The definition of growth has drastically changed for SaaS companies in the last 12 months. The software industry went from a standard of hyper-growth targets and sugar-high valuations to a focus on profitable, sustainable growth and more conservative valuations. In Simon-Kucher’s Global Software Study, using a panel of over 500 B2B SaaS executives, respondents reported an average revenue growth rate below 10% in 2022. This is in stark contrast to the results from 2020 when average revenue growth was above 20%.

The changing economic climate has put pressure on many KPIs: increasing costs of salaries, higher cost of capital, lengthening sales cycles, increasing costs per lead, higher discounts to close deals, and increasing churn.

Given these factors at play, the landscape of business growth in SaaS has evolved. Today, SaaS leaders need to focus on longevity, prioritizing growth measures that are equal parts profitable and sustainable. In turn, companies need to reconsider the KPIs and targets they set to track their performance on this new growth objective. So, what metrics should you prioritize?

What KPIs are B2B SaaS companies currently measuring?

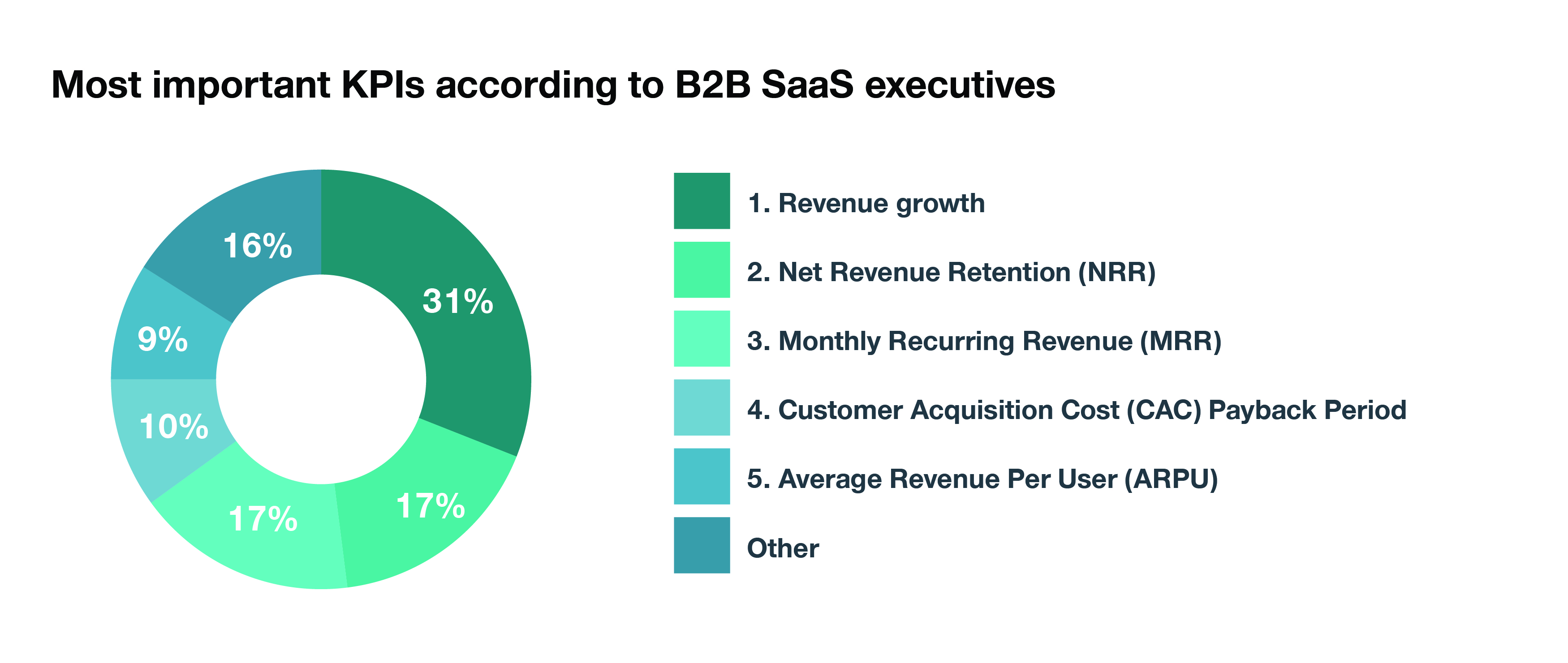

Traditionally, B2B SaaS companies have focused heavily on metrics that assess the company’s ability to efficiently acquire new customers such as revenue growth, MRR and CAC. Though the importance of these metrics prevails, over the last 12 months focus has increased on metrics that assess companies’ ability to retain and grow from their current customer base (e.g., NRR and CAC payback period). Monitoring and improving growth from both new and existing customers will be key to secure sustainable profitable growth for the future. Below we dive deeper into considerations behind the top 5 metrics that executives use and provide relevant benchmarks for strong KPI performance.

Figure 1: Most important KPIs according to B2B SaaS executives

What to consider when measuring these KPIs?

1. Revenue growth rate (Year-on-year revenue growth)

Although it does not provide the full picture on whether growth is profitable or sustainable, revenue growth rate remains a key metric for the business performance when combined with other key indicators. Benchmarks for this vary depending on size and maturity of the company.

2. Net Revenue Retention (Monthly recurring revenue growth rate for existing customers)

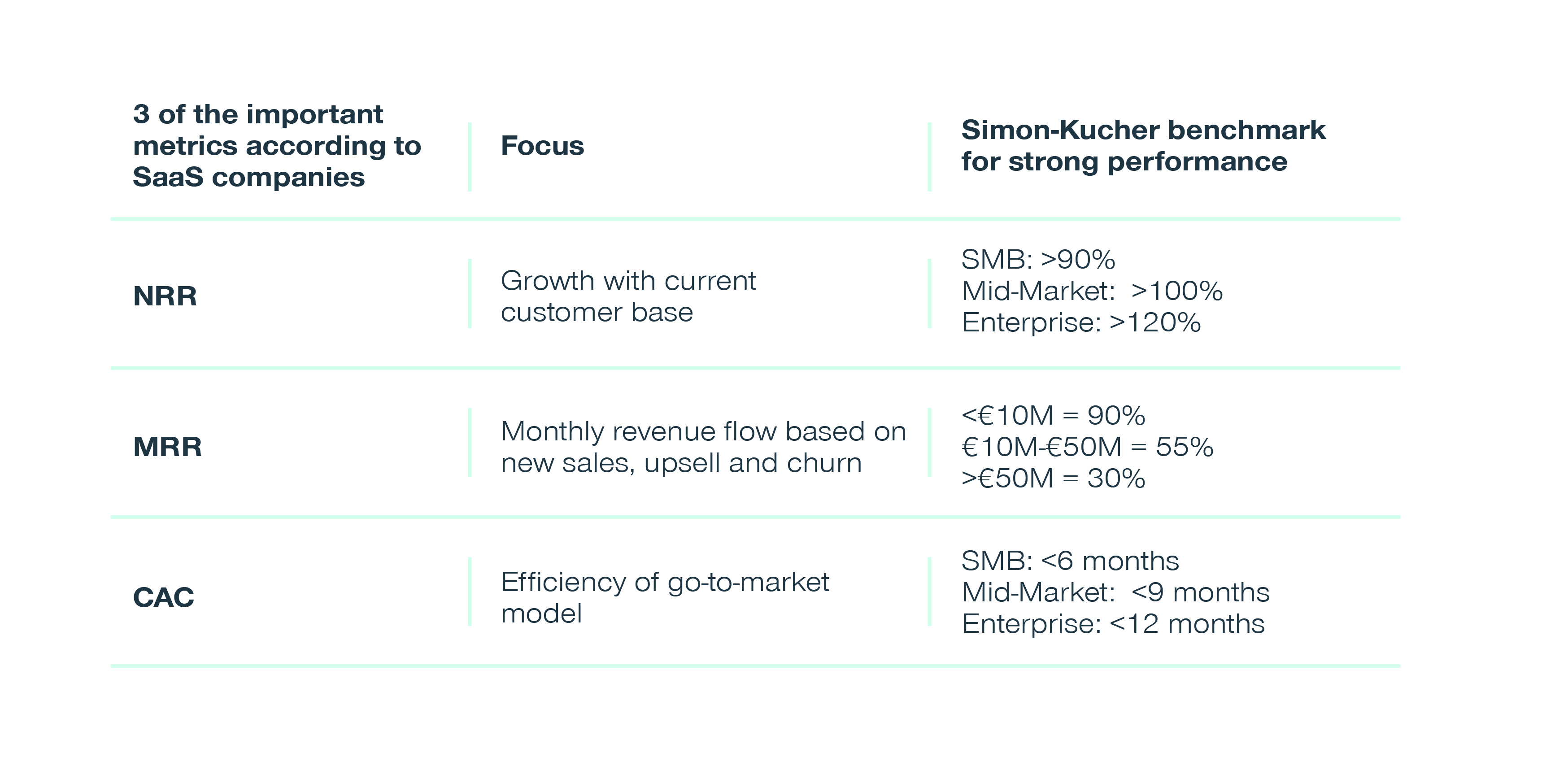

Net Revenue Retention (NRR) provides insight into the company’s ability to retain and expand from their current customer base. Simon-Kucher sees that a strong NRR varies strongly depending on the end market, ranging from 95%+ when serving SMB while 120%+ for those serving enterprise customers.

3. Monthly Recurring Revenue growth rate (predictable monthly revenue from active subscriptions)

MRR provides insight into the monthly revenue flow based on new sales, upsells and renewed business. A benchmark for strong performance for SaaS companies is a 30% MRR growth rate for large (>€50M) companies, but relatively less mature companies (<€10M) should be looking to aim at 90% growth.

4. Customer Acquisition Cost Payback Period (Number of months required to recoup customer acquisition costs)

The CAC payback period measures the efficiency of your go-to-market model. Tracking the CAC payback period helps companies to calibrate their acquisition investments and prioritize the right customer segments for growth. The benchmark for strong performance depends on your end market and ranges from less than 6 months for SMB to less than 12 months for those serving enterprise level customers.

5. Average Revenue Per User (Total revenue divided by the number of users)

Average Revenue per User (ARPU) measures the ability of a company to monetize their customer base. We typically recommend analyzing ARPU and its development over time with different cuts; e.g. new logo vs. current base, active users vs. inactive users, etc. This can help with forecasting revenue and providing a sense of direction where the opportunities lie (e.g., which customer segments are under-monetized of which customers within a segment should be prioritized for expansion).

Simon-Kucher benchmark for strong performance for 3 of the most important KPIs according to B2B SaaS business leaders

Figure 2: Benchmarks for most important metrics

Looking ahead: CEOs should measure profitable growth – not growth at all costs

Despite the changing macro-economic context, we still see that companies focus heavily on growth metrics rather than profitability. Disappointing growth rates can be acceptable in combination with high profitability according to the Rule of 40, which tells us that there is a trade-off between growth rates and profitability. The Rule of 40 means that well-performing companies have 40 pp divided over revenue growth and the gross margin. This KPI is interesting for companies who want to monitor both growth and profitability. In our opinion this economic climate of slow growth rates should warrant a shift towards profitability metrics.

Aside from the Rule of 40, B2B SaaS companies should also separately monitor their margins. For SaaS executives it is key to understand how different revenue streams are contributing to their overall gross margin to identify potential improvement opportunities. Best performing companies in terms of revenue growth from the Global Software Study are 30% more likely to actively track their gross margin. The higher your gross margin, the more money is available to reinvest in your company to further scale and grow.

At successful SaaS companies we typically see a gross margin that is at least 75% of revenue after COGS. For the gross margin post customer success FTE and overhead this should be at least 60%. Subtracting then also from this the sales and marketing costs, successful SaaS companies are operating at a contribution margin of at least 30%.

Improving these metrics requires both sales and pricing excellence. Sales excellence includes optimally enabling your sales and customer success teams to ensure efficient growth with new and existing customers. Pricing excellence includes the optimal offering structure to grow with your customers through up- and cross-sell and a well-trained pricing muscles to effectively – and consistently - implement price increases.

Securing sustainable growth in uncertain times

In conclusion, although SaaS executives are moderately positive about the future, significant uncertainty remains for what the road to recovery will look like. SaaS companies will need to remain cautious. Setting realistic growth targets, prioritizing customer retention, effectively monetizing current customers, and optimizing their go-to-market spend through sales and pricing excellence will be key to secure long-term sustainable growth.

Curious to see how you can optimize these KPIs and unlock sustainable and profitable growth? Contact us to talk about how we can help.

The authors wish to thank Roos Offerhaus (Manager) and Pepijn van Eerten (Senior Consultant) for their contribution to this article.