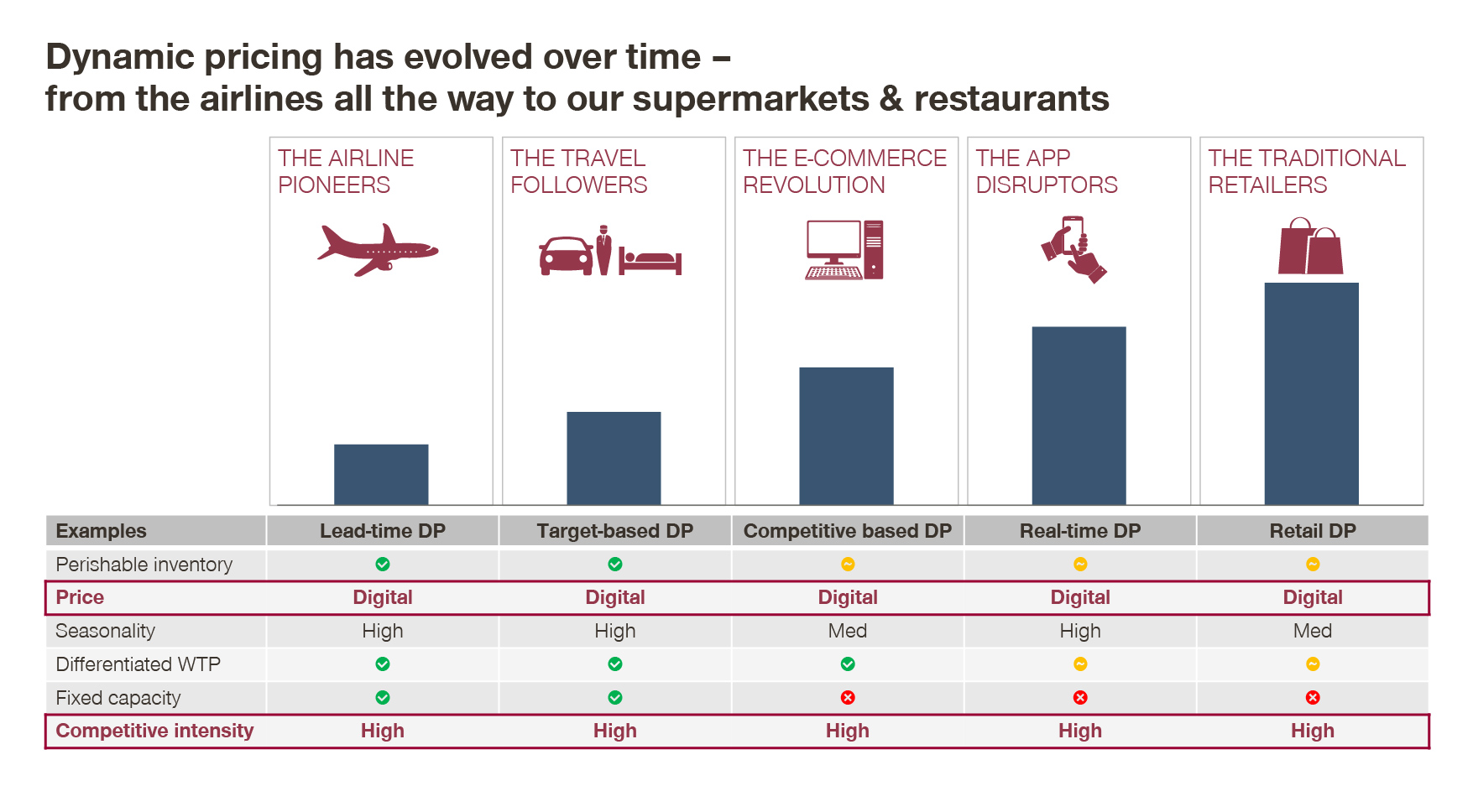

Dynamic Pricing was applied for the first time at scale when deregulation in the airline industry allowed American Airlines to effectively compete against People Express. Just two years after American’s adoption of the dynamic pricing model, the competitor went bust, kick-starting an adoption spree which has been growing ever since.

After airlines abandoned old pricing models, dynamic pricing emerged in tangential industries. Car rental companies soon followed in the 90s. Hotel chains joined the party as well. Like airlines, both industries were helped by having both a fixed capacity and expiration. All these industries boasted a perishable commodity and extensive databases from which to begin their dynamic pricing journey. Today, cruise and train Operators, tour agencies, parking lots, theaters, sports arenas and many other players in the Leisure, Travel and Transportation sector have abandoned set prices in favor of dynamic pricing.

Wherever competitive pressure leads companies beyond cost-cutting and certain basic requirements are present, innovation will lead to dynamic pricing. The main factors driving adoption are:

- Increase in the amount of information generated (transactional or otherwise), and recording and processing capabilities

- Strengthening of competitive pressure and price transparency at scale

- Enhanced efficiency in price publishing and distribution (i.e., through digitization)

- Advances in relevant fields of academic research (Optimization, Machine Learning, Game Theory and correlates)

- Growing capability and availability of “real-world” know-how

Marketplaces are growing ever more competitive, as sellers become increasingly data-driven and buyers have access to more information.

It’s natural that dynamic pricing grows in line with this increase in market pressure and capability. As fast food restaurants and supermarket chains implement digital menus and price tags, dynamic pricing initiatives are no longer labor intensive activities.

Even utilities are exploring the concept, not just to make a profit, but also to control usage and ensure supply. Take electricity, where the idea of real time pricing is central to large coordinated efforts such as the US’s SECC. It has become part of the operating reality of smaller players like Brazil’s Celpe, in the state of Pernambuco. Nearly 10 years ago, in 2010, California was already experimenting with dynamic rates for water, and dynamic pricing in roads is actively being discussed and tested as a way of controlling congestion.

If any kind of firm fares highly on the above list of dynamic pricing accelerators, it’s players whose core business is mostly related to technology. Alongside the app disruptors such as Uber, whose surge pricing tactics have enabled it to rapidly set higher prices at peak times in a way airlines could never have envisioned, the new wave of dynamic pricing no longer relies on having a perishable commodity.

LinkedIn charges dynamic prices for InMails depending on how many companies are bidding for a specific segment of its user-base. If many firms want to reach a specific LinkedIn profile with a targeted message, the one with a higher bid will be the winner. This ensures the user base will not be spammed, and maximizes profits for the platform. Facebook, Google and their ilk all use similar approaches to optimize revenue.

How can traditional businesses employ Dynamic Pricing?

Simon-Kucher is frequently commissioned to realign Dynamic Pricing processes because some expensive price optimizer has gone black-box. While price fluidity is the future, not all companies are prepared to implement it, and most will not be ready for many years to come.

Before going dynamic, businesses must build a solid static foundation. From the airline pioneers to the e-commerce revolution, specific transactional information must be digitally recorded and readily available. Further to this, a clear strategic position must be attained and understood throughout the organization. This includes a view on the wider market, accounting for competitor pricing and customer segments and price elasticity.

A host of specialized software providers are following the steps of Sabre, Amadeus and other trail-blazers in selling off-the-shelf solutions. Pricefx, Vendavo, IDeaS, Duetto, SPOSEA, Pricefy and Blue Yonder are just a few among of the many available vendors from which firms can hire software that can obtain, analyse and implement dynamic pricing algorithms to boost revenue.

Software is only a small part of the equation. To achieve optimal pricing, implementation depends on many factors that go beyond software quality – the most advanced tool in the world will worsen performance, not improve it, unless it is used correctly. A good first start is to read about the high-level Dos and Don’ts of Dynamic Pricing. Pricing decisions do not exist in a vacuum. Paramount to creating a dynamic pricing strategy is realizing that success depends on buy-in and engagement. Not only of the C-suite, but of several hierarchical layers of the business. Automated price optimizers rely on learning logic which can either be enriched as time passes or deteriorate as “bad overrides” are effected, a common cause of which is internal pressure on Revenue Managers.

Dynamic Pricing, strategic a topic as it might be, is a game of pragmatism. While the technical underpinnings continue to evolve, one constant remains: firms risk sharing the fate of iconic People Express unless they build their capabilities to optimise their prices and adapt to new market realities.

We at Simon-Kucher have a wide set of experts that develop dynamic pricing strategies and implement customized solutions, that deliver up to 15% increase in revenue. The trick to all these is not to implement dynamic pricing because it is a buzzword, but to do it in a way that is relevant to your company, with the right set of data and take it as a journey that can be enhanced and improved over time.

Enjoyed reading our article? You may also find this interesting:

The 8 Dos and Don’ts of Dynamic Pricing

Introduction to B2B Dynamic Pricing

Seven Solutions to Change Management Challenges in B2B Dynamic Pricing