Travel budgets are rising. Discover how Gen Z and Millennials are choosing holiday destinations, how AI is reshaping holiday planning, and where health and wellness travel is taking off – and what it means for your business growth strategy.

Where are travelers headed next – and how are they getting there? Our Global Travel Trends 2026 study, built on insights from more than 10,000 respondents across 10 key markets including China, India, Saudi Arabia, France, the UK, and the US, reveals powerful shifts influencing the industry’s next chapter. Covering all generations from Gen Z to Baby Boomers, the results capture how people are discovering, booking, and experiencing travel in entirely new ways. Below, we spotlight five major trends for travel in 2026.

These shifts reveal a global traveler who is more digital, more discerning, and more willing to spend - challenging the industry to keep pace with fast-changing expectations. In short, 2026 will reward the travel providers that connect insight to action.

1. Young travelers are the growth drivers for 2026

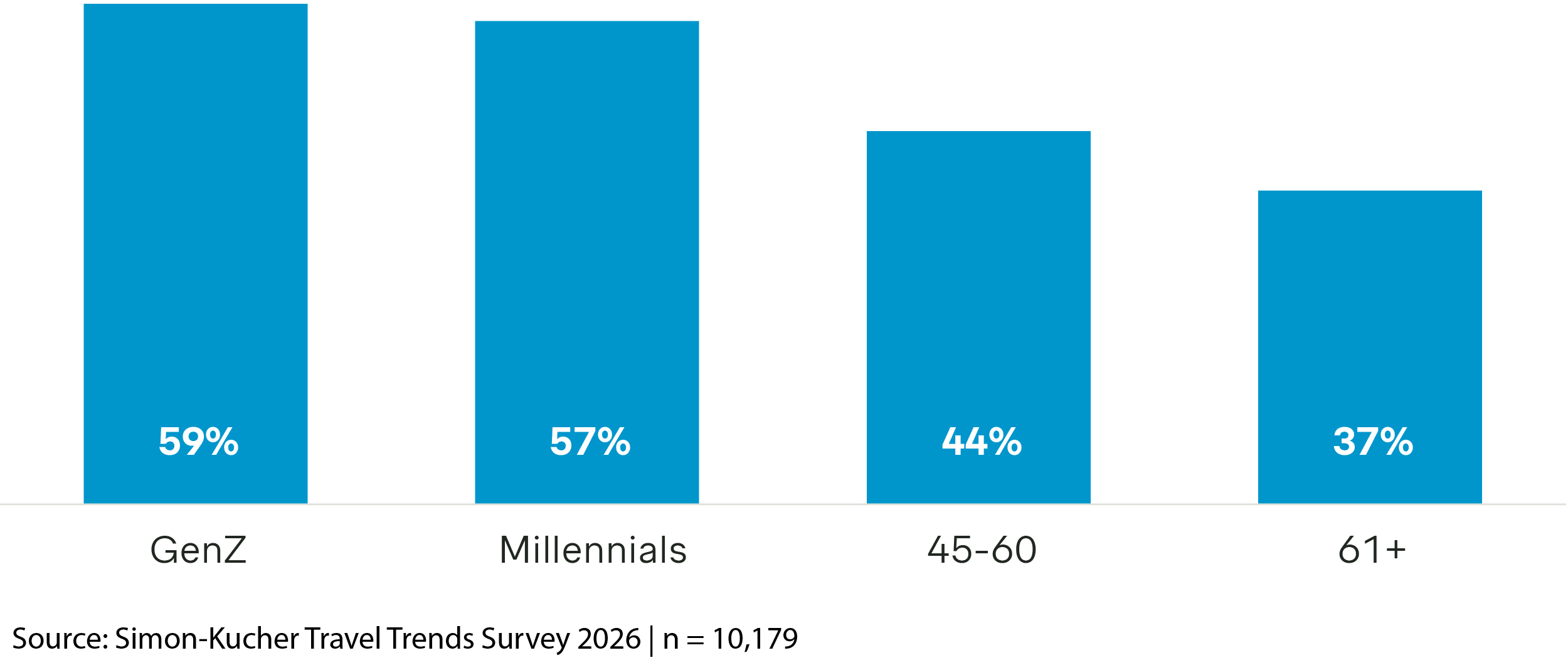

Gen Z and Millennials are redefining travel behavior. Almost 60% took two or more trips of at least five nights in 2025, with 57% and 55% respectively choosing international destinations. In contrast, less than half of older travelers took multiple holidays, most staying closer to home.

Travelers who went on two or more holidays (5+ nights) in 2025:

Young generations will be the key growth drivers in 2026 as they allocate a larger share of household budgets to travel. Holiday spending has already risen by 4% since 2024. Two-thirds of Gen Z and Millennials intend to increase their travel budgets next year, with 19% of Gen Z and 15% of Millennials planning to boost spending by more than 20%. By comparison, only around 35% of older travelers expect to do the same. While older travelers spend about 30% more per trip on average, younger travelers are driving growth through more frequent travel and higher overall budgets.

2. AI takes over as the new travel planner

Artificial intelligence (AI) is fast becoming integral to the travel experience. In 2025, 42% of travelers used AI-powered tools for itinerary planning through platforms like ChatGPT or Co-Pilot, while 33% used them for translation and 31% for travel search.

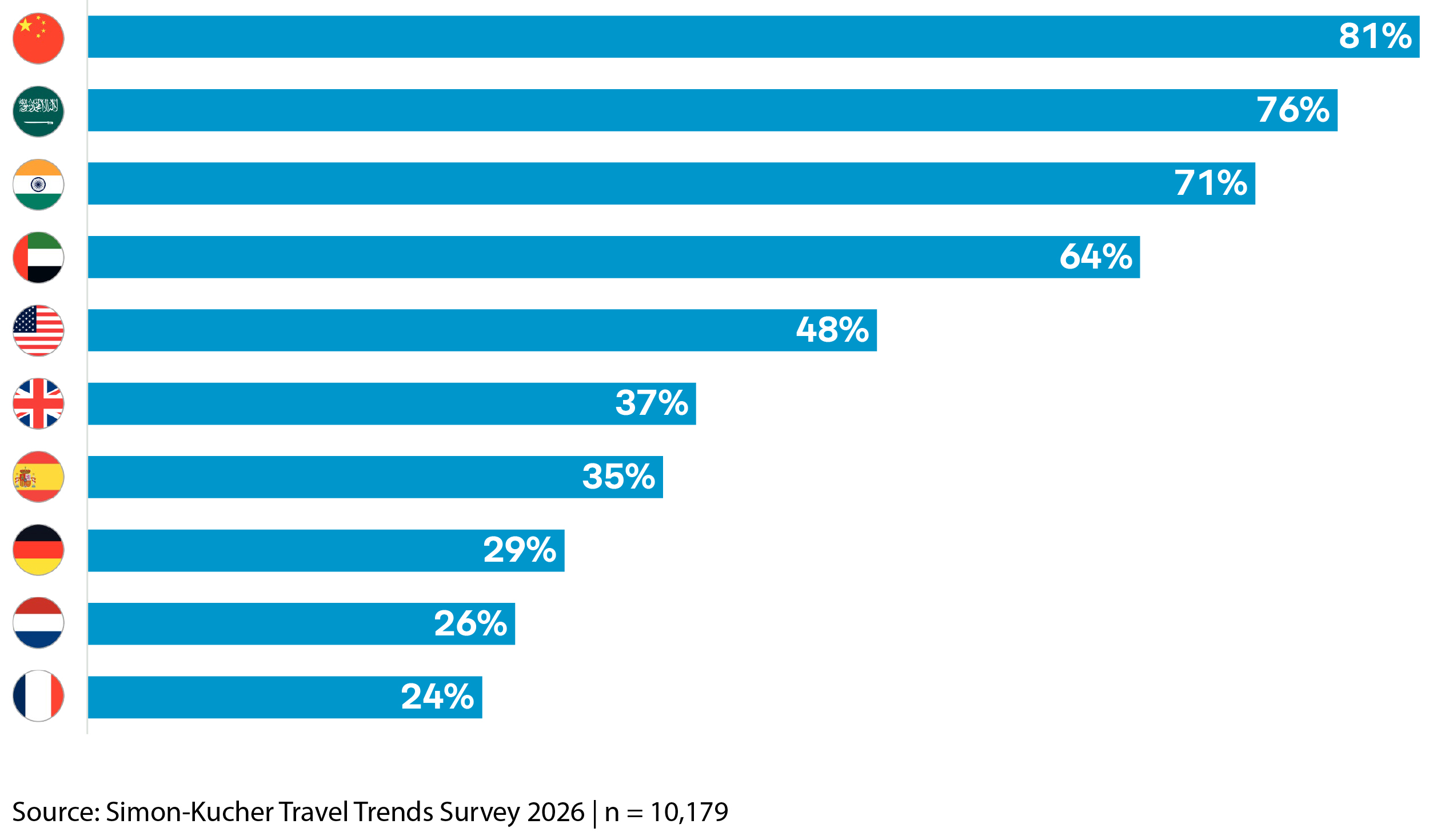

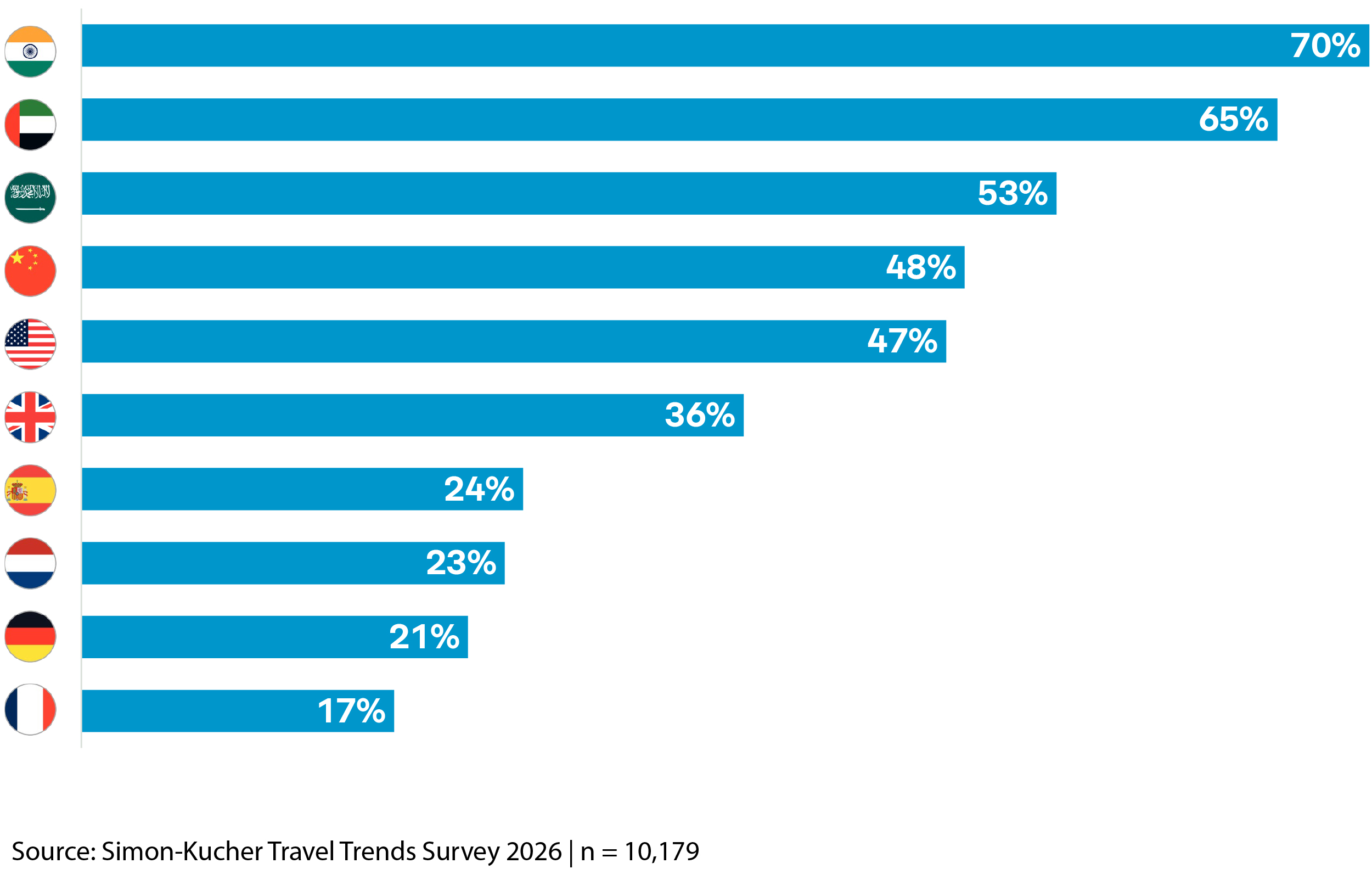

Adoption is strongest in Asia and the Middle East, where digital penetration and travel appetite are both high. In China, 81% of travelers used AI for holiday inspiration, followed by Saudi Arabia (76%), India (71%), and the UAE (64%). Usage in Europe is markedly lower, with just 24% in France and 26% in the Netherlands, reflecting slower integration of AI into the traveler journey - and perhaps a more traditional approach to travel.

Travelers who use AI-tools for travel inspiration

Digital-native generations are leading this shift: over 60% of Gen Z and Millennial travelers use AI tools for planning or inspiration, compared with just 10-44% among older groups.

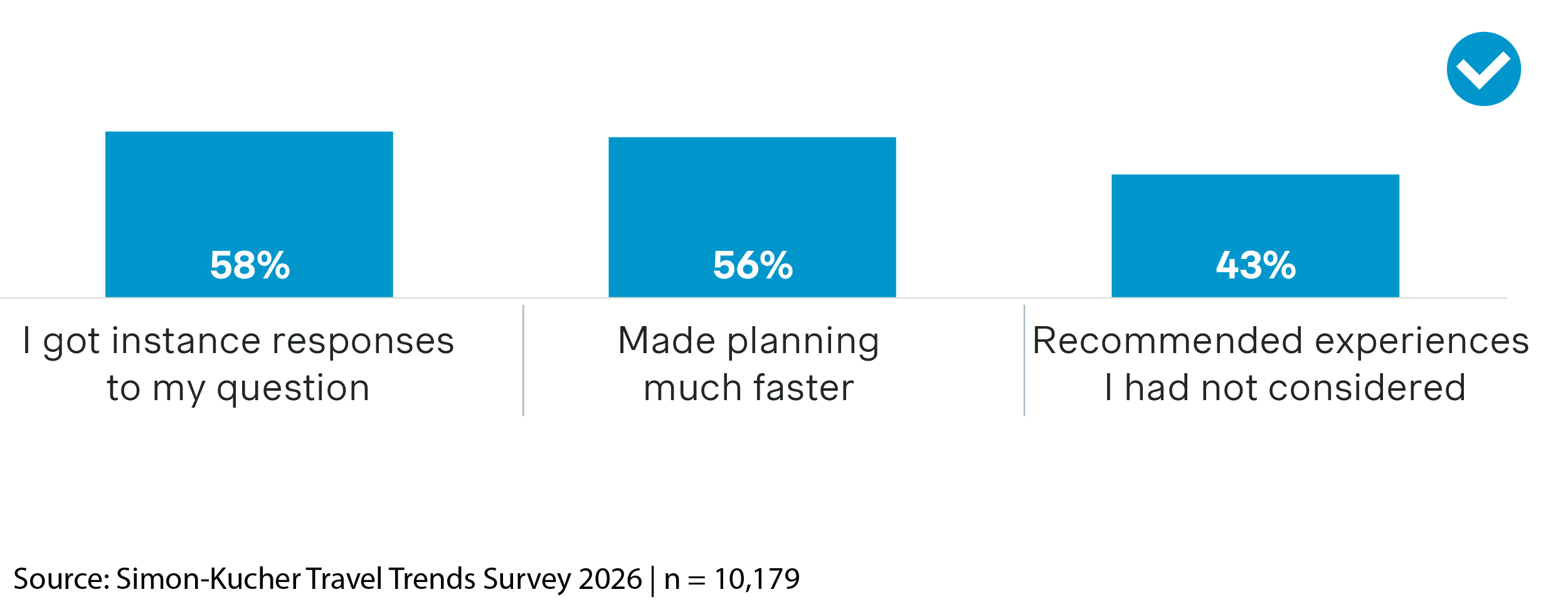

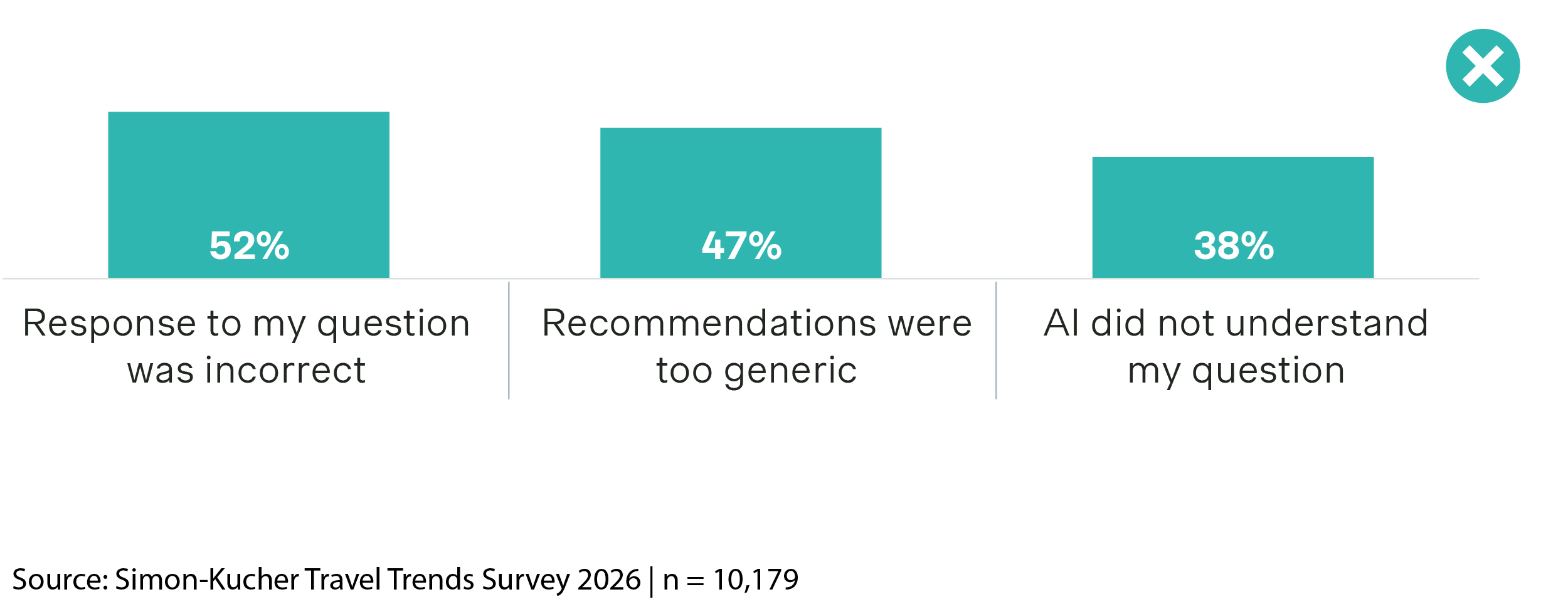

Traveler satisfaction with AI tools is largely driven by time savings: 58% value instant responses and 56% say planning is faster as a result. Another 43% appreciate new recommendations. Dissatisfaction stems from inaccurate responses (52%), impersonal recommendations (47%), and poor comprehension (38%). Only a small share mention tool complexity (15%) or outdated technology (11%), suggesting that current platforms are user friendly.

Which features of AI travelers were satisfied

Which features of AI travelers were not-satisfied

3. Social media continues to influence and inspire

Social media and digital storytelling now decisively shape travel intent among younger generations. Over 55% of Gen Z and Millennials say influencer content inspires where they go, while those over 45 remain far less influenced by social platforms.

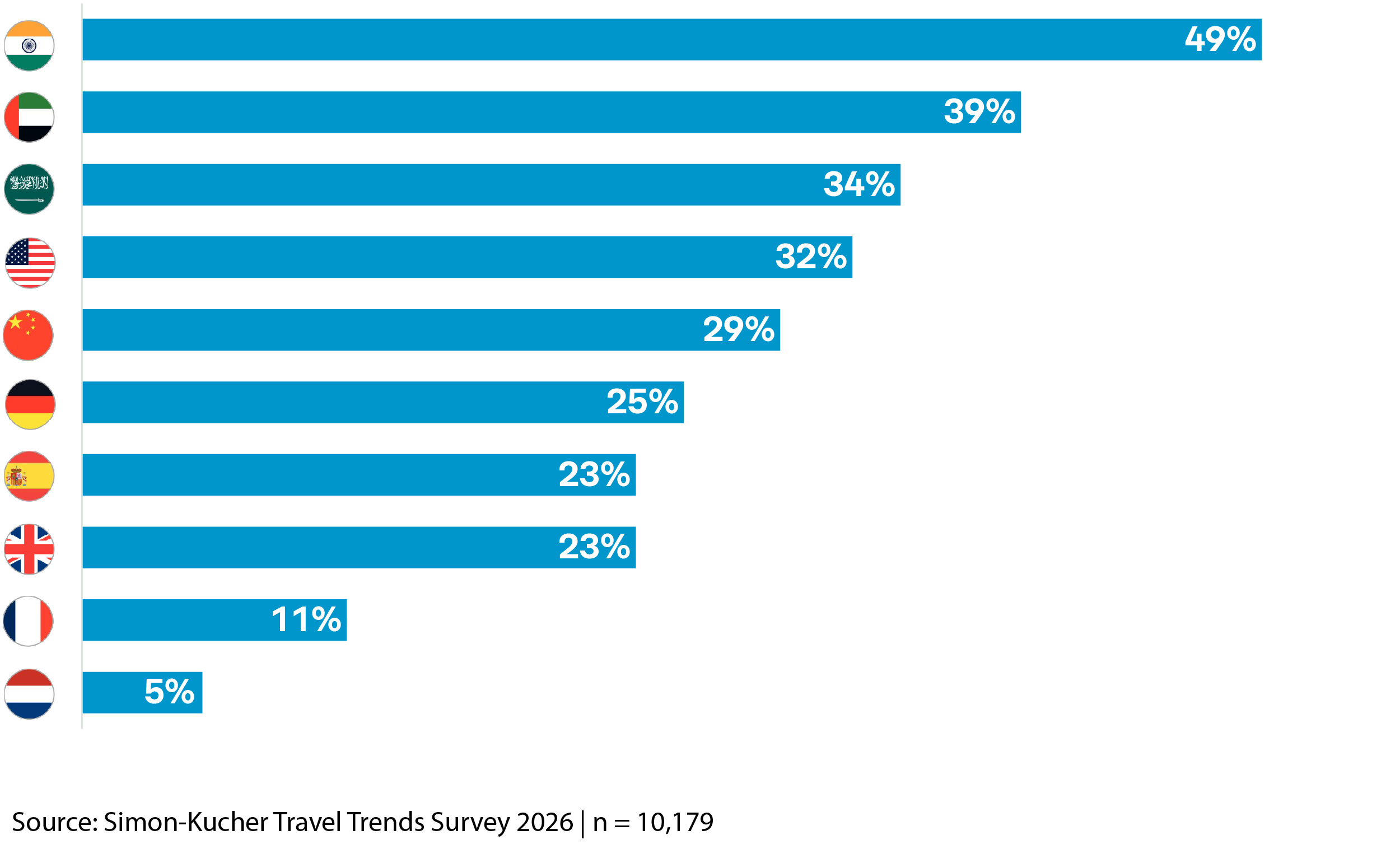

As with AI adoption, the pattern is strongest in mobile-first markets. In India, 70% of travelers cite social media as a key source of holiday inspiration, followed by 65% in the UAE, where a diverse expat community and high connectivity amplify digital engagement. In comparison, more than half of European travelers say they are not influenced by social media.

Travelers inspired by 'social media influencers'

Digital influence increasingly converts inspiration to reality. About a third of Chinese travelers and nearly three in ten Indians have visited destinations discovered on social media. Overall, Asian travelers actively seek novelty, while Europeans often return to familiar favorites.

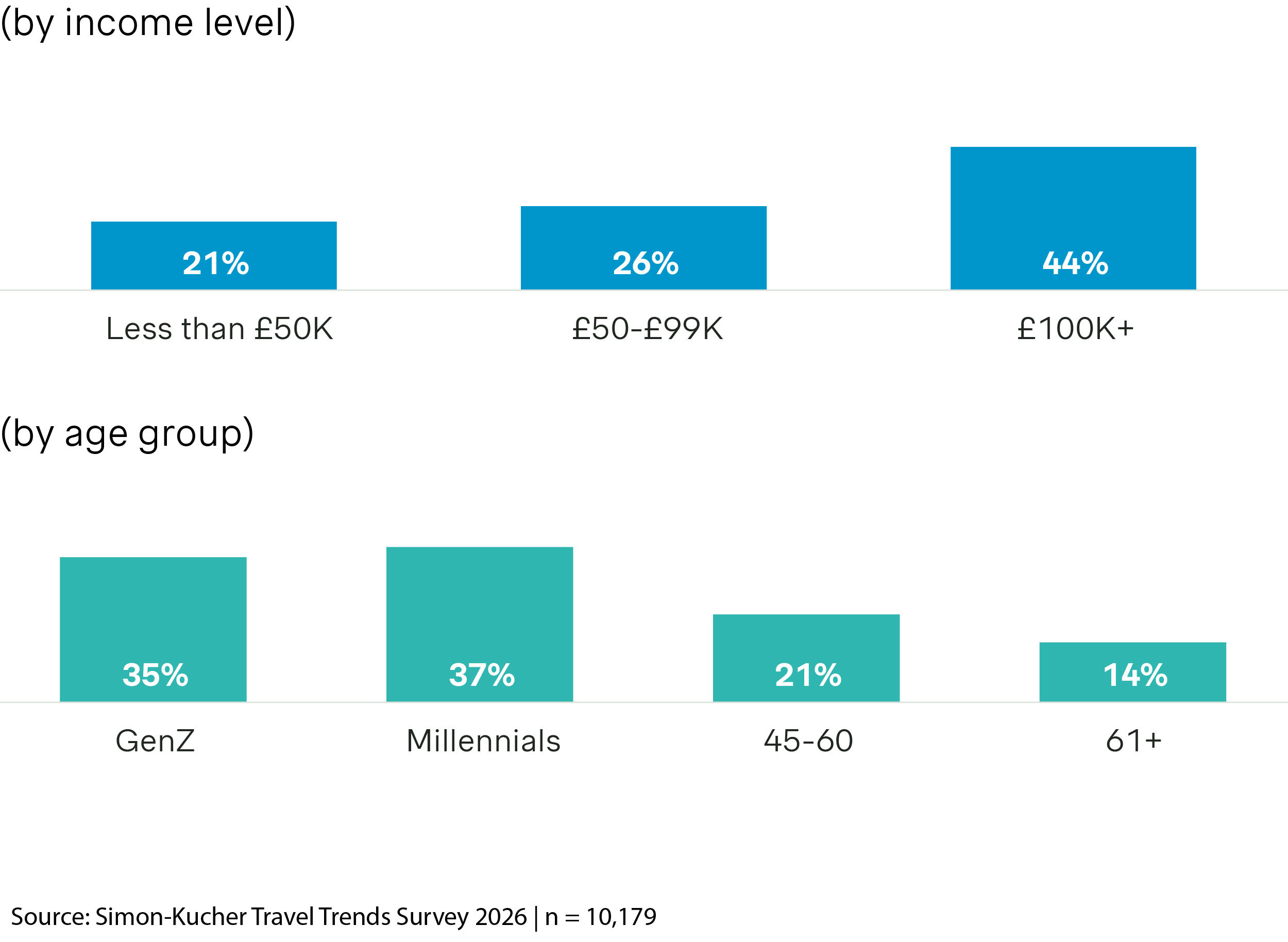

4. Wellness travel grows but carries a luxury price tag

As health and wellbeing move higher on the travel agenda, spa- and wellness-focused holidays built around nature, fitness, mindfulness, and rest remain a premium holiday experience. High-income travelers lead this segment: 44% took a health and wellness trip in 2025, compared with 21% of lower-income travelers. And this trend continues into 2026, with 58% of high-income travelers actively planning a wellness-related holiday, compared with 26% of lower-income travelers. This reinforces wellness travel as an aspirational category – one that signals self-investment as much as rest.

Taken a specific trip for health and wellness purposes in 2025

Younger travelers are expanding the market base. Nearly half of Gen Z and Millennials intend to book a wellness trip next year, indicating rising interest beyond the traditional high-income bracket. Providers can evolve offerings by introducing more accessible health and wellness formats without diluting exclusivity.

Travelers who took a health and wellness related trip in 2025

Awareness and uptake are highest in Asia and the Middle East - India (49%), the UAE (39%), and Saudi Arabia (34%). In France and the Netherlands, half of respondents are unfamiliar with wellness holidays.

Travelers in the US, the Middle East, and Asia are ready to spend over 30% more on a premium holiday experience. Younger generations globally show the greatest appetite, willing to pay up to 36% more.

5. Support for overtourism measures gains momentum

Overtourism is now a serious concern, with local communities also pushing back against unchecked visitor numbers. Travelers are responding in kind, showing greater awareness of crowding and more openness to measures that protect destinations and elevate the quality of their holiday experience.

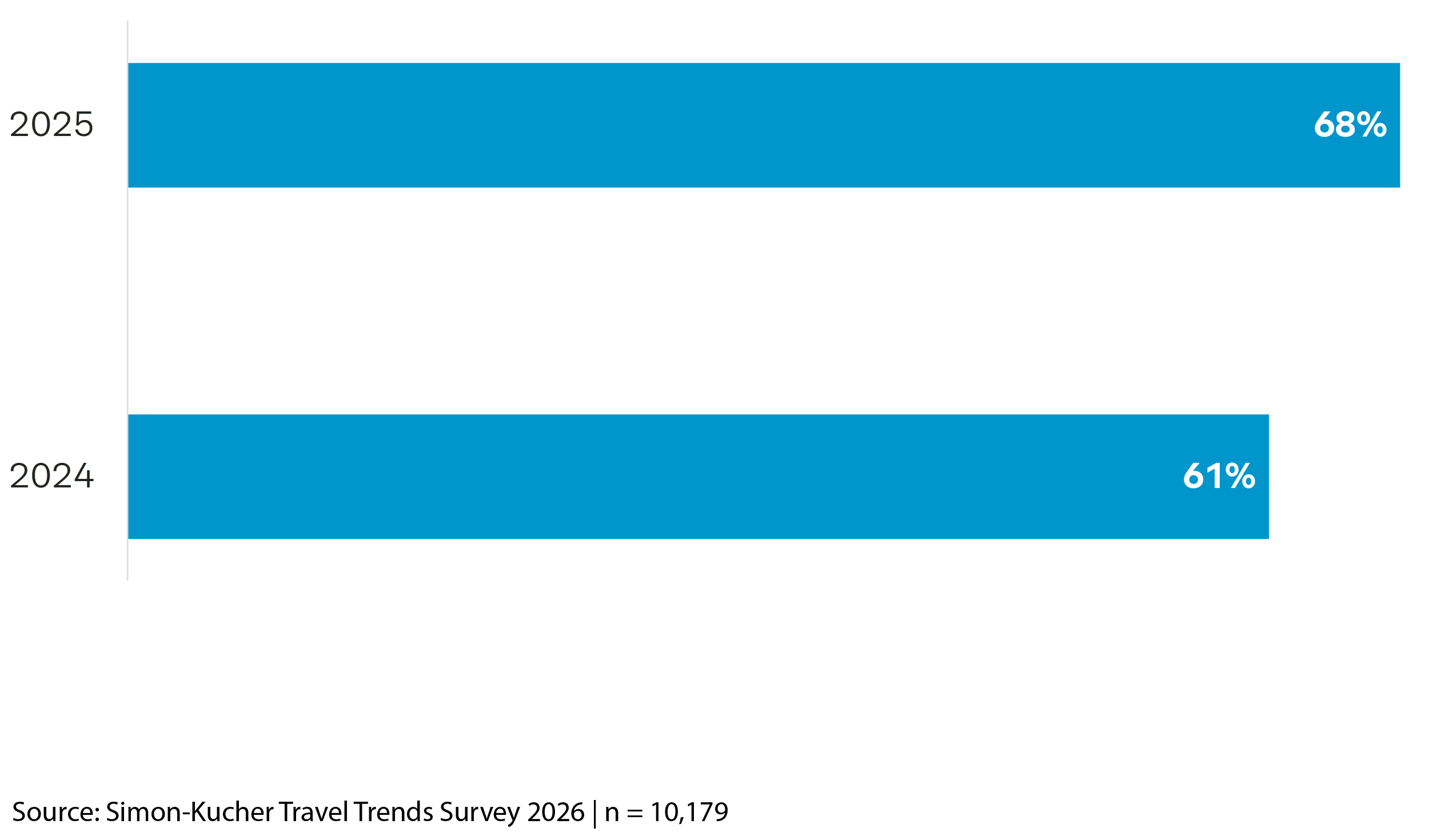

Since 2024, there has been a seven-percentage point increase in travelers who say they would avoid a destination due to overcrowding. This suggests that many have experienced the effects of overtourism firsthand.

Travelers who would avoid booking a popular destination that will be over-crowded

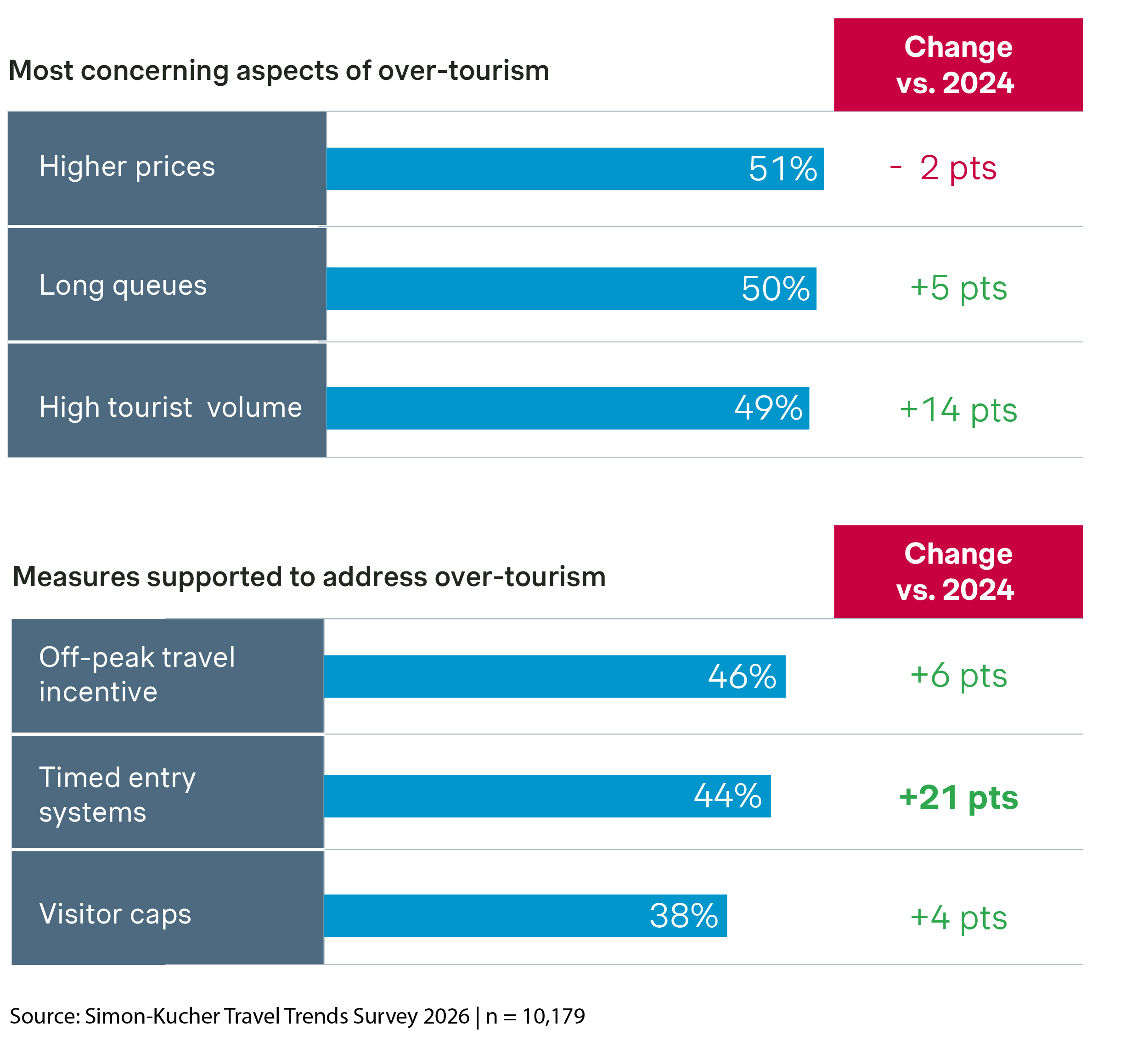

The biggest concerns are high tourist volumes (up 14 points) and insufficient amenities (up 12 points) compared with 2024. Interestingly, worry about rising prices has eased slightly (-2 points), while environmental and cultural impacts remained among the lowest-ranked concerns.

Travelers increasingly back initiatives designed to enhance their holiday enjoyment. Off-peak travel incentives are the most popular, supported by 46%, a six-point increase from 2024. Timed entry systems have nearly doubled in preference to 44%. This signals that travelers now see thoughtful crowd management as a way to improve their enjoyment of destinations.

Support for monetary controls has also grown. More travelers now endorse tourism taxes (28%) and higher accommodation prices (24%) as practical ways to manage visitor volumes and protect destinations from overcrowding.

How travel providers can capture the next wave of growth

By mapping these emerging travel trends to the customer journey, providers can identify where to inspire, convert, and retain tomorrow’s travelers.

Shape awareness with digital reach and influence

Brands must invest where travelers are inspired - online and across social platforms. Younger travelers engage most with short-form content on TikTok and Instagram, while others still respond to PR, print, and digital advertising that build credibility and brand awareness. A balanced, multi-channel marketing strategy that optimizes direct sales and extends reach through OTAs and travel agents are the most effective.

Make planning effortless with AI integration

Prepare for AI as the next layer of customer interface. Travel providers should ensure their websites and booking engines are AI-agent ready, allowing tools like ChatGPT to surface accurate content and offers directly. Investing in Model Context Protocols enables AI platforms to access real-time pricing and availability, helping travelers move seamlessly from search to booking in a single interaction.

Convert with smart, value-based pricing

Pricing remains one of the most powerful levers to secure bookings. Companies that define clear pricing principles across seasons and channels can build early demand while protecting profit. Use dynamic pricing tools to respond to conversion data, demand signals, and competitor movements in real time. The key is aligning perceived value with willingness to pay, particularly as younger, higher-spending travelers redefine what “premium” means.

Grow revenue through personalized value

Revenue growth will depend on how effectively travel providers tailor and tier their offerings. Build intuitive upgrade tiers - Good, Better, Best – to move customers smoothly from standard to premium experiences. Add-on services should reflect each segment’s priorities, while expanding into adjacent ancillaries helps capture more share of wallet and keep travelers within the brand ecosystem.

Drive retention through satisfaction and reward

The post-trip moment is the start of the next sale. Personalized follow-ups, feedback loops, and loyalty rewards transform satisfied travelers into repeat customers. Whether through proprietary programs or strategic partnerships, the goal is to reward lifetime value, not one-off transactions – closing the loop between experience and retention.

Form placeholder. This will only show within the editor