Earlier this year, we outlined how luxury industry’s growth was cooling, yet far from capped. India, experiential luxury, and sharper consumer segmentation were leading the way. Our most recent research shows where demand is materializing, how price perceptions are shifting, and which consumer profiles are gaining ground. Here’s an updated view of luxury industry trends in 2025, and the concrete moves leaders should make now.

Form placeholder. This will only show within the editor

A quick rewind: what the first half of 2025 told usIn May, we shared three core insights around luxury trends:

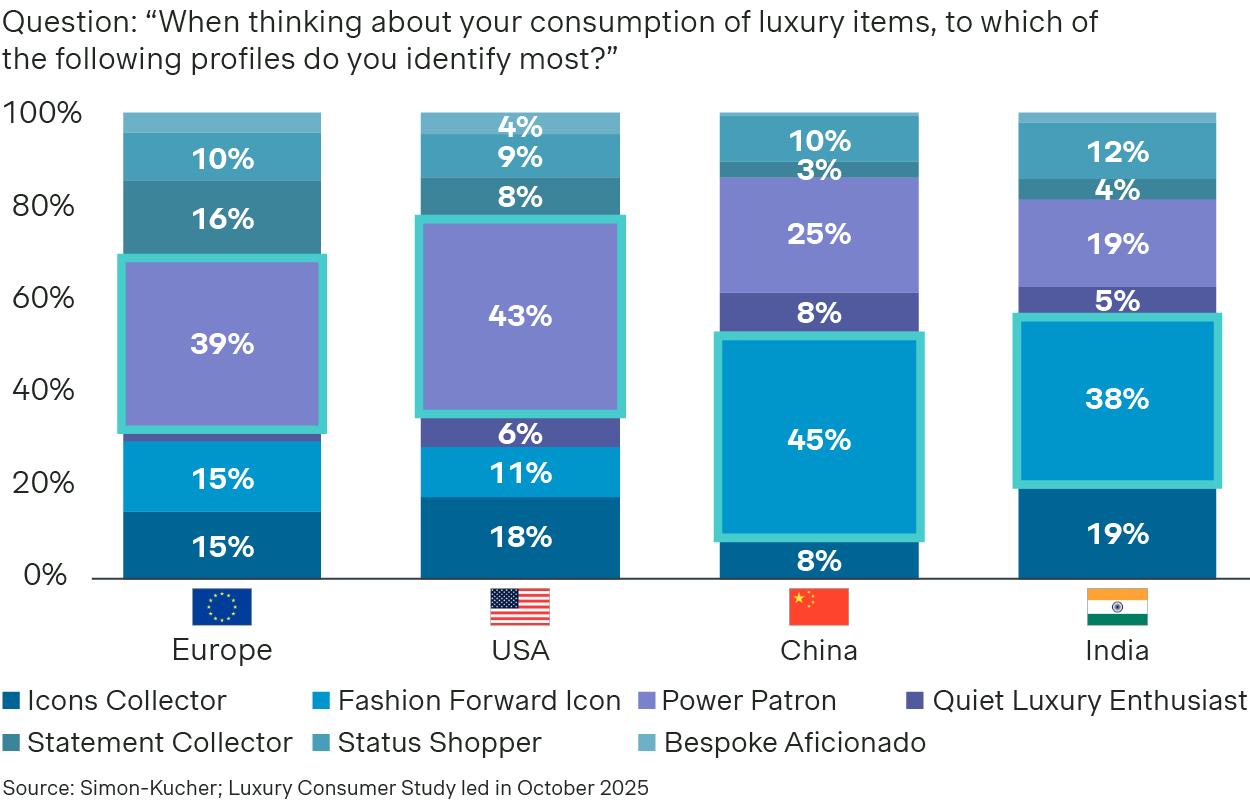

Those seven profiles (Icon Collector, Fashion-Forward Icon, Power Patron, Quiet Luxury Enthusiast, Statement Collector, Status Shopper, and Bespoke Aficionado) established a shared strategic lens for understanding today’s luxury consumers and identifying growth opportunities across segments. We also flagged omnichannel developments such as store-led in mature markets and digital acceleration in India, as well as the importance of communicating value where price sensitivity is rising. |

What’s changed: the second-wave read

1. Growth is cooler but clearer.

Our latest research and the Euromonitor database points to an overall 2.9% CAGR for 2025–2030, reflecting a still-resilient but tighter runway. The growth mix remains familiar: experiential luxury, leather goods and jewelry, and India continue to provide substantial momentum. For luxury brands, the takeaway is straightforward: the focus should be on fewer bets and better targeting.

2. The demand map is shifting.

Spend remains stable in Europe and the US. Meanwhile, China is less driven by ultra-high spenders than earlier in the cycle. India shows a slight dip in past spending, yet the forward view is positive in every market than it was in April.

Intent to increase luxury spending is now 86% in India (+2pp vs. April), 52% in the US (+11 pp), 42% in China (+3 pp), and 32% in Europe (+3 pp).

For luxury businesses, this means forecasting models must overweigh intent signals in India and the US, while watching China’s asymmetric shift.

3. How shoppers plan to spend is diverging by region.

In Europe and the US, luxury consumers who plan to spend more will do so via higher purchase frequency. In China and India, the increase will come from more items and trading up to more prestigious brands.

In fact, over half of Indian, Chinese, and US consumers who expect to increase spending will buy more items and upgrade. This is a crucial cue for assortment and price-pack architecture.

4. Shopper profiles are moving fast.

The Quiet Luxury mindset has accelerated noticeably in the US. Fashion-Forward Icons have also expanded in India, signaling a closer alignment with Chinese shoppers on trend-forward purchases.

Meanwhile, more than 75% of European and US shoppers compare prices across brands and channels before purchase. Over two-thirds of Chinese consumers view luxury as a lifestyle, not a category. These nuances must shape creative and conversion plays for luxury brands in 2025.

5. Price perception: Ceiling effects are real but not universal.

Over 60% of respondents from the Europe, India, and US markets say prices are higher than two years ago.

In the US, about one-third report declining value for money but note the exception: watches. Fewer than one in ten consumers report a drop in value for money in luxury watches, underscoring the category’s enduring premium craftsmanship and strong elasticity narrative.

Form placeholder. This will only show within the editor

6. Channel dynamics: Omnichannel, not one-size-fits-all.

Over 70% of luxury consumers prefer buying in-store in the US, China, and Europe. However, less than half of Indian luxury shoppers buy in store, with digital being their primary entry point.

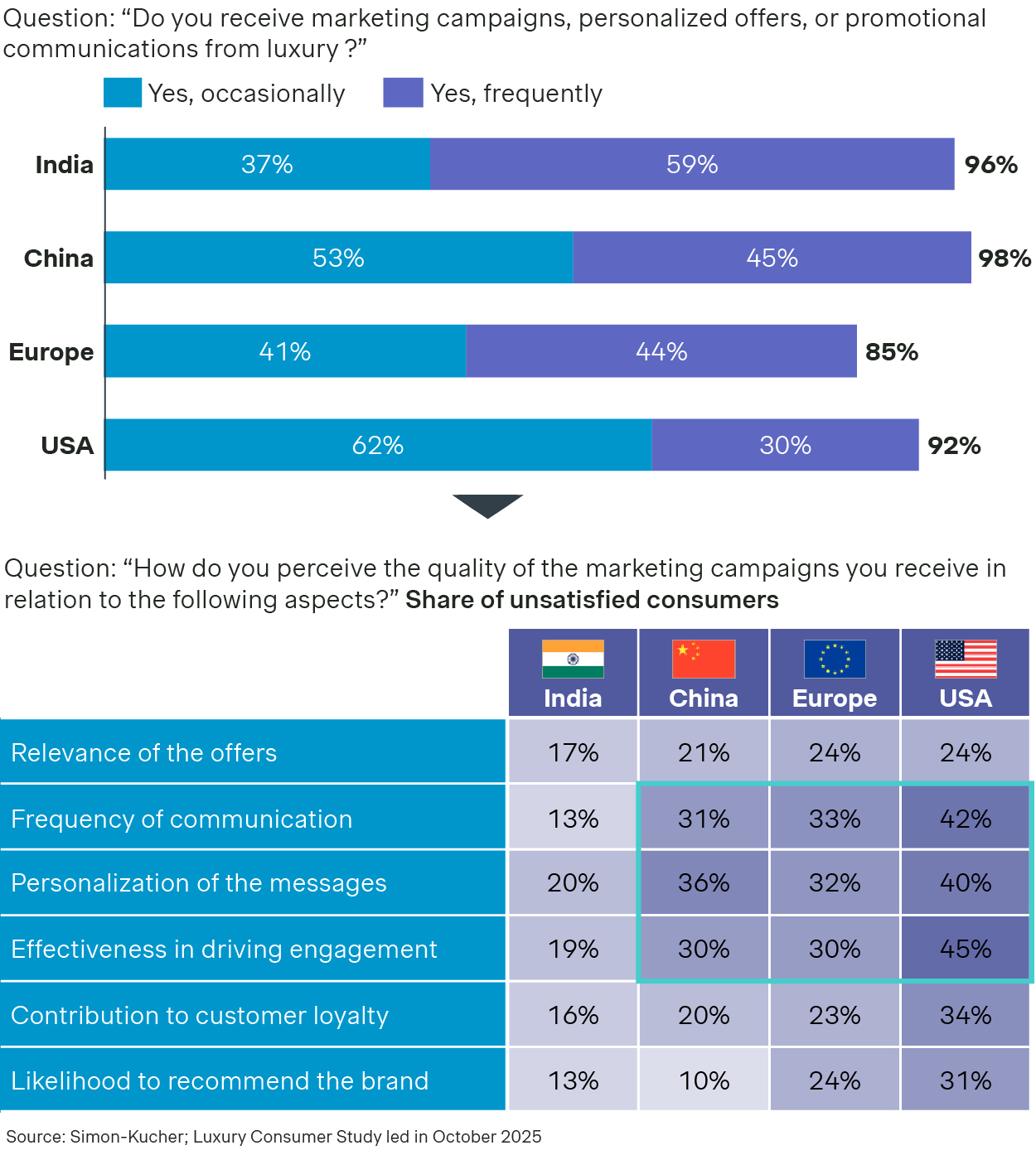

Satisfaction scores are highest in India (NPS +60). But the story elsewhere is more concerning. Around 40% of US shoppers say they’re unsatisfied with CRM communications. European and Chinese consumers (around 30%) also report significant dissatisfaction with the CRM strategy. This signals a broader engagement gap and is a warning that retention is at risk even where stores are dominant.

7. New trade frictions are testing the industry’s profitability model.

Tariffs now reach up to 39% on Swiss exports to the US and 15% on EU goods, exposing how dependent many houses remain on single-origin models and long, margin-thin supply chains. Luxury’s traditional strengths of heritage, craftsmanship, scarcity remain intact, but the structural economics beneath them are being rebalanced.

8. Luxury promise shifts from “made-in” to “believed-in”.

For decades, luxury has drawn strength from geographic roots: Swiss watches, Bordeaux wines, and Italian fashion, to name a few. But as trade dynamics, costs, and consumer values evolve, the origin story is widening. Younger audiences in particular prize sustainability, innovation, and craftsmanship over a single country label.

Form placeholder. This will only show within the editor

Your next move: A practical playbook for luxury brands in 2025

The imperative for 2025 and beyond is to reimagine where and how value is created.

Reframe origin as authorship, not coordinates on a map.

As our latest Luxury Barometer shows, consumers’ sense of value for money increasingly depends on how credibly a brand can convey why its products are worth their price, not just where they come from. Treat origin as a story of authorship rather than geography. Highlight the creators, processes, and ideas that bring your products to life. Celebrate craftsmanship, innovation, and cultural collaboration instead of relying solely on “Made in” labels.

This evolution matters because perceived value is no longer anchored in country of origin but in authentic creation stories. With over 60% of consumers across major markets saying luxury prices have risen and one-third of US shoppers citing declining value for money, brands that show how expertise, time, and intent shape their products will stand apart.

Local moves:

- In the US, the Quiet Luxury surge calls for fewer logos, more provenance, and quieter craft. Think tight capsules with elevated materials and finishes, plus content that teaches ateliers, techniques, and repairability.

- In India, the rise of Fashion-Forward Icons demands faster trend cycles and bold collaboration drops, launching for social discovery and short-window scarcity.

- China remains aspirational with low price sensitivity. Here, keeping exclusivity at the core of message and experience becomes key.

Let market dynamics inform, not disrupt, your pricing strategy.

As tariffs and trade costs tighten margins, you can no longer rely on absorbing the impact centrally. Instead, manage profitability locally, reflecting market realities rather than defaulting to uniform global lists or reactive discounting. Take cues from brands like Birkenstock, which recalibrated European pricing to offset margin pressure in the US, an early example of a broader shift toward market-specific price architecture. Your challenge will be to preserve consistency of perception and exclusivity while navigating greater regional complexity.

Local moves:

- Where price perception is tight (Europe/US), let the story carry the premium: craftsmanship proof, limited runs, and service layers.

- Where sensitivity is lower, such as in China, dial up prestige cues and experiential layers, including private previews, atelier access, and concierge fulfilment, to gain margin without eroding equity.

Explore new growth levers: from owning objects to owning experiences.

Although your products remain the foundation of your brand, treat services as the next frontier of growth. Invest in direct-to-consumer experiences, experiential flagships, and exclusive after-sales programs to build differentiation and resilience. Take inspiration from Apple, whose flagship stores function less as points of sale and more as immersive expressions of brand philosophy. In digital channels, build service ecosystems, from personalized styling and private memberships to blockchain-based provenance tools, that sustain trust, exclusivity, and long-term loyalty online.

Local moves:

- The US already benefits from strong in-store preference, but high dissatisfaction with CRM signals a gap in post-purchase engagement. Reimagine your CRM as a relationship platform, not a promotional channel.

- In Europe, use service innovation to modernize without diluting heritage.

- With most of Indian luxury shoppers entering through digital, build discovery-first experiences online. When consumers visit in person, elevate the store experience as a continuation of digital engagement.

Diversify ecosystem, securing access to craftsmanship, tech, and creative capital.

Recognize that independence alone is no longer enough. The complexity of today’s global landscape demands collaborative ecosystems, from suppliers and logistics partners to creative agencies, tech firms, and retail platforms. Treat these networks as engines of innovation. Integrate data, technology, and creative partnerships to accelerate insight and agility, as Gucci has done through AI in design and marketing, or as LVMH has through its collaboration with Google Cloud. While traditional luxury clusters like Paris, Milan, and Geneva still anchor heritage and talent, diversify your ecosystem footprint to secure craftsmanship, technology, and creative capital across regions. Independence will always define luxury, but interdependence will define its future.

Local moves:

- In the US, there is a clear case to build stronger technology and data ecosystems, partnering with AI, analytics, and platform providers to deliver personalization and predictive relationship management.

- European brands can consider broadening access to craftsmanship networks beyond traditional clusters (Paris, Milan, Geneva)

Ready to secure actionable recommendations to elevate your luxury growth strategy? For in-depth insights from the study, contact our sector experts today.