Despite margin pressure and rising competition, many banks are still overpaying for deposits due to flat-rate strategies – approaches built for simplicity, not performance.

Accurate pricing has become a must-have, not a luxury, in the current business climate. The ability to tailor offers based on customer needs and financial impact is one of the most efficient and effective levers to improve business performance.

Shifting from uniform rates to individualized pricing unlocks real margin control. In our experience at Simon-Kucher, pricing optimization alone can deliver 8 to 18 basis points of margin uplift, often without requiring other measures.

Why precision pricing is the biggest untapped lever

One-size-fits-all is costing you more than you think

Many banks still rely on undifferentiated rate structures. These legacy pricing models prioritize operational simplicity but fail to account for meaningful differences in customer behavior, loyalty, and value contribution.

This misalignment leads to business inefficiencies: banks often over-incentivize rate-sensitive customers who actively shop around for the best deal, while under-recognizing the value of more stable, loyal customers. The result is elevated interest expense with limited returns on any promotional spend.

By contrast, implementing segmented and tailored pricing logic enables banks to align rate decisions with customer behavior and the strategic priorities of the business. Rather than applying broad incentives across the entire book, banks can focus pricing incentives where they deliver the greatest impact: on acquisition, retention, profitability, and funding cost efficiency.

We’ve seen this approach drive material results in practice: a $140 billion book for a US bank achieved a $45 million annual reduction in interest by introducing segmented pricing strategies tied to customer behavior and value potential. And with a minimal impact on volumes.

The evolution of deposit pricing

From broad pricing to individualized decisions at scale

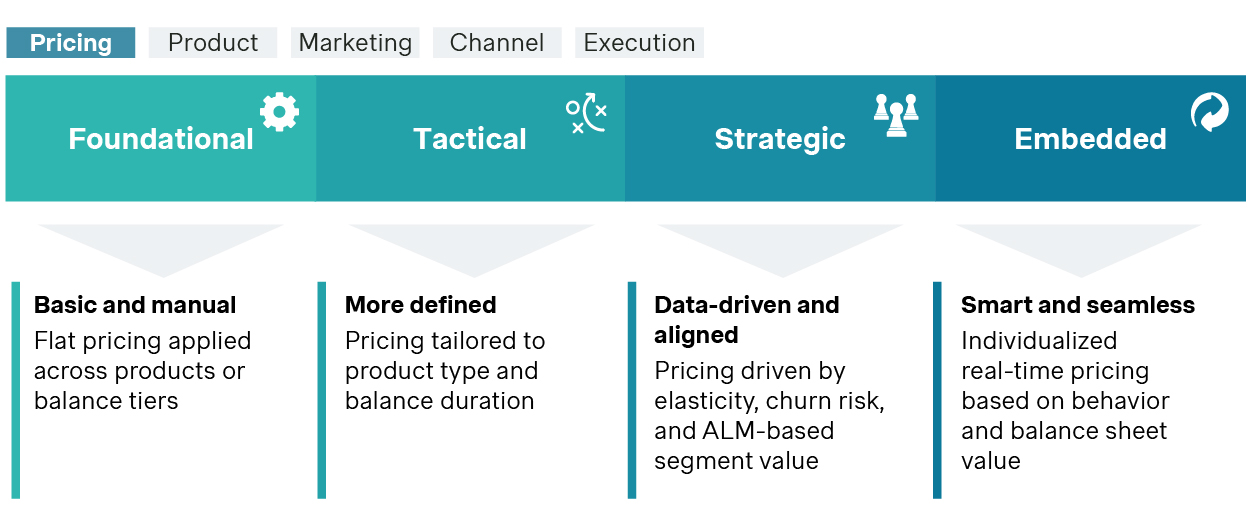

Deposit pricing maturity typically progresses through four distinct stages, each representing a step change in how banks use data, segmentation, and execution to improve performance:

Foundational

One-size-fits-all rates applied broadly across products or customer types. Pricing decisions are reactive and based primarily on market movements or competitor benchmarks.Tactical

Basic segmentation introduced using high-level criteria such as balance tiers, product type, customer primacy or geographic region. While more structured, this stage is still largely product led.Strategic

Rate decisions are informed by behavioral signals like churn risk, price sensitivity, and customer value. Offers are more targeted and aligned to retention, profitability, and funding goalsEmbedded

Individualized or micro-segment pricing at scale, driven by near real-time behavioral data and integrated into frontline and digital systems.

The deposit pricing maturity journey

Most banks are already at Stage 1 or 2. You’re not starting from zero. And you don’t need a full transformation to see results. Every step forward (better segmentation, smarter pricing logic) delivers real impact.

What individualized pricing really means

Tailored rates with real margin control

Individualized pricing is not about giving every customer a completely unique rate. Instead, it’s about designing pricing strategies that reflect customer behavior, needs, and value potential, so that each offer feels relevant, fair, and timely.

Effective individualized pricing uses data-driven logic to match rate decisions with specific customer signals. It prioritizes personalization where it matters most, without adding unnecessary complexity to a bank’s operations.

Consider the following examples:

A loyal customer with low churn risk may be engaged through tailored benefits beyond pricing to reinforce relationship value

A customer with growing balances could be offered a targeted rate step-up to maintain momentum and deepen retention

A dormant saver might be reactivated with a time-limited offer, automatically triggered by inactivity or declining balances

Banks don’t need to over-customize to personalize effectively. The goal isn’t complexity, but rather smarter pricing decisions, delivered faster and with stronger return on investment.

Pricing can be individualized by:

Defining high-impact customer segments

Using behavioral triggers such as balance trends, tenure, or digital engagement

Applying churn risk or elasticity models to guide pricing decisions

The right approach balances relevance with efficiency, targeting the customers, behaviors, and moments where pricing can make the biggest difference.

Personalization in practice

Personalization without chaos

For many banks, the idea of individualized pricing can raise concerns about operational complexity. But true personalization isn’t about giving every customer a different rate. Instead, it’s about delivering the right rate, to the right customer, at the right time.

To achieve that, banks need execution guidance: clear rules, well-defined segments, and automated triggers. Personalization becomes powerful not when it is bespoke for everyone, but when it is relevant, strategic, and controlled.

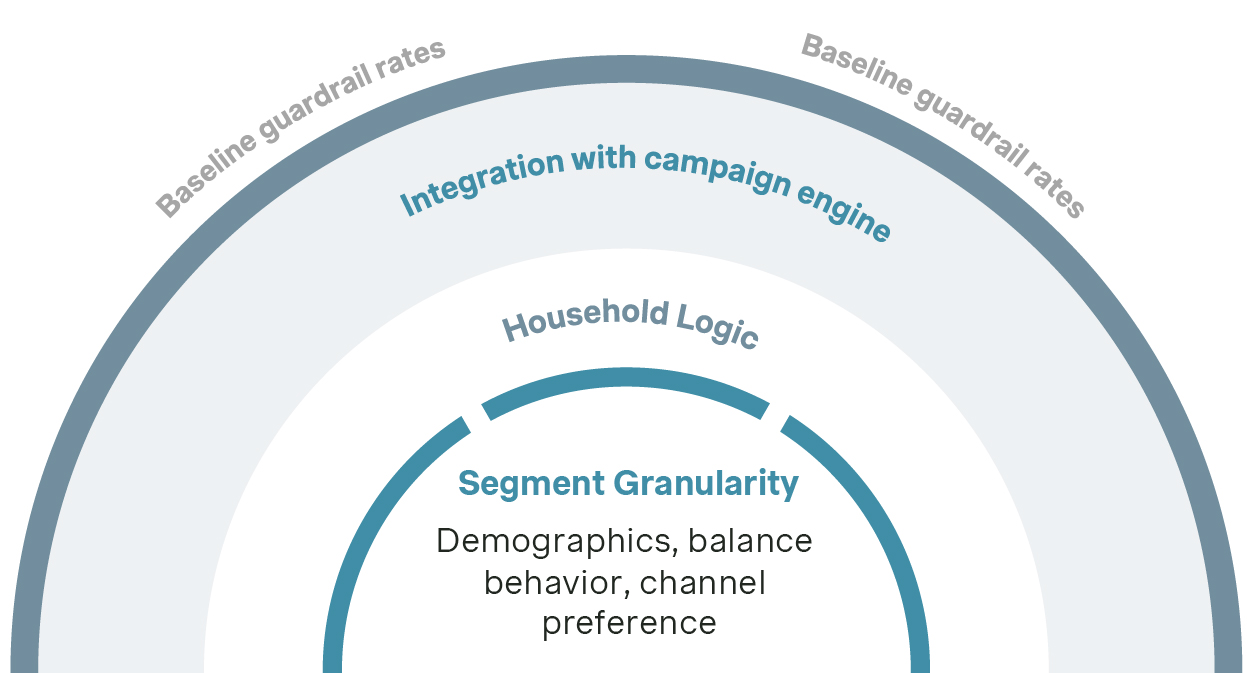

Here are some key factors to consider when designing a scalable personalization approach:

Segment granularity

Beyond basic demographics, segmentation can incorporate balance behavior, digital engagement, or channel mix to create more meaningful groupings

Household logic

Pricing decisions can reflect relationship-level value, offering consistent rates across joint accounts to reinforce loyalty and perceived fairnessIntegration with campaign engine

Linking rate offers to specific customer events, such as tenure milestones, behavioral triggers, or product holdings, to ensure relevant engagement

Compliance guardrails

Guardrails such as rate floors, caps, and regional constraints ensure alignment with regulatory requirements and internal risk policies

Critical elements for delivering personalized pricing at scale

Not all deposits are equal. Price for balance sheet value

Incorporating duration and stability into pricing decisions

Effective deposit pricing is not just about customer segmentation but also about funding quality. In other words, the value of a deposit isn’t only defined by who holds it, but by how it supports the balance sheet.

Duration, stability, and liquidity characteristics all influence the strategic value of a deposit. A pricing strategy that ignores these variables risks overpaying for short-term, high-volatility balances while under-incentivizing the long-term funding the institution actually needs.

To better reflect funding value, banks can tailor rate offers to promote the right deposit behaviors:

Sticky, long-duration balances can be encouraged with sustained rate incentives or loyalty bonuses

Short-term, high-beta balances may merit little or no uplift, especially if they increase reprice risk or reduce liquidity stability

For example, a campaign could apply bonus interest only to the portion of balances that exceed a threshold and are held consistently for six months, encouraging not just growth, but growth that supports funding stability.

By embedding balance sheet considerations into pricing strategy, modern pricing logic moves from “attract more deposits” to “attract the right deposits.” Banks can better manage interest expense, improve funding duration, and enhance asset-liability alignment without sacrificing customer relevance.

Real impact, fast

Better pricing isn't just smarter, it pays off fast

A common misconception is that individualized pricing requires long transformation timelines or advanced infrastructure before it begins to pay off. In reality, when designed with focus and executed with discipline, pricing strategies can start delivering meaningful results within 6 to 12 months.

Banks that adopt targeted, behavior-driven pricing have seen rapid improvements across key performance areas:

Balance-neutral cost reduction

By reallocating rate incentives more effectively, banks can reduce overall funding costs even without increasing balances

Improved retention in priority segments

Personalized offers help retain high-value customers and reduce churn risk in the most profitable parts of the book

Smarter promotional spend

Rate incentives become more efficient, focusing on segments where they influence behavior, rather than applied broadly without impact

Stronger liquidity and risk management

By attracting more stable, longer-duration deposits, banks can improve funding resilience and align better with asset-liability goals

Pricing isn’t about maximizing yield. It’s about maximizing outcomes.

With a structured approach, the returns from better pricing go far beyond margin uplift. They enhance campaign performance, reduce volatility, and create a more sustainable deposit franchise

How Simon-Kucher can help

Tools, analytics, and execution built for banking realities

Successfully moving from broad pricing to individualized strategies requires the right expertise, tools, and execution framework. That’s where Simon-Kucher brings a distinctive advantage.

We combine global experience in deposit pricing with specialized banking knowledge to help institutions turn strategy into measurable results. Our approach is pragmatic, data-driven, and built for execution in real-world banking environments.

Here’s how we support our clients:

We bring accelerators and proven playbooks, working with your data to build elasticity models that fit your market

Our support spans pricing strategy, tool design, governance, and frontline adoption

We help you move from tactical wins to embedded capabilities – at your pace

Whether you're aiming for quick wins or laying the groundwork for long-term transformation, we tailor our support to match your goals, systems, and organizational readiness.

Are you still pricing for simplicity? It’s time to do better.

Individualized pricing offers a smarter way forward – one that aligns rate decisions with customer behavior and funding strategy, drives efficiency, and delivers measurable results in months, not years.

You don’t need advanced AI to start. Many banks already have the foundational capabilities in place. What’s needed now is a more structured, strategic approach and the confidence to evolve with purpose.

Let’s start a conversation about what pricing excellence could look like in your deposit portfolio.