Deposits are back on the agenda, but the old playbook no longer works for retail banks.

The era of passive rate-taking is over, and simply reacting with rate hikes is not only insufficient, but also costly. Customers are more rate-sensitive and digitally empowered than ever, while funding markets are tightening. To stay competitive, banks must move beyond defensive tactics and embrace a holistic deposit portfolio strategy that drives margin, financial resilience, and growth.

Why this matters now

Banks are navigating a new era of deposit management marked by interest rate volatility, shifting customer behaviors, and intensifying funding pressures. Yet many institutions continue to rely on blunt, outdated tools, resulting in missed opportunities for retail banking profitability and increased balance sheet risk.

Without distinguishing between deposit types or customer behaviors, banks often overprice balances that offer limited strategic value.

Many banks offer overlapping or redundant deposit products, creating customer confusion and operational inefficiencies.

Campaigns are often rolled out without alignment to customer needs or market signals, hindered by fragmented processes and siloed systems.

A focus on quantity over quality results in short-duration, high-beta deposits that are costly and unreliable during market stress.

A comprehensive deposit strategy rests on five levers

Managing deposits as a portfolio requires building a strategy around five key levers. Each lever adds value individually, but when used together, they deliver the greatest impact. This integrated approach forms the foundation of a modern, high-performing deposit business.

Take our 5-minute assessment to find out where you stand.

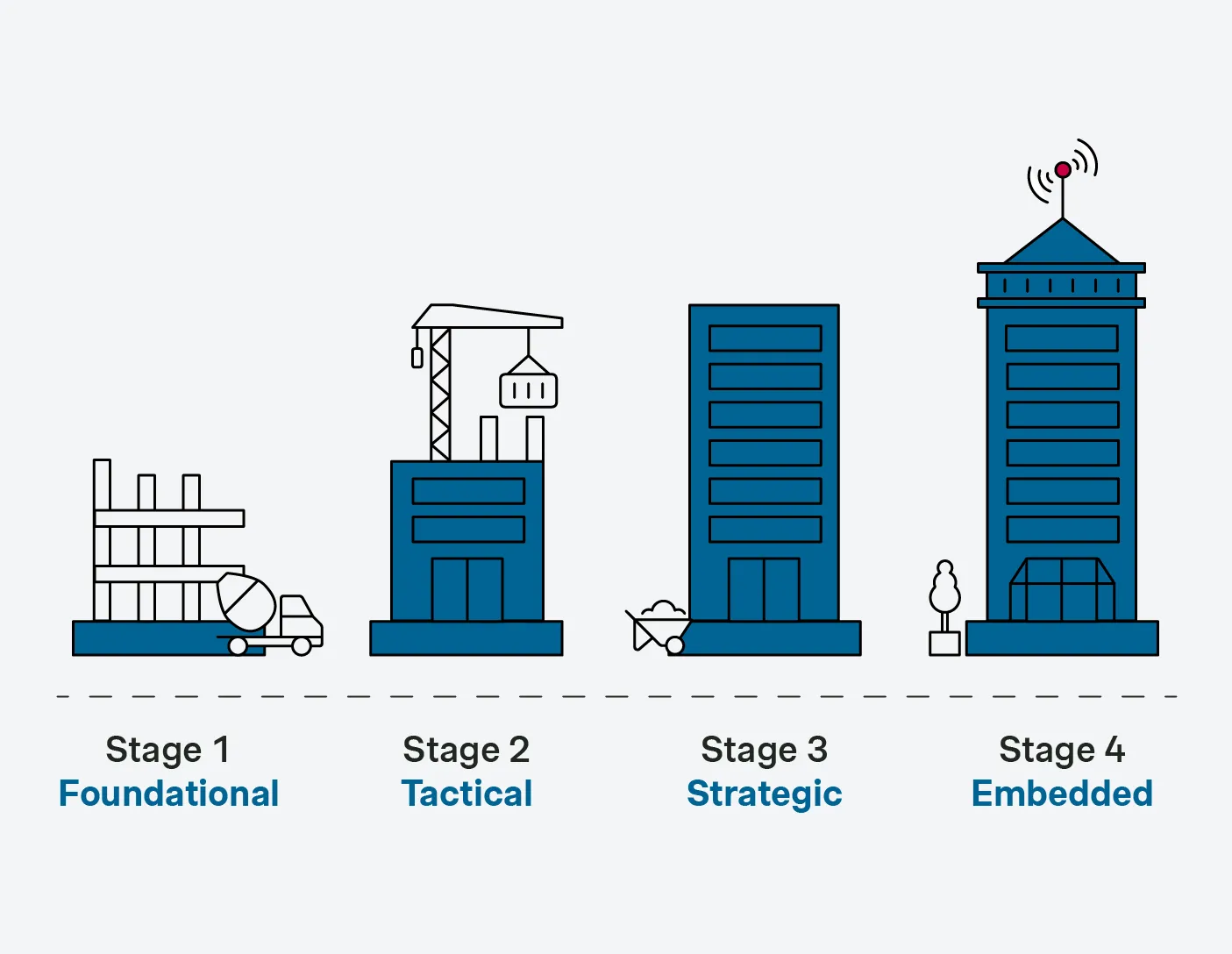

Use our Deposit Maturity Framework to assess your current stage, uncover opportunities, and unlock a clear path to profitable growth.

You’re at the start of your deposit journey. That means big upside, and clear, actionable next steps. Focus on optimizing your product shelf, introducing segmentation, and building early governance structures.

What to focus on next:

1. Evaluate your product shelf – whether it’s too complex or too limited – to ensure it supports margin, retention, and customer needs.

2. Introduce basic segmentation by product type or customer group.

3. Establish foundational governance with clear roles and pricing accountability.

You have strong foundations, but major gains are possible with coordinated execution and personalization. Strengthen pricing science, clarify governance, and improve channel delivery.

1. Build elasticity or churn models to inform more precise pricing.

2. Align product, pricing, and marketing decisions across teams.

3. Improve execution consistency across branches and digital channels.

You’re on the right track. Your deposit strategy is built on smart logic and clear operations. Now’s the time to scale personalization and embed execution into your systems.

What to focus on next:

1. Scale personalization using behavior-based triggers and offers.

2. Introduce product features that improve retention and align with balance sheet goals, such as tiered loyalty bonuses or minimum holding periods.

3. Automate campaign and pricing delivery across key systems.

4. Use performance data to optimize offers and identify new growth levers.

1. Explore self-learning models for dynamic pricing and retention.

2. Optimize pricing and product design to influence deposit duration and stability, improving both margin and funding quality.

3. Embed deposits into broader product ecosystems (e.g. bundles, fintech-style features).

4. Drive innovation loops through continuous test-and-learn cycles.

You’re at the start of your deposit journey. That means big upside, and clear, actionable next steps. Focus on optimizing your product shelf, introducing segmentation, and building early governance structures.

You have strong foundations, but major gains are possible with coordinated execution and personalization. Strengthen pricing science, clarify governance, and improve channel delivery.

You’re on the right track. Your deposit strategy is built on smart logic and clear operations. Now’s the time to scale personalization and embed execution into your systems.

Congratulations! You’re operating at a best-in-class level. But deposit strategy is never done. We can help you push even further with innovation, automation, and next-gen levers.

Why Simon-Kucher

Talk to our experts

Get in touch

With over three decades of experience as growth advisors in the financial services sector, we understand what it takes to grow in today’s challenging market.

When it comes to deposit management, our team of experts can guide banks through the journey from foundational fixes to fully embedded high-performing deposit strategies. This marks a shift from passively following market flows to actively managing deposits as a strategic asset.

Get in touch to explore how Simon-Kucher can help you design and deliver a deposit strategy that performs efficiently, effectively, and with lasting impact.