Small and medium-sized enterprises (SMEs) are the backbone of the Australian economy, employing over 4.7 million people in the country. However, our recent study among more than 200 small business owners reveals that many are not receiving the support they need from banks to thrive.

Half of all SMEs rely on third party digital offers to compensate for limited offerings from banks. Traditional banking services are often not tailored to meet the specific needs of SMEs, and many feel as though their banks don’t understand their businesses or offer relevant features or customizations. This means businesses are turning to alternative providers for products that better fit their needs.

We also found that half of SMEs consider churning away from their current financial provider – but uncertainty about which new bank or fintech to pick can be discouraging. Those already using third-party providers are even more likely to look for new providers in the next three years due to ease of use, better product choice, and lower cost options available elsewhere.

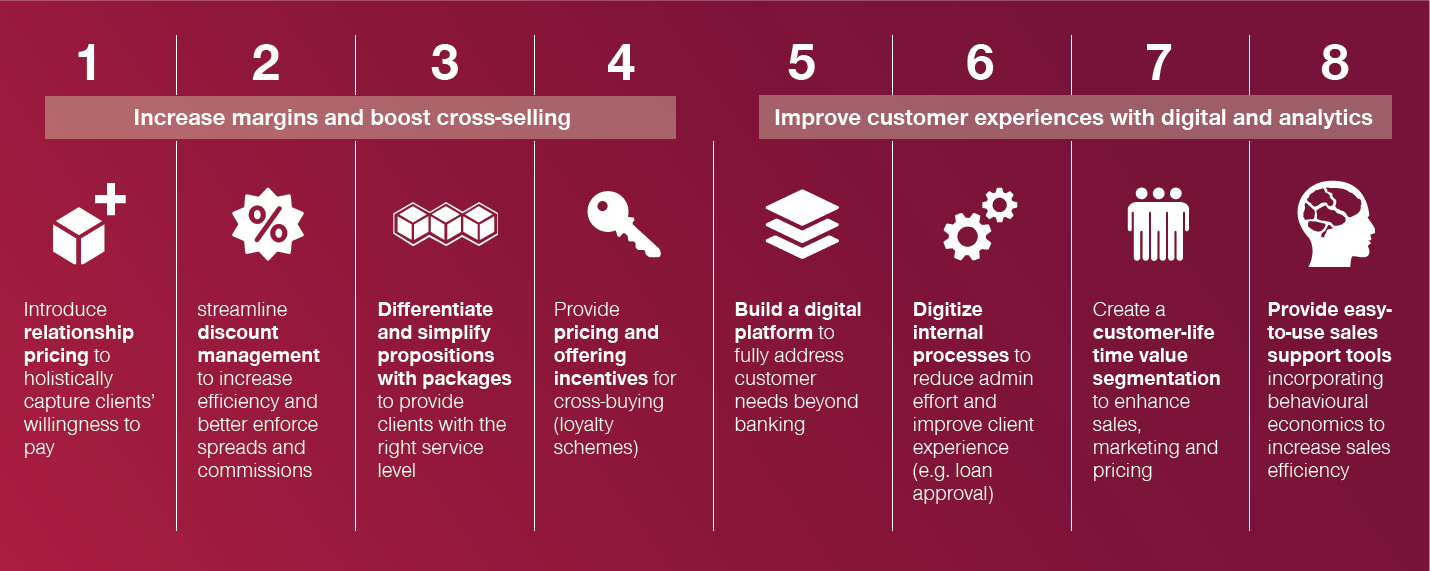

For financial institutions to succeed in this segment, they need to facilitate and tailor their digital offerings to meet the specific SME needs. At Simon-Kucher, we have extensive global project experience in financial services and have developed a "Pathway to Success in SME Banking" which outlines the proven approach for helping organizations win and keep customers, increase revenue, improve profitability, and enhance the customer experience.

It’s clear there is an opportunity for financial institutions to provide better digital services and products for small business owners across Australia. With the right approach and tools at hand, banks and fintechs can become trusted partners and help drive success for themselves and other businesses alike.

APAC Insights

Stay informed on the latest market trends and industry insights from the APAC region

Form placeholder. This will only show within the editor