Since the launch of ChatGPT and other AI tools in the last year, the world has discovered that true generative AI is not a thing of the future, relegated to Science-Fiction: it is here, and it is now.

It is no surprise that investment in artificial intelligence has skyrocketed last year. A 2023 report by Crunchbase indicated that over 25% of startup investments in the US went to AI-related ventures, more than double AI-related ventures' average share of start-up funding for the previous 5 years.

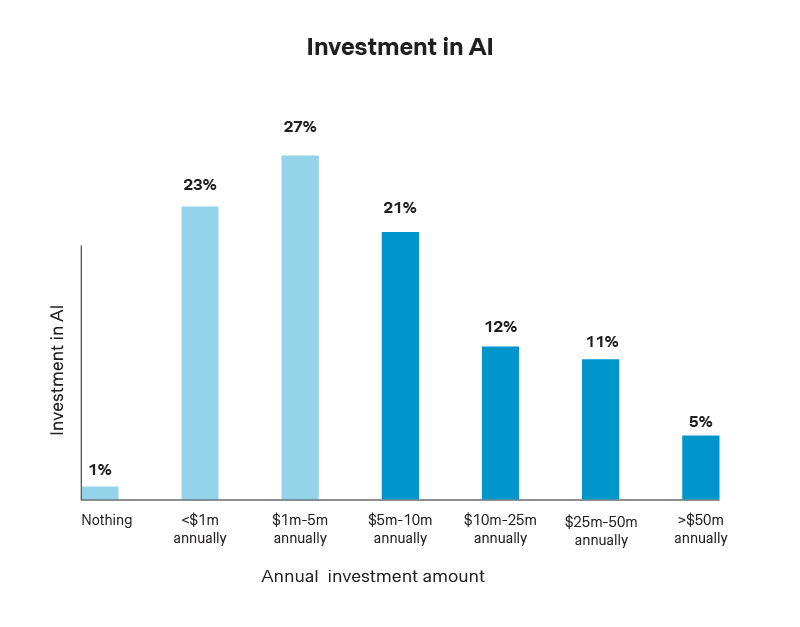

However, start-ups and their backers are not the only players throwing their hat in the ring. Data from Simon-Kucher’s Global Software Study shows that nearly all SaaS executives’ companies are investing in generative AI and/or Large Language Model (LLM) technology, and nearly half of respondents are investing at least $5M per year.

SaaS companies believe that AI is a modern-day gold rush, and no one wants to be left behind. Generative AI can provide massive value to customers, and there is a belief that whoever is able to launch an effective solution will likely gain market share, increase customer retention, and boost revenue growth.

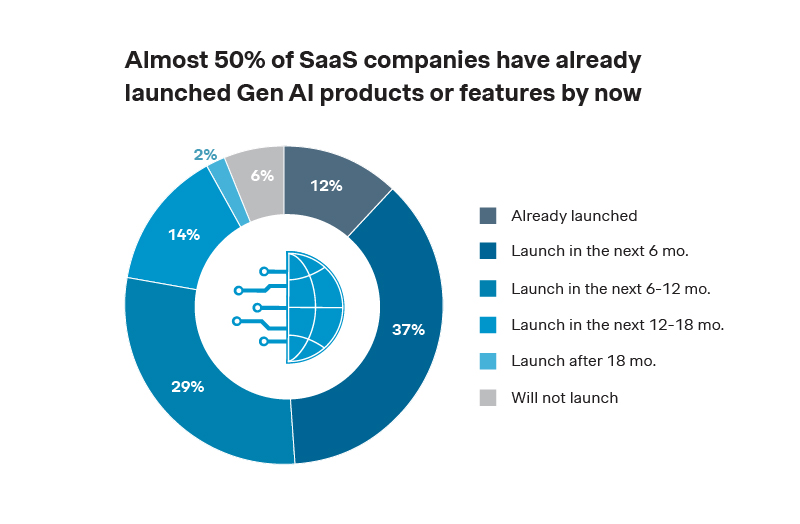

Major tech companies like Salesforce and Microsoft have all launched or announced new AI tools and products. But large corporations are not the only ones trying to get new AI products to market. Around half of SaaS executives in our study reported that their company has either already launched (or plans to launch within 6 months) new products or features that leverage generative AI or LLMs. Another third of respondents expect to launch similar products or features within the next 12 months.

Will SaaS companies be able to reap the benefits of AI?

Executives and customers alike are obviously very excited about this technology. The expectation is that AI will drive a new industrial revolution, as disruptive as the one brought by the dot com boom.

Despite this excitement, industry experts are expecting at least some resistance to adoption. This technology is still in its early stages and many stakeholders, including SaaS customers, are not hiding their concerns around topics such as data security, technical complexities, and implementation costs, as highlighted by Dell Technologies’ Generative AI Pulse Survey.

According to our results, almost a third of companies expect low adoption (<10%) of generative AI among their install base within the first 2 years of launch. Only 11% expect adoption rates of more than 50% in the same period. However, adoption rates of new technologies can often be increased with the right communication, and sound pricing and sales strategies. The high-flying times of seemingly endless funding and SaaS growth in 2022 have left companies too focused on building products and landing deals. Throughout 2023, the ability to sell, communicate, and train customers on the true value provided was not top of mind and led to more customer and revenue churn than may have been warranted. Aligning customer usage and value is critical to driving both adoption and retention of a ground-breaking technology like generative AI.

Interestingly, there is a correlation between expected adoption and firm revenue size. Executives at larger companies are more optimistic than their counterparts at smaller firms. This is likely driven by several factors, such as more substantial investments in the technology, a more structured approach to sales, or a larger customer base.

Expected AI adoption by revenue

Revenue Size | Weighted avg. adoption rate |

|---|---|

<$10M | 20% |

$10M-$100M | 27% |

$100M-$1B | 36% |

>$1B | 49% |

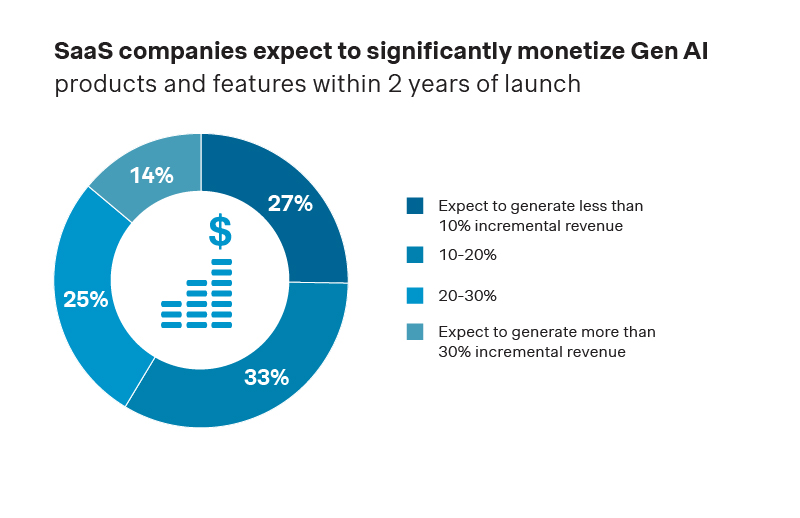

However, there is one thing that all executives agree upon: generative AI will drive incremental revenue for their organizations. According to Simon-Kucher’s Global Software Study, SaaS companies expect AI products and services to generate an average revenue boost of 18% within two years of their launch, even with relatively low adoption. More specifically, over one-third of executives expect a significant revenue increase of at least 20%. ServiceNow, a major player in the industry, announced in their latest earnings call that AI drove the largest net new ACV contribution and less than 25% subscription revenue growth in Q4 2023. One can expect further growth in the long term as this technology becomes more established, its benefits are proven, and initial concerns are resolved.

With so many varied uses, generative AI has the potential to transform the software industry. In this article we discussed the rise and benefits of investing in artificial intelligence, but your business likely has even more areas where it can improve. Reach out to our growth experts at Simon-Kucher if you are ready to accelerate your growth.

The Global Software Study survey was conducted from May to July 2023 by Simon-Kucher, with fielding through panel data provided by RepData, an independent market research agency. The study surveyed 500+ software executives across 20 countries, including the United States.