Sustainability: This is a topic in many industries nowadays. Consumers want it, regulators request it, but companies are still – to a varying extent – struggling to develop more sustainable offerings or business models. However, effective monetization is key to transform businesses sustainably. In our new blog series, we shine a spotlight on this topic.

Consumer goods, foodstuffs, energy – in industries like these, sustainability has been a prevalent topic for quite some time now. But what about logistics? How important is the topic for this sector? As it turns out – quite.

Sustainability is important …

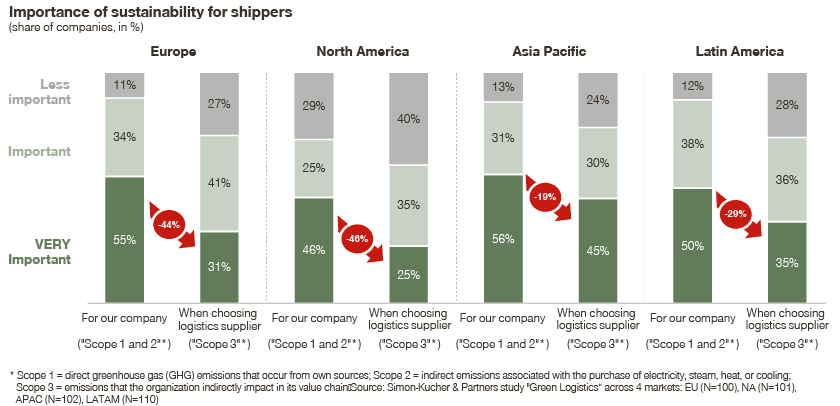

Across all industries, sustainability is something to think about. Almost all (96 percent) of the world’s largest 250 companies report on their sustainability performance, usually in the form of a sustainability (CSR) report. Taking a closer look at the logistics sector, the majority of logistics companies’ customers think it is an important topic. Logistics customers in Asia-Pacific have the highest approval ratings (56 percent), closely followed by customers from Europe (55 percent), Latin America (50 percent), and North America (46 percent). These figures were determined in our recently published Simon-Kucher Green Logistics B2B study, where we surveyed over 400 companies across the globe that use logistics service providers.

… but somewhat less when choosing suppliers

However, this explicitly stated importance applies to a much higher degree to their own products, services, or processes. And less to those of the logistics provider they choose. The importance rating “very high” drops from 52 to 34 percent on average when choosing a sustainable logistics service provider compared to sustainability of one’s own company. Geographical differences, again, play a significant role: only 25 percent of customers from North America rate the importance of choosing a sustainable logistics provider very high, compared to 45 percent of customers from Asia-Pacific.

As can be seen, both direct greenhouse gas emissions occurring from the participant’s own sources (scope 1) and indirect emissions associated with their purchase of electricity, steam, heat, or cooling (scope 2) are most important. They still rank higher than emissions that impact the organization in its value chain indirectly (scope 3). When it comes to the supply chain – of which logistics providers are a central element – being sustainable becomes less of a priority – a disparity that will most likely level out in the next few years.

Only few logistics companies with long-term sustainability investments

What applies to shippers is also true for logistics companies: Almost all major logistics companies around the globe have set specific emission targets for themselves in line with the Paris Climate Agreement. For example, Maersk or DPDHL are aiming for CO2 neutrality (within their own processes, scope 1 and 2) by 2050. Kuehne+Nagel has even achieved CO2 neutrality already, in part by investing in offset projects.

Having said this, most companies do not disclose the efforts they’re willing to take to achieve more sustainability, which becomes most obvious when looking at the communicated monetary commitments (or the lack thereof) geared towards sustainability goals. Only very few companies state clearly how much they are investing in order to achieve CO2 neutrality (e.g. DPDHL: 7 billion Euros until 2030, FedEx: 2 billion US dollars until 2040). How the remaining logistics companies plan to improve their sustainability footprint and how much they’re willing to invest is therefore largely unclear.

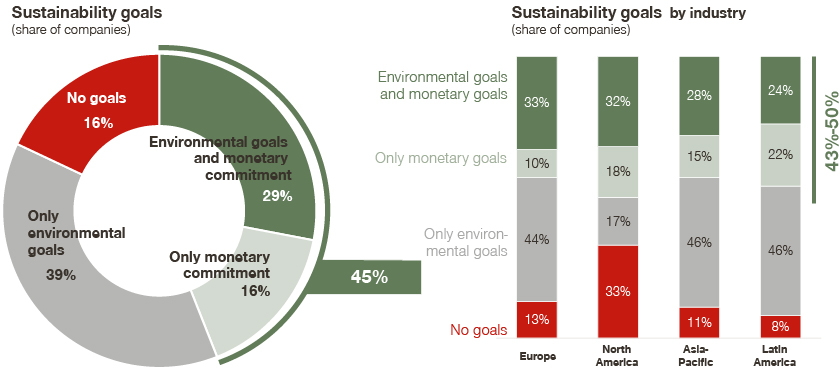

Logistics customers more clearly committed

The situation is somewhat different for the shipper companies. Not only do B2C companies like Amazon and Microsoft have a higher focus on sustainability, but they also appear to provide more information on total spending figures (on selected initiatives, e.g., waste reduction, water technologies, …). Our study results show that almost half of the shipper companies have agreed on monetary obligations (among others) to reduce emissions. Monetary or sustainable commitments are, however, more common in Europe, Asia-Pacific or Latin America (where on average only 8 to 13 percent of the surveyed companies stated that they do not have any type of commitment) than in North America, where about every third firm did not set itself any type of goals. This follows suit with the overall lower importance rating of sustainability in North America (as shown in the infographic below).

High costs and low margins make monetization strategies necessary

Therefore, the logistics sector still has a lot of catching up to do. Especially since potential CO2 savings are through the nature of the industry considerable. But they would come at a high price: Climate-neutral fuels such as Sustainable Aviation Fuel currently costs five to six times more than conventional fuels. Adding to this the overall low margins in this industry means that logistics companies need to develop a clear idea on how to pass on the higher costs. Hence a price explosion would be the result. Without a smart monetization and communication strategy, this would lead to a massive outcry from logistics customers.

It remains a fact: Either customers of logistics services are prepared to pay significantly higher prices in the future – or governments will be called upon to tighten their regulations. In any case, absorbing the higher costs themselves will hardly be possible in logistics.

Monetizing Green Logistics

How to design and price emission compensation measures in Logistics