During the course of the COVID-19 pandemic, and due to its surrounding circumstances, consumer behavior has drastically changed. And many of these behavioral changes are expected to last well into the future. We asked five colleagues from our global Consumer & Retail practice how the specific impacts look like on an international level and how consumer goods companies can prepare for them.

How did you find out how consumer behavior changed since the beginning of 2020?

Dr. Benjamin Pfister: We actually conducted the very comprehensive and representative Global Touchpoint Study 2021 study in June. Within, we asked more than 15,000 participants from 15 counties about their purchasing behavior and their likes and dislikes when buying before, during, and after the COVID-19 pandemic. Of course, we were already familiar with many of the ongoing developments, but our goal was to gather more insights into shoppers’ behaviors on an international level to gain a clearer and global foundation for advising our clients form the consumer goods industry.

What were the key insights from this study?

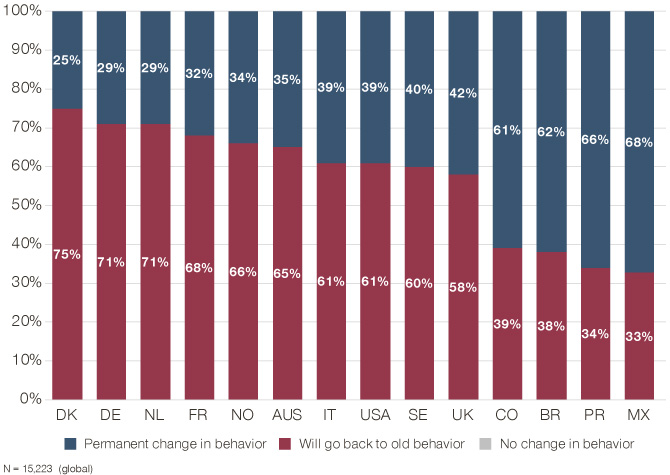

Nina Scharwenka: Unsurprisingly, many consumers surveyed stated that they had changed their shopping behavior since the start of the COVID-19 crisis. What’s interesting, though, is that the change is apparently here to stay: In all surveyed countries, at least 25 percent of consumers say that they have permanently altered their habits and do not expect go back to their pre-pandemic behavior. We observe the strongest perceived permanent behavior change in Latin America (more than 60 percent of respondents), where offline shopping was the predominant way of buying pre-COVID. On the other hand, central European consumers (e.g. in Denmark, Germany, the Netherlands, France, and Norway) are more reluctant to permanently change their shopping habits, as you can see below.

We attribute this to the aforementioned countries’ already higher acceptance rate for online shopping.

So you’re concluding that online shopping overall has gained in importance?

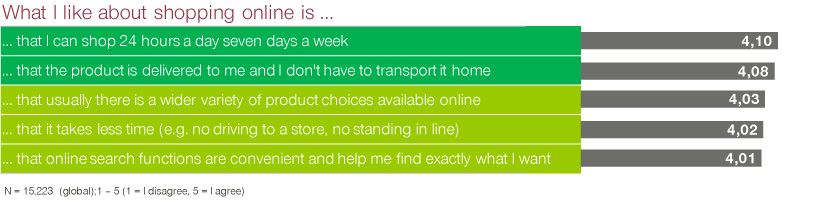

Martin Crépy: Yes, that’s right. And since the benefits of online shopping apply as well in a post-pandemic world, we expect it to gain even more traction in the future. For example, we found out that consumers especially appreciate the convenience of using online shopping channels. They like that they can shop anytime they want that there is a much wider array of products available, and that they get it delivered to their homes directly.

Especially grocery and beverage retailer’s online stores have gained popularity as they fulfill these needs very well – and even though they stayed open during the recent lockdowns. Another trend that takes into account these customer requirements are delivery apps. In all countries surveyed their usage is on the rise, with Norway (27 percent of users) and Colombia (23 percent) being the front-runner regarding grocery deliver apps and Columbia (33 percent) as well as Peru (26 percent) leading the field in terms of beverage delivery apps. They offer consumers the ultimate amount of convenience and will therefore become even stronger in the future.

Apart from delivery apps, in what kind of online stores do consumers shop preferably? Do they simply choose their favorite brick and mortal store’s online channel?

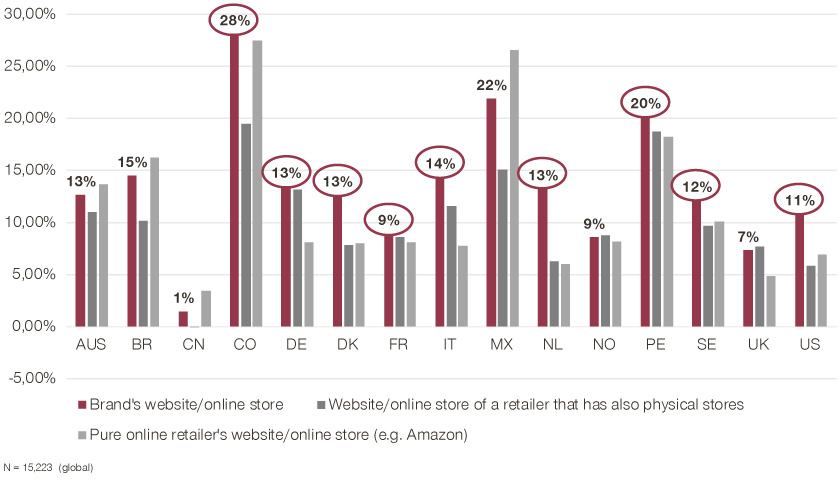

Wenbo Li: No, in fact quite the opposite, which leads to interesting ramifications for consumer goods manufacturers. We detected from our study results that in almost all countries, online brand stores are on the rise. Except for China (where brand stores were already in high demand pre-COVID-19), we anticipate a significant uplift in their future usage with double digit growth. This growth is expected to even outperform the uplift of online retailers (which offer more variety) in the majority of countries.

What should the consumer goods industry conclude from these figures?

Jos Eeland: In particular the trend towards a stronger focus on brand stores is surprising, one would have thought that consumers tend to order rather from established retailers or cross-brand portals. But with the numbers being what they are, consumer goods manufacturers should make sure that they provide customers with easy-to-use online shopping channels. What’s more, they need to invest in measurements to keep conversion rates high. This way, they’ll be able to realize the full potential direct to consumer channels currently offer. Online shopping as well as convenient omni-channel experiences will continue to be very important in the future, since customers want to easily switch between offline and online channels without barriers (e.g. shipping costs). China, for instance, serves very well as a show-case for this trend: Omni-channel was already more than twice as much the preferred way of shopping (48 percent) compared to all other surveyed countries. Consequently, a large proportion of consumers was not forced to change their shopping habits at all during the COVID-19 pandemic.

Thank you for these interesting insights!