The first half of 2023 has presented unique and significant challenges to companies within the residential real estate value chain. Price increases continue to move down the value chain, pressuring profit margins. At the same time, demand has weakened as mortgage rates continue to reach decade highs. Mitigating profit loss will require agile responses from companies, and Simon-Kucher Construction & Building Materials experts Will Humsi and Tom McClure lay out three immediate actions companies should consider as they navigate the current and near-term market environment.

Challenge #1: National trends don’t paint the full picture

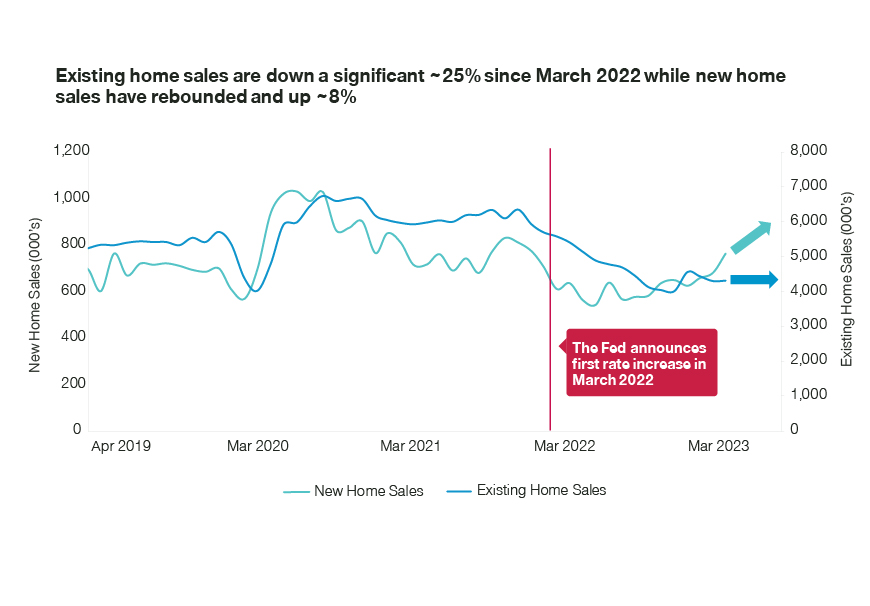

While national headlines continue to tout doom and gloom in the construction sector, the hard data paints a clearer picture of what can be expected in the near future. Yes, the existing homes market has cooled as current homeowners are reluctant to give up their locked-in mortgage rates. However, May 2023 sales of newly constructed homes were ~41% higher than July 2022’s lows (St. Louis FRED). With additional rate increases still possible and elevated rates expected into 2024, new construction will continue to carry the housing market.

Additionally, total construction spend continues to increase in the United States as non-residential spending has surpassed residential spending.

Opportunity #1: Re-assess segments and microsegments

Given that overall demand remains robust, best-in-class companies are proving adept at effectively pivoting to provide for their most profitable segments and microsegments. These companies understand the unique needs, preferences, and buying habits of each segment. They tailor marketing messages, products, and services to better meet their specific needs, and ultimately increase customer satisfaction while driving also higher conversions rates. These companies are also able to rebalance and optimize commercial resources to ensure they are deploying the right people in the right markets at the right time.

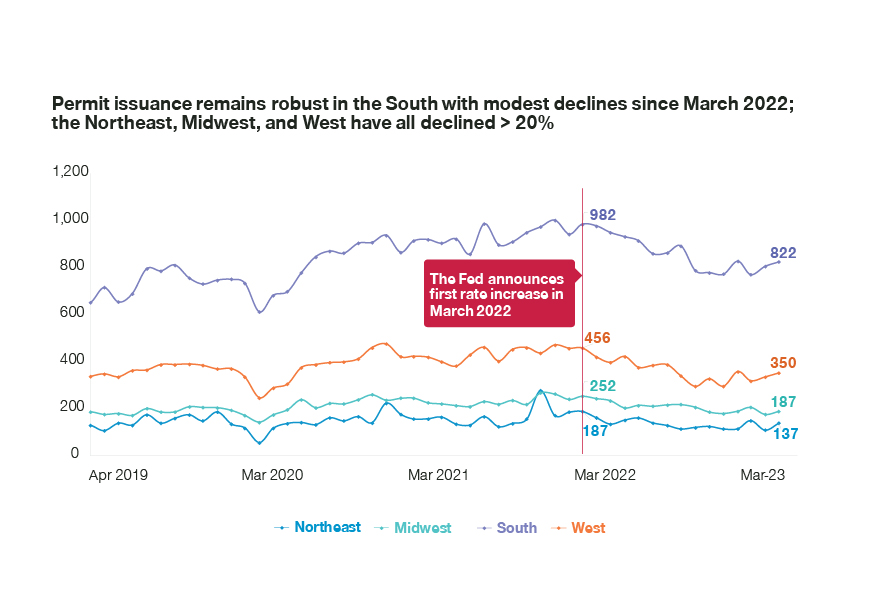

A real-world example is demonstrated by the nuances in housing permits issues across regions. Compared to March 2022, the national total lags ~20%, however, there are significant regional variances. The South saw a more modest ~16% decrease while the Northeast, Midwest, and West experienced decreases between 23-27% (US Census Bureau).

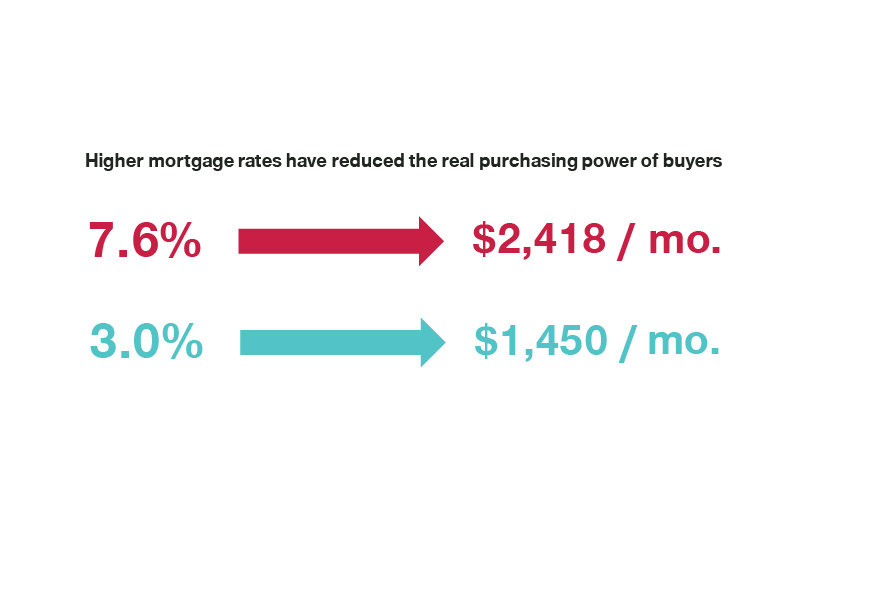

Challenge #2: Less real purchasing power for buyers

As interest rate increases translate into higher mortgage rates, first-time home buyers have lost considerable purchasing power compared to the last five years. Even with a 20% down payment, a $430k home (the median Q1 2023 home price) with a 7.6% interest rate equates to $2,418 per month. That same $344k loan (assuming a 20% down payment) would have been a $1,450 monthly payment with a 3% rate. (See for yourself using www.calculator.net.)

Opportunity #2: Deploy less expensive alternatives

Providing customers will optionality is essential for driving conversion in today’s price sensitive market. Additionally, ensuring each offering contributes to a healthy profit margin, even if the revenue is reduced, is imperative for business health. By offering and marketing less expensive alternatives, business can continue to drive growth even as buyers are choosing to scale back on higher margin finishings and upgrades. The key to successfully offering less expensive alternatives lies within a company’s ability to effectively value engineer their products; or taking a systematic approach to providing all necessary functions at the lowest possible cost.

Challenge #3: Sellers do not effectively communicate value

When companies fail to effectively communicate value, customers may not understand the unique benefits or advantages their products or services offer, leading to a lack of interest or a perception of low value. This can result in lost sales, decreased customer loyalty, and difficulty in differentiating from competitors. Without clear value communication, companies may struggle to command premium pricing, face price sensitivity, and find it challenging to justify their offerings in a crowded marketplace. Effective value communication is essential for attracting and retaining customers and achieving business success.

Opportunity #3: Upskill the sales force

Upskilling salespeople is crucial for success in today's dynamic marketplace. Salespeople are the frontline representatives of a company, and their skills directly impact customer satisfaction and revenue generation. By investing in their development, businesses can enhance their ability to understand customer needs, effectively communicate value propositions, and close deals. Upskilling equips salespeople with the latest industry knowledge, sales techniques, and technology proficiency, enabling them to adapt to changing market trends and customer expectations. Best-in-class salespeople can effectively communicate the total value and cost of ownership while highlighting the benefits and return on investment – this increases conversion for products with higher upfront costs but greater long-term savings.

While the residential real estate industry is facing unprecedented times, there are still strategies your organization can utilize to ensure profitability. Contact Simon-Kucher industry experts Will Humsi and Tom McClure to develop and implement a personalized growth strategy today.