What are the major trends shaping the China medtech industry in 2024? Our experts highlight the three key trends and their implications for the world’s second largest market.

China holds significant growth opportunities for the medtech industry. Through extensive conversations with industry leaders in the field, we’ve identified three crucial trends that will drive market growth in 2024.

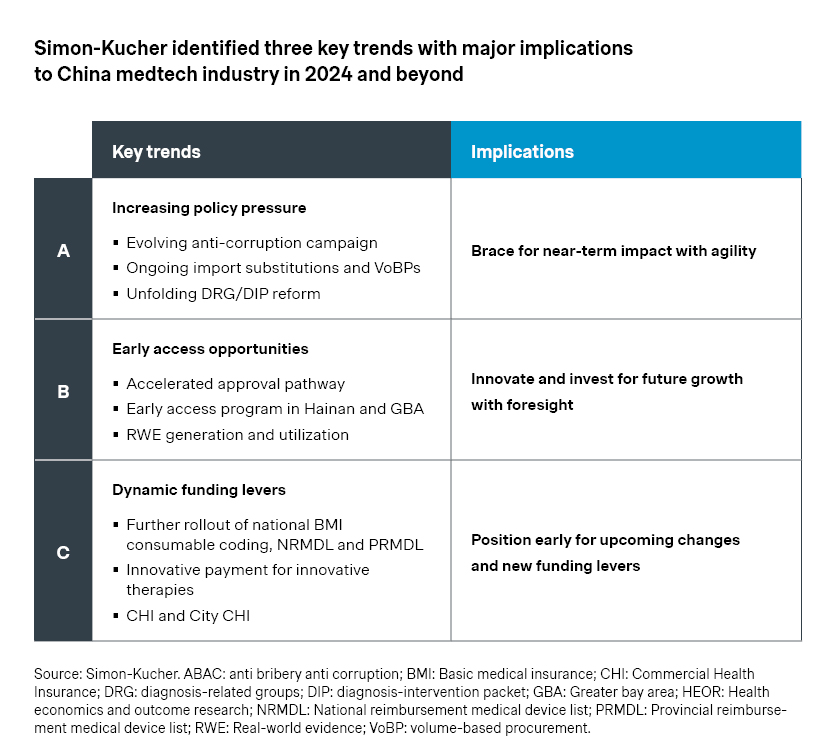

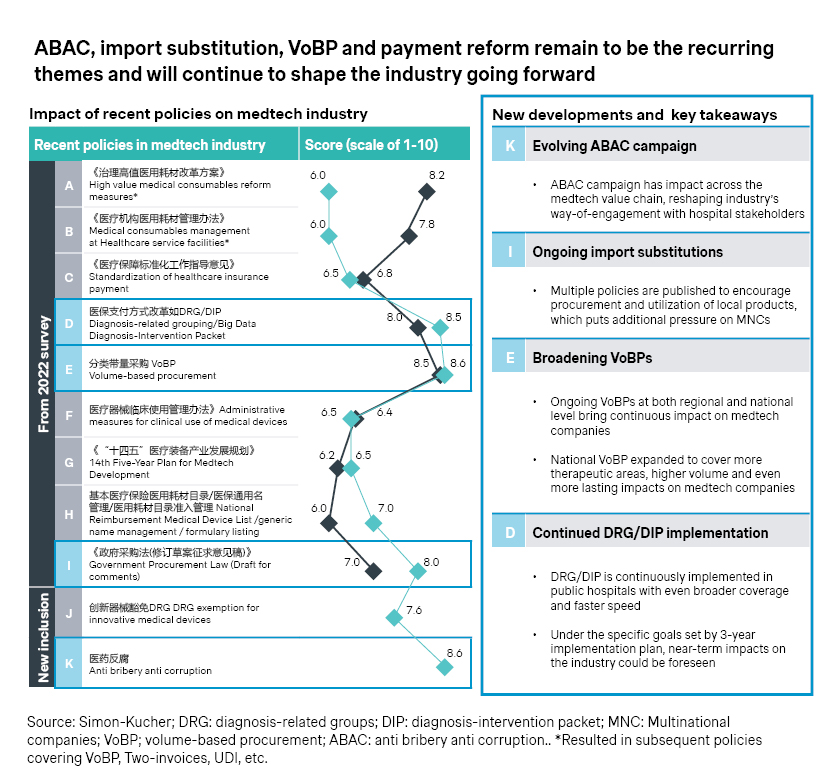

1. Increasing policy pressure

On the policy front, the industry will continue to see impacts from volume-based procurements (VoBP) and new payment reforms.

- The fourth batch of national VoBP on intraocular lens and sports medicines featured around 70 percent price cut on average. Meanwhile, most companies in the bidding process made it to the final list, including Alcon, JNJ, and Smith & Nephew. That is partly a result of the more relaxed rules which allow players a second chance to bid and get back into the game.

- At the regional level, the IVD VoBP led by Anhui has been closely monitored as it aggregates the volume for public hospital purchasing across 25 provinces, representing a stake nearly as significant as the national VoBP. The bidding rules considered additional factors beyond price, such as historical market share and portfolio breadth, which was encouraging for established players like Roche, Beckman, and Siemens. As a result, most top players were able to secure a place, and the average price cut of 54 percent is relatively moderate compared to previous national and regional VoBPs.

- As part of the ongoing reform of payment models, Diagnosis-Related Group (DRG) and Diagnosis-Intervention Packet (DIP) systems are being rolled out across the country. Although there are regional variations, the central thesis is a fundamental shift from fee-for-services to prospective payment systems, which will have a significant impact on China’s access environment. In addition, the anti-corruption campaign of 2023 may still have lasting effects going forward, with increased scrutiny on marketing, sales, and hospital purchasing.

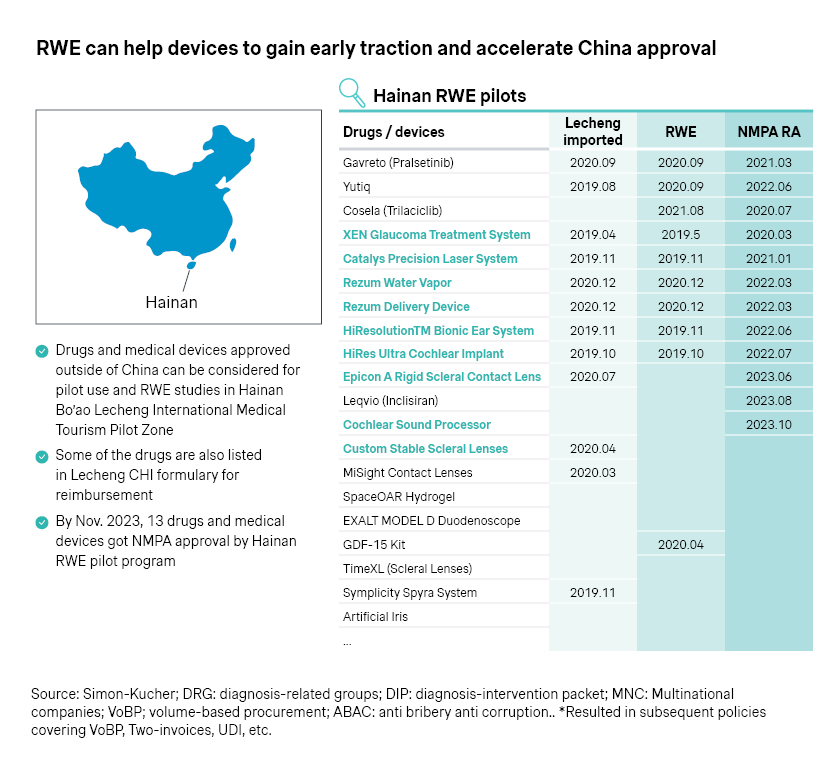

2. Early access opportunities

Despite the persistent cost pressure and headwinds, innovation continues to be the theme for the industry.

- Many industry players are exploring special review pathway to expedite the approval of medical devices in China. By September 2023, 41 products received accelerated approval from the Center for Medical Device Evaluation, compared with 26 in 2020 and 35 in 2021.

- Even before the formal approval, early access could be achieved in pockets of the Chinese market, like Hainan, which also spearheads the real-world evidence (RWE) program for innovative medtech devices. Epicon A is among the latest successes as it became the first approved scleral lens in China in June 2023, backed by RWE data from 300 patients.

- The Greater Bay Area has been a fast follower, flaunting a much larger and more affluent market of around 100 million population across 11 cities, including Hong Kong, Macao, Shenzhen, and Zhuhai. Four batches of innovative therapies with prior approvals in Hong Kong and Macau have achieved early access in the area, with innovative medical devices accounting for 30 percent of the total.

3. Dynamic funding levers

- Meanwhile, reimbursement has always been crucial for success in China. The latest guidance from the National Healthcare Security Administration requires the local reimbursement list to be established in all provinces by 2025.

- Besides the local reimbursement list, each province is expected to introduce a formal mechanism for local access and pricing, and to set the reimbursement standards tailored to local budget and healthcare needs.

- Shanghai has been among the first to come up with its scheme, including a rigorous process of expert review and price negotiations, and requirements on cost-effectiveness and budget impact assessments for medical devices and consumables going forward. Other regions may develop different schemes or variations, and the more successful pilots could inspire others and potentially become the blueprint for national rollout in the future.

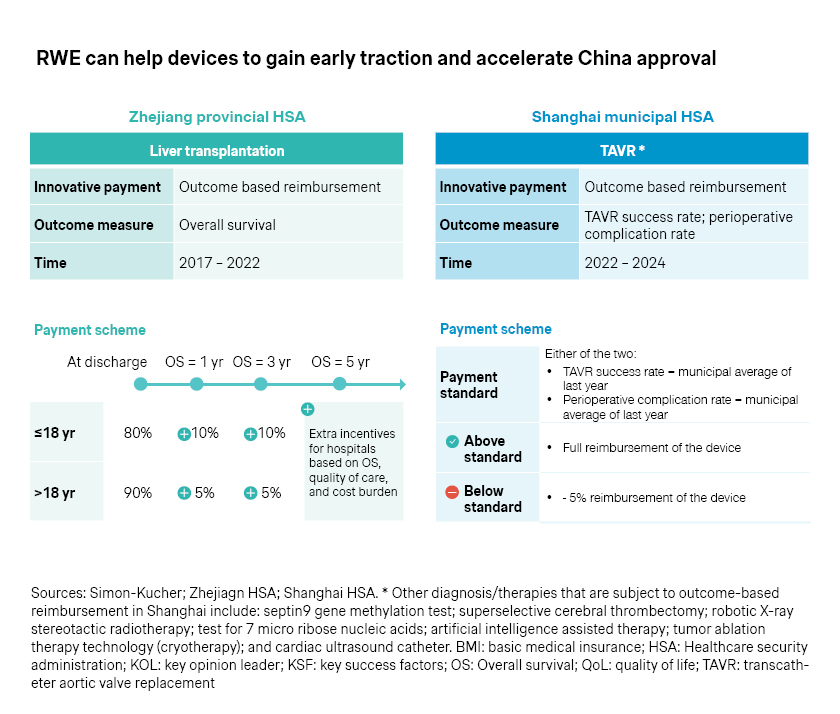

- At the same time, outcome-based reimbursement schemes have emerged at the regional level. Zhejiang, for example, piloted outcome-based reimbursement for liver transplantation, with overall survival as the primary measure to define reimbursement level. Shanghai also tested outcome-based reimbursement for transcatheter aortic valve replacement (TAVR), with reimbursement levels tied to success rates and perioperative complication rates.

Adapt and innovate: Succeeding in China’s medtech industry

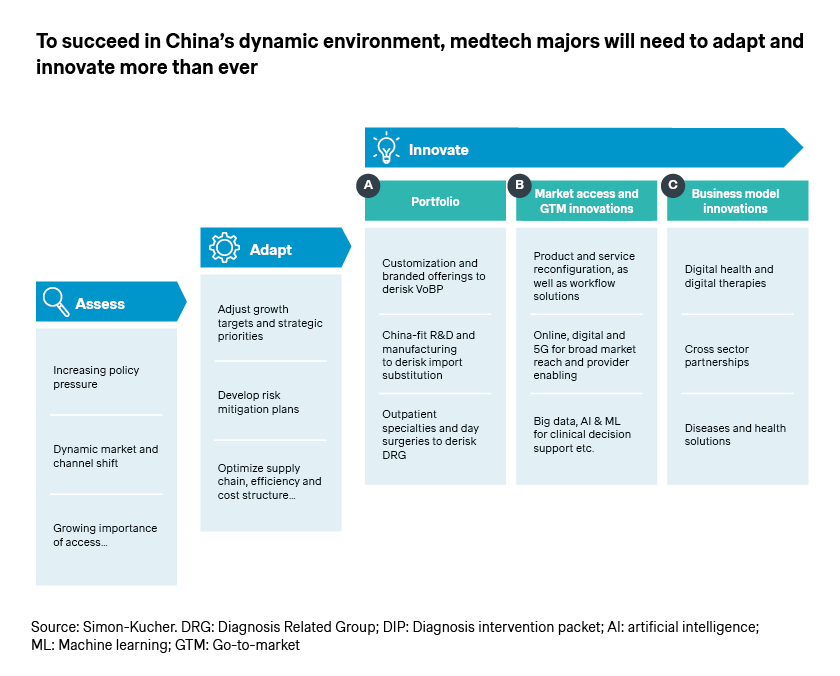

China’s medtech industry will experience continued growth in the new year, supported by strong macro drivers. However, companies must be prepared for ongoing changes and recurring challenges.

Now more than ever, it’s critical for companies to thoroughly assess the key trends, adapt with agility, and continue to innovate. After all, innovation is the name of the game for the industry, and the vital source of differentiation.

- Many multinational companies are pursuing China-fit product portfolio through local R&D and manufacturing and supply chain, which helps de-risk VoBP and import substitutions. Boston Scientific for example unveiled its plan for the first China manufacturing site in Shanghai in October 2023, toward “supporting the high-quality development of China’s healthcare industry through commercial excellence, agile and localized operations, and sustained investments in talent and capabilities”, per its global CEO Michael Mahoney.

- Access and go-to-market innovations can help accelerate product approval, secure reimbursement, and maximize uptake, given the latest developments in Hainan, Greater Bay Area, Shanghai, and Zhejiang. More importantly, as the access and reimbursement landscapes continue to evolve, companies have the rare opportunity to shape the changes, instead of merely reacting and adapting.

- In addition to capturing the near-term opportunities, it is also a favorable time to plan for long-term growth and innovate business models accordingly. This enables companies to position themselves as solution providers for patients and physicians as well as preferred partners for hospitals and healthcare systems, offering better quality and efficiency.

Reach out to our team of experts for the full report, as well as additional insights into the market and industry.

With contributions by Hanwen Cao.