In an era where satisfaction drives loyalty and revenue, telcos must rethink how they delight customers. Our first instalment in a three part Global Telecommunications Study 2025 series explores the “Happiness” factor. What truly makes subscribers recommend their provider? Our experts reveal actionable strategies grounded in global data.

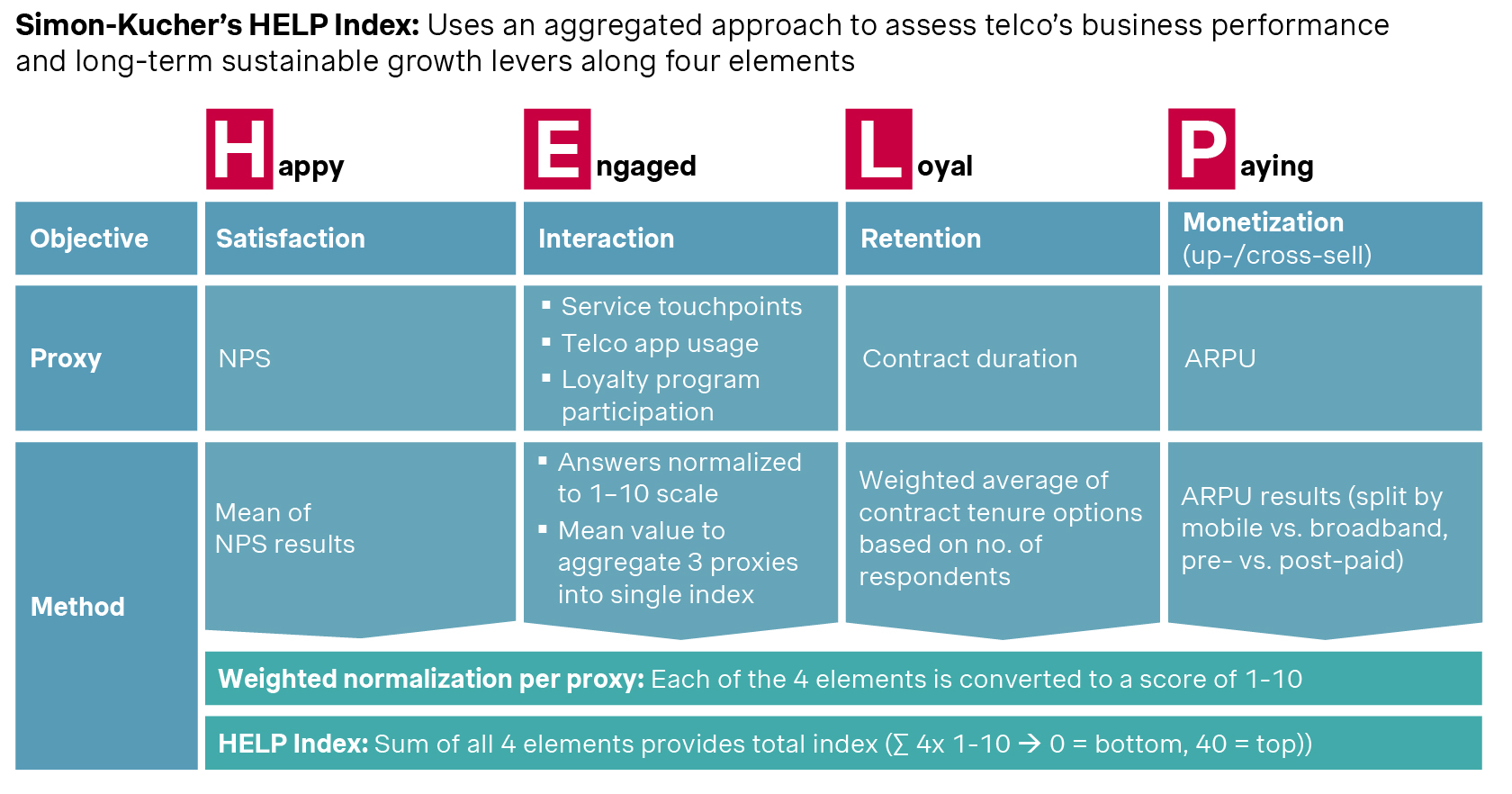

Customer satisfaction is not a soft metric. It’s a revenue engine. Simon Kucher’s Global Telecommunications Study 2025 introduces Happiness as the first pillar in the HELP framework (Happiness, Engagement, Loyalty, Paying) that measures telcos’ ability to unlock customer lifetime value.

On average, global telcos score just 5.7 out of 10 on the “Happiness” pillar (Top 10%: 8.7), contributing to a modest 60% exploration of their full customer value potential, while big differences across – and often within – markets provide benchmarks how to improve it.

Why happiness matters

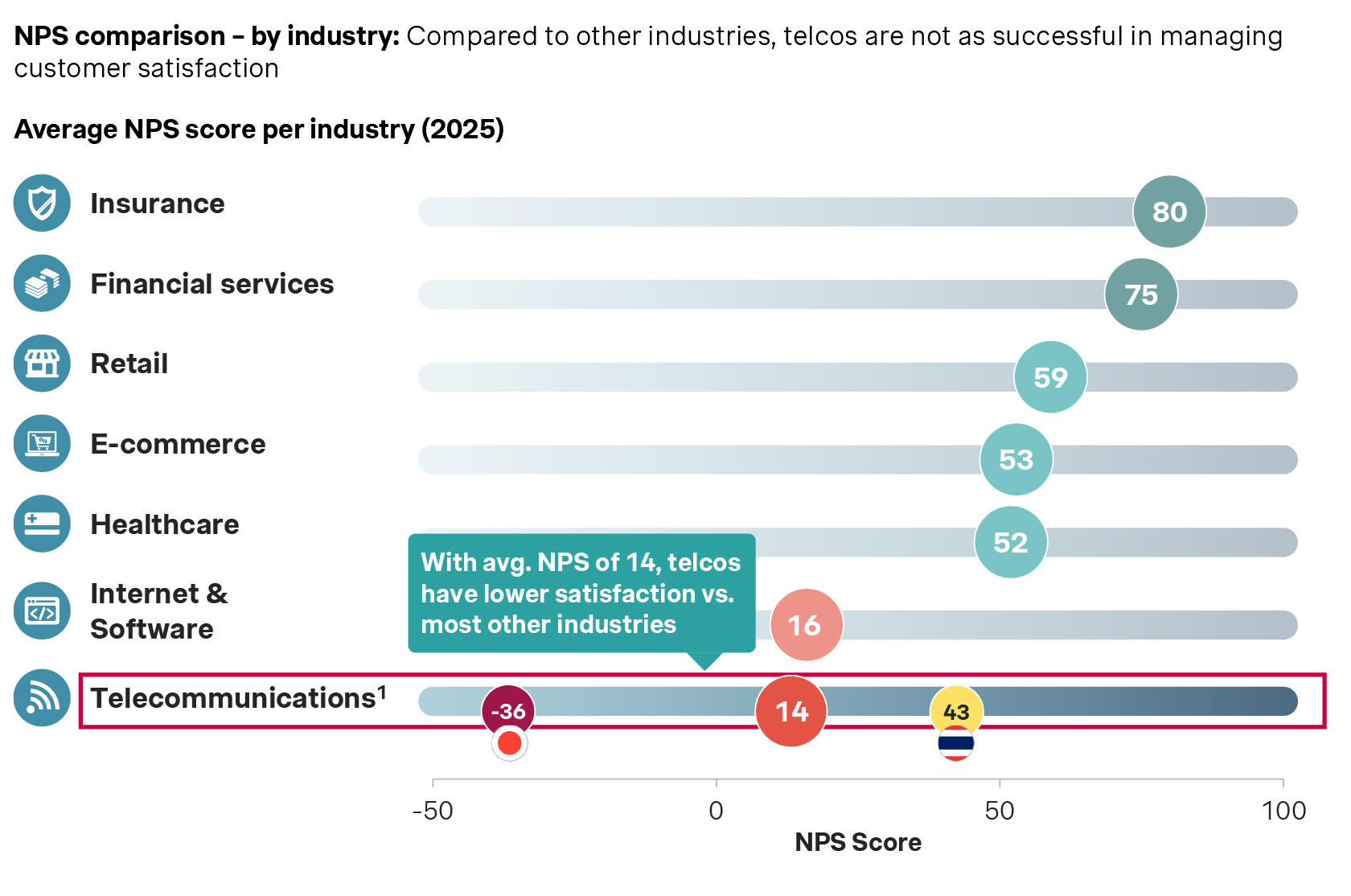

Net Promoter Score (NPS) remains the gold standard for gauging satisfaction. The global NPS for telcos stands at 14 which is well below other industries that range between a score of 16-80. Telco providers have significant room for improvement. Every 10 point increase in NPS can increase revenue by approximately one to three percentage points, translating directly to higher value impact.

A quick look at the global customer satisfaction footing

This year’s global telecommunications study is Simon-Kucher’s biggest and most comprehensive study until today, spanning 31 markets and surveying over 15,700 consumers. The extensive insights shed light on stark regional disparities: telcos in Southeast Asia and the Middle East lead with NPS scores above 30, while European markets have a larger share of unhappy customers.

These differences underscore the importance of tailoring satisfaction initiatives to local market dynamics rather than relying on ‘one size fits all’ solutions.

How must telcos drive happiness for their most valuable customers?

To elevate NPS and keep customers satisfied, telcos must focus on four behavior based drivers identified in the study:

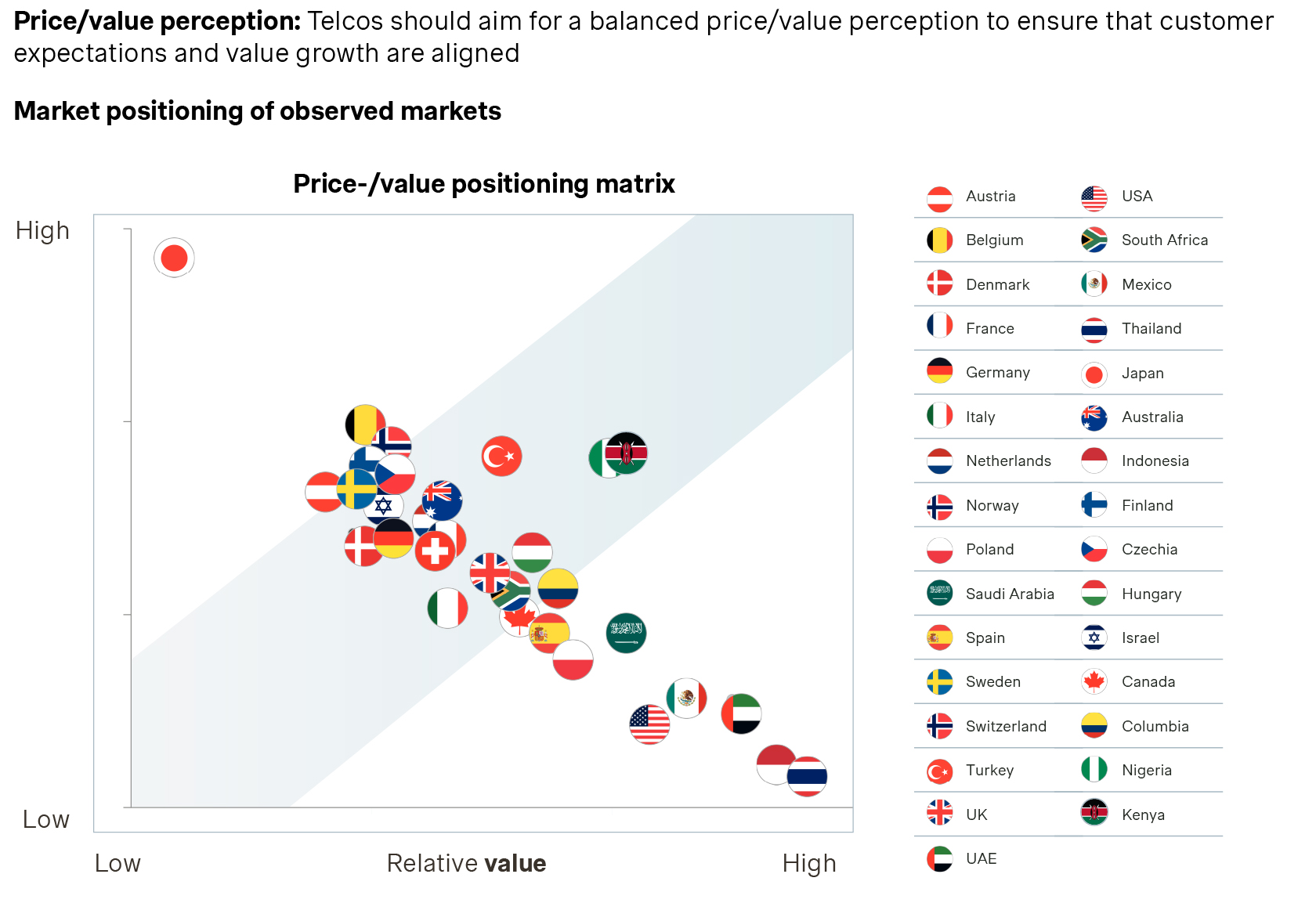

1. Price/Value perception

Nearly half of subscribers view their service as expensive, yet those with a strong price/value perception consistently report higher NPS. Communicating the benefits of bundled services and demonstrating the value delivered are essential to shifting perceptions.

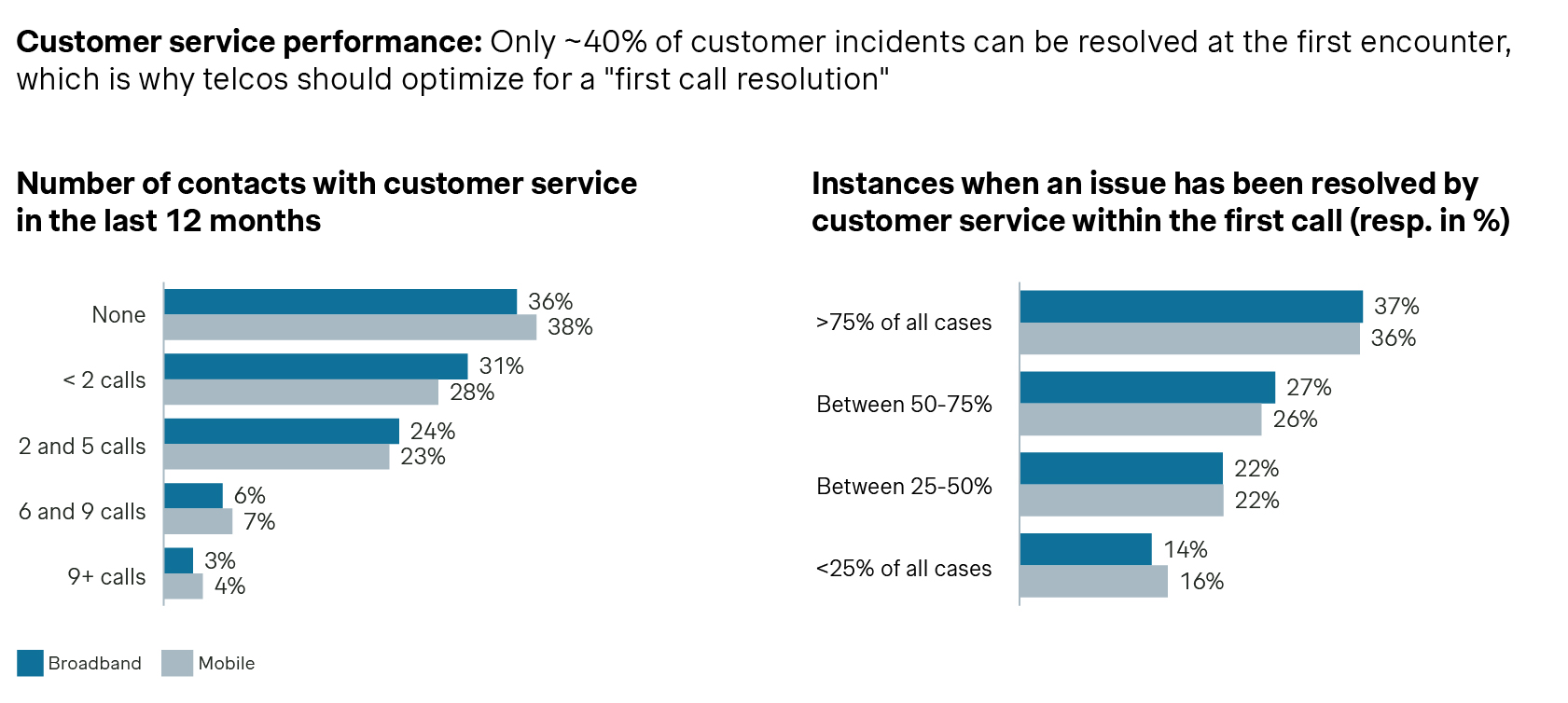

2. First call resolution

Only 36-38% of mobile and broadband customer support issues are resolved on first contact, leaving almost two thirds of interactions incomplete. Customers appreciate simple and quick availability, as well as talking to “real” humans in the call Improving first contact resolution not only reduces operational costs but also yields immediate satisfaction gains.

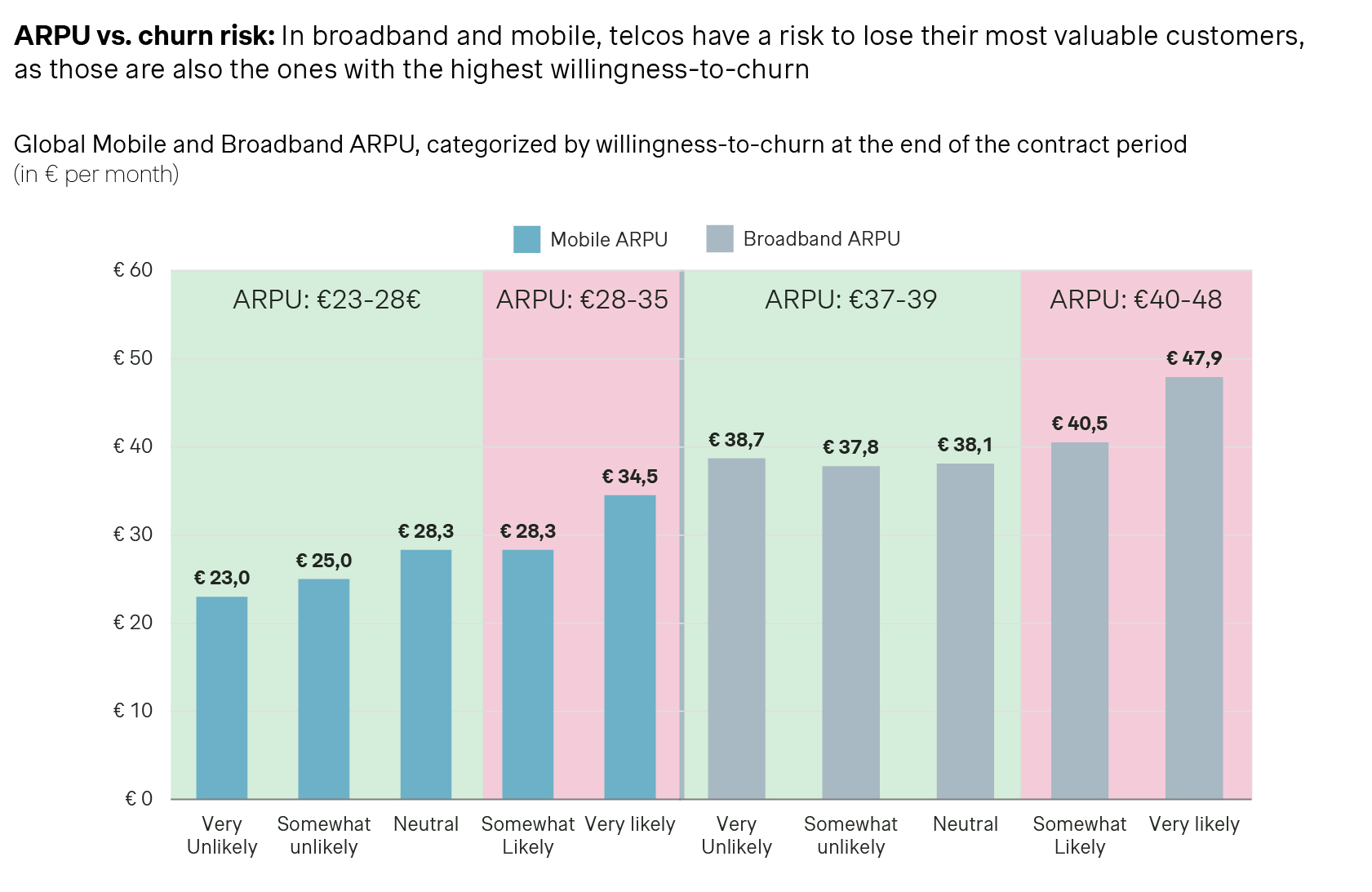

3. Churn risk among high value customers

High ARPUs customers show the highest churn risk compared to lower spending segments. As these users contribute disproportionately to ARPU, targeted retention programs such as personalized offers or proactive outreach can have outsized impact on overall satisfaction.

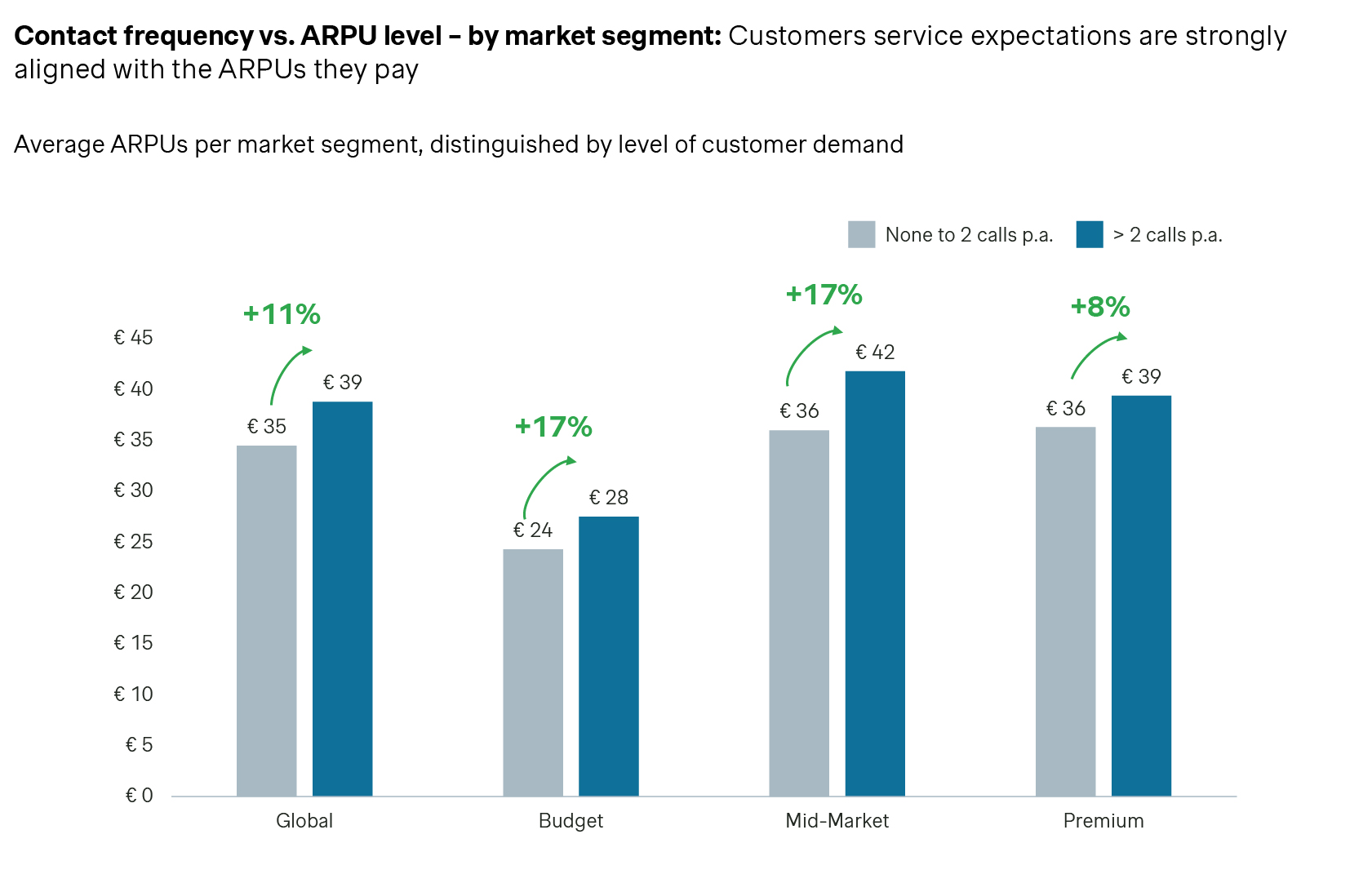

4. Service expectations

The number of service touchpoints a customer requires aligns with their ARPU level: Premium subscribers expect more frequent and seamless support. By investing in multi-channel support (e.g., chatbots, in app messaging, etc.), telcos can meet these elevated expectations and pre-empt dissatisfaction.

Next-best actions to translate these insights into opportunities

Data alone can’t drive growth, but actionable strategies do. Based on the key drivers mentioned above, telcos should prioritize:

- Value-first communication campaigns: Highlight the total cost of ownership savings and exclusive perks within existing plans.

- Support process optimization: Implement smart routing, empower frontline agents with knowledge management tools, and track first contact resolution as a key performance indicator.

- High value customer outreach: Leverage predictive analytics to identify at risk high ARPUs subscribers and automate personalized retention offers before service lapses.

- Enhanced self service channels: Expand intuitive in app support for routine tasks, reserving live agents for complex issues where human empathy drives satisfaction.

Not to forget, measure progress. Telcos must monitor shifts in NPS alongside operational metrics such as first contact resolution rates, average handling time, and price/perception scores. Regular ‘voice of the customer’ surveys coupled with transaction data will reveal whether improvements in these levers translate into meaningful customer lifetime value gains.

Before you go…

Elevating customer happiness demands strategic focus on value communication, efficient support, and personalized retention. By embedding the Happiness pillar into their commercial playbook, telcos can unlock sustainable growth, enhance loyalty, and forge deeper customer relationships.

Stay tuned for our next chapter, where we share critical insights into the Engagement pillar of our HELP framework. This lever focuses on transforming every service touchpoint into a growth opportunity.

Interested in our 2025 Global Telecommunications Study results in more detail?

Form placeholder. This will only show within the editor