As digital banking lowers switching costs and pricing competition intensifies, customer loyalty has become a strategic differentiator. This article outlines three pillars of effective loyalty program design – and what banks must get right to drive sustained engagement and long-term value.

The rise of loyalty programs in banking

Digital banking has materially changed how customers choose and change their bank. As switching costs fall and cost-of-living pressures persist, consumers are increasingly focused on maximizing the value of their money. In this environment, winning customers through the right pricing and promotions has become easier. Sustaining loyalty, however, has become the central challenge.

We observe a positive correlation between increasing rates and increasing deposit balances, but entering a price war is not viable. Banks are catching up to this, as loyalty and rewards programs gain traction across global and domestic banking markets. In Australia, all major banks now offer rewards propositions, with challengers such as ING and HSBC rapidly building their own.

Single-use promotions and rate increases may effectively influence desired short-term behavior through transactions or increased deposits acquisition, but they rarely drive long-term retention. Moreover, poorly selected promotional tactics or benefits that lack relevance can further hinder participation.

On the other hand, loyalty and rewards programs provide a distinct mechanism. Designed effectively, they can differentiate a bank’s proposition, deliver incremental revenue, deepen customer engagement, and support core business objectives. Whole-of-bank programs are inherently suited to promote engagement and improve customer retention. In this article, we outline three pillars of loyalty program success, leveraging domestic and international benchmarks that exemplify the principles discussed.

Three pillars of loyalty and rewards program success

Loyalty programs exist to reward customers for their continued business. Therefore, their design should be centered around customer preferences to ensure relevance – but not at a loss to the bank.

As rewards and loyalty propositions become more common with online banking reducing switching costs, only programs that deliver incremental value will drive meaningful participation.

Value to bank

The breadth and depth of a loyalty program determine its ability to generate value for the bank.

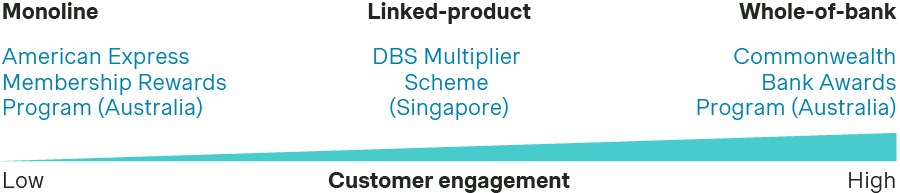

At the most basic level, breadth defines how extensively a loyalty program can span products and customer behaviors. Monoline programs, which are linked to a customer’s relationship with a single product, are the simplest to execute and understand. However, their limited scope constrains opportunities to scale engagement across the broader banking ecosystem. Linked-product programs require a higher degree of set-up and business unit collaboration, but they extend engagement and increase loyalty by broadening program depth to include multiple products. Whole-of-bank programs are the most comprehensive of the three, encompassing the bank’s entire product suite. While these programs require the most involved execution, they could be game-changing in deepening customer relationships. Within this archetype, rewards are tied to the customers’ overall engagement with the bank and, particularly when unmonetized, offer the greatest potential to deliver the most compelling benefits.

Free, behave-to-earn programs generate value through the specific banking activities they incentivize. Funds under management (FUM) holdings are typically associated with low switching friction. Roy Morgan reports that 2.9% of Australians have switched their main financial institution to newer digital banks such as Macquarie, ANZ Plus, ME Bank, Ubank, and Up, for a better interest rate. But while higher rates will attract new customers, they will not win loyalty.

“Sticky” behaviors, including transactions, bill payments, and salary credits, signal bank of choice status and extend customer lifetime value by increasing switching friction. Best-in-class programs mandate a combination of revenue-generating and anti-churn activities to reduce gaming risk and maximize customer value to the bank. Explicitly linking rewards to these behaviors – for example, offering cashback to drive transaction volume – further incentivizes customer participation.

Program depth

Program tiering is a structural component that enables banks to deliver differentiated benefits aligned with customer engagement levels and the value generated for the bank. Well-designed tiers drive deeper customer engagement to unlock higher-value benefits while limiting overall cost exposure.

Tiering models typically fall into three categories: explicit, implicit, or un-tiered. Each approach has its own nuances, benefits, and drawbacks.

While an explicitly tiered approach offers a transparent and easy-to-understand path to rewards, these programs are often rigid in their scalability and ability to personalize. Implicit tiering addresses this drawback. Within this structure, a differentiated value exchange still exists but allows for improved scalability and increased personalization potential, as customers may choose how they earn rewards or the rewards themselves.

Loyalty programs without tiering, although not differentiated, must still enforce a clear value exchange to remain commercially viable. Attractive offers that require minimal customer value exchange quickly become costly to sustain. For this reason, tiering decisions should be made early. Introducing eligibility requirements later in a program’s lifecycle may hinder customer sentiment and participation.

Chase Bank UK provides a relevant illustration. Launched in 2021 with a largely uncapped, unconditional 1% cashback offer, the program initially did not require any value exchange beyond transaction activity. In 2023, it tightened the criteria and introduced a deposit requirement of £500 to earn rewards and imposed a £15 earning cap per month. The un-tiered offer still stands today but has been fenced by an increased deposit requirement of £1500 and with a reduction in categories that qualify for cashback.

Examples of explicit and implicit tiering approaches

| Commonwealth Bank (Australia) | ING (Netherlands) | |

| Key features |

|

|

| Tiering type | Explicit | Implicit |

Value to customer

Loyalty and rewards programs should be designed with the bank’s target customer preferences at its core. The efficacy of a program is highly contingent on its benefits, which are ultimately the driving factor of participation.

For the highest levels of engagement, better programs will strike a balance between benefits which are instantly provisioned (for example, cashback) vs earned over time (for example, sweepstakes or internal points). Delayed receipt of benefits may hinder ongoing participation. A sweepstakes winner, for instance, may not participate again if they no longer believe they will win. Similarly, a flushed points balance after cashing in a reward may also reduce future motivation to participate due to the perceived effort required to accrue points again. Better programs will layer in sweepstakes with additional benefits for reinforcement or - if points-based – offer rewards which are easily accessible and more aspirational.

Personalization mechanics further enable banks to deliver greater value to their customers through targeted communications at critical lifecycle stages or by delivering relevant offers. Banks should leverage customer transaction data to deliver meaningful messaging and subsequently influence buying behavior – especially relevant to banks with co-funded benefits. For example, if a customer makes regular grocery transactions every Sunday at Coles and is pushed a 5% cashback offer at Woolworths during this time, they may consider switching grocery providers.

Providing customers with a choice of benefit may also increase their motivation to earn. Mox by Standard Chartered (Hong Kong) allows credit card customers to toggle between spend benefits.

Creating personal experiences will further enhance a bank’s relationship with customers. For example, goal-based provisioning of a savings bonus by reinforcing progress toward a savings goal with a $50 boost or re-introducing highly regarded lapsed product features in response to customer feedback demonstrates that the bank values both customer input and ongoing business.

Getting loyalty programs right: Key design considerations for sustained value

When designing a new loyalty program or evaluating an existing one, the following considerations should be considered for optimal outcomes.

Value to bank:

- Value exchange: Does the program mandate a clear value exchange either monetary through paid subscription or non-monetary through defined behavioral requirements?

- Deepened relationships: Does the program differentiate benefits based on a customer’s value and level of engagement with the bank?

- KPI achievement: Does the program incentivize behaviors that generate profit and/or increase expected customer lifetime value?

- Shared investment: Is the value provided to customers partially funded by partners?

Value to customer:

- Value of benefits: Are the benefits delivered compelling enough to incentivize program participation?

- Control over benefits: Do customers have a choice in how they earn benefits and/or which benefits they receive?

- Personalization: Are the benefits delivered generic or are they hyper-personalized through leveraging banking activity data?

- Instant gratification: Do customers gain immediate access to their benefits, or must the benefits be accrued over time?

- Simplicity: Is it clear to customers what benefits they will receive, how those benefits are earned, or could the value delivered be more explicitly communicated?

- Ease of use: Is the process of earning and redeeming benefits straightforward for customers? Are elements of gamification leveraged to support customer comprehension? Must benefits be activated or are they automatically applied? Are the required earning actions attainable by relevant customer segments or aspirational?

Value in market:

- Brand affinity: Does the program align with the bank’s identity and reinforce its value in the market?

- Uniqueness: Is the program meaningfully differentiated in its structure and benefits in the market, or does a comparable proposition already exist? If it doesn’t exist, can it be easily replicated?

- Reach: Does the program contain engaging elements that generate buzz in the market?

Simon-Kucher brings deep global expertise in banking loyalty. We have decades of experience supporting financial institutions across markets in the design, launch, and optimization of loyalty and rewards programs. If you are considering developing a new loyalty program for your banking customers - or evaluating the effectiveness of an existing one - reach out today to start a conversation.