To unlock digital growth, medtech companies must rethink how their commercial teams deliver digital solutions. Many find their digital ambitions falling short because legacy approaches and systems hold them back. Discover how building the right target operating model can turn digital ambition into sustainable growth.

What if the biggest barrier to medtech’s digital future isn’t technology, but the way companies are structured to deliver it? Consolidation across healthcare providers, coupled with tighter regulatory requirements and growing pressure from payers and governments, is reshaping how the industry operates. But even as companies invest in AI-powered platforms and data-driven solutions, sustainable growth remains elusive. In this environment, medtech leaders from commercial and operations to market access and IT are all asking the same question: how to make organizations efficient today and resilient for tomorrow.

Many medtech companies have responded by investing heavily in digital business models and solutions - whether stand-alone or integrated with traditional devices. Yet meaningful revenue growth is still below expectations.

In recent years, medtech organizations have made clear progress on the commercial side. They have learned how to design, package, and price software in ways that align more closely with customer needs and expectations. Companies now understand local requirements and integration needs and are steadily mastering both. In other words, the solutions are strong. And still many companies struggle to commercialize them successfully. A key reason is that sales and operating models have not fully adapted to the unique realities of selling digital solutions compared to legacy products.

At Simon-Kucher, we see the target operating model (TOM) as the backbone for overcoming this barrier and unlocking sustainable growth. A well-defined TOM aligns people, processes, and systems with the right strategy. Too often, medtech companies remain constrained by legacy structures or fragmented approaches that create friction and slow decision-making. Optimizing the TOM is now critical to realizing the full potential of digital in medtech.

Why medtech is excited about the opportunities in digital health

The medtech industry increasingly sees digital health as a frontier for growth. Customers and investors recognize how digital solutions can reshape care delivery and improve both efficiency and outcomes. At the same time, companies face the practical challenge of defining sustainable ways to monetize these offerings.

Momentum is building. More than 75% of medtech companies now report having a digital strategy in place, and industry projections suggest that digital could account for 31% of revenues by 2032. These signals raise two important questions: How can medtech organizations best position themselves in this expanding market? And what role should digital play alongside core product portfolios?

Digital health has captured medtech leaders’ attention for several reasons. Core businesses provide a strong platform, but new opportunities are emerging at the intersection of devices, data, and software. Software-driven models deliver higher valuations and stronger returns, while digital platforms help differentiate products at risk of commoditization. Regulators and payers are also pushing adoption of digital tools that improve data collection, patient tracking, and outcomes measurement.

The contrast in market trajectories is striking. The global medical device market stood at $542 billion in 2024 and is expected to reach $800 billion by 2030 (6.5% CAGR, Fortune Business Insights). In comparison, the digital health market – currently estimated at $288 billion - is projected to grow to $946 billion by 2030 (22.2% CAGR, Grand View Research).

Implications for the future

Digital health technologies are already entering operating rooms and care environments, complementing traditional devices. Successful solutions will be interoperable, data-ready, and modular enough to evolve with changing technologies and connectivity standards. Together, these developments highlight a critical inflection point. Digital health has shifted from a peripheral experiment to a strategic priority with growing financial and clinical weight. The open question for leaders is not whether digital will matter, but how to embed it into medtech operating models to capture its full potential.

The challenges holding back medtech digital growth

In the last three to five years, medtech companies struggled to develop packaging and pricing models that drive customer adoption across product tiers. Communicating the right value proposition often proved difficult. Many found it challenging to target the right customer stakeholders with relevant patient data, evidence, and messaging. Each component of a digital solution, from essential to differentiating features, required careful assessment of its value impact. Companies also needed to make perceived advantages and disadvantages explicit to guide value communication. Evidence was critical for demonstrating ROI and credibility, though data type and quality varied significantly by market and pathway.

On the offer side, pain points included packaging models. Digital solutions could be bundled with varying levels of flexibility, but companies needed to carefully manage the trade-off between flexibility and complexity. Understanding the perceived value and adoption potential of each offer element became critical. Where organizations professionalized and refreshed packaging, uptake of digital solutions accelerated.

Pricing was another area of trial and error. Companies experimented with charging structures, contract setups, and tiered price points. Models such as pricing by usage, by customer characteristics, or by ROI each carried specific advantages and disadvantages. The most successful organizations evaluated these systematically and applied them individually or in combination to create a robust monetization strategy.

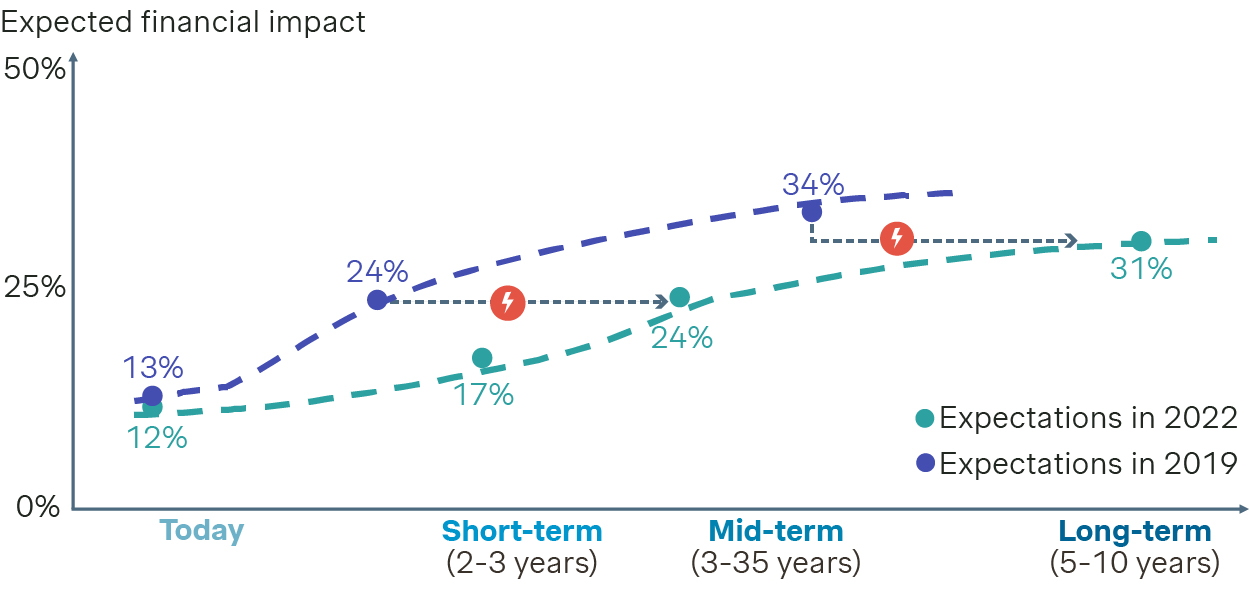

As companies mature in digital product management, many of these early challenges have been addressed. However, digital revenues still lag expectations. In 2019, industry forecasts expected digital solutions to contribute 13% of revenues at launch, 24% by year two, and 34% by year five. By 2022, confidence in those forecasts had declined sharply, dropping to 12% at launch, 17% in the short term of 2-3 years, and only 24% in 3-5 years. Today, industry consensus suggests meaningful contribution may not reach 31% until 5-10 years after launch.

Expected financial impact of digital products and solutions within medtech/diagnostics

Source: Simon-Kucher Digital Health Trend Study 2022; Digital Health Study 2019

This underperformance exposes a deeper issue. While commercial strategies for design, packaging, and pricing have improved, operating models have not kept pace. Many companies still struggle to align sales structures, governance, and internal business processes with the reality of selling digital solutions.

Even organizations that recognize the urgency to evolve often struggle to turn intent into action. Common challenges include:

- Legacy silos that slow cross-functional collaboration and unclear decision rights between global and local structures that create inefficiencies and lost momentum.

- Fragmented IT landscapes that limit scalability and the ability to unlock the full value of data, compounded by talent shortages in areas such as digital health and analytics.

- Competing priorities where short-term firefighting often crowds out longer-term transformation.

These challenges are not insurmountable, but they require a structured approach and a clear framework to avoid piecemeal fixes and deliver lasting impact. Below are two examples of how operating model constraints can prevent medtech companies from realizing the intended value of digital solutions.

Case study #1: When legacy systems block scalability |

| Our client, a manufacturer of large capital equipment, developed optional digital capabilities to be sold as an annual subscription. While the commercial design was sound, the company’s internal billing systems were built for one-time capital sales and consumables. These systems lacked the ability to process recurring charges, forcing teams to rely on manual workarounds. As a result, the product launched either as a capital price increase or a one-time software license rather than a subscription. The inability to support recurring revenue contracts constrained the intended business model and limited scalability. |

Case study #2: When misaligned sales incentives block digital adoption |

| Another client in the surgical implant space launched a digital solution to complement its core products. Selling the solution required engaging new stakeholders such as hospital IT leaders and administrators and providing differentiated value messaging supported by data and evidence. However, the salesforce was incentivized primarily to drive implant volume, and digital sales were rewarded in the same way as implants. Consequently, sales teams focused on their core products, and adoption of the digital solution remained limited. Misalignment between sales incentives, required capabilities, and packaging and pricing models reduced the impact of the initiative. |

Both cases point to the same diagnosis: operating models designed for traditional product businesses are poorly suited to digital. Without adjustments in systems, sales structures, and incentives, even well-designed digital solutions risk underperforming commercially. These are just two examples showing how different areas of the operating model can hold back digital success.

Our framework for defining and optimizing the TOM for selling digital in medtech

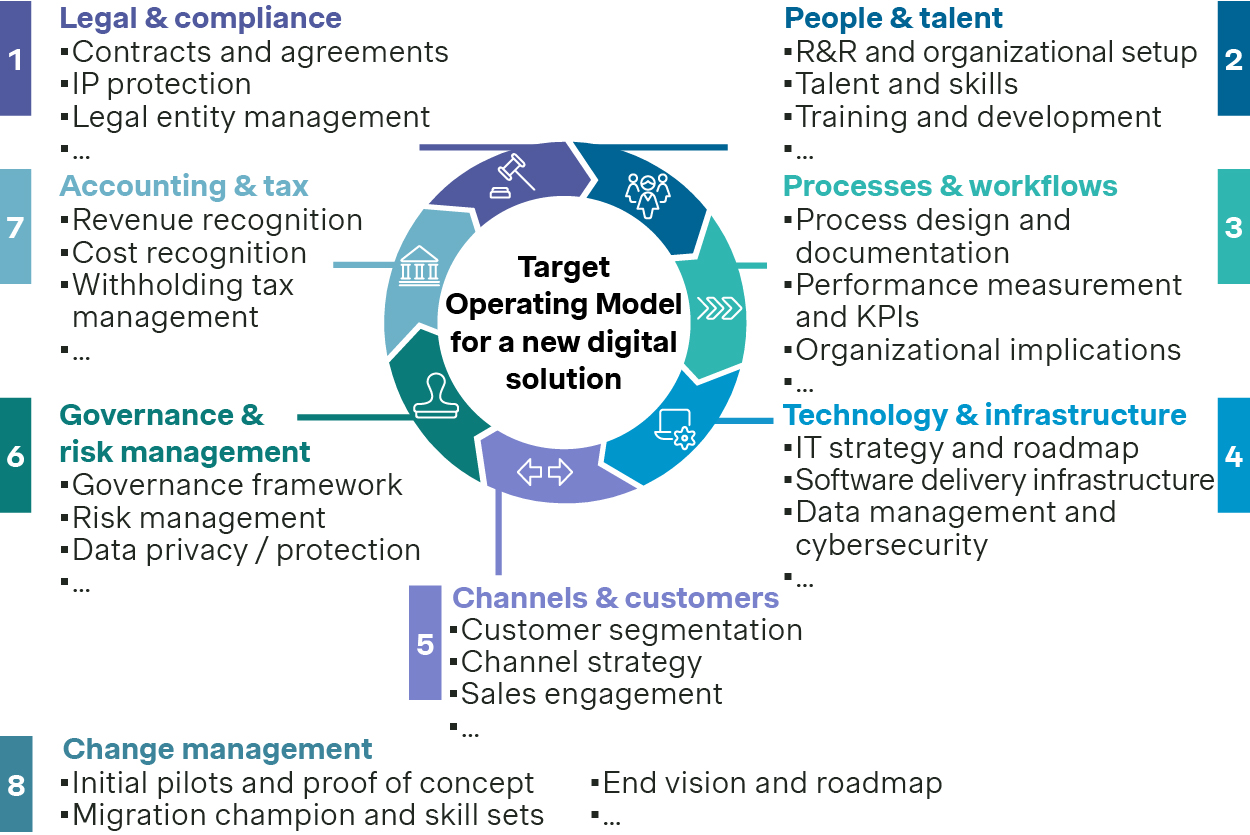

To help medtech leaders tackle these challenges, Simon-Kucher has developed a comprehensive TOM framework for commercializing digital. It breaks down the complexity into interconnected dimensions that define how organizations deliver value effectively and sustainably for digital solutions within a company’s wider product portfolio:

Source: Simon-Kucher insights

Let’s take a closer look at each dimension:

- Legal and compliance: A robust TOM requires a strong legal and compliance foundation. Ensuring operations align with complex and evolving regulations across global markets reduces risk exposure and safeguards trust.

- People and talent: Capabilities determine how well organizations adapt to new demands. Building the right skills and leadership capabilities is key to addressing emerging needs in digital health, market access, and commercial excellence.

- Processes and workflows: Business processes shape how work gets done and how change sticks. Standardization improves efficiency but must leave room for flexibility to address local market realities.

- Technology and infrastructure: Technology and data enable everything from customer insights to supply chain resilience. Modern, integrated systems create scalable platforms and automate workflows that boost efficiency and unlock actionable insights.

- Channels and customers: The way medtech companies engage customers directly influences their relationships. Adapting to different healthcare providers, patients, and partners across digital and physical channels ensures lasting customer centricity.

- Governance and risk management: Governance and risk management affect how fast decisions are made. Clear decision-making structures, accountability, and risk oversight prevent bottlenecks and support agile, responsible growth.

- Accounting and tax: Financial transparency underpins operational efficiency. Optimized structures enable compliance and clarity, ensuring that costs and revenues are clearly attributed and recognized.

- Change management: No TOM transformation succeeds without buy-in. Even the best designs can fail without acceptance and adoption, making clear communication, targeted training, and cultural alignment essential for successful transformation.

Only by considering the full picture can medtech companies design a TOM that is fit for the future - and fit for selling digital solutions.

How Simon-Kucher supports medtech TOM optimization

We combine deep medtech expertise with a proven TOM framework for commercializing digital solutions. Our approach is collaborative and practical. We partner with you to assess if your current operating model is fit for enabling digital growth and to identify key gaps. Together, we define the target state and design a roadmap to get you there, balancing ambition with feasibility.

We bring benchmarks, best practices, and data-driven insights from across the industry. Drawing from unparalleled experience with pure-play healthcare IT companies on both commercial and operational topics, we know what it takes to succeed in deploying digital solutions in healthcare institutions. Whether your priority is enhancing efficiency, building new commercial capabilities, or enabling digital transformation, we help ensure your TOM becomes a driver of growth.

If you are considering redefining your target operating model for selling digital - or want to stress-test your current approach - we would be delighted to start the conversation.

Thank you to Peter Riekes and Jianyi He for their contributions.